Housing: The Affordability Issue, The Credit Issue, And The Supply Issue

Views From the Stream

The Monthly Letter covers two topics this month. First, we return to the Housing Market. We review the current state of the market and the changes needed to address the affordability issue, the squeeze on non-prime credit, and the ability to create more unit supply. Second, as always, we close with brief comments of interest to our readers on a variety of current topics relevant to the economy and the markets.

Housing: The Affordability Issue, The Credit Issue, And The Supply Issue

When I bought my first house, I certainly did not possess a 700+ credit rating. My credit rating probably stood somewhere in the 600s. But it never came up when I applied for a mortgage. Instead, the bank focused on the income that I and my wife earned. And it also cared that we possessed sufficient savings to cover the 20% down payment plus all the fees we ended up paying to close. And, of course, the bank cared that our income could cover the mortgage and insurance on the house within reason. There existed no bright line ratios that determined if you qualified or not. The goal stood to make Housing affordable to the average American, whether they lived in an expensive metropolitan area such as the New York City suburbs, where we bought our first house, or in the midst of Nebraska. Most home purchases occurred with sub-700 credit ratings with government assistance for those below 600.

However, this changed after the 2008 – 2009 Housing Crisis. During the Housing Bubble from 2004 – 2006, a number of banks did not verify incomes. They attempted to maximize the number of loans they processed in order to maximize their fee income as they knew they did not have to hold the mortgages but a short while. They knew that the loans would quickly wend their way into the securitization market freeing their balance sheets to make even more loans. Thus, borrowers who never should have received a mortgage did so. In addition, credit rating agencies that rated mortgage backed securities issued by the major brokerage firms turned a blind eye to the lack of documentation behind the mortgage pools. Thus, they facilitated the issuance of Mortgage Backed Securities providing AAA Ratings to mortgages backed by home buyers with insufficient income to cover the mortgage. In addition, with these buyers allowed to put down less than 10% and in many cases less than 5% as down payments, there existed no incentive for them to stand by the mortgages. Instead, they walked away leaving the banks and mortgage backed security holders in limbo.

When everything blew up in 2008, the Federal Government held not one bank Executive, credit rating agency CEO, or brokerage firm Managing Director accountable. Not one senior officer at any of these firms went to jail. Instead, the Congress passed the Dodd-Frank legislation to prevent a recurrence of the Housing Bubble. This legislation produced a profound impact on the Housing Market. It effectively cut people with Sub-700 Credit Ratings out of the market for standard mortgages. Instantly, a large portion of Homebuyers, who previously qualified with Credit Ratings as low as 500 including the large portion of the market in the 600s who had almost automatically qualified for a mortgage, became effectively shut out of the Mortgage Market. Instead, mortgage loans went to 700+ Credit Ratings almost exclusively. A 700+ Credit Rating suddenly became a bright line to determine if a borrower stood credit worthy. No thought occurred that someone with a 650 Credit Rating willing to put up a 20% Down Payment should find the same reception as someone with a 700+ Credit Rating.

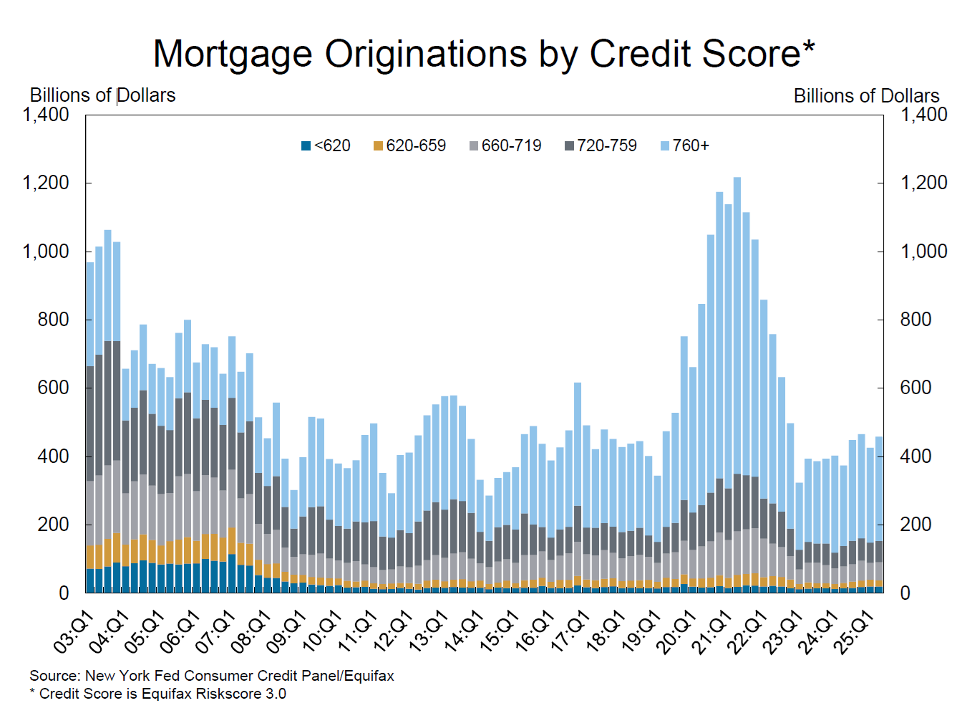

Prior to the Dodd-Frank legislation in 2008, Credit Scores below 720 made up 35% – 45% of all mortgage issuance. Starting in 2009, with the implementation of Dodd-Frank they fell to just 22% of all mortgage issuance. Today, over the past few years, they averaged just 20% of all mortgage issuance. The flip side stands the growth in 760+ Credit Scores from just 25% of all mortgage issuance pre-2008 to 65% – 70% today. (Please see New York Federal Reserve Quarterly Report on Household Credit and Debt for Q2 2025 available at: https://www.newyorkfed.org/microeconomics/hhdc .)

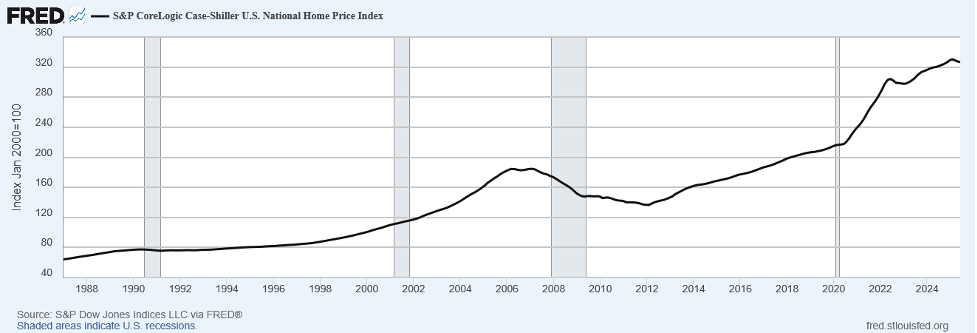

In addition to the above unintended impact of Dodd-Frank, another impact from the Law of Unintended Consequences came about care of the Federal Reserve. In driving down Mortgage Rates and pumping money into the economy from 2020 – 2022, Home Prices soared by 50% in 18 months:

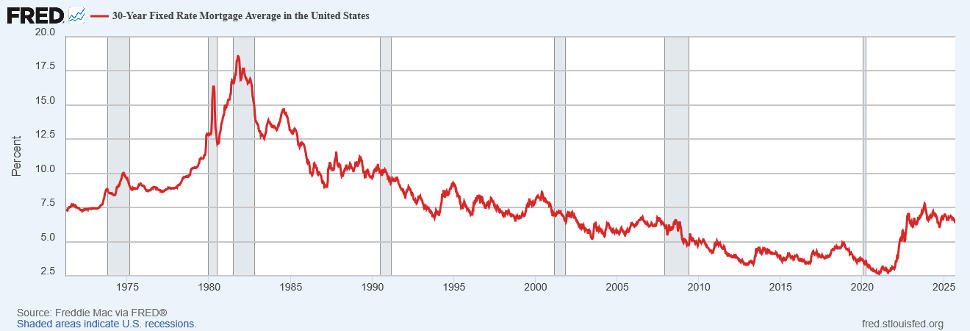

When the Federal Reserve realized its error, it raised interest rates, driving up Mortgage Rates to their highest level since the 1990s:

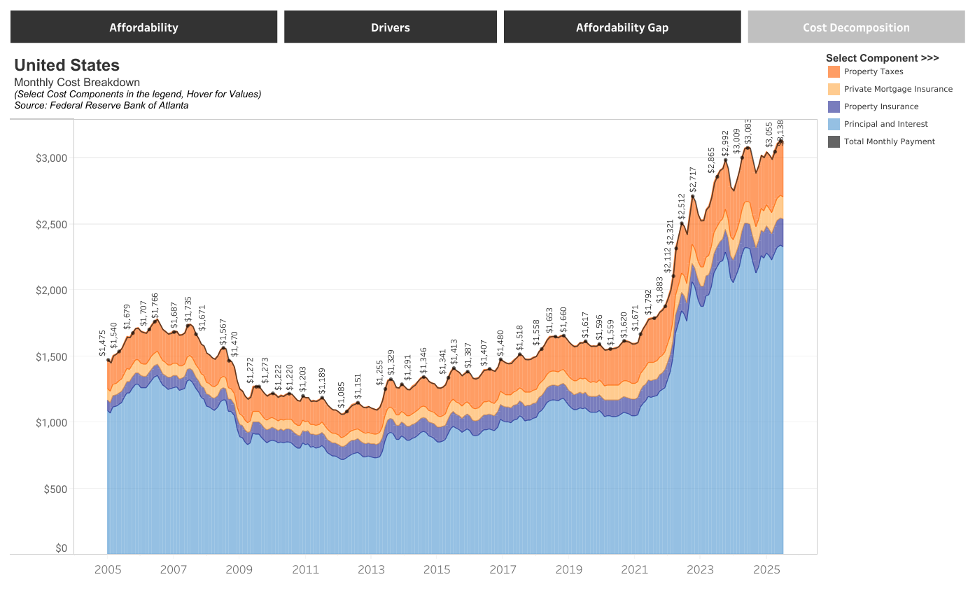

This caused the Monthly Payment for the Median House to double from 2020 – 2023:

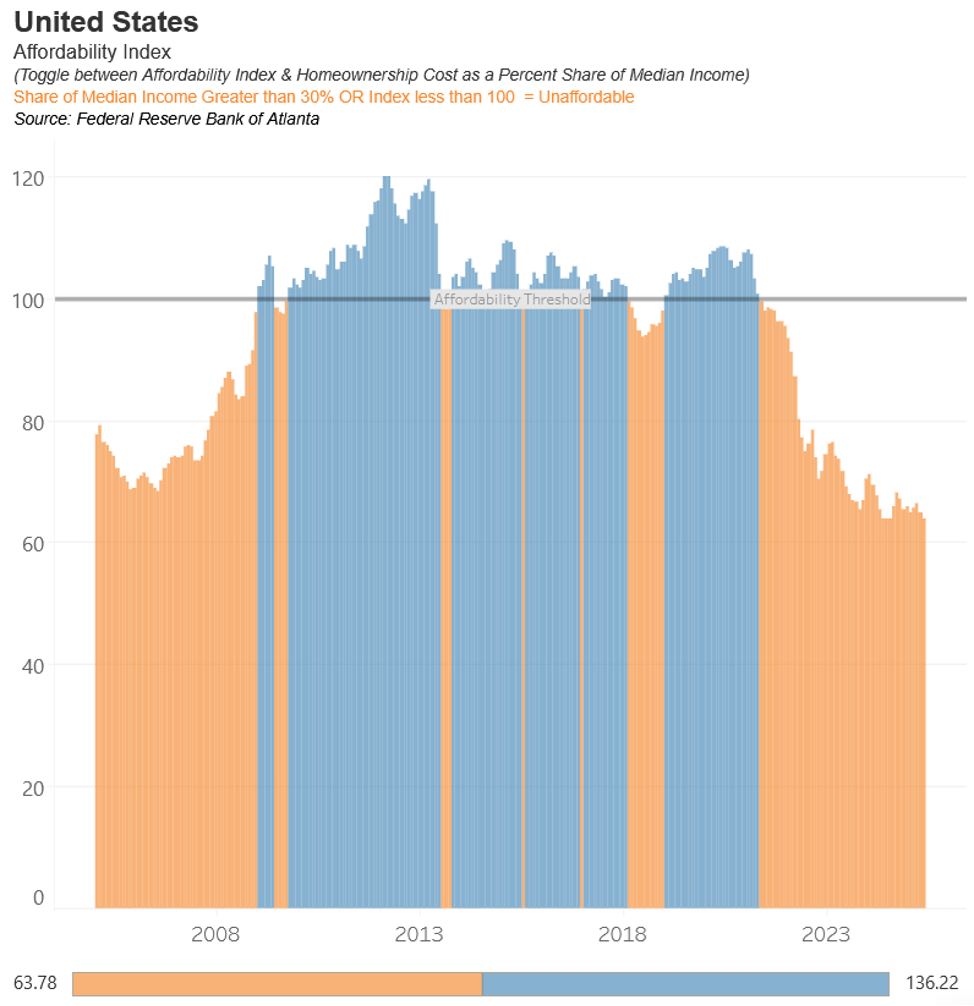

And, of course, this cratered affordability to its lowest level since the 2005- 2007 period, just prior to the Housing Crisis, and below where it stood at the peak of the Housing Bubble:

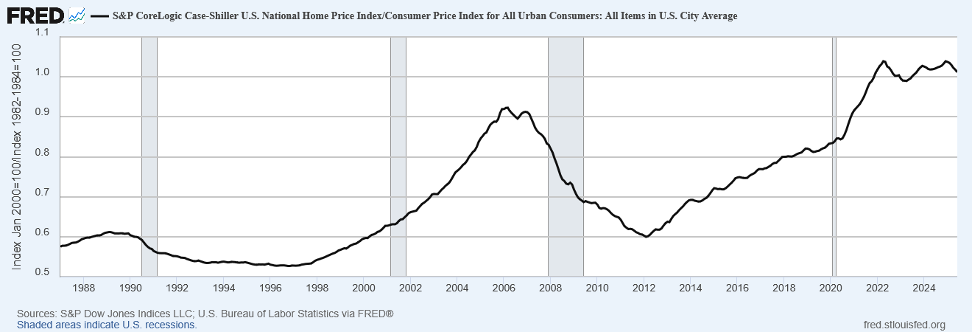

There already appears an impact on the Housing Market as Real Home Prices stalled out over the past three years:

In fact, Real Home Prices peaked in 2022 when measured via the Case Shiller U.S. National Home Price Index adjusted for the CPI. However, at some level, the Case Shiller Index lags the reality on the ground. In areas like Florida, Home Prices stand down 20% or more. In addition, major public homebuilders continue to report declines in sale prices year over year. Lennar Corp. recently reported prices down 9% year over year. Adjusted for the CPI, this would indicate home prices down double digits in real terms. So, while the data have yet to show up in official statistics, they clearly continue to show up on the ground. (For more background, please see Housing: Shades of 1987 published April 30, 2022.)

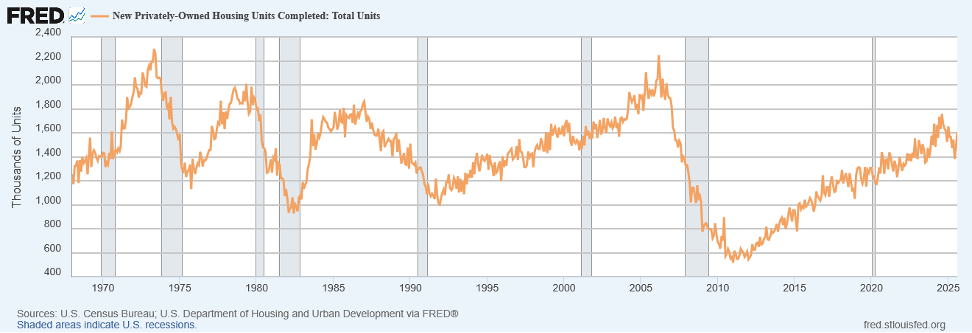

This stands not the only challenge facing the Housing Market. The other challenge facing the market is the Supply Side. The following chart shows Housing Completions for all types of housing units from single family homes to multi family apartment buildings:

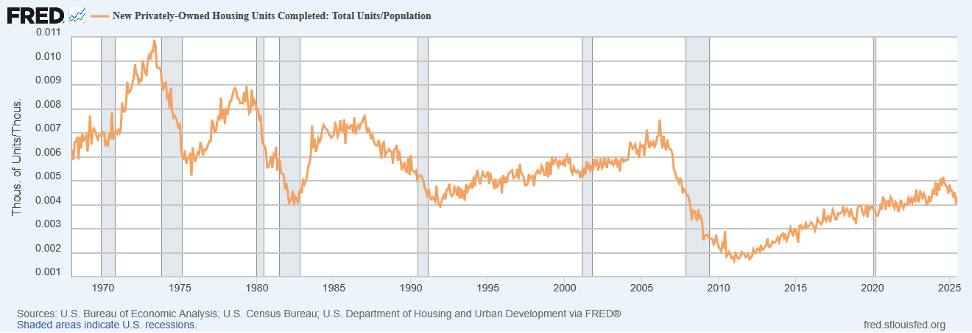

As the chart demonstrates, Housing Completions stand below the average level they achieved during the 1980s. And should Completions rise 10%, they would recover to 1980s levels. However, this does not tell the whole story. These statistics need adjustment for population growth. The following chart adjusts for the increase in the US population since 1968:

As the above chart shows, Housing Completions would need to rise 50% from current levels to return to their 1980s levels relative to Population, not a mere 10%.

To get there requires understanding the impediments that exist today. First, Environmental Laws require elaborate studies prior to any development. This can delay projects for years. Second, building codes stand much tighter than prior. This raises the real cost and complexity of building a home or an apartment building. Third, many states enacted Green Energy requirements that add cost to build any type of building. Fourth, many communities possess zoning laws that limit density. This prevents various projects that would add more units from potential building sites. Fifth, with the enactment of Dodd Frank, Federal Law made it more difficult for lower credit customers to purchase a home. This went against the Housing ethos enshrined during the 1930s and post World War II with the GI Bill. These laws encouraged home ownership and created mechanisms to make home ownership easier for the average American. Combined, all these impediments created roadblocks to building homes and apartment buildings throughout the United States.

To solve the “Housing Crisis” will require a coordinated national effort at both the Federal level and the State level. First, the Federal Government will need to ease up permitting to stop the multiple lawsuits that can delay any project for over a decade. This will need to come through Congressional legislation that addresses permitting reform. Second, States will need to enact laws that force local communities to allow higher density projects to proceed. Third, States will need to weigh Green Energy initiatives against Home Affordability for the average American. At some level, states such as California will need to ease their requirements. And Fourth, the Federal Government will need to reform the Dodd Frank legislation to enable lower credit Americans to obtain mortgages and return to the 35% – 45% of all home purchases as before 2008. Fifth, the Federal and State Governments will need to incent and potentially require builders to build lower price point units that meet the needs of average Americans. This will push builders away from much of the luxury home focus that they exhibit today. Such actions should provide both carrot and stick. When taken together, these five steps would lead to more Supply and lower price points.

While nothing stands written in stone, the anger of Americans over the cost of Housing stands palpable. And the lack of access to credit adds to this divide between the Haves and the Have Nots. For the average American brought up on the concept of the American Dream, where hard work would enable the purchase of a home that one could call one’s own, the concept rings somewhat hollow. But with politicians ultimately accountable to the people, the beginnings of change continue to appear. In a state such as California, various communities and cities such as San Francisco continue to consider higher density. The Governor of California just eased up on environmental regulations to enable refineries to stay open in the state and to prevent gasoline prices from spiking. With public pressure building to address this issue, further actions to enable more units, lower costs, and more credit seem just ahead. While today the country faces a Housing Affordability Crisis, the moves on addressing the Credit Issue unlocking The Supply Side draw ever closer. And, once they occur, Housing will once more drive the American economy as well as restore American’s faith in the American Dream.

Cornering the Market, It’s a Cycle, and Vendor Financing

Finally, we close with brief comments on Cornering the Market, It’s a Cycle, and Vendor Financing. First, the US bought out 100% of Rio Tinto’s production of Scandium, a key metal, for the next five years. This is a key input into defense and aerospace applications. With the US moving to create alternative supply for critical metals and rare earths with it at the head of the line, we see the US Cornering the Market. Second, Heavy Duty Trucks make up one of the most cyclical industries around. Production can soar or collapse in any given year. The latest production figures show US production down 42% year over year. For the truck manufacturers, It’s A Cycle. And Third, Nvidia announced a $100 billion investment into Open AI to enable it to finance the purchase of Nvidia chips. In effect, Nvidia invested part of its profits to ensure future demand for its products. This type of Vendor Financing arrangement mimics the behavior of the late stages of the Dot Com Era in the late 1990s, which ended badly. Should AI not produce the cash flow to maintain its torrid spending, things could like quite different in a couple of years.

In Closing

Should you have any questions on how the above issues or the items discussed in our accompanying cover letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer