AI, Green Energy, & Manufacturing: Driving An Electric Investment Renaissance

Views From the Stream

The Monthly Letter covers two topics this month. First, we provide an overview of the Electric Sector. After almost a decade of no growth in demand, due to the aftermath of the 2008 – 2009 Recession and the substitution of energy saving devices for more energy intensive one, such as LED lighting replacing incandescent bulbs, Electric Demand started to grow again in 2017. This growth accelerated in 2022, as the impact of the Inflation Reduction Act, CHIPs Act, other Congressional legislation, and the adoption of EVs started to impact the economy. And this stands before Reshoring picks up in the second half of the decade. As a result, electric demand growth accelerated from 0.5% in the prior decade to what is estimated to reach almost 5% per annum over the next five years. This growth in Electric Demand poses both opportunities and challenges for the Electric Sector. Second, as always, we close with brief comments of interest to our readers on a variety of current topics relevant to the economy and the markets.

AI, Green Energy, & Manufacturing: Driving An Electric Investment Renaissance

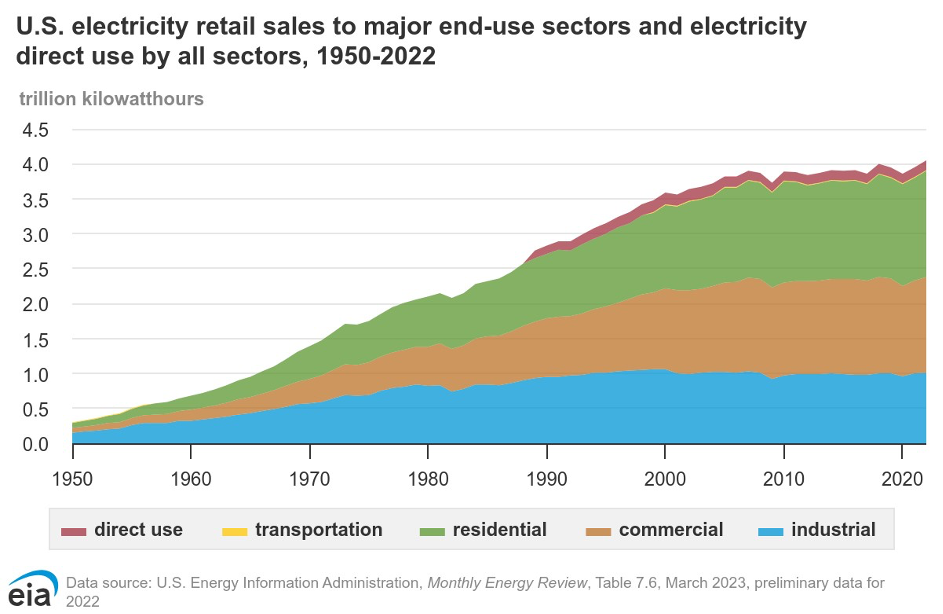

Electric usage growth stands one of the key indicators of true underlying economic growth. It reflects the demand from citizens for everyday life coupled with the growth in real output of the economy. When the real economy grows, actual units consumed grow. When the real economy shrinks, actual units shrink. There exists no hiding. The following chart from the U.S. Energy Information Administration lays out electricity consumption from 1950 – 2022:

As the chart makes clear, U.S. Electricity Consumption grew steadily over the period of 1950 – 2007. Then, it stagnated from the 2008 – 2009 Recession until 2017, when it began to grow again, making a new high in 2019. After a pullback during the Pandemic, it continued to grow over the past few years.

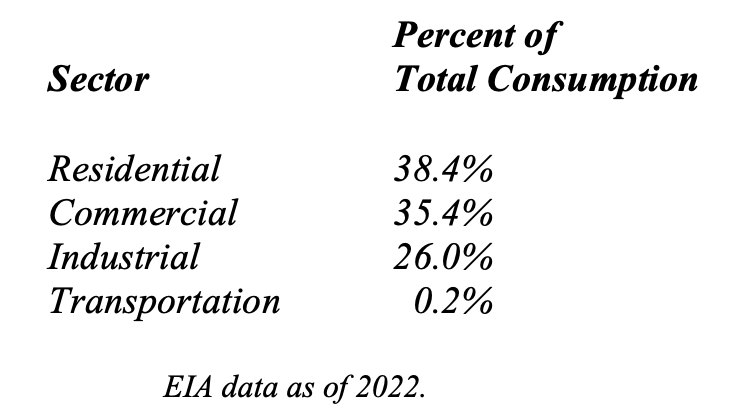

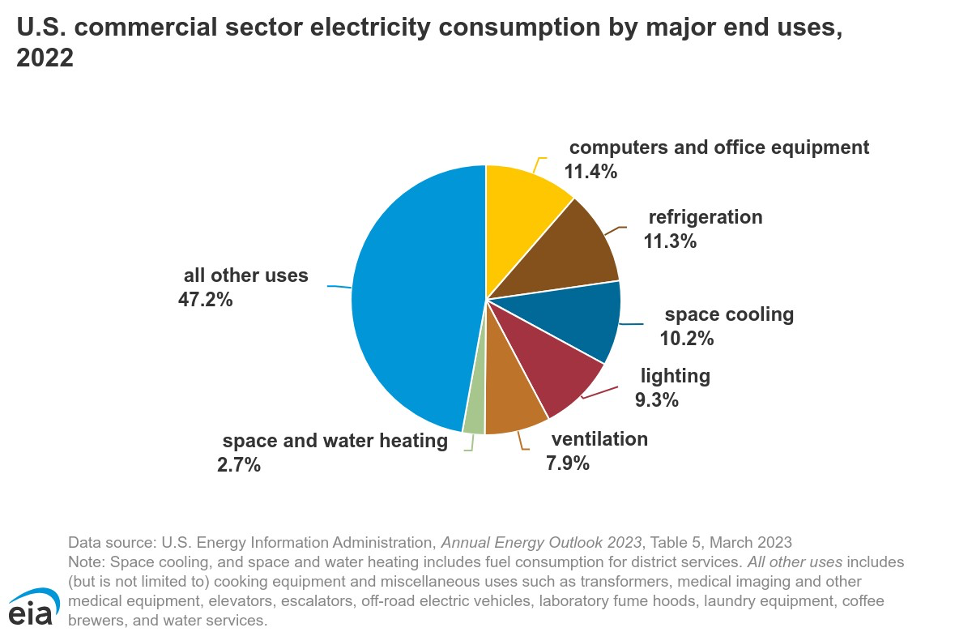

Electric Consumption in the United States falls into a few major categories. These break down into the following sectors:

As the next chart makes clear, included in the Commercial Sector are Data Centers, which already make up 2.5% of all electric demand in the country:

According to a report from Boston Consulting Group, due to the explosion in AI Data Centers, this sector could make up 7.5% of all electricity demand by 2028. In other words, over 5 years, electric demand from Data Centers could triple, due to the electricity intensity of AI Chips for servers, which consume 3x to 12x as much electricity as standard CPU Chips, and due to their heat intensity, which requires a much more robust cooling environment.

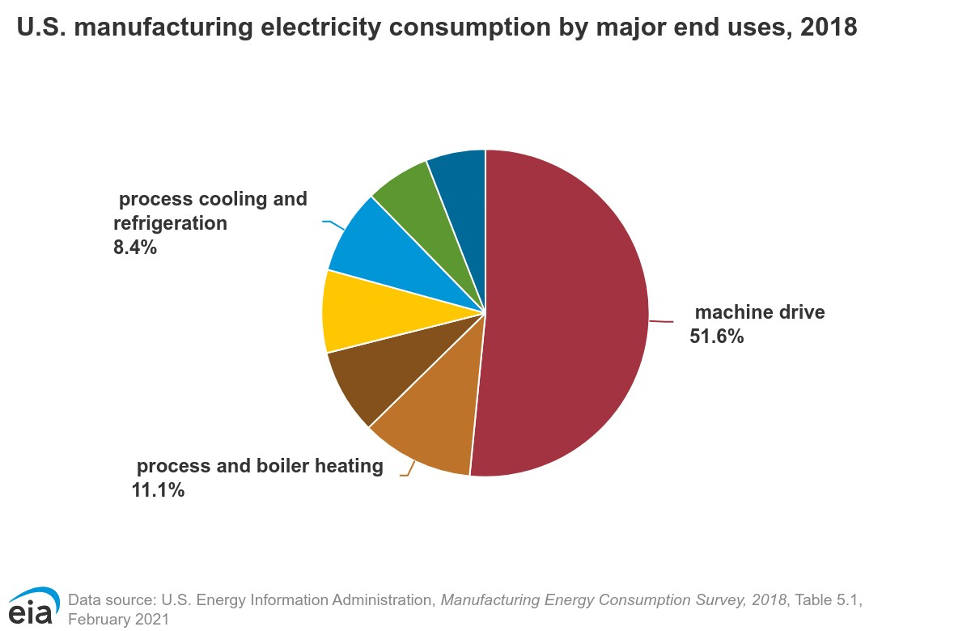

In addition to the above, the U.S. Government, through a variety of legislation and regulatory actions, created significant incentives to build Semiconductor Fabs and EV Manufacturing facilities in the U.S. Furthermore, the Federal Government began to push for various industries to move certain production back to the U.S., which should accelerate in the second half of the decade. Industrial demand for electricity breaks down as follows:

As this chart demonstrates, almost 85% of the Industrial demand relates to the actual production out of the plant. Thus, as the U.S. grows its manufacturing once more, electric demand from this sector should grow commensurately.

Prior to 2008, Electric Consumption grew between 1.8% and 2% annually. This was underlying demand growth of 3% – 4% offset by efficiency improvements and the adoption of new technologies. From 2008 until 2016, annual Electric Consumption growth slowed to just 0.5% per year. However, Electric Consumption growth reaccelerated in the 2022 – 2023 period such that forecast cumulative increase in demand by 2028 went from 2.6% to 4.7% in just one year. (Please see The Era of Flat Power Demand Is Over from Grid Strategies at https://gridstrategiesllc.com/wp-content/uploads/2023/12/National-Load-Growth-Report-2023.pdf . Data in the report are based on FERC (Federal Energy Regulatory Commission) required load filings.) Data Centers mostly account for this changed forecast. And since utilities filed this data with FERC, they raised their growth forecasts further to account for over 200 new manufacturing plants announced in 2023, to meet domestic content legislation, along with incremental demand from Electric Vehicles by end users as well as state government regulations and incentives to move to electric heat pumps from natural gas boilers. Should demand growth return to its pre-2008 pace, cumulative demand growth over the next 5 years could total 7.5% – 10.0% or more. This 5 Year Growth would exceed all of the Electric Consumption growth from 2008 – 2017, representing a sea change in demand. And this demand forecast excludes new applications such as hydrogen plants

To meet this demand will require a major pivot by Utilities and Utility Commissions to meet the investment needed to satisfy demand. In other words, Utility Commissions will need to face the reality that they must approve significant rate base increases for Utilities to enable the utilities to put in place the transmission, distribution, and generating capacity needed to meet this growing demand. In fact, recognizing this reality and the need to address the construction of Transmission Lines, the FERC issued a new order in 2024, Rule 1920, that requires Utilities to plan and construct sufficient Transmission to meet demand growth. (Please see https://www.ferc.gov/media/e1-rm21-17-000 for a copy of the rule.) For Utility Commissions, which have basked in Utility Bills dropping from 7% of the average Consumer’s wallet in 2007 to just 5% in 2022, the reality of increased Rate Bases, which require raising Utility Bills, stands a difficult political decision, best deferred until after the 2024 Elections to avoid political heat.

To give some sense of this, a quick look at Electricity Industry infrastructure installations will create some context. Due to lower growth post-2008, Utilities slowed their build of Transmission lines. While they committed to line growth reflecting pre-2008 growth until ~2015 of 1700 miles of new High Voltage Lines per year, this fell to just 645 miles in the second half of the decade. To return to prior levels of construction, Utilities will need to increase their Transmission build by over 150%. In addition, U.S. Transmission Grids possess an average age of 35 – 40 years. This compares to a 30 year average transmission cable life. Reflecting this underinvestment into Transmission, there exists a record amount of Generation awaiting interconnect from Utilities across the nation according to the annual survey conducted by the Lawrence Berkeley National Laboratory:

On the Generation side, in 2022, Utilities initially planned for just 21 GW (gigawatts) of needed capacity from 2024 through 2028. In 2023, this figure rose to 38 GW, which assumed just 0.9% per annum growth in Electricity Demand over the period or a total of just 4.6%. Should demand growth return to the pre-2008 level of 1.8% – 2.0% per annum, driven by the factors outlined above, then Electricity Demand would grow 9.3% – 10.4%, requiring 77 – 86 GW of Generation, more than twice what Utility Commissions project today. In addition to these pure capacity needs, Utility Commissions required many Utilities to install Solar and Wind Energy. Given their intermittent production, this will require Storage Facilities and Backup Power Facilities to produce power when Solar and Wind do not. Today, there exist over 20 GW of planned Battery Storage Projects as of April 2024, which exceeds the current installed base of 17.4 GW. This represents incremental investment on top of that needed for Transmission and Generation.

As this data makes clear, the AI Data Center Construction Boom, without any additional demand drivers, would require a faster pace of growth in Electricity Infrastructure. On top of this, Green Energy, due to its intermittent nature of electric generation, being dependent on the wind and the sun, will require additional investment to store the excess electric production in Battery Storage Facilities. This incremental capital need does not enter into the equation when putting in place nuclear or natural gas driven capacity, which requires no storage. In addition, Green Energy requires Backup Generation for when the Wind does not blow and the Sun does not shine. All of this requires incremental capital investment by Utilities. Lastly, the United States began to reshore Manufacturing production. The first area of focus stands semiconductors, with the enactment of the CHIPs Act. But the government also moved to require a significant portion of other industries to have domestic production, such as EVs. Without significant domestic content, an EV will fail to qualify for the tax credits and incentives under Congressional legislation. In addition, for National Security reasons, the Federal Government started to expand Defense Industrial Production to ensure the United States could defend itself in a war. This initiative includes not only the sophisticated technology needed for missiles and other goods, but also the basic manufacturing necessary to produce the thousands of components needed for most products. With AI, Green Energy, and Manufacturing all growing at a rapid pace, it stands clear that, these factors combined, will Drive An Electric Investment Renaissance for the foreseeable future.

Glued to the Tube, Oh Deere, Oil’s Not Well, and The Bionic Human

Finally, we close with brief comments on Glued to the Tube, The New Discounters, and The Bionic Human. First, while the news stands filled with the struggles of streaming services, there appears an exception. Netflix’s revenues and subscribers continue to grow apace. The company grew revenue over 17% and subscribers over 16% in Q2. For Netflix, its viewers are clearly Glued to the Tube. Second, there appears a slowdown occurring in the farm economy. Tractor sales are down this year and the inventory of use equipment for sale continues to rise. With industry sales still above long term mid-cycle levels, the downturn should extend into 2025 as farmers digest the large amount of new machinery they purchased over the past five years. For the manufacturers of equipment, all we can say is Oh Deere. Third, the disease ravaging the Olive Oil farms in Europe started to flow through the grocery store which impacts the average consumer well beyond what any CPI gauge would indicate. A simple example will make clear the massive increase in prices that shelf tags exhibit. Two years ago, our favorite imported, cold pressed Olive Oil at Whole Foods cost ~$16.99 for a 1.00 liter bottle. This then rose to $18.99 around 18 months ago. Then about 12 months ago, the price rose to $22.99. Six months ago, this rose to $26.99. Then Whole Foods increased the price to $28.99 just two months ago. This past week, the price in the supermarket for the same bottle stood at $32.99. But that was not all. There only existed on the shelf a few 1.00 liter bottles, which stood discontinued. Instead, the new 0.75 liter bottle started to take over the shelf space priced at $28.99. If one does the math, this equates to a price of $38.65 per 1.00 liter as shrinkflation comes to Olive Oil. That price represents a 127.5% increase to the consumer over the past two years. As we would say, Oil’s Not Well Here. And fourth, a team of scientists at Anglia Ruskin University, utilizing nanotechnology, created a scaffold on which to grow cells from the eye’s retina. This potentially provides a stable structure on which the cells can be implanted into someone’s eyes to restore vision for conditions such as Age Related Macular Degeneration (AMD). (Please see https://www.ophthalmologytimes.com/view/study-retina-cell-breakthrough-could-help-treat-blindness .) AMD impacts almost 12.5% of all adults in the U.S. over age 40 with ~1% of all adults facing complete loss of sight. And, according in the Journal Ophthalmology, the prevalence rises significantly over age 75. (Please see https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3087833/ .) With the ability to restore sight coming into focus, it appears just one more step on the path to The Bionic Human.

In Closing

Should you have any questions on how the above issues or the items discussed in our accompanying cover letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer