1920s and 1930s Beggar Thy Neighbor and Friends: Trade Wars, Opium Wars, & Currency Wars

Views From the Stream

The Monthly Letter covers two topics this month. First, we discuss how the current environment resembles that of the 1920s and 1930s. During that decade, countries attempted to manipulate their currencies to export their excess domestic capacity to other countries, due to the collapse in domestic demand. This led other countries to, in turn, depreciate their currencies and put up import barriers, principally through tariffs. With a whole host of Emerging Market countries building capacity to drive their economies through exports, the Developed Markets began to shut off their access. Despite this, countries such as China continue to add massive capacity with no chance for absorption. These actions likely will lead to rising levels of economic conflict between countries. Second, as always, we close with brief comments of interest to our readers on a variety of current topics relevant to the economy and the markets.

1920s and 1930s Beggar Thy Neighbor and Friends:

Trade Wars, Opium Wars, & Currency Wars

For those who wish to understand the global economic backdrop today, a nostalgic trip down memory lane to the Roaring 1920s and Great Depression 1930s stands in order, with a little background to boot. In the early 1900s, the United States stood the rising economic power. It added capacity and protected its markets, just as did all the countries in Europe. With Europe suffering from World War I and its aftermath, the US took advantage to build up domestic capacity to service its own markets and to export manufactured goods and grains to Europe. However, after World War I, Europe rebuilt its factories to produce its own goods and planted its fields to produce grain once more. This led to pressure on American factories and farms. In response, the United States enacted the Fordney-McCumber Tariff Act of 1922. This Act raised tariffs on numerous items to protect American business. It effectively undid the 1913 Underwood-Simons Tariff Act, which lowered tariffs, and it restored American Protectionism. In addition to raising tariffs above the 1912 level, it empowered the President to impose tariffs of up to 50% on imported goods based on domestic prices. In retaliation, European countries raised their own tariffs. France raised its tariff on imported autos from 45% to 100%. Spain raised its tariffs on American goods by 40%. And Germany and Italy tariffed out American wheat. With domestic markets protected, countries built out their domestic industry utilizing the new found electrification of the assembly line, pioneered by Henry Ford from 1908 – 1915. Utilizing this new power source, companies could dramatically increase productivity and hence capacity. This led to an investment boom to build out electrified factories. This meant more demand for steel, iron ore, train cars, …. Along with this, demand for electricity soared. In just the U.S., it rose from 9,250 million kWh in 1912 to 53,930 million kWh in 1928. Investment to build power plants and transmission lines soared. However, wages did not keep up with the amount of goods that these factories could produce. This ultimately led to a collapse in profits in the late 1920s. In response, factories cut back investment as they could not sell all the goods they could produce, let alone goods from additional investment that would increase output. This led to layoffs at manufacturers of steel and capital goods and at the mines supplying the steel companies. In addition, it led to reduced demand for rail shipments and trucking and electricity, which also led to layoffs. All these layoffs then led to lowered demand for factory goods from the consumer, which led factories to lay off more people. As this negative feedback loop accelerated, it ultimately led to the Great Depression.

With their economies in shambles, countries looked at other ways to solve their problems. One option became devaluing one’s currency. Doing this would lead to an improved competitive position for local industry against imports and undercut the tariffs imposed by foreign governments. Spain moved first down this pathway. It devalued its currency in 1929, 1930, and again in 1931. This was followed by Austria and Italy in 1931. In addition, Great Britain dropped the gold standard that year. That had been the bulwark underpinning the British Pound for years and began to undercut the value of the British Pound. In 1932, Austria, Finland, Denmark, Greece, Japan, Norway, Spain, and Sweden devalued and the UK followed after exiting the gold standard the prior year. And then, with a new U.S. Administration recognizing that the U.S. possessed the unenviable position of last man standing, the US went off the gold standard in 1933, prior to devaluing its currency in 1934. In effect, it followed the path blazed by Great Britain. By the end of 1936, all major currencies devalued but found themselves in the same relative place they were in 1930. Thus, the devaluations fought deflation, but did not produce economic growth. This attempt to devalue a country’s way out of its economic troubles became known as Beggar Thy Neighbor, as countries attempted to make their goods cheap enough to offset import tariffs of other countries and fill up their factories at other countries’ expense.

If we fast forward to today, it appears that countries stand set to repeat the actions of the 1920s and 1930s. Of course, the epicenter of this film remake stands in China. Despite capacity utilization in many industries that should cause plant closures, China continues to build massive capacity in its country to maintain its economic growth targets of 5% per year. Should it actually invest at a level justified by the economics, the economy would need to shrink and shrink significantly. Such an occurrence would put the Chinese leadership in jeopardy. Given this reality and the structure of the economy, the Chinese government possesses no alternative but to continue to invest massive amounts into industry and into infrastructure. For example, China continues to build EV Battery plants to drive exports despite capacity utilization of just 43% in 2023. Similar overcapacity exists in its Auto production facilities where companies like BYD continue to add significant capacity. In addition, China continues to domesticate supply chains under its Made in China 2025 strategy. For example, Chinese technology companies plan to increase capacity to manufacture Silicon Carbide substrates for semiconductors by 7x by the end of 2026 to displace imports. China continues down the road to manufacture almost 30% of Global Semiconductors despite a much smaller demand domestically. As this government directed capacity comes online, plant by plant, the government issues instructions to industry to purchase these products, such as domestically produced semiconductors, instead of foreign made products. China continues to build massive amounts of basic chemicals, even with low capacity utilization and returns on capital well below those needed to justify new plants. Given that domestic plants already supply more than 100% of domestic needs, it appears another example of a sector expanding to maintain the growth rate of the Chinese economy without the fundamental underpinnings to support it.

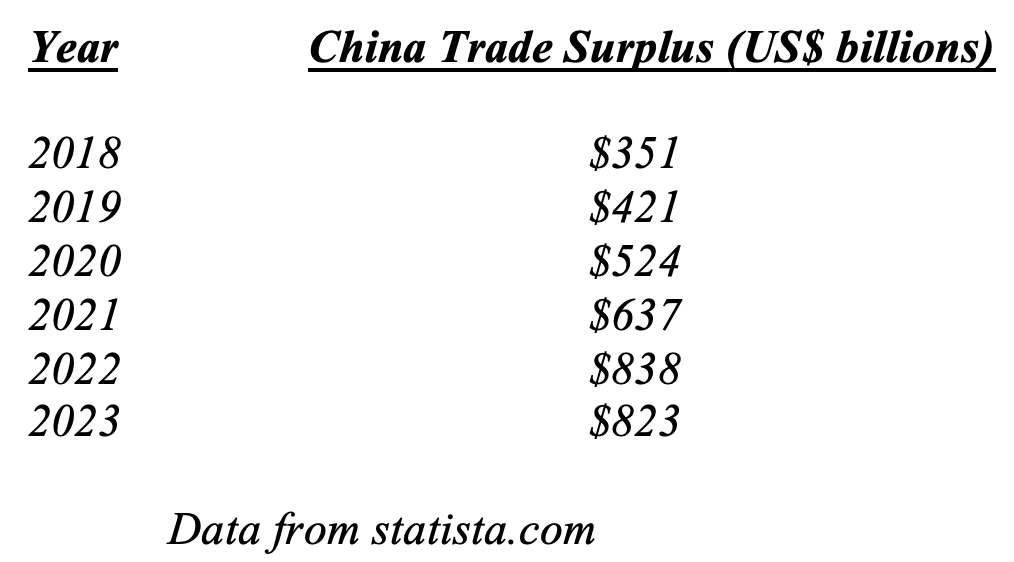

With domestic demand collapsing due to the collapse in its property markets, coupled with its significant excess capacity, China continues to massively increase its exports of domestically manufactured products which its own demand cannot absorb. Chinese auto exports exceeded 5 million vehicles in 2023 compared to less than 1 million in 2020. Chinese excavator exports grew to over 100,000 in 2023 compared to less than 30,000 in 2019. Chinese exports of Crop Protection Chemicals rose 56% year over year in January and February 2024 compared to the same period in 2023. Chinese steel exports increased almost 33% year over year for this same time period. With 31% of Global Industrial Manufacturing but an economy that cannot absorb but a fraction of its production, it went on a global tear over the past few years to export its way out of its problems. In fact, over 20% of China’s GDP relates to exports directly, which excludes many of the industries that feed into this 20%. With these policies in place, China’s global export share reached almost 15% in 2022 as it sought growth any way it could. And its trade surplus massively grew from 2018 – 2022 as it looked to offset the issues in its domestic economy:

The impact of this shows clearly in the export country mix of various countries that send goods to China. For example, China’s share of South Korea’s exports fell steadily from over 27% in 2019 to just 19.6% in February, 2024. A similar impact can be seen in Japan as China continues to focus on moving up the economic value chain.

With China moving to disrupt the key industries of Europe, Japan, and the US, to maintain its growth and to hobble their industry, to continue its 100 Year March, the inevitable outcome becomes economic conflict or, what is colloquially known as, Trade Wars. In effect, China recreated the conditions that led to the Protectionism of the 1920s and 1930s. In response to China’s actions, countries around the world, over the past few years, began to tariff or embargo Chinese goods as a threat to their economies. And these actions accelerated over the past 12 months. The US imposed tariffs on Chinese goods and blacklisted Chinese technology companies. Europe recently put in place emergency measures to bar Chinese EV Batteries which the country dumped into the EU over the past year, which would have put its domestic industry out of business. In addition, the EU sent an official warning to China on dumping goods into its markets. India imposed tariffs on Chinese steel and solar power to protect its industries. Simply put, these actions mimic the Trade Wars of the 1920s. And these actions between China and the Developed Markets reflect an even earlier time during the early 1800s, when China shut foreign countries out of trade with its economy, but exported silk, porcelain, and tea to collect gold and silver for itself. This led to the Opium Wars from 1839 – 1842 and from 1856 – 1860. France and Great Britain ultimately won those wars leading to the forced opening of China.

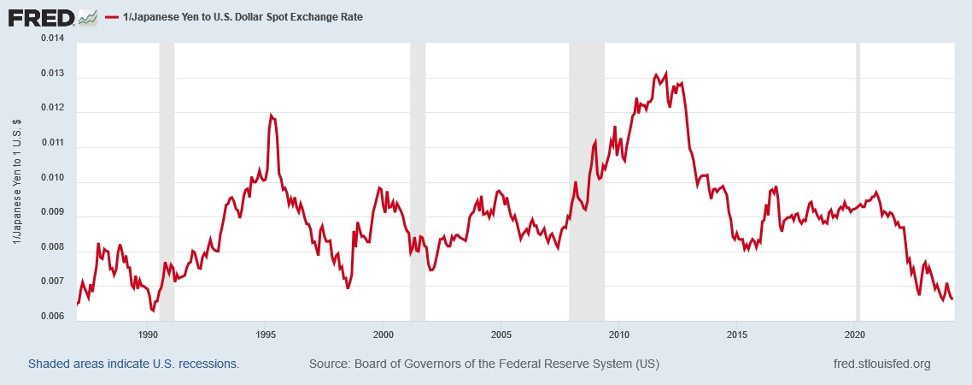

With Protectionism rearing its head today, countries, as in the 1930s, sought other means to improve their competitive position and lower the impact of tariffs imposed around the world. This includes manipulating their currencies. The clearest example stands Japan.

Over the past few years, Japan entered into massive money printing and negative interest rates. As a result, the value of the Yen fell dramatically, dropping almost 30% between 2019 and 2024, and reached a level last seen in 1990.

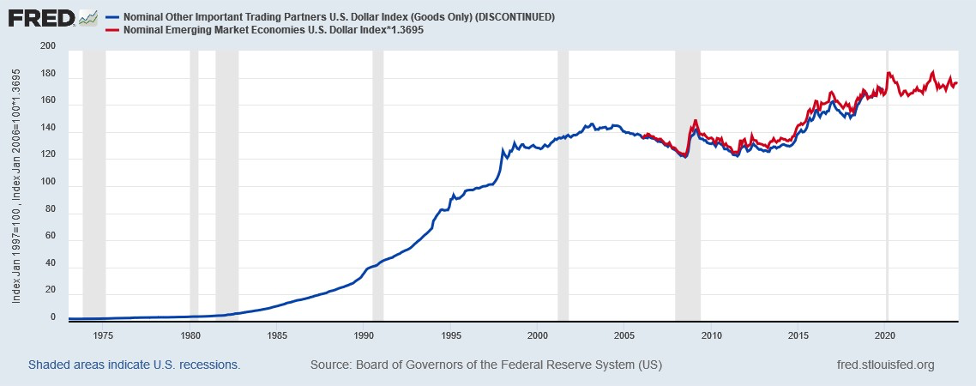

Across the globe, Emerging Market countries, as a whole, continue to devalue their currencies to maintain their competitive position, with the US Dollar continuing its long term rise against this basket of currencies:

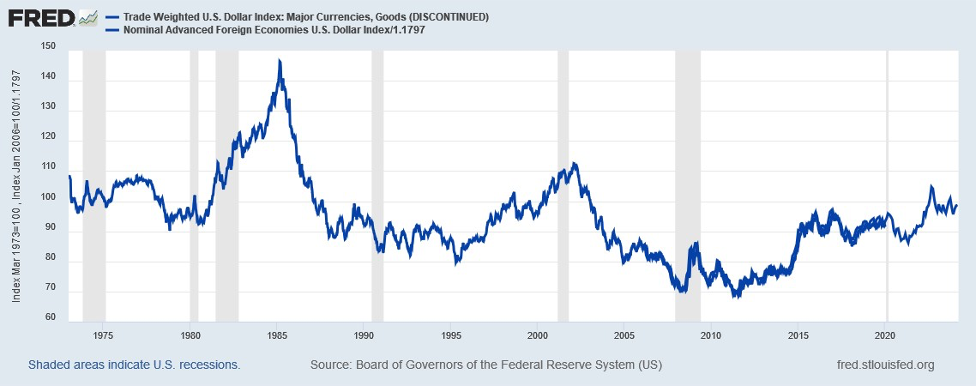

And this devaluation pathway stands not just an Emerging Market phenomenon. The US Dollar continues its decade plus long upward march against a basket of Developed Market Currencies as well:

The US Dollar is now approaching the heights last seen in 2000 and before that in the mid-1980s. Simply put, the rest of the world devalued against the US Dollar similar to the 1930s and the U.S. remains last man standing, just as a century ago. Once the U.S. devalues, the world will look much as it did in 1936 when competitive devaluations by all countries left currencies close to where they stood just six years earlier: more inflation but not more economic growth. While these Currency Wars look likely to continue, the net of all these actions stands a massive stalemate.

As Mark Twain once said, “History does not repeat itself, but it does often rhyme.” With the world looking much like the 1920s and 1930s, history seems set to rhyme. China’s Made in China 2025 Policy looks much like a repeat of the policies that led to the Protectionism of the 1920s and 1930s. And it appears to repeat the policies of the 1800s that led to the Opium Wars. With China shutting off access to more and more of its economy, countries began to retaliate with shutting off access to their markets. And with the Rest of the World losing access to key end markets, they began to devalue their currencies to ensure that they could maintain their exports despite China’s moves and in the face of competitive devaluations and tariffs, creating Currency Wars. And, as in the earlier era, the United States appears “Last Man Standing” with a true devaluation ahead that will restore the status quo. With Beggar Thy Neighbor & Its Friends in full command, it seems only a matter of time before a Clash of Titans occurs, as countries seek to manipulate the Global Economy to advantage their economies over other countries’ economies, with the spoils the dominance of the Global Order.

Thank You Boeing, It’s A Sunny Day, and Here Come The Incentives

Finally, we close with brief comments on Thank You Boeing, It’s A Sunny Day, and Here Come The Incentives. First, Boeing’s production issues stemming from poor quality control stand a blessing in disguise. While they mean that Boeing’s deliveries will face significant delays as it restructures its internal operations to meet the safety demands of the U.S Government, these delays will significantly tighten the Supply-Demand Balance for Global Airlines. For all Airlines, this should help industry pricing stay strong. And for those airlines with spare capacity able to meet demand growth, they will benefit disproportionately. Either way, CEOs of Airlines will say Thank You Boeing. Second, U.S. weather turned favorable in Q1. The number of wet days fell 11% year-over-year in February and fell 14% in March. In addition, temperatures proved quite mild, with warm days up 11% year-over year in Q1. For companies tied to construction, It’s A Sunny Day. And Third, U.S. Auto sales continue lackluster. The March SAAR (Statistically Adjusted Annual Rate) stood at just 15. 41 million, well below the healthy level of 18+ million. Inventories continue to rise and have more than doubled over the past 2 Years to 2.59 million units. Incentives, which bottomed at 3.8% of Average Ticket Price (ATP), now stand at 7.1% of ATP, still just 60% of their pre-Pandemic level. With foreign car manufacturers’ incentives rising sharply and US manufacturers’ inventories high, it seems just a short time till the US companies match their competitors. For U.S. Consumers, it’s Here Comes The Incentives.

In Closing

Should you have any questions on how the above issues or the items discussed in our accompanying cover letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer