Global Economic Quarterly, Part 1: China Growth Illusions And The Coming Global Economic Split

Views From the Stream

The Monthly Letter covers two topics this month. First, we review Chinese Growth, its trajectory, and the implications for the Global Economy. While China continues to report 5% growth year in, year out, data on the ground continues to bring this statistic into question. While Chinese companies continue to take share from non-Chinese ones, growing at rapid rates, overall underlying growth remains anemic. Furthermore, with real estate continuing to shrink, continued investment into manufacturing capacity and exports remains the preferred method to drive GDP Growth. However, this puts the economy at major risk over the next decade as foreign countries continue to react to China flooding the Globe with product. In response, countries continue to put in place tariffs, import barriers, and domestic production requirements. As they slowly but surely get implemented, they have begun to cause real issues for China’s exports, creating more overcapacity domestically then currently exists. Second, as always, we close with brief comments of interest to our readers on a variety of current topics relevant to the economy and the markets.

Global Economic Quarterly, Part 1:

China Growth Illusions And The Coming Global Economic Split

“May you live in interesting times.”

Ancient Chinese Proverb

The Chinese Economy stands a miracle of growth over the past 50 years. From humble beginnings, the Chinese Communist Party steered the country adroitly, creating the second largest economy in the world. In doing so, it eschewed the rules that it agreed to follow when it joined the global trading system. And the government focused on driving its industry at all costs. In addition, it packed 50 years of modernization into the past 25 years, building world scale companies and industries that could challenge any company around the globe. As a result, China possesses massive scale across numerous industries producing over 50% of the world’s steel and more solar cells than many countries combined. It now set its sights on becoming the dominant technology powerhouse in order to continue its torrid growth, adding semiconductors, semiconductor capital equipment, networking, AI, and other areas to its dominant industrial position. And, for the leaders of the CCP, enabling the country to continue its 5%+ annual economic growth on its march to become the dominant global country.

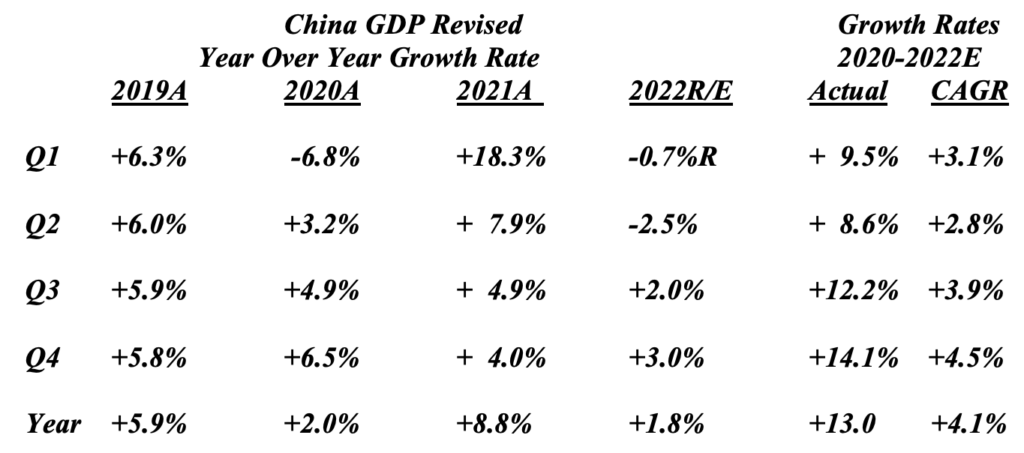

While China continues to report spectacular growth numbers, the continued push to drive its economy forward leaves it little choice but to put the foot on the export accelerator while continuing massive investment under its FAI program. With huge overcapacity across numerous areas of the Chinese economy, this means these economic growth numbers bear some examination. As written previously, China’s reported growth deserves real scrutiny. And, once recomputed to bear some resemblance to the data on the ground, the GDP Growth data demonstrates the following results:

Data from National Bureau of Statistics of China and Green Drake estimates.

Please see Global Economic Quarterly, Part 2: A Slowing Dragon & An Elephant Leading the Charge

Originally Published May 31, 2022

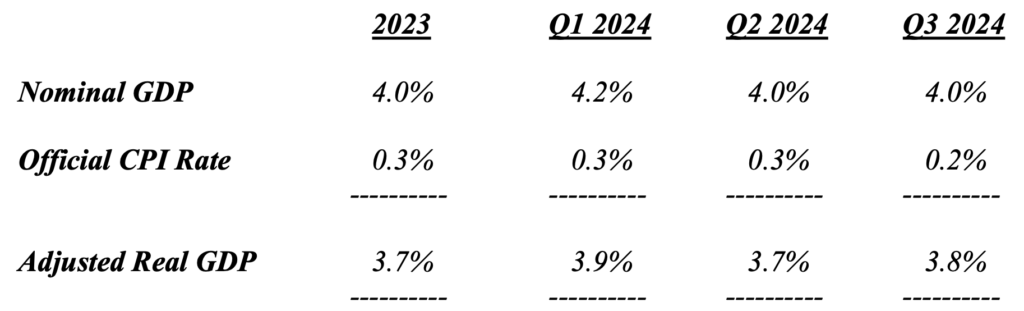

More recent data looks as follows:

Source: China National Bureau of Statistic

Source: China National Bureau of Statistic

Please see Global Economic Quarterly: Every Country for Itself

Originally Published May 31, 2024 and Updated from https://www.ceicdata.com/en/indicator/china/nominal-gdp-growth

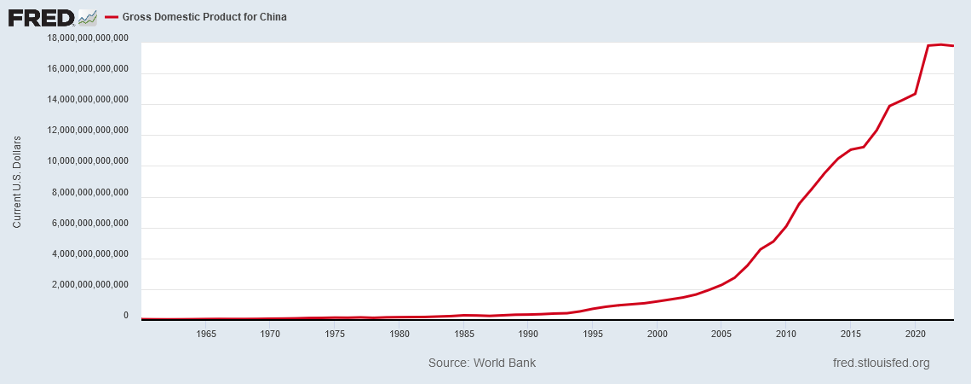

This stands consistent with the deceleration reported in prior years. The below graph shows China’s GDP in US Dollars since 1960:

As the Chart demonstrates, China’s GDP appears to have flattened out in US Dollars. In fact, 2022 Annual GDP Growth settled at 0% in US Dollars and 2023 showed negative growth of -0.3% in US Dollars. This appears a far cry from the reported 5%+ Growth or even the growth outlined in the tables above.

This should come as no surprise. Numerous local governments stand in a payment squeeze, with suppliers and workers going unpaid. And Youth Unemployment soared to almost 25% before the statistic was discontinued. To offset this, the national government continued massive Fixed Asset Investment to create a totally self-sufficient economy and drive exports. With other countries beginning to create local content laws, such as Indonesia, and the United States moving to reshore and nearshore production, the sustainability of these policies stands in question. An indication of this stands in China’s share of Global Exports, which stalled over the past few years in the face of these policies. Given the size of China’s economy, the growth it fundamentally enjoyed from 2000 to 2010, stands impossible to recreate. However, to meet political goals pinned by China’s 100 Year March to global dominance, these economic statistics must conform to those dictated by the leadership of the CCP and show China’s inevitability in becoming the dominant global power.

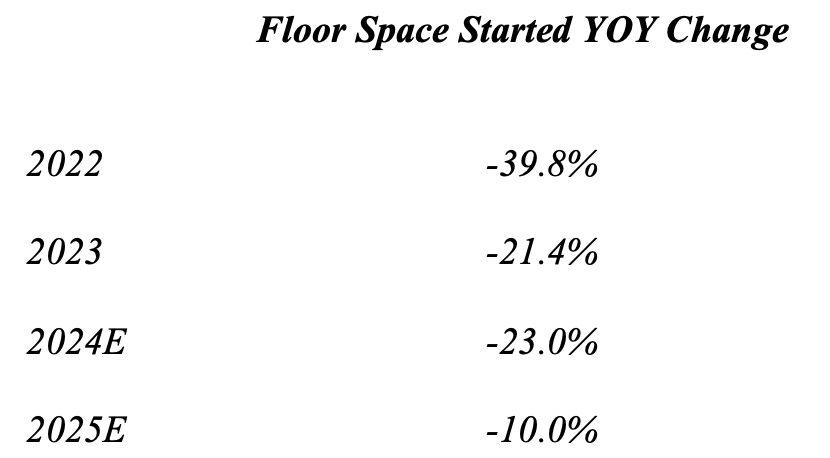

To understand the disconnect that exists between the top down driven policy and the bottom up data, a simple look at real estate will illustrate the problem China faces. The data on Floor Space Started stands as follows:

Real Estate production, measured in square footage started, collapsed 63% since 2021. With real estate representing ~25% of the economy at its peak, this represents a serious drag on the economy of up to 15% of GDP over the past 3 Years. Given that real estate consumes copious amounts of steel, concrete, plumbing, …, the spillover effects stand large. With China reporting economic growth of 5%+ per year, this would imply the remaining 75% of the economy drove 10% compound growth in Total GDP over the past three years. In other words, the rest of the economy grew at a 15.6% compound rate to offset Real Estate’s decline. It stands hard to imagine how such an outcome could occur.

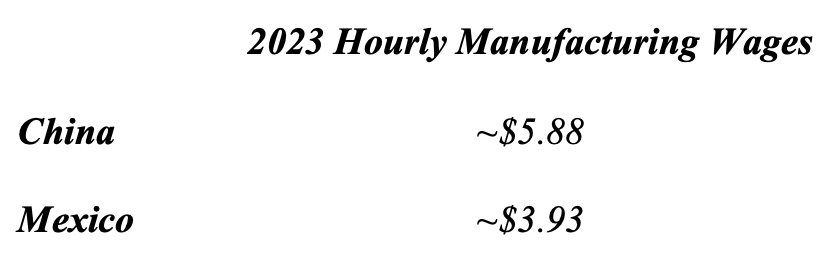

In addition to the issues with Real Estate, China faces fundamental issues in manufacturing. It is no longer competitive as a low wage country. The following table illustrates the challenge from other lower wage countries such as Mexico:

Given this reality, the only way for China to compete here stands massive government subsidies to its manufacturing sector. Or to move to trans-ship component product to these countries where they become assembled into finished goods by lower wage labor. This appears its strategy with Mexico whereby its components make up 80%+ of info tech product assembled there according to reports by the U.S. Government. With the US – Mexico trade agreement set for renegotiation in 2025, this lack of locally produced content will become a major issue, likely creating U.S. content minimums, North American content minimums, certificates of origin for various components, and embargoes on imported components from certain countries. For China, none of these actions will aid its trade sector and will push it to dump even more goods into its Asia neighbors and those to the South. With other countries wanting to drive their own manufacturing, their reception may become less that rosy, as they run into local production requirements. In addition to these purely economic interests, there now permeates, throughout all industry, geopolitics as an overriding factor. With the US and China entering a New Cold War which entails each producing its own key economic goods, the outlook for trade in numerous advanced manufacturing industries targeted by China appears dim. Already, the impact showed itself in the 29% drop in Electric Vehicle exports recently reported by China as the US and EU imposed tariffs. Should the U.S. continue to reshore production, which appears a logical move from a National Security perspective, then additional restrictions and blocks would occur surrounding Chinese manufactured goods and their import. As an example, the U.S. Congress just approved billions of dollars to enable telecom and utilities to remove all Chinese technology from their networks. And, with China embargoing exports of critical materials, metals, and parts as a message to the rest of the world of its manufacturing dominance, these moves should accelerate in the United States and around the Globe as countries seek to disentangle their supply chains from China. The logical outcome of all these pressures on its export economy appears a Coming Global Economic Split and an exacerbation of its overcapacity issues. And such a “Split” will sorely damage this key remaining growth driver of China’s economy, likely creating further headwinds for the second biggest economy in the globe. Not an outcome desired by the CCP, but one set in motion by its actions.

Lastly, China faces a demographic disaster. Due to the One Child Policy, the country’s population peaked in 2021. Since then, overall population continues to decline. Various outside think tanks estimate that China’s popular will fall from over 1 billion people to less than 700 million as the century progresses. This creates additional headwinds for real estate and fundamental questions around its ability to find the manpower to support its economy. The working age population peaked before 2020, which represents additional drag. Compounding this demographic disaster, the fertility rate stands at just ~1.7 in 2024. With a nation needing to produce 2.1 babies per couple to maintain its population, let alone grow it, China’s fertility rate will lead to continued population shrinkage over the long term, beyond what its one child policy created. And, ultimately, a shrinking population leads to a lesser role in the global economy, as other nations continue to grow their populations and increase their share of potential future consumption. Simply put, Demographics is destiny.

For China and the CCP, there stands a cultural imperative to become the largest and strongest nation on Earth. In achieving this goal, the country would undo, what the country calls, The 100 Year Humiliation. However, when one peeks under the tent surrounding The 100 Year March, it becomes less an inevitable outcome than a vision of the country. Much of China’s growth reported over the past several years appears Growth Illusions, produced for outside consumption, but bearing little resemblance to the reality within the country that they cloak. And if this reality should shine forth, there exists an existential question of whether the CCP can withstand such scrutiny. Thus, any challenges to the view of the country’s inevitable triumph or to the CCP leads to less than happy results for any Chinese citizen. For the Globe, the reality of China’s situation bears huge implications, as growth relocates elsewhere as do supply chains. And, as this global rearrangement unfolds, China will stand the center of this change, bearing the costs of stranded assets and fewer outlets for its goods. Just as its Real Estate Sector collapsed, so could its manufacturing should other countries tariff out or embargo its goods and move to domesticate production for National Security reasons. While the CCP views its Made In China 2025 policy as the pinnacle of restoring China’s glory, it may become its undoing as countries around the globe move to protect their industries from the massive overcapacity China continues to create. With China Growth Illusions standing tall and The Coming Global Economic Split upon us, it appears China faces a future much different from its 100 Year March vision that could potentially prove fatal to the CCP and its economic philosophy.

Nothing Wasted, Feeling Creamed, and All The News

Finally, we close with brief comments on Nothing Wasted, Feeling Creamed, and All The News. First, solid waste companies continue to use pricing to offset lackluster volume growth. Despite negative volumes in 2024, these companies reported positive revenue growth leaving Nothing Wasted. Second, Costco recently replaced Land ‘O Lakes Half and Half (half milk and half cream) with its own store brand. In doing so, it raised the price from $1.99 to $2.29 or by ~15%. As a result, buyers might be Feeling Creamed. Third, the New York Times continues to raise prices aggressively to make up for its lackluster subscription growth. It raised prices from $17 per month for a regular subscription in 2024 to $20 per month in 2025 or by 17.6%. This is up from much lower levels several years ago when it utilized teaser rates to attract and retain readers. For subscribers, All The News continues to get more and more expensive.

In Closing

Should you have any questions on how the above issues or the items discussed in our accompanying cover letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer