The Wild West & The Return of Vigilante Justice

“Out on the frontier, and generally among those who spend their lives in, or on the borders of the wilderness, life is reduced to its elemental conditions. The passions and emotions of these grim hunters of the mountains, and wild rough riders of the plains, are simpler and stronger than those of people dwelling in more complicated states of society. As soon as the communities become settled and begin to grow with any rapidity the American instinct for law asserts itself; but in the early stages each individual is obliged to be a law unto himself and to guard his rights with a strong hand.”

Chapter IX: The Cowboy Land

The Wilderness Hunter

By Theodore Roosevelt, 1893

When I was growing up, there were numerous Westerns that came out in the movie theaters, such as True Grit, Hang Em High, The Magnificent Seven, and Rio Lobo starring actors such as John Wayne, Clint Eastwood, Yul Brenner, and Charles Bronson. And then there were the reruns of the famous movies from the prior 20 years on TV such as High Noon, Rio Bravo, The Outriders, and Gunfight at the O.K. Corral, starring actors such as Kirk Douglas, Jimmie Stewart, Gary Cooper, and John Wayne. Yes, John Wayne shows up in both those lists as he was a staple of Westerns for over 40 years and you could not think of Westerns and The Wild West without thinking of him. But the quintessential Western movie was Shane. Shane was the lone outsider who came to work on a farm in Wyoming to forget his past as a gunfighter. Though the farmer had purchased his land legally, a ruthless cattle baron wanted to drive the farmer’s family and others off their land. He hires a highly skilled gunfighter to eliminate the farmers who stand in his way. Ultimately, when the sheriff proves unable to control the cattle baron and his men, Shane faces the hired gunfighter alone, killing him. Then, in a gunfight to end the movie, Shane defeats the cattle baron and his men. After providing justice for the farmers, he rides off into the sunset, wounded but standing strong. Thus, justice is served from outside the system. Thus, it was in San Francisco in the 1850s when the Vigilance Committee dispensed justice in the city when the sheriff and courts proved unable to handle the Sydney Ducks gang in 1851 or crime in the mid-1850s. Thus, the birth of private Vigilantes to maintain order when government proved incapable. (For a brief history of the Vigilance Committee of San Francisco, which grew out of the 1848 Gold Rush that brought a flood of people to mining camps and cities, see https://en.wikipedia.org/wiki/San_Francisco_Committee_of_Vigilance .)

For those of us observing the economy, it seems that, with a Federal Reserve pledging to continue to pour money into the marketplace until inflation consistently exceeds desired levels and with a Congress pledging to spend money without raising taxes, in a re-enaction of The Wild West, the bond markets will become the ultimate arbiter to dispense justice in the economy, acting as the Vigilance Committee in San Francisco did in the 1850s. For those of us who remember the 1990s Bond Markets, there arose a phrase that brought a chill to stock market investors hearts and dread to the politicians in Washington, D.C: The Bond Market Vigilantes. These “uncontrolled” movers of interest rates threatened higher rates every time the economy accelerated or Congress embarked on deficit spending. Thus, they acted as a natural brake to offset the “outlaws’ actions” occurring elsewhere in the markets and the economy.

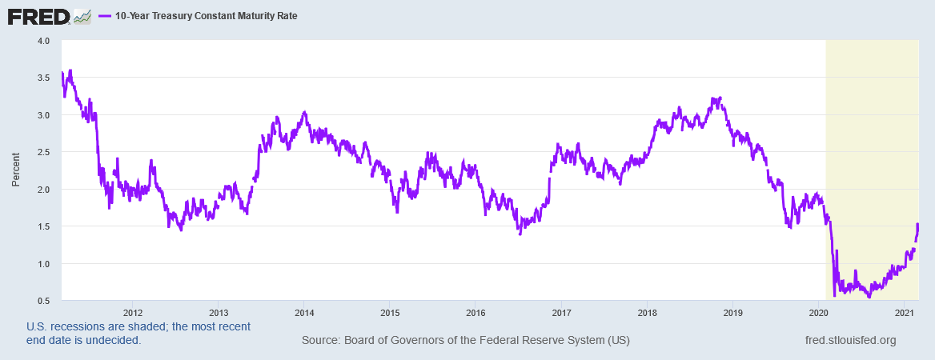

A quick look at the bond markets will make clear the role interest rates possess in indicating the true state of the economy and predicting its future path. Statistically, interest rates and the shape of the Yield Curve possess one of the highest predictive abilities to indicate the path of future economic growth and the potential amount of inflation in the system. Historically, Interest Rates naturally rise when economic growth accelerates and decline when it slows. The following chart demonstrates this over the past decade:

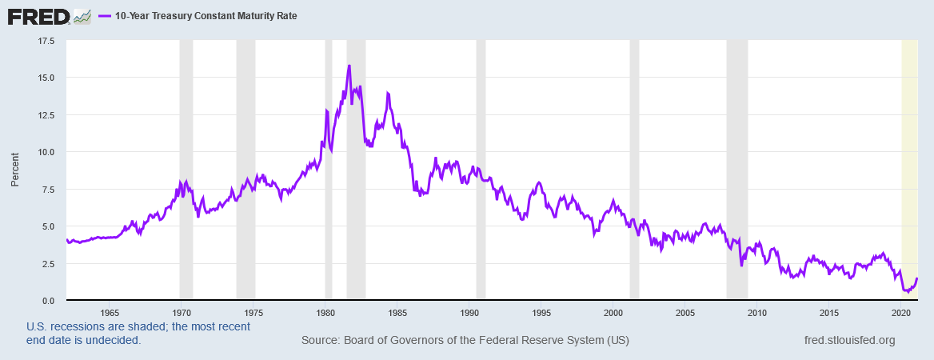

As the chart clearly shows, 10 Year Treasury interest rates have begun to come off of their multi-year low. However, they barely stand at the trough levels of 2016 and 2012, which occurred during significant slowdowns in the economy. Thus, should economic growth continue to accelerate, it should come as no surprise that they should continue to climb. It would just represent a return to normalized levels of Interest Rates for the level of both Real GDP Growth and Nominal GDP Growth from the last decade, let alone the normalized levels seen from 1960 – 2007. When viewed in a long term context, 10 Year Treasury Interest Rates appear exceedingly low:

In fact, 10 Year Treasury Interest Rates stood this low only in the 1930s and 1940s. And should economic growth return to levels seen from 2000 – 2007, let alone earlier times, rates would reasonably be expected to reflect this improved economic growth.

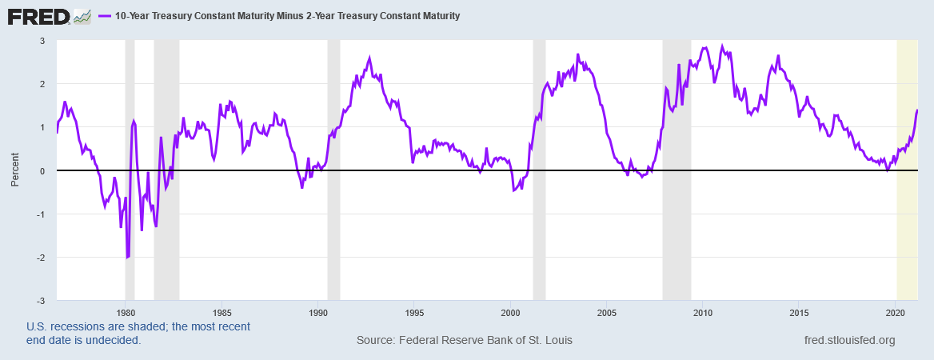

If we then turn to the Yield Curve, defined as the difference between the 10 Year Treasury Interest Rate and the 2 Year Treasury Interest Rate, the Bond Markets clearly see a significant acceleration ahead in the U.S. Economy:

This looks no different than in prior times, when the economy emerged from a recession. However, at just 1.40%, the Yield Curve stands well below levels typically reached in the years following a recession, when it normally rises to a level somewhere between 2.00% and 2.75% as seen in the 1990s, 2000s and 2010s. Thus, what appears to be going on in the Debt Markets, looks more a return to normal than an explosion to the upside, unlike the picture the media paints.

For those of us waxing nostalgic for the old days of The Wild West, the economy appears at the beginning of the 1848 Gold Rush. The Federal Reserve continues to pump money into the economy at a rapid rate, despite housing prices at record levels, manufacturing prices accelerating, commodity prices back to 2014 levels, and GDP set to blow through its prior peak. Congress appears on the cusp of enacting a massive $1.9 trillion stimulus bill, equivalent to almost 9% of GDP, without raising taxes, thus massively increasing deficit spending in what appears old fashioned Pump Priming. With all participants acting like The Wild West, focused on mining gold, by driving economic growth to over 5% this year and next, levels last seen in the 1960s, it appears merely a matter of time until The Vigilance Committee re-forms to bring justice to the markets and the economy. And with events set to unfold over the next 2 – 3 years, given the forces set in motion, those of us who miss the old John Wayne movies and the vison of Shane dispensing justice merely need to wait a short while before we can enjoy The Return of Vigilante Justice.

The Reopening Derby: Coming Into The Home Stretch

For the United States, Reopening appears rounding the curve and Coming Into The Home Stretch. With the approval of Johnson & Johnson’s vaccine coupled with increased production by Moderna and Pfizer/BioNTech, deliveries of doses from vaccine manufacturers are set to soar from 10 million per week to 15 million per week to 20 million per week over the next month. And with the opening of mass vaccination sites, the bottlenecks that plague the system will disappear, enabling anyone who wants to receive a vaccine to do so. With vaccine deliveries headed upward and drug company manufacturing running flat out, President Biden proclaimed that every American will receive a vaccination by the end of May. Indicative of this, it appears California Health Officials will finally allow Disneyland to reopen in California on April 1, over a year after Disneyworld reopened in Florida. And with cruise lines and resorts sold out starting in the second half of 2021, as Reopening occurs, it truly appears the American Horse entered The Home Stretch and turned on the afterburners to cross the finish line first and win The Reopening Derby.

Upcoming Speaking Events

Our “live” Public Speaking continues to accelerate in 2021 as groups have adjusted to the Zoom and Skype dominated world. Recent appearances include several private investor groups and associations. Upcoming appearances include a number of C Level Executive groups, industry associations, and investor groups. With our vaccination likely to occur in the next 60 days, we look forward to appearing live at the United States National Strategy Seminar in June in Carlisle, PA. It will feel good to get up in front of a large audience once more. As to speaking for your group, either Zoom or live once more, please feel free to contact us. We would be happy to accommodate your needs.

Monthly Letter Preview

This Month, we provide our Global Economic Quarterly and what likely will ensue as the Pandemic comes to an end:

- Global Economic Quarterly: The Reopening Force & The Fight For Global Growth: Currency Wars, “Emerging” Markets, and Recapturing Global Growth – With the US recognizing the threat from China, US economic policy moved to accelerate US growth and to create higher levels of investment into the economy. In many ways, the U.S. continues to embrace the policies utilized by Emerging Economies over the past 20 years to supercharge their growth. Should the U.S. continue down this path, it creates major implications for how the Global Economy will grow and for the relative growth of Developed Economies compared to Emerging Markets.

As always, we end the Monthly Letter with Economic Observations on the US Economy through Interesting Data Points that provide color on the happenings in America. The link to the Monthly Letter is:

https://greendrakeadvisors.com/views-from-the-stream-march-2021/

Should you have any questions on how the above issues or the items discussed in our accompanying Monthly Views From the Stream Letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer