The Great Game of Power: China for Chinese Companies Only Again, The Global Market Share Grab, & The Rise of the US National Interest

Views From the Stream

Views From the Stream

The Monthly Letter covers two topics this month. First, we look at the accelerating fracturing of the global order built over the past 30 years. As China moves to project power around the world challenging US interests, the United States reacted, putting in place the beginnings of the foundation to go toe to toe with China. With conflict between the two countries rising over Spheres of Influence across the globe, economic competition continues to heat up. China moved over the past decade to push its Made in China 2025 program spending trillions of dollars and massively subsidizing its industry. The United States began to respond with incentives and subsidies of its own over the past few years. And while the two throw jabs at each other, moving to protect their industries, other countries continue to attempt to pick off pieces that they can own. This prance of the elephants likely will lead to collateral damage around the world, with some mice squashed as the two countries vie for global influence. Second, as always, we close with brief comments of interest to our readers on a variety of current topics relevant to the economy and the markets.

The Great Game of Power: China for Chinese Companies Only Again, The Global Market Share Grab, & The Rise of the US National Interest

The World of the 2020s continues to resemble, more and more, that of the 1890s. During that prior era, countries strove to improve their global position at the expense of other countries. Alliances formed to meet rising powers’ aspirations. And wars always stood on the doorstep as conflict between competing interests made war a potential solution to deliver a nation’s goals. In that period, a rising Germany coupled with Austria-Hungary strove against the combined power of France, England, Belgium, Denmark, and Russia, with the United States standing in the wings to prevent a single power from dominating the European Continent. Today, China and Russia stand allied in Russia’s war in Ukraine, with the European Union and the United States opposing these efforts. At the other end of the Eurasian Continent, Japan, India, Australia, Malaysia, The Philippines, and Indonesia, with the explicit backing of the United States, stand arrayed against a rising China that believes in its Place In The Sun at all costs, seeking to sweep away those that would impede its rise. For China, triumph in Taiwan would stand just a first step in claiming its dominant role over the globe. War between the major powers stands in the wings today, much as in an earlier era. And the pieces on the chessboard continue to move into place ahead of potential global war. (For those wishing to understand current Chinese domestic and foreign policy, please see Germany 1897 & Our Place In The Sun: Parallels with the Current and Future Rise of Chinese Militarism originally published in April 2013.)

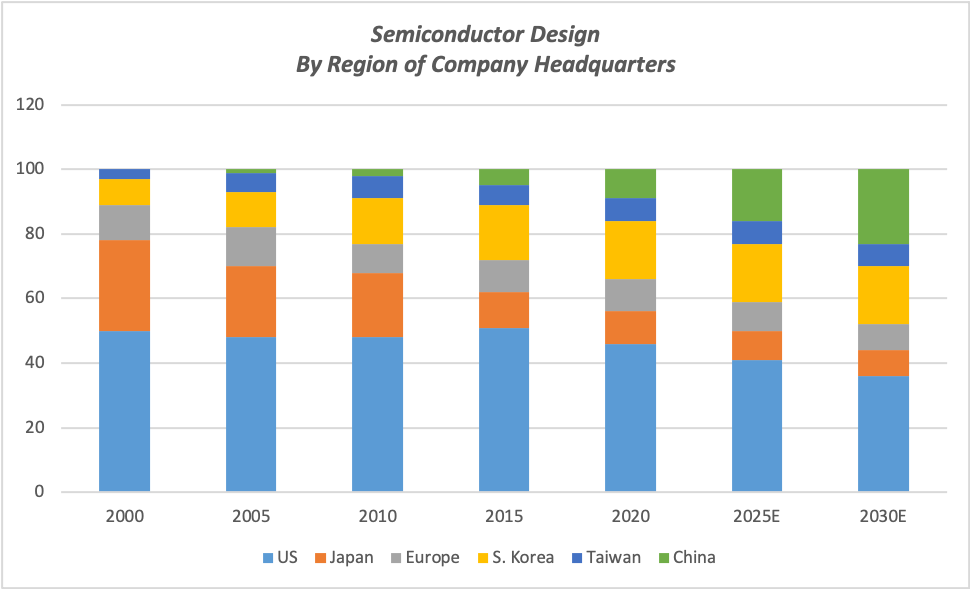

For China, Made in China 2025 stands not only an economic goal, as articulated in the country’s official Five Year Plans, but an ethos against which national success will be measured. This all encompassing goal crosses all industries, whether the simple ability to melt steel or the complicated goal of creating a domestic semiconductor chain from blank wafers to finished electronic products. After pouring $300+ billion into building and standing up its semiconductor industry, China poured another $5 – $10 billion or more into each new company to ensure its survival, an additional amount estimated at $100 – $200 billion. For example, China recently invested $7 billion into Yangzte Memory Technologies (YMTC) to ensure its survival. The company that received the most state aid over the past few years stands Huawei. According to Bloomberg, the company received over $30 billion to ensure its survival and to build a secret network of semiconductor plants to undercut US blacklisting of the company. The following data from the Semiconductor Industry Association’s State of the Industry 2022 illustrates the Chinese strategy in motion:

From just 2% of the global industry in 2010, the SIA projects China to have achieved a 9% share in 2020, which is expected to grow to 16% in 2025 and 23% in 2030. Of course, the major loser over the decade of the 2020s stands the United States, which the SIA projects will see its share drop from 46% in 2020 to just 36% in 2030. This differs little from its actions in the LCD Panel Industry, where the country went from less than 5% Global Share to 50% Global Share in a decade by subsidizing massively its industry.

And now that China created a domestic semiconductor manufacturing colossus via $400 – $500 billion of state investment, it plans to create a semiconductor equipment industry to supply it. This will use the same state backed fund that created YMTC, Semiconductor Manufacturing International Corp. (SMIC), and Hua Hong Semiconductor. The initial down payment of $40 billion received recent approval. To put this into perspective, a company such as Applied Materials, the largest semiconductor capital equipment company in the world, will spend about $3 billion on R&D and less than $1 billion on capital expenditures in calendar 2023. Lamm Research, the second largest company in the industry, will spend $1.8 billion on R&D and $500 million on capex this year. ASML, the largest European company and largest lithography company in the world, will spend €3 billion in R&D and €2 billion on capex. If we were to add to this spending, the rest of the global industry, China will spend an amount equivalent to the entire global industry’s combined expenditures on R&D and Capital Expenditures.

A similar pattern exists in the Electric Vehicle (EV) industry. China’s larger EV companies continue to receive massive government subsidies. For China, no cost stands too great as it seeks its Place In the Sun. The government continues to back the expansion of domestic capacity with the goal to become the dominant exporter to the globe. BYD, China’s leading EV company, continues a massive capacity expansion that will turn it into one of the largest manufacturers of cars in the world. With no market for this capacity in China, the company can only fill up its factories by exporting millions of cars overseas. China similarly continues to invest in battery component capacity with local governments backing these companies with billions of dollars of investment. If the country cannot export batteries to the globe, due to local manufacturing requirements, then maybe it can export the components, creating critical vulnerabilities in other countries ability to manufacture electric batteries. China continues to move forward across multiple other areas as well. Whether backing Huawei to create a dominant domestic mobile phone manufacturer or State Grid’s IT subsidiary to create a domestic ERP industry which can displace global competitors such as SAP, foreign industry stands in China’s crosshairs as it moves to control every aspect of its economy and dominate the globe. For the world, China For Chinese Companies Only Again continues to drive China’s strategic policy goals, to dominate the global economic landscape, as a replay of the Opium Wars appears ahead.

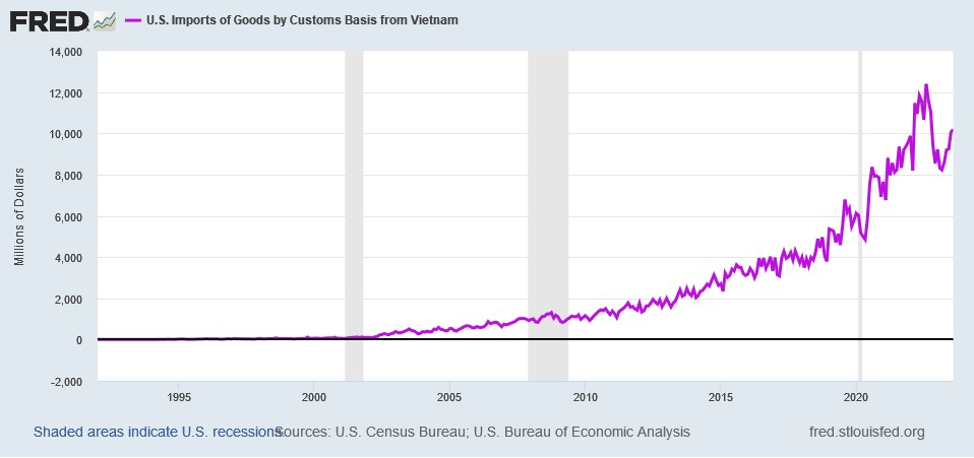

However, China stands not the only country to look to improve its competitive position. Vietnam’s exports to the United States continue to grow at a rapid rate as the following chart demonstrates:

The country’s focus on high value electronics continues to move its development forward. The country now wants to build a domestic semiconductor manufacturing industry to expand its Technology footprint. And, in a recent visit, President Joe Biden appeared to support this ambition. (We note this foreign policy goal would conflict with the United States goal of domesticating semiconductor production and technology production for National Security reasons.) Despite the country’s ambitions, it may find itself in a crowded field, competing with its Asian neighbors, and with the potential for the export markets expected to receive its planned manufacturing bounty less open than it expects.

Just across the water in Malaysia, the country just produced its New Industrial Master Plan in August. (Please see https://www.nimp2030.gov.my/ for the official government website on the plan. And the plan can be downloaded at https://www.nimp2030.gov.my/index.php/pages/view/63?mid=455 .) This plan focuses on four major areas to drive the Malaysian economy over the next decade:

- Advanced Economic Complexity – This focuses on Electronic & Electrical Sectors, which drive Malaysia’s manufacturing exports.

- Establish Wafer Fabrication via Global Fabs in Malaysia

- Establish A Global Leadership Position in IC Design for EVs, Super Chargers, and Smart Sensors.

- Focus on Value Chains for Pharmaceutical and Chemical Sectors by increasing production of Active Pharmaceutical Ingredients.

- Establish Production of EV Components to leverage Malaysia’s Technology Footprint

- Tech Up for a Digitally Vibrant Nation – At its core, this goal seeks to accelerate the digitalization of Malaysia’s manufacturing sector. To reach this goal, the country seeks to create over 3,000 Smart Factories by 2030. This will focus on expanding the market for local automation solution provider GREATEC and funding the transition through the NIMP 2030 Industrial Development Fund.

- Automation & Robotics

- AI (Artificial Intelligence)

- Industrial Automation & ERP Systems

- Additive Manufacturing

- NIMP 2030 Industrial Development Fund:

- Direct Funding for Industrial Development

- Matching Grants for Malaysian Companies

- Subsidized Loans and Financing

- NIMP 2030 Strategic Co-Investment Fund:

- Increase the Pool of Capital available to companies

- Decrease the Risk to Investors and the Cost of Capital to companies

These four areas underpin Malaysia’s long term focus on creating a strong global competitive position in manufacturing as an alternative to China and becoming the next major industrial power in the globe. With companies moving production out of China, Malaysia sees an opportunity to benefit from The Global Market Share Grab.

A little further South, Indonesia continues to move its “Resource Nationalism” forward. Indonesia no longer exports low value raw materials or semi-processed raw materials. It outlawed their export almost a decade ago. Instead, Indonesia focused on capturing the full Value Chain where its key raw materials, such as nickel, act as critical inputs and provide a strategic edge in creating a strong position in various industries, such as the EV Battery Market. Thus, the country required the full economic chain across several industries to be built in Indonesia. Today, Indonesia stands on the path to create a strong position in EV Batteries due to its nickel mining. Over the past decade, the Economic Value Added in the country from the nickel chain rose from less than $15 billion to over $150 billion. And Indonesia stands not alone here in attempting to capture a larger share of economic value within its economy. Australia just blocked the takeover of one of their lithium miners by Albemarle, the leading US lithium mining company. Instead, it stands in discussions with Japanese firms to build advanced processing and components for EV Batteries within the country, leveraging its resource base to capture a larger share of the Economic Value Added and, at the same time following the trail blazed by Indonesia.

To the West, across the Bay of Bengal, India continues to encourage economic development and the movement of manufacturing production to the country. In effect, India wants to displace China as the manufacturing hub for the globe. To do so, the country continues to adopt domestic first manufacturing policies and to invest in infrastructure. This sequence of actions mimics those of China from 25 years ago and follows in the footsteps of countries such as Malaysia, Indonesia, and Taiwan. As with other Asian countries, India enacted huge financial incentives to locate production in the country. For example, the Indian Government will provide 50% cost subsidies for the erection of Semiconductor and Display Fabrication, Testing, and Packaging facilities in the country. On top of this, several states offer an additional 20% subsidy plus subsidized land, water, and electricity. This brings the outright Subsidy to 70% of the project’s costs. In addition, ongoing operating costs stand heavily subsidized as plant operators will receive cheap power and pay below market for water. India plans to triple Electronics Production from ~$100 billion in Fiscal 2023 to ~$300 billion in Fiscal 2026. As part of this Global Market Share Grab, the country plans to increase Electronics Exports from $25 billion in FY23 to $120 billion in FY26 or by a factor of almost 5x. To put this into perspective, China’s exports of Electronic Equipment are expected to reach $335 billion in 2023. In addition, to the outright subsidies, India continues to move to require local production of goods it considers critical to its future. This localization initiative looks remarkably like China’s Made in China 2025, but without the overt message to the rest of the world. Areas considered critical here include: Mobile Phones and Components; IT Hardware, Laptops, Tablets, PCs, and Servers; White Goods including Air Conditioners and Washing Machines; LED lights and Lighting Fixtures; and Telecomm Hardware. All of these areas are eligible to receive Production Linked Incentives (PLIs). These PLIs complement India’s push into Infrastructure spending. Capital Expenditures to GDP continues to rise. From just 1.5% of GDP in FY2018, this spending will reach 3.5% of GDP in FY2024. In nominal terms, Infrastructure spending will almost quadruple from 2.6 trillion Rupees to 10.0 trillion Rupees. And, with Gross Fixed Capital Formation at only 29% to 30% of GDP, Capital Investment into its economy appears at sustainable levels for some time.

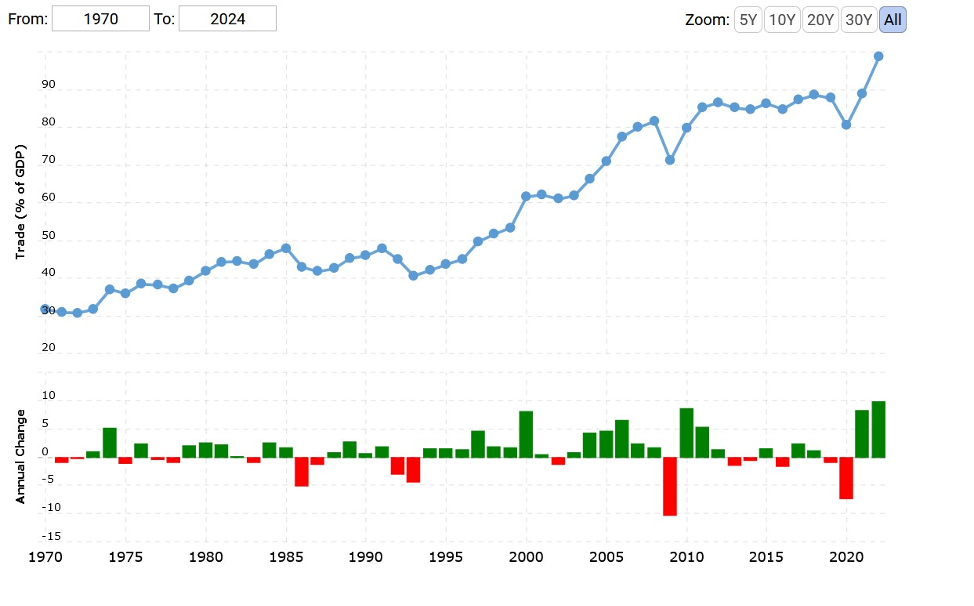

Continuing across the Continent in a Westerly direction, one bumps into Europe. The Continent continues to focus on manufacturing and running a trade surplus. And Europe possesses one of the most mercantilist countries in the world: Germany. Trade remains the dominant feature of its economy. In fact trade almost exceeds the country’s GDP today:

And to make sure it competes with China and Asia on the incentive front, to maintain its global competitive position, Germany continues to quietly invest funds into attracting semiconductor investment. This amount totaled €14 billion in 2021 and €20 billion this year, and will likely rise next year to continue to incent the location of semiconductor plants in Germany. Intel alone received a €10 billion subsidy in July 2023 to locate its European plant there. In effect, Germany, on its own, may put in place more funds than the CHIPs Act in the US over the next few years. In addition to this subsidy by Germany, the European Union (EU) plans to provide more funds than the US CHIPs Act to incent the construction of future semiconductor and telecomm equipment plants there. President Ursala von der Leyen announced in September her intent to pass the European Chips Act, with a planned €160 billion in subsidies, for Europe to become self-sufficient in semiconductors. Between the estimated €100 billion that Germany alone will spend and the €160 billion under this European Act, the EU will spend 2.5x+ what the US passed to locate technology production in Europe over the next few years.

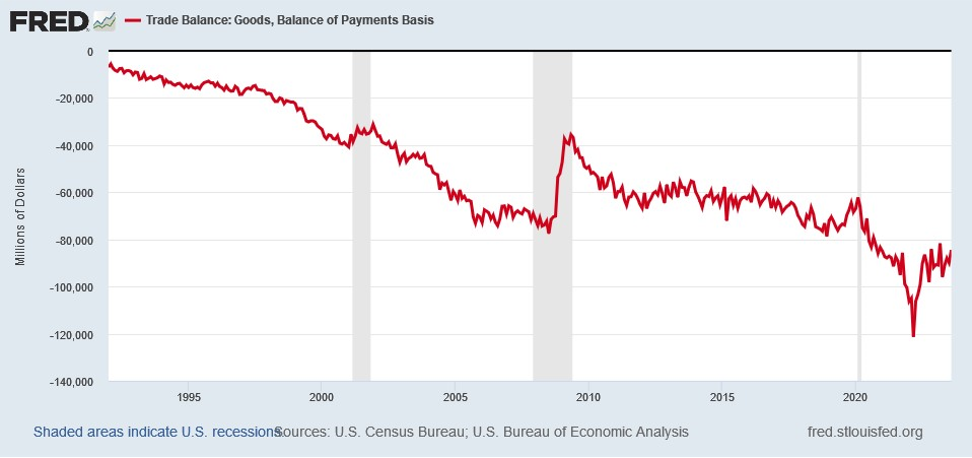

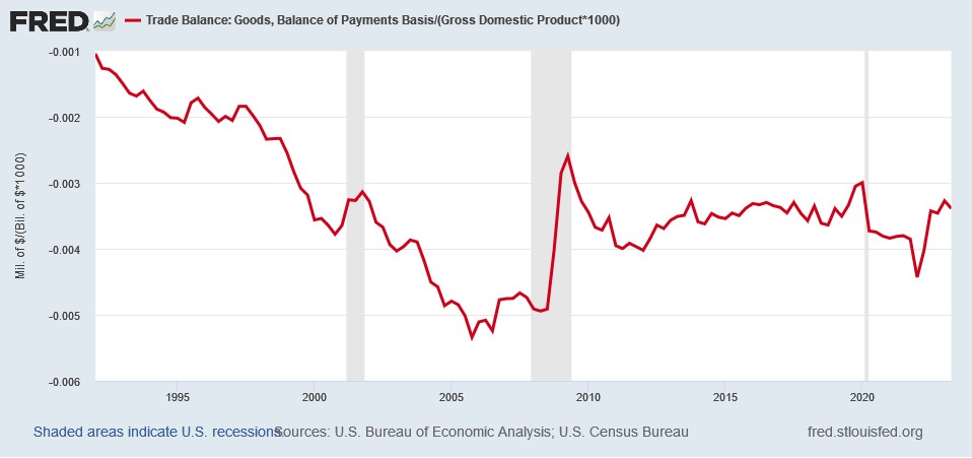

For the United States, the outcome of this Mercantilist Global Market Share Grab over the past 25 years stands clear. Goods Production moved overseas and will continue to move overseas in the future, should the US not change its fundamental approach to manufacturing and trade policy, benefitting foreign economies and retarding US economic growth. The current rounds of subsidies and incentives across the Globe, coupled with increasing domestic production requirements, look to continue this trend going forward. The following chart makes clear the results of 30 years of “Free Trade” with the rest of the Globe:

With large subsidies, the rest of the globe increased its manufacturing footprint at US expense and sent increasing amounts of goods to the United States to fill up their factories. In fact, the only country not to respond yet stands the United States. Standing in the background are the large corporations who cheered this policy, which benefited their profits and sales, as they used the cover of “Free Trade” and the World Trade Organization to gain entry to foreign markets and to take advantage for their shareholders of the various country subsidies available abroad. (For more on this corporate impact on the United States, please see our What’s Good for GM, Is Not Good For America series written from 2017 to 2021 and The End to Free Trade & The Coming Rise of Fair Trade written in 2015.)

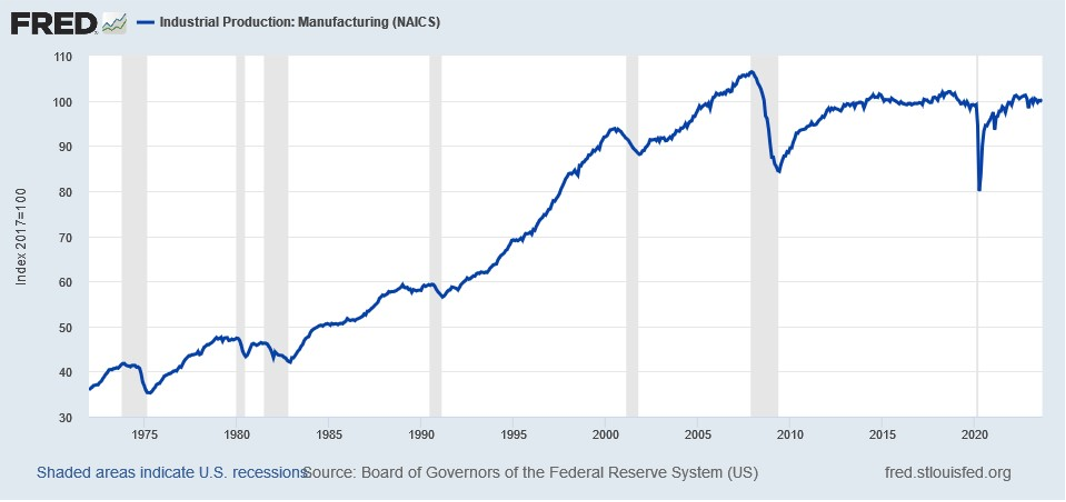

However, two decades of allowing the WTO and “Free Trade” to dominate the economic policy of the United States severely impacted US Industrial Production, effectively halting Industrial Production growth:

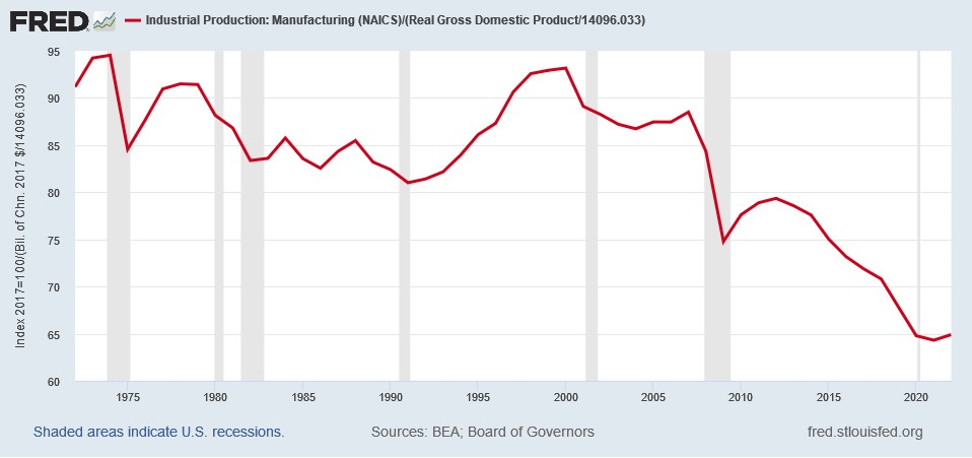

In fact, US Industrial Production Manufacturing stands a mere 6% above its level in 2000. And, as a result, US Manufacturing Output stands at just 10% of the economy compared to 16%+ in the 1990s. The following chart makes clear the massive drop in Manufacturing relative to the overall US economy since 2000, when the WTO officially began:

Yet, not all is lost. The United States finally recognized, in the waning days of the Obama Administration, that the Chinese Communist Party (CCP) did not adhere with that agreement under which it came into the world trading system via the WTO. In addition, the Administration understood that China’s military ambitions could negatively impact the US over the intermediate term. Unfortunately, it ran out of time to adjust policy prior to the Trump Administration. With the prior Administration having recognized this issue, the Trump Administration articulated the need to serve the US National Interest. And, by creating official government studies across every aspect of the economy, it laid the intellectual foundation to address this challenge to America’s position in the world. As a result, it directly started to address the US trade deficit in goods, especially those critical to the National Defense. And the Biden Administration continued this policy, despite internal opposition, with the logical next step, creating legislation that enabled the US to subsidize manufacturing production, as most countries around the world do, and to ensure that the next generation of products contained large amounts of domestic U.S. production.

Despite the non-response by the US Government until 2021, the US actually stabilized its Goods Imports to GDP almost a decade ago, as goods consumption lagged services growth significantly:

However, this lack of growth for goods demand, relative to the economy, does not solve the fundamental issue that US Manufacturing relative to GDP stands well below a normalized level that its Developed Economy peers exhibit and massively below the level of China and many other Emerging Market economies. Only due to the overall size of its economy does the US remain a large global producer.

For the US, a situation needing a catalyst to create a remedy found two. First, US Median Family Income stalled for almost 20 years, leading to rising Populism. And, Second, Geopolitics and the necessity to stand toe to toe with dictatorships across the globe reared its head as China and Russia more forcefully challenged US Interests around the globe. Both converged over the past few years to bring to the fore, once more, the concept of the National Interest and National Defense, last dominating politics in the 1980s under President Reagan. And, as Ukraine and the recent Israeli conflict made clear, the ability to support the National Defense stands in need of attention and requires significant additional domestic manufacturing capacity to produce the steady stream of goods that a war, similar to Vietnam or Korea, would consume and to ensure the key goods and components needed possess domestic sources of production. In effect, the National Interest to meet Geopolitics and Populism to drive living standards will slowly but surely come to dominate decision making as the U.S. prepares to potentially fight a war against China directly, support its allies across the globe, and raise living standards for its populace. This National Interest Tsunami, like its namesake, despite opposition from global corporations, will squash all opposition in its path, engulfing them in its waters. And to meet the needs of the National Interest, a rethink of Free Trade stands ahead as the US recognizes the reality of the massive subsidies abroad and the need to possess its own manufacturing base to support its global strategic position. In effect, a return to the GATT (General Agreement on Tariffs and Trade) continues to progress at a grinding speed, gaining ground as the exigencies of the world continue to rise.

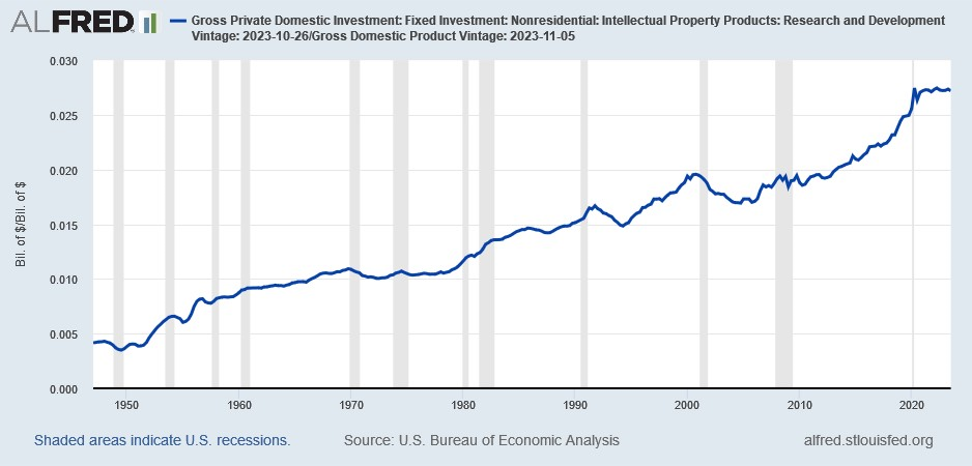

For the United States, several long term trends bode well when coupled with the recent Congressional legislation to subsidize US productive capacity. The first is the strong level of R&D. The US remains a top R&D spender globally and R&D as a percent of GDP remains strong:

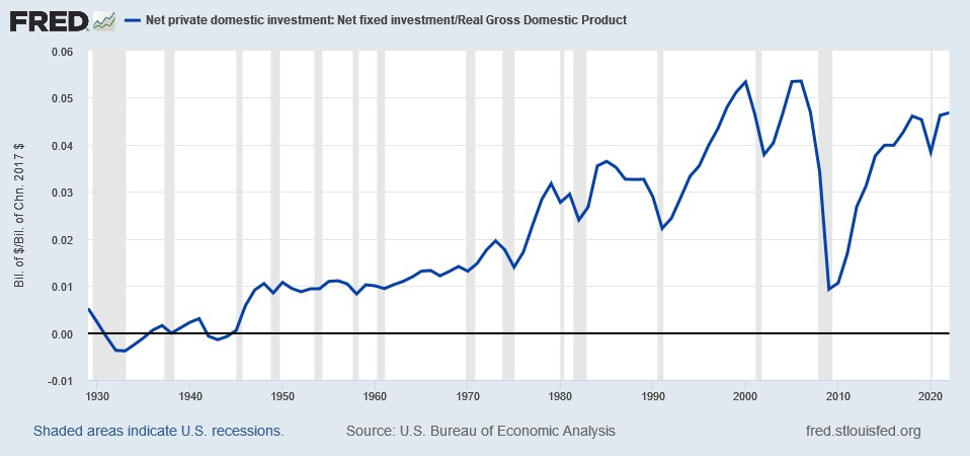

In addition, Private Fixed Investment staged a strong recovery from its Housing Bubble collapse over the past decade. It continues to grow relative to GDP and stands close to previous heights last seen in the late 1990s:

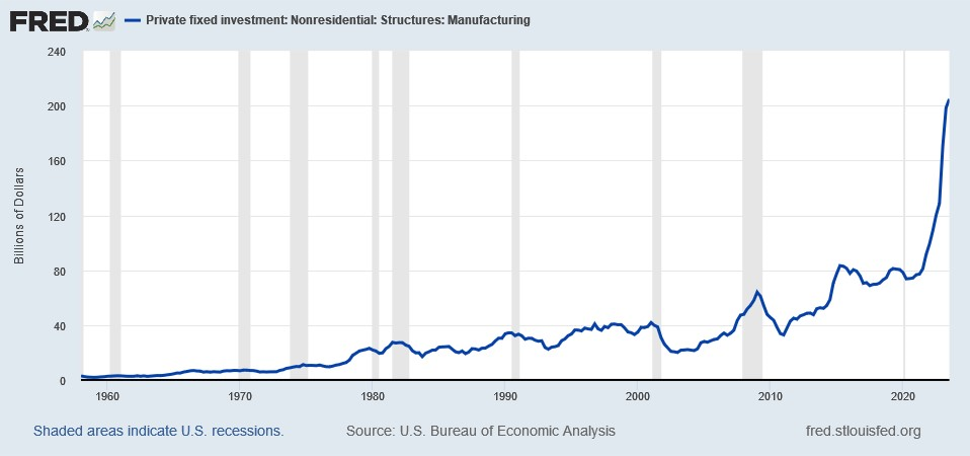

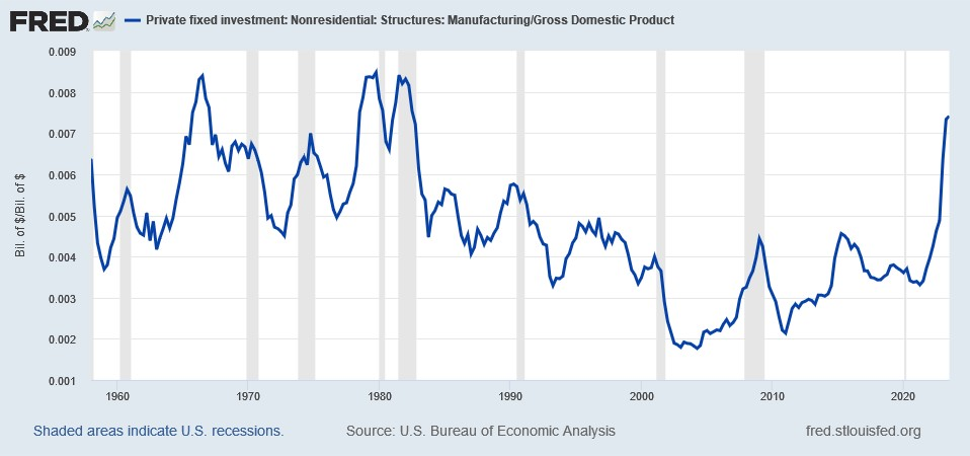

And for those who believe Government Policy does not have a large impact on the economy, the data clearly differ. The Federal Government’s incentives for domestic manufacturing coupled with tariffs and bans led to a virtual explosion in spending on a variety of plant capacity in the US:

For the US, with its large domestic consumption markets, finally joining the game should reap large rewards. This first can be seen in Manufacturing Structure Investment to GDP:

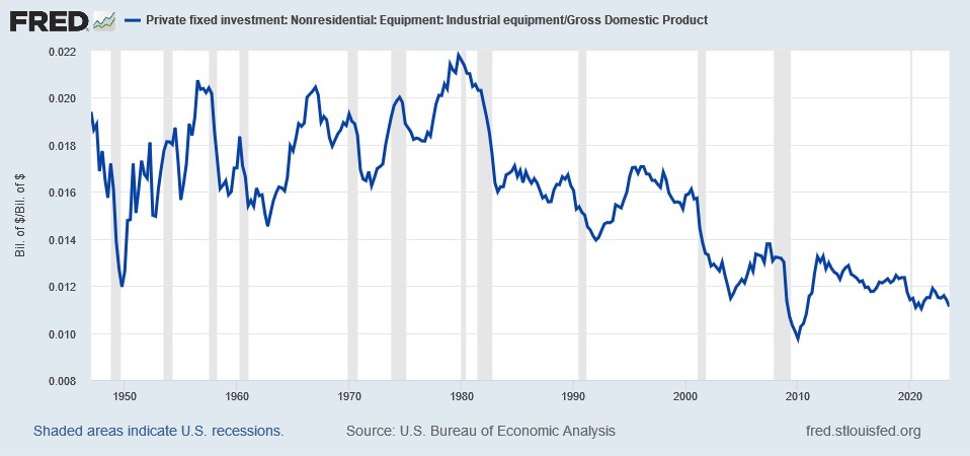

And while Industrial Equipment Investment relative to GDP continues to lag:

It stands only a matter of time until this turns up as well, as the Manufacturing Structures get completed. At that point, companies will need to fill these Structures with the Industrial Equipment necessary to produce the various components and goods for which the plants were designed. For the United States, these changes could not happen soon enough as the global environment continues to become more dangerous.

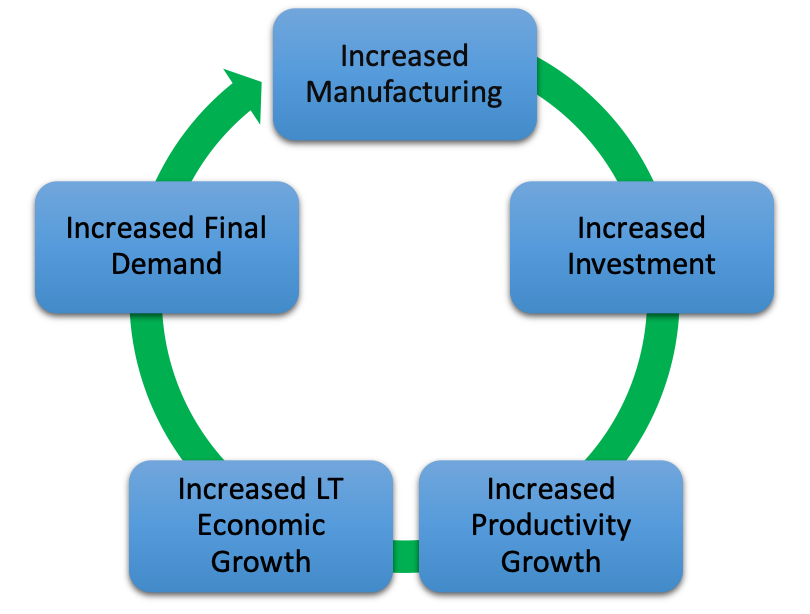

In addition to driving Investment in the economy and producing short term growth from this higher level of Investment, this revival in Manufacturing should produce significant long term benefits. The key one stands Productivity. Productivity Growth remains intimately linked to Investment and Production. In fact, numerous studies show Manufacturing produces over 70% of all Productivity Growth in the economy. And should Productivity Growth accelerate, so should Median Family Income as Productivity Growth drives Real Wages. The following chart demonstrates the virtuous loop that occurs from higher Investment in Manufacturing for the country:

For the US, the reignition of this virtuous circle will drive economic growth for many years, restoring normalized levels of growth last seen before the 2008 Recession and enabling the country to meet both its National Interest and National Defense challenges.

In many ways, the various country actions between 2016 and 2023 merely return the United States, the Communist countries, the Western democracies, and the rest of the world to a state that existed from 1948 through the early 1990s. At that time, the US stood in the midst of a Cold War with Russia and China for whether democracy or a totalitarian future awaited the world. Concepts like Geopolitics and Balance of Power stood part of the everyday lexicon as did National Defense and National Interest. And the Global Trading System sat under the GATT. However, after the collapse of Russia, the end of the Berlin Wall, and the reunification of Germany, the Western democracies believed, falsely, that a permanent change in the world occurred that would allow them to change their modus operandi of the past 500 Years. In fact, Francis Fukuyama’s famous 1992 best selling book, The End of History and The Last Man, exemplified this mistaken belief, providing the philosophical foundations that led to the opening of the world and the WTO as well as massive decreases in defense spending relative to GDP for the US, Europe, and their allies. However, with China grabbing and creating islands in the South China Sea; Russia moving to recreate the USSR, in one fashion or another; authoritarian countries like Iran moving to project hard power, threatening their neighbors; and totalitarianism rising across the globe, putting democracies at risk, the facts on the ground dismembered this belief, putting numerous nails in its coffin. Reflecting this Realpolitik, Stephen D. King, the Special Advisor to the UK House of Commons Treasury Committee and Senior Economic Advisor to HSBC, published his book Grave New World, The End of Globalization, The Return of History, which reflected the reality on the ground as opposed to the utopian vision of Fukuyama. For the world, thinking came full cycle. In accordance with this reality, China for Chinese Companies Only Again, The Global Market Share Grab, and The Rise of the US National Interest stand the facts on the ground. The Great Game of Power continues in ascendance. And the pieces on the chess board continue to move into position. With The Great Game breaking into the open once more, all sides continue to move to advantage themselves at the expense of other countries. And with War on two continents and the potential for armed conflict across a third, the world continues to resemble the early 1900s and the 1930s as the Great Powers prepare for what could evolve into a global conflict that will leave no country unscathed and reshape the Global Landscape.

Egg-tra Egg-tra, Powering Through, and In The Soup

Finally, we close with brief comments on Egg-tra, Powering Through, and In The Soup. First, consumers continue to adopt all things organic across every aspect of the food aisle. This now extends from organic meats, such as chicken and beef, to both vegetables and dairy products. This move to organics has revolutionized the Egg category. New companies exploded across the sector with cage free non-organic eggs making up 28% of industry volumes and organic eggs accounting for ~6% of industry volumes, according to United Egg Producers. These categories are expected to continue to grow strongly, with organics growing at more than 20%, rapidly taking share. For the consumer’s breakfast table, we see Egg-Tra Egg-tra read all about it. Second, according to Quanta Services, demand for electric grid upgrades remains strong. Utilities continue to contract for these at record levels as exhibited in the company’s backlog. With this data confirming industry trends, we see the US Powering Up. And Third, soup volumes remain under pressure. Consumers, to save on groceries, continue to cut back on both condensed and ready to serve soups. And even broth volumes dropped slightly. For the soup manufacturers like Campbells, we see them In The Soup.

In Closing

Should you have any questions on how the above issues or the items discussed in our accompanying cover letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer