Better, Faster, Cheaper: Technology Comes To The Defense Industry

Views From the Stream

Views From the Stream

The Monthly Letter covers two topics this month. First, we take a look at the revolution occurring in Defense spending. Technology’s tendency to eat its own came to the Defense Industry over the past two decades. With budgetary pressure the Pentagon looked for ways to deliver systems and weapons at much reduced costs. And with geopolitical threats emerging over the past decade, the Pentagon needed to create a new generation of weapons and systems within the budgetary constraints of Congress. As a result, it looked to new companies to challenge the existing defense prime contractors with new products produced at much lower costs. And, based on existing results and the products in the development pipeline, the military succeeded in creating change that will enable the country to afford the weapons and systems needed to meet new threats. Second, as always, we close with brief comments of interest to our readers on a variety of current topics relevant to the economy and the markets.

Better, Faster, Cheaper: Technology Comes To The Defense Industry

For those watching the Technology Industry over the years, innovation never stops. It only accelerates. The companies that dominated one era inevitably give way to those of a newer generation. And each iteration produces a sea change in how the world operates. The world of computers provides a classic example. In the 1960s, IBM mainframes dominated the scene. As semiconductors grew more powerful, along came mini-computers from companies such as DEC, which became the product of choice in the late 1970s and 1980s. Then came the PC from companies such as Commodore, Apple, and Dell in the 1980s. PCs came to dominate the scene, proliferating across offices and homes. Of course, laptops followed and so forth. The other unavoidable consequence of innovation stands, what Schumpeter called, “Creative Destruction”. In other words, the new companies displace the former companies, oftentimes forcing them to exit a product or to go out of business. Northern Telecomm, which dominated analog telephone switches lost the market to newer companies focused on optical switches. Motorola, who stood one of the dominant cell phone manufacturers in the 1990s, lost out to Apple and other smartphone vendors who forced them out of the market for cell phones. And for those who remember Commodore Computer, the company went bankrupt as newer competitors, such as Dell, produced personal computers much more cheaply and efficiently. Wherever one looks in Technology, Better Faster Cheaper wins driven by continuous innovation, creating new companies that come to dominate the industry.

For the Defense Industry, such rapid change, occurs only at critical inflection points historically. The last such change occurred in the 1980s with the rise of such products as Cruise Missiles. Starting in the 1990s, the Defense Industry entered into a massive consolidation as wars proved limited and the ability to grow fundamentally fell to the ax of budget cuts. This led to the creation of large dominant firms such as Lockheed Martin or Raytheon Technologies. And, to the chagrin of those at the Pentagon attempting to create some accountability for the monies spent procuring goods, competitors disappeared into joint ventures. This led to the rise of oligopolies and effective monopolies over various products the DOD needed to purchase. For example, Boeing’s rocket division merged with Lockheed’s rocket division to form United Launch Associates. For the Pentagon, looking to buy launch services for its satellites, competitors that would bid against each other disappeared and then raised prices aggressively. With no alternatives the cost of defense goods skyrocketed, literally, creating what the public called platinum coated programs that became unaffordable.

However, with Technology transforming the US and Global Economy over the past 30 years, Technology stands poised to change the Defense Industry in fundamental ways. These technologies advanced precision driven weaponry to new heights, effectively outmoding many of today’s critical platforms while making US defense infrastructure vulnerable. These risks, amplified by the need to meet new global geopolitical threats that arose over the past decade, accelerated the winds of change already blowing in the industry, winds that will leave no aspect of the industry untouched and no established company unscathed. And for the Pentagon, needing to meet the reality of a potential war with a global peer, they will provide welcome relief on pricing as new competitors arise with a new generation of defense products, driven by innovations that are Better, Faster, and Cheaper, enabling the DOD to purchase the volume of goods it needs without blowing its budget out of all proportion.

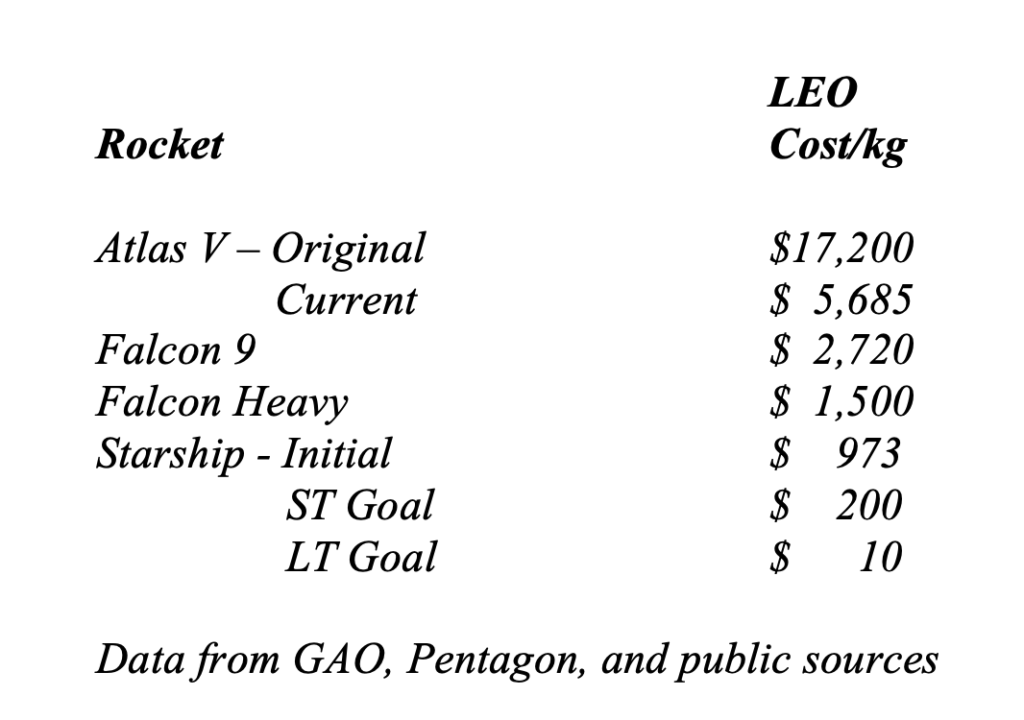

This transformation began back in the 2000s when the Pentagon seeded companies such as Space X. Space X developed innovative launch technology that allowed it to reuse a rocket multiple times. Thus, instead of needing to build a brand new rocket for each launch, only some parts needed replacing, vastly reducing the cost of launch services. In many ways, companies such as Space X created a car that could be leased for each launch instead of selling the Pentagon a new car for each launch. And the economics of leasing vs buying the rocket followed. These new launch services stood a fraction of the cost of current services, enabling the Pentagon to save significant sums as it met its needs, while simultaneously creating competition in the industry. The following table illustrates the launch cost difference between Space X and United Launch Associates for the same launch services:

As the above table demonstrates, the government could afford 5 Falcon 9 Launches in the place of just 1 Atlas V Launch. And because the rockets proved reusable, the time between launches could fall significantly. This would allow the US to build a fleet of rockets to meet future needs for the same cost as just one rocket. Then along came the Falcon Heavy. Should Space X’s Starship Rocket finish development in the next one to two years as planned, it will represent a step function change in costs, enabling the commercialization of space and the ability to have permanent colonies on the Moon and Mars. And with Satellite costs falling from over $100 million for large GEO machines to less than $1 million for cube sats, a revolution occurred here as well. Now, thousands of satellites could launch into orbit in the place of just one satellite providing redundancy and an explosion of capabilities. Better, Faster, Cheaper comes to space.

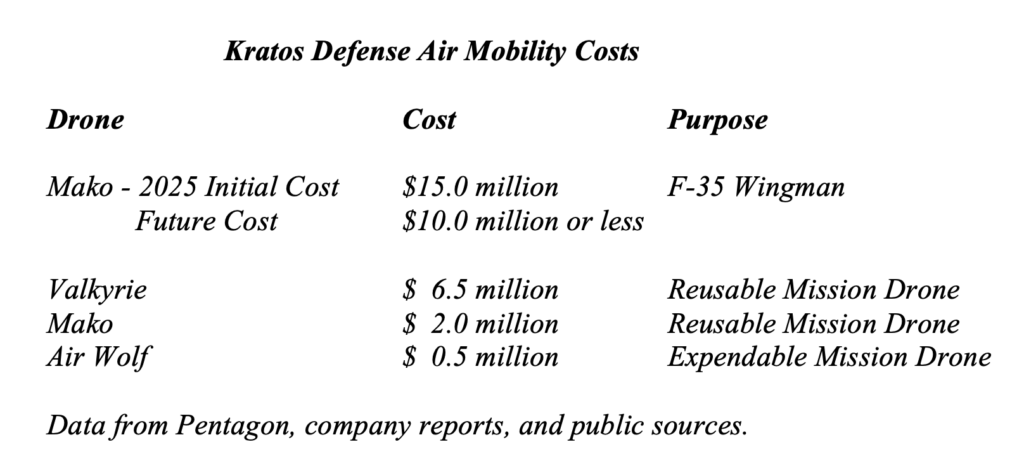

This ethic applies to numerous other areas of defense such as the Air Force. A new F-35 Fighter can run $70 – $90 million per plane. Creating a batch of 1,000 on a regular basis to fight a real war would cost $80+ billion. And with missiles that cost $1 million or less capable of knocking them out of the air, the economics becomes unsupportable, especially when put in the context of all the goods and services needed across all branches of the military. The solution stood in creating a much cheaper alternative that could meet the same mission parameters. For the Air Force, this solution came right out of the radio controlled planes of the 1970s built by hobbyists. What if the military built unmanned, Mini F-35s whereby the pilot of one F-35 could control multiple versions of these mini-planes? Of course, this solution bears the name: Unmanned Aerial Vehicles (UAVs) or, more prosaically put, Drones. And these in no way resemble the miniature planes built 50 years ago. They resemble mini F-35s without the limitations of a human pilot in terms of the G Forces such a pilot can withstand, creating greater maneuverability. The following table illustrates the cost differential between the two alternatives:

Companies such as Kratos Defense have production ready drones that are undergoing testing. The cost of these drones enables the Air Force to buy a fleet of drones for a fraction of the cost of a fleet of F-35s. Thus, the Air Force can meet its needs for the next war without consuming a disproportionate share of the Pentagon’s budget. Complementing these UAVs, there are miniature drones with specific mission parameters that cost $1 – $2 million each or less, such as Mako or Air Wolf above. For the cost of less than 2 F-35s, the Air Force could create a swarm of these miniature drones to overwhelm enemy defenses in an economic yet lethal manner. And it can produce a stockpile of missiles at a fraction of prior cost. Better, Faster, Cheaper comes to the Air Domain.

For the Navy, the development of precision missiles presents an existential challenge. Either a ship must exhibit the characteristics of the battleships of old, able to, as the saying goes, take a licking and keep on ticking, or the ship must possess the agility and capabilities to ward off such an attack in a way that enables a ship to remain afloat and functional. The current Navy resembles neither case. As a result, the fleet built over the past 30 years stands mostly outmoded, as technology enables adversaries to asymmetrically offset the value of these ships. Only submarines still maintain the value despite these developments. And with China turning out submarines as fast as it can, even this fleet could become outgunned in a major conflict. However, all stands not lost. Unmanned ships represent the next iteration for the Navy. In this case, inexpensive miniature ships that move faster than current ships can provide intelligence as well as forward offensive and defensive capabilities. Some of these ships, all built by new entrants into the supply chain, can move at over 90 miles per hour while providing critical intelligence, interdiction, and attack. There is currently a major debate going on between those that continue to want to preserve the jobs provided by the large shipyards and those that want to redirect resources into building fleets containing thousands of these vessels that could meet the challenge posed by the precision anti-ship missiles that exist today. If a sufficiently large number of these new vessels deploy in a conflict, then even large attrition would still allow the Navy to achieve its mission objectives. Ultimately, the exigencies of an impending war should win allowing Better, Faster, Cheaper to come to the Sea Domain.

For the Army and Marines, a different scale of challenge exists. Precision missiles make not only troops and armored vehicles vulnerable, but critical infrastructure as well. This infrastructure can be targeted based on its digital signature, creating true vulnerability in the military command and logistics chain. To meet the need for speed and agility as well as create competition, this branch stands focused on breaking “vendor lock” via modular open design for new systems. This allows two key changes to happen. First, it forces defense contractors to submit bids only if they contain a modular design. This creates more OEM (Original Equipment Manufacturer) competition within programs as components can easily be swapped out due to standardized interfaces. Second, in future production runs that include new versions of platforms to meet evolving needs, non-OEMs can bring superior plug and play products into a program, allowing the Pentagon to focus on best of breed at any given point in time. This extends a given platform’s life as new capabilities develop that become natural upgrades to an existing platform due to plug and play. At the same time, it avoids the need to develop a completely new platform as long as the platform can meet the services’ current needs. The Army already implemented this strategy with its two new vehicles, the FLRAA and XM-30. This will eventually spread across all aspects of the ground forces. Better, Faster, Cheaper comes to the Land Domain.

To meet the logistics vulnerabilities, the DOD continues to focus on a distributed architecture for its logistics. In other words, lots of small, decentralized locations distributed across geography and across the battlefield to maintain sustainability of supply. To meet the need to track these systems, supplies, and manpower, the Army Futures Command (AFC) continues to turn to commercially available software that can provide traditional inventory tracking and supply chain logistics, available from multiple commercial software vendors today. In other words, the Army will purchase off the shelf ERP systems with added security and encryption to meet its needs. In addition to the logistics challenge, the AFC continues to focus on the ability to give commanders and those on the ground the data they need to make the optimal decisions under stress. This comes down to the sustainability and mobility of what the DOD labels the C3I Infrastructure or Command, Control, Communications, and Intelligence Infrastructure. The Pentagon assumes that China will attack the infrastructure in the mainland United States in a future conflict and that such infrastructure stands vulnerable to the new precision missiles. With the growth of the Cloud, the Pentagon is now turning to the commercial cloud providers such as Amazon and Microsoft to support this capability and to create the ability to share data across platforms and across the branches of the Armed Services. This architecture, what is known as the JEDI contract, could instantaneously switch between the massive number of data centers across the US, preventing an adversary from crippling US C3I capabilities. In doing so, the DOD aims to create sustainable infrastructure that can continue to function even if a portion gets destroyed in combat. Better, Faster, Cheaper comes to logistics and C3I.

Given the race to meet the geopolitical challenge of China and to defend Taiwan, there stands no branch untouched by the rush to meet this challenge. All stands fair game as the DOD pivots to create the weapons and systems that enable the Armed Services to meet their mission to Defend and Protect. With the future rushing forward to the present, there exists no time to debate these changes. The current war in Ukraine demonstrates the utility of small precision weapons against weapons and assets costing 20x to 100x or more. And the reality of this grinding war, a war that consumes vast quantities of men and materials similar to the wars of Vietnam, Korea, and World War II, upended the economics and assumptions of the past 30 years. In doing so, it forced a complete rethink of the systems and assets the US Military needs to win the next war, putting all aspects of the military under the microscope. With the major defense contractors moving at a pace that would not meet the timeline the military required, the Pentagon moved to create an alternative future. For the traditional defense contractors, this coming shakeup will completely rejigger the pecking order, as new entrants take significant market share and the Pentagon prevents the entrenched competitors from buying out the new challengers to block their ascent. Given this, today’s leading companies will stand at risk of seeing their products obsolesced, as in prior eras of change. But for the US Military, it will represent a victory, providing the foundation and structure for a military pivot to meet the challenge of a geopolitical peer an ocean away. As Technology Comes To The Defense Industry, it will produce the needed transformation of the Armed Services. And, in doing so, it will provide the pathway for the complete revision to military strategy to meet its future needs through new weapons and new capabilities to come to fruition. For the Defense Industry, Better, Faster, Cheaper will represent sweeping change. This change will downgrade the competitive position of hitherto impregnable companies, just as earlier eras of change displaced IBM and DEC as market leaders. And, as Technology Comes to the Defense Industry, the industry will undergo the Creative Destruction that rules economics elsewhere and meets the needs of the future, creating new winners and leaving former leaders behind.

In The Aggregate, Here Come The Nanotubes, and Hold The Spice!

Finally, we close with brief comments on In The Aggregate, Here Come The NanoTubes, and No Relief in Sight. First, producers of crushed stone continue to crush it. After aggregate stone prices rose 13.7% year over year in last year’s second half, Martin Marietta Materials projects they will rise another 16.8% in the second half of this year. For producers of crushed stone, the profits are all In The Aggregate. Second, Huntsman Chemical announced the beginning of construction on its Miralon carbon nanotubes material plant, first announced in 2021. This plant with take methane gas emissions and turn them into Nanotubes and clean Hydrogen while reducing carbon emissions by 95%. Nanotube materials provide strength up to 25x that of steel while possessing strong electrical and thermal conductivity properties. For the world, it will finally be Here Come The Nanotubes. And third, Consumers continue to cut back on their everyday spending to stay within their incomes, which have significantly lagged the price increases they face. McCormick, the largest provider of spices in the US, continues to report negative unit volumes in its US Spice Business. For the latest quarter, Spice Volumes/Mix fell 4%, which continues the trend that began in 2022. Given this data, we see Consumers saying: Hold The Spice!

In Closing

Should you have any questions on how the above issues or the items discussed in our accompanying cover letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer