Europe: Changing of the Guard & The Return to Growth

Views From the Stream

The Monthly Letter covers two topics this month. First, we take a look at Europe and its recent moves related to supplying its own defense needs. This move, driven by the U.S. Administration, will push Europe to invest heavily in its own production, leading to accelerating growth. Second, as always, we close with brief comments of interest to our readers on a variety of current topics relevant to the economy and the markets.

Europe: Changing of the Guard & The Return to Growth

Europe stands one of the world’s great tourist destinations. With its long history, ancient buildings, world class art work, varied cultures, beautiful landscapes, and great cuisine, what could a tourist not like. And with welcoming people in many of its countries, tourists feel at home despite the language and cultural differences. Thus, its popular destinations, such as Italy and Spain, find themselves overrun by tourists during the summer months.

However, underneath this glorious surface patina, there exist significant issues, not the least of which consists of poor economic growth, strife over immigration, and the inability to defend itself. For the past 30 years, Europe underperformed US economic growth massively.

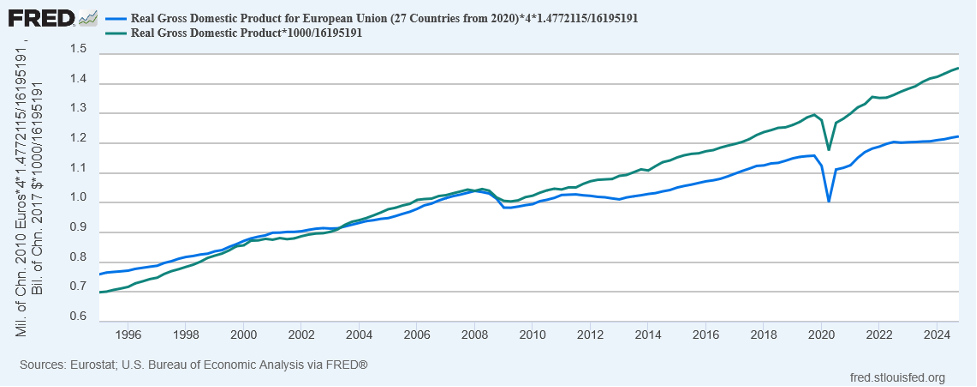

From 1995 – 2007, the US economy outgrew the EU by ~10%. And then from 2008 – 2024, US GDP grew 23% more than the EU, bringing the outperformance to more than 33% since 1995.

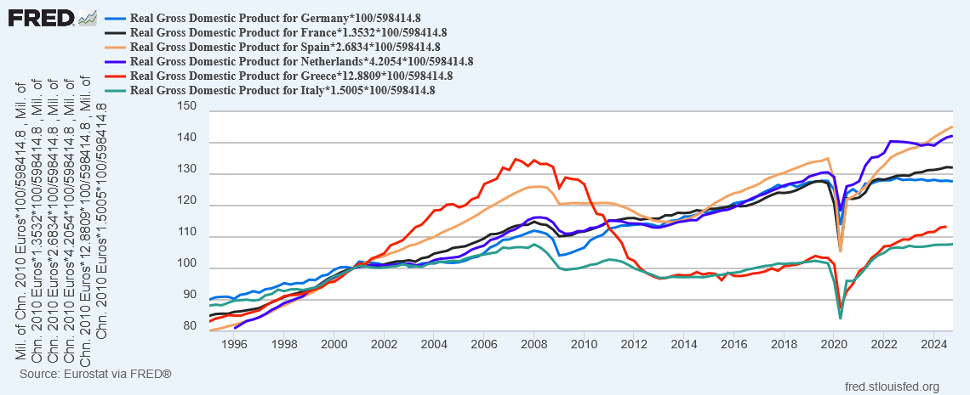

In addition to the above, there occurred massive differences in growth rates within the European Union since 2008. This was due to monetary policy that initially benefited Germany and bringing the Southern European countries into the EU with inflated currency values. Furthermore, Germany provided Greece with vendor financing to purchase goods from Germany and France, which caused its economy to grow faster than its normal organic rate then crash when the country could not afford to take on more debt to continue to drive its economy forward. Lastly, Germany tied a portion of its exports to China, supplying China with high value capital goods. This worked until China moved to domesticate manufacturing in these industries, retarding German growth over the past 5 Years.

As is clear since 2008, the average European country grew just 1% per year over the past 17 years. In addition, countries such as Greece have grown less than 0.5% per year since 2000 and Italy’s economy stands at its late 2007 GDP level. With poor economic growth, birth rates continued to fall leading Europe to move to allow immigration. However, with these immigrants not assimilating themselves into the European culture, anti-immigrant strife arose. In addition, with the end of the Cold War, Europe dismantled its armies and arms industries. Instead, it relied on the U.S. to protect itself from future conflicts. With the Russian invasion of Ukraine, Europe realized this policy stood a mistake. It left the Continent defenseless should the U.S. not provide a protective umbrella.

With the poor economic growth, unrest arose within the voting public. As a result, over the past 5 years, the parties on the right resurged posing a real political test to the entrenched parties. In addition, with the change in Administration in the United States, access to the U.S. market will now come with a larger price tag. And with Europe possessing a large trade surplus, this stands as another challenge to its growth. For example, should the U.S. move to domesticate car manufacturing, as almost every other country around the world does, the impact could be significant as Europe exports both cars and parts to the U.S.

All these forces combined produced large pressure on the existing political establishment to change the policies that led to the subpar economic growth. With Donald Trump becoming President, a catalyst came to the fore to push Europe to rethink its economic policies, led by Germany. Germany’s ability to increase its spending stands limited by its “Debt Brake”, a part of the Constitution which strictly limits the budget deficit the government can run. Germany’s current government declared an emergency to change the Constitution which would eliminate the Debt Brake. This would allow the German Government to create deficit driven stimulus to drive its economy in a similar fashion to many governments around the world, such as China and the U.S. The first step to leverage this change stands the Infrastructure Fund. This €500 billion fund will provide needed funding to areas such as railways, schools, electricity, … At €50 billion per year and a 10 year time horizon, it will enable long term project commitment and boost German Government spending by 1.2% of GDP. The second step concerns German defense spending. Under the changes, any spending greater than 1% of GDP will not count towards the Debt Brake. This will allow Germany to significantly increase its defense spending without worrying about any constraints up to 3.5% of GDP and could provide a significant boost to the economy while updating its defense manufacturing capacity.

In addition, with the Trump Administration threatening to withhold aid to Ukraine’s military, the EU began to discuss an €800 billion ReArm Europe initiative. The EU broke this spending into two parts. The first part comprises €650 billion in additional spending by the member governments over 4 Years or €162 billion per year. This would enable the member states to spend up to an additional 1.5% of GDP without falling subject to the Excessive Debt Procedure. In other words, Governments can add an additional 1.5% to the budget deficit without a fight with the EU. The second part would consists of €150 billion in Europe wide spending funded by bonds or €37.5 billion. The EU Bonds, guaranteed by the governments of the EU, would stand the first practical step to government budget integration. From a practical point of view, this means Germany and France guaranteeing the debt. The more important aspect is that the € 800 billion would represent 1%+ stimulus per year to the Continent. This would stand on top of whatever stimulus would flow in individual countries.

With Europe finally moving to address its fundamental issues, better times likely lie ahead. This includes faster economic growth and rising living standards. These two critical components of any stable country possess the potential to recement relations between countries in Europe, especially between the North and the South. While time will tell if Europe actually carries through with these initiatives, the signs appear promising. And if thoughts turn into action, the potential Changing of the Guard will have led Europe to The Return to Growth.

The High Cost of Laundry, Getting In Shape, and Here Come the Robotaxis

Finally, we close with brief comments on The High Cost of Laundry, Getting in Shape, and Here Come the Robotaxis. First, one of the major laundry soap manufacturers shrank its container size by over 30%. Hidden inside this shrinkage was a rise in price of over 15% per ounce. For consumers, this adds just one more item where prices continue to rise, as The High Cost of Laundry hits home. Second, gym attendance and spending continue to rise. Both Life Time Group and Planet Fitness reported strong growth in revenue and continued growth in membership. This stood despite the turmoil in the markets and the economy. Given this, we see consumers Getting In Shape. And Third, Uber reported that Waymo’s cars are performing well above expectations in their Austin, Texas launch. Uber plans to scale its Waymo cars in Austin over the next few months, then launch Waymo cars in Atlanta, Georgia over the summer. For consumers, Here Come the Robotaxis.

In Closing

Should you have any questions on how the above issues or the items discussed in our accompanying cover letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer