Commodities and the Long Cycle: Real Returns, Investing, and The Coming End to the Down Cycle

“Even in the corn-exchange of a country town on a market-day the equilibrium price is affected by calculations of the future relations of production and consumption; while in the leading corn-markets of America and Europe dealings for future delivery already predominate and are rapidly weaving into one web all the leading threads of trade in corn throughout the whole world. Some of these dealings in ‘futures’ are but incidents in speculative manoeuvres; but in the main they are governed by calculations of the world’s consumption on the one hand, and of the existing stocks and coming harvests in the Northern and Southern hemispheres on the other. Dealers take account of the areas sown with each kind of grain, of the forwardness and weight of the crops, of the supply of things which can be used as substitutes for grain, and of the things for which grain can be used as a substitute. Thus, when buying or selling barley, they take account of the supplies of such things as sugar, which can be used as substitutes for it in brewing, and again of all the various feeding stuffs, a scarcity of which might raise the value of barley for consumption on the farm. If it is thought that growers of any kind of grain in any part of the world have been losing money, and are likely to sow a less area for a future harvest; it is argued that prices are likely to rise as soon as that harvest comes into sight, and its shortness is manifest to all. Anticipations of that rise exercise an influence on present sales for future delivery, and that in turn influences cash prices; so that these prices are indirectly affected by estimates of the expenses of producing further supplies.”

Book V: General Relations of Demand, Supply, and Value

Chapter III: Equilibrium of Normal Demand and Supply

Principles of Economics, 8thEdition

By Alfred Marshall, 1920

The history of commodity cycles stands as one that follows both economic cycles and inflation cycles. These commodity cycles can span just one economic expansion and recession or they can form a multi-year industry investment cycle. Typically, commodities move up and down with the economic cycle. However, every 15 – 20 years, the commodity industry must renew its capital base. This requires a sustained period of higher prices across economic cycles, as not only must producers increase output, but the companies that manufacture the equipment for the producers must expand capacity, which requires higher prices for the equipment manufacturers to justify increasing output. Thus, the higher prices from the equipment manufacturers increases costs for the producers, which then need even higher prices to justify expanding their production. This continues for 8 – 10 years until production across the entire supply chain increases enough to support future growth. Then the cycle ends, often viciously, with a massive crash in prices. The most recent cycle like this occurred from 1998 – 2008, when Emerging Market growth accelerated, driving demand for commodities. Ultimately, demand growth slowed but supply growth did not, as it often takes several years to bring major commodity projects online. Throw in a recession causing growth to shrink at the same time as new mines come online and, presto, commodities collapse. Oil will serve as the classic example during this cycle. Oil rose from a low of ~$12 per barrel in 1998 to a peak of $147 in July, 2008. It then crashed to less than $50 by the end of the year.

The other type of commodity cycle relates to the creation of money by governments. This can occur through two different approaches, but they both end with the same result. The first approach occurs when a government runs significant budget deficits on a regular basis to meet spending goals and prints money to fill the gap. This approach is followed by a number of African and South American countries. This inevitably leads to continuous high inflation, as the number of pieces of paper called money expand faster than the goods people can buy. Citizens resort to commodities, such as gold, or hard assets, such as real estate, to preserve their wealth. Velocity of money accelerates, as no one wants to hold the pieces of paper any longer than necessary. This further increases inflation. While the prices of these commodities may not rise in terms of other currencies outside the country in question, for the citizens of that country, inflation hovers like a black cloud following them everywhere they go. The other approach to printing money occurs when countries run up too much debt. If the debt stands truly outsized relative to their economy, countries default, slashing their debt, but hurtling their economies into bruising recessions. As politicians like holding office, they try to avoid this outcome if possible. And there exists a way to make this possible. Inflate your way out of the problem. Countries will print money to massively depreciate the value of their currency. This causes inflation to rise well above the interest rate they are paying on outstanding debt, thus decreasing in real terms, often significantly, the cost of interest and massively slashing the future value of the debt when it matures. This occurred during the 1970s in the U.S. when inflation exploded. A US Dollar in 1980 bought only as much in real goods as $0.33 did in 1970. In other words, a US Dollar’s value fell by over 65%. However, if one held gold during the 1970s, gold prices went from $39 in 1970 to $595 at the end of 1980, actually hitting $850 at one point during 1980. In other words, gold rose over 15x, well in excess to the 3x for prices in the economy.

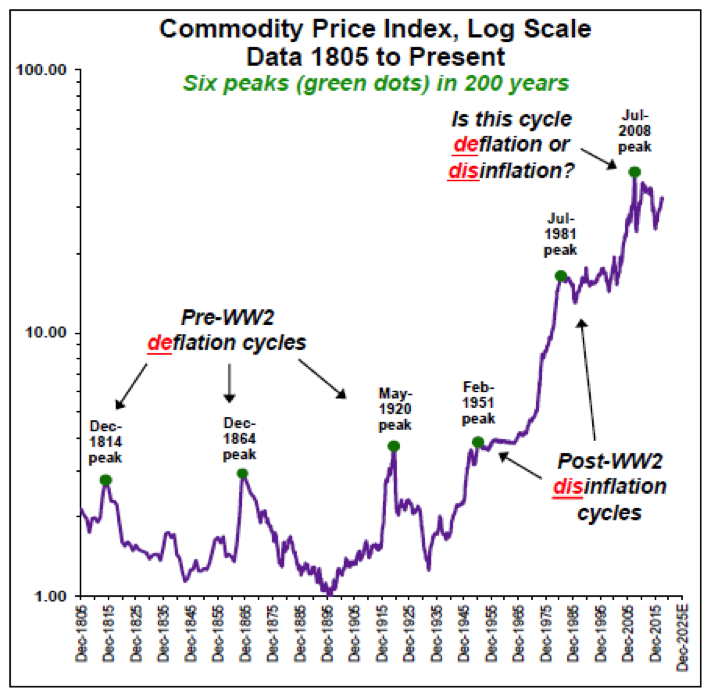

For investors, understanding whether Commodities sit in one of the regular, short cycles or in an extended cycle becomes critical. If a normal cycle, then a few years of upside will get wiped out by a few years of downside. Timing becomes critical. But if a long cycle, then the upside can extend for many years, which means ignoring short term fluctuations. The below chart provides some historical perspective on commodity cycles over the long term:

As the chart shows, US commodity cycles spend years going nowhere or down, then explode to the upside. They also, since the creation of the Federal Reserve in 1912, seem to move in approximate 25 – 30 year cycles. Most also can be associated with wars and/or post-war inflations, that inflate away the real value of debt. The peak in 1920 occurred after World War I. The peak in 1951 occurred after World War II. The peak in 1981 occurred after the Vietnam War and at the tail end of the Cold War. And the 2008 peak can be, at some level, associated with the wars in Afghanistan and the Middle East, where the US spent over $1 trillion combined. Based on the above cycles, the next secular move in Commodities should begin sometime between 2025 and 2030. However, typical downcycles only last 10 – 12 years, before basing. Major commodity bottoms occurred in 1932 – 1933, 1962 – 1963, and 1993 – 1994. Typical bases take 3 – 5 years after a bottom before the next major upcycle ensues. Given this, 12 years after 2008 would indicate some sort of bottom in 2020 – 2022, that would represent the End to the Down Cycle, which would extend through 2025 – 2027. Such timing, for a new upcycle to begin, would coincide with the massive unfunded liabilities of the U.S. government, in the form of Social Security, Medicare, and Medicaid, coming due. (While not “debt” in the traditional sense of the word, they represent payments the government must make and in that sense are “debt-equivalents”.) These liabilities, at multiples of GDP, represent amounts that can never be paid in real terms. And, as noted above, when governments cannot pay their debts, they either default outright or default via massive inflation that reduces the real value of the liabilities. For the US, default via inflation would follow historical precedent as noted above and for earlier periods of debt such as the Civil War and The War of 1812.

With a recession likely in the 2021 to 2022 time frame, Commodities could put in a low during the recession that represents the bottom for the Long Cycle. After a several year period in which Commodities base, Investors could then look forward to a new secular Up Cycle that would drive Real Returns. In the meantime, typical cyclical moves lasting several years to the upside followed by several years to the downside likely will ensue. With Commodity Cycles long and the accumulation of real assets taking time, Investors should possess a large opportunity to accumulate assets ahead of the next Up Cycle. They could then look forward to many years of Real Returns as the Long Cycle turns in their favor. (Data from public sources and Stifel Nicolaus & Company coupled with Green Drake Advisors analysis.)

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2018 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.