Consumer Credit, Bank Credit, & Private Credit: It’s A Cycle

Views From the Stream

Views From the Stream

The Monthly Letter covers two topics this month. First, we take a look at Credit throughout the economy. For the past decade, credit expanded at a rapid rate, especially during the Pandemic and afterward. This was fueled by the U.S. Government which backstopped the Consumer and a Federal Reserve which followed the precepts of Modern Monetary Theory. However, as in many things, the Law of Unintended Consequences reared its ugly head, as Inflation took off. To head them off at the pass, as an earlier generation might say, the Federal Reserve embarked on a tightening campaign not seen since the 1970s. Having raised rates and withdrawn money, the usual results continue to flow, such as a turn in the Commercial Real Estate Cycle. And having cut them off at the pass, the consequences of the Inflation fight continue with casualties rising as the economy slows and real asset prices likely have peaked for the cycle. With these cattle wrestlers in the Fed’s hand, a true Credit Cycle appears ahead that will burn the prairie grass from horizon to horizon, leaving no blade of grass unscorched. Second, as always, we close with brief comments of interest to our readers on a variety of current topics relevant to the economy and the markets.

Consumer Credit, Bank Credit, & Private Credit: It’s A Cycle

The Years 2007 and 2008 stood bad years for credit and, unfortunately, for Bordeaux red wine. After an unbelievable year in 2005 for both and a good year in 2006, things began to deteriorate in 2007. And they culminated in a horrible year for credit in 2008 and a poor year for red wine as well. For those intrepid soles who invested in credit in early 2009, the year turned into a huge opportunity as the government rescued the financial system with huge rewards as the year progressed and the rewards continued in 2010 as recovery moved into full bloom. The Year 2010 proved a bantam year for Bordeaux, with the wines producing some of the best bottles in decades. Since then Credit clearly outperformed the reds, as credit cycles have been muted. And in the one instance where a true Credit Cycle appeared set to spring forth, during the Pandemic the federal government stepped into the fray with helicopter money and forbearance, creating improving credit during a recession, an unparalleled event over the past 50 years. Unlike Credit, Bordeaux reds experienced the classic variation that normally accompanies any thing dependent on the weather. There were some poor years and some great years. And while governments try to control many things, they have yet to figure out how to control the weather.

Despite the government’s best efforts to eliminate credit losses and credit cycles, there appears a Credit Cycle visible on the horizon. And while it is not here yet, the cycle appears set to slowly work its way from the horizon to the present and to dump the typical storm winds and credit crunches that normally accompany it. In addition to the normal turbulence that occurs, it seems the Federal Reserve plans to exacerbate its impact, as it imposes stricter credit conditions on banks and increases reserve requirements. What appears to the Fed as “positive” for long term stability of the financial system, unfortunately leads to drought for an economy in need of credit to complement equity investment to grow. And unlike the unpredictable weather, which can create a bounty or a disaster in the vineyards of France in any given year, the Federal Reserve’s actions possess predictable outcomes that can aid or retard the ability of the U.S. economy to grow.

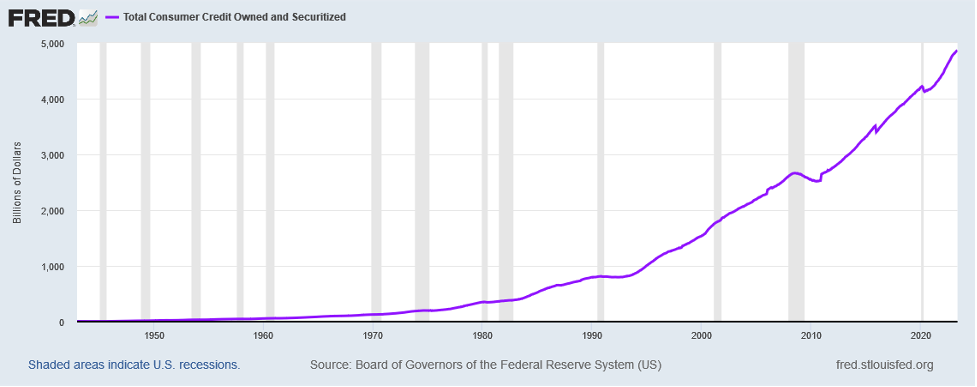

Consumer Credit continues to grow at a reasonable rate. As per the data from the Federal Reserve, Consumers continue to spend money despite the potential issues in the economy and the rise in interest rates. Spending today stands 126% of its level in 2019.

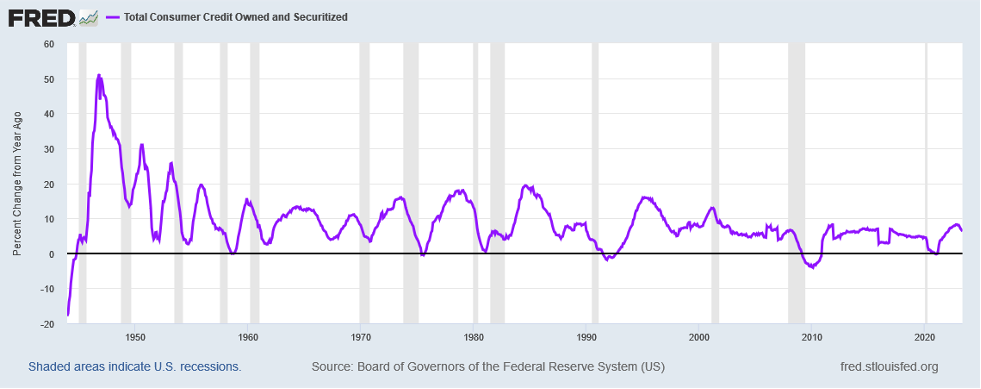

And when viewed in context of growth rates historically, the U.S. Consumer acted in a rational manner despite all the noise on Wall Street and in the Press. Year over year growth stands relatively muted compared to historical cycles:

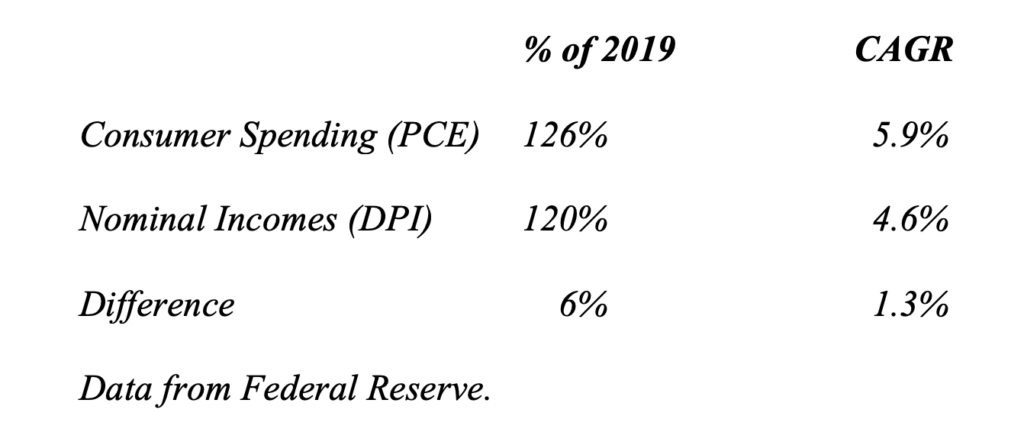

Over the past 4 Years, spending grew at a 5.9% compound rate. With Consumer Incomes growing at just a 4.6% rate, the difference needed to come from somewhere. The following table lays this out:

This difference stems from a combination of: Helicopter Money from the U.S. Government and Increases in Debt. According to estimates from Jefferies, the Consumer utilized 75% of the Helicopter Money to date. And it is estimated that Consumers in the lower income strata utilized 100% of their “found” monies. In order to sustain spending, given the massive Inflation, the Consumer started to take on revolving debt a year ago, to fill the gap. This caused credit card balances to grow at an accelerating rate. The latest data show these balances growing at 14.4% year over year.

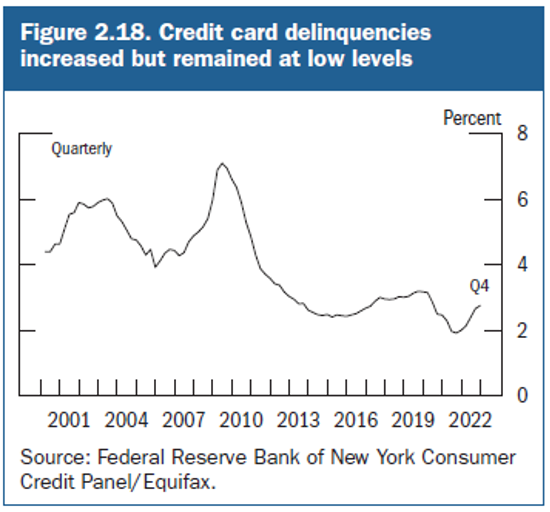

For the companies providing Consumer Credit through auto loans, home mortgages, and credit cards, the last 5 Years exhibited abnormally low loss rates. As the following chart from the Federal Reserve’s Financial Stability Report, published May 2023, demonstrates, Credit Card Delinquencies fell during the Pandemic Recession in 2020 as the U.S. Government provided Helicopter Money to the Consumer.

This stands the opposite of the norm during a Recession. Normally, Delinquency Rates rise 250 – 350 Basis Points. In other words, losses double. In this case, loss rates fell by one third, pushing Delinquency Rates well below normal for an expansion let alone a recession. Thus, Credit Card companies enjoyed earnings well above the norm during 2020. And instead of restricting credit, which typically accompanies a recession, they expanded their balance sheets and increased their exposure through securitized credit card receivables rapidly. With Credit Card Delinquencies beginning to normalize, let alone reflect difficult times, Credit Card companies, such as Capital One, began to report disappointing results. With Credit Card Portfolios typically taking 36 Months for Loss Rates to mature, delinquencies and earnings should remain under pressure through 2025. And should a recession occur, then earnings could collapse as Delinquency Rates shoot upward with the normal response of restricting credit by those firms impacted.

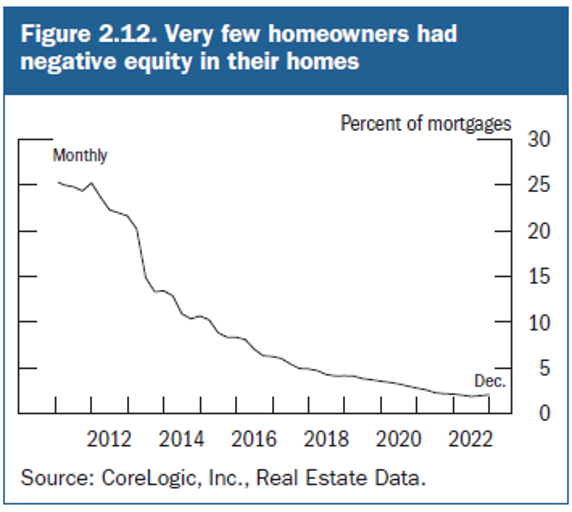

Other areas of Consumer Credit reflect the benign environment consumer finance focused companies enjoyed over the past decade. With the Federal Reserve creating a large inflation in home prices over the past decade, including a 40%+ rise above their level in 2019, homeowners with negative equity collapsed, as the following chart indicates:

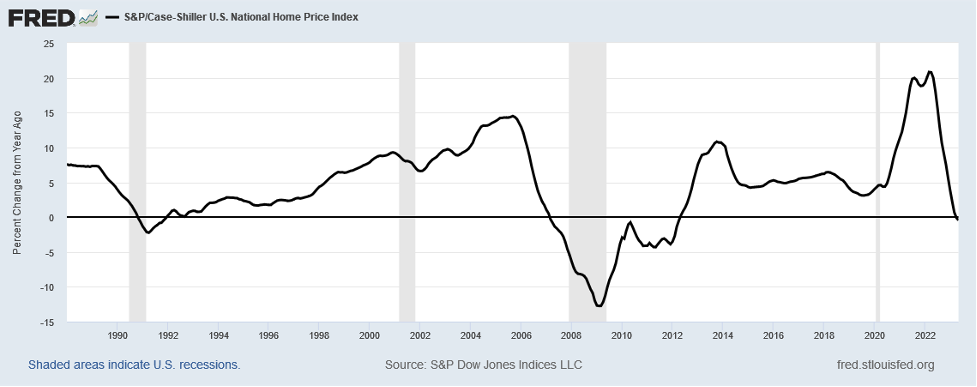

The rise in home prices since 2019 stands out as truly outsized. The following chart shows how home prices rose at a faster rate recently than during the Housing Bubble in 2004 – 2007:

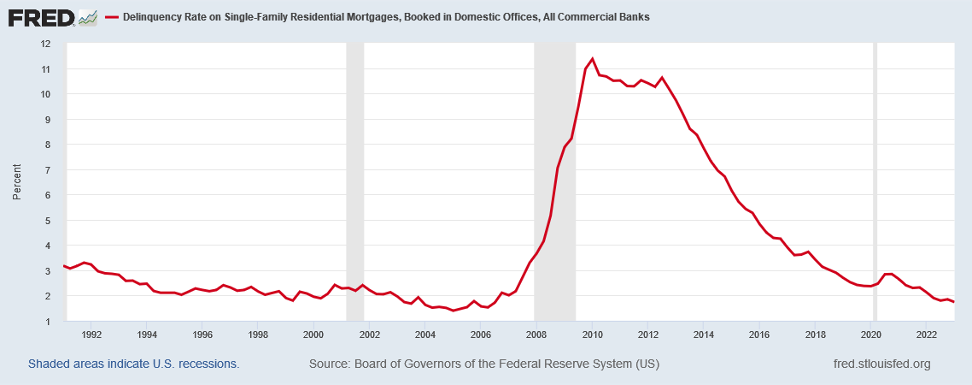

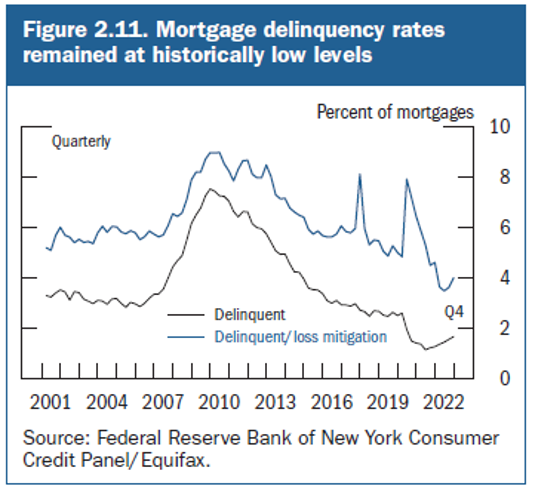

With home prices exploding upward, loss rates on mortgages collapsed to level last seen in the early 2000s:

However, with home price increases slowing, loss rates began to creep up over the past year to more normal levels, as the following chart from the Financial Stability Chart demonstrates:

Should home prices flatten out, Loss Rates should continue to grind upward. And should there be a recession, then Loss Rates could accelerate upward as rising unemployment impacts homeowners’ ability to meet their mortgage payments. For those companies issuing mortgages over the past few years, their earnings stand well above sustainable levels.

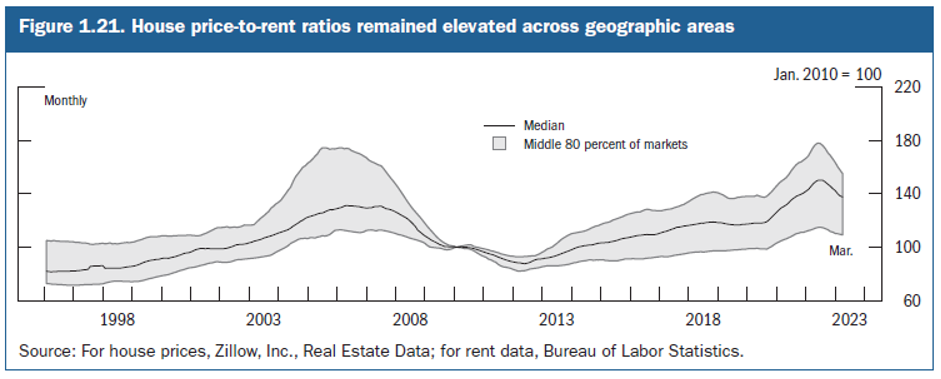

One other issue stands out. Median Home Price to Rent Ratios stand above their 2007 levels as the following chart demonstrates:

This stands a function of low mortgage rates coupled with a lack of housing supply. However, home builders are rushing to fill the supply shortage. In addition, apartment deliveries stand at record levels, which began to put pressure on rents. And should the normal deaths, divorces, and relocations occur, home turnover should pick up, despite the rise in interest rates. This should push supply back to normalized levels. And once that occurs, the likely impact stands a correction in prices or a period of time when home prices go sideways while incomes catch up. When this occurred in the late 1980s and then in the 2005 – 2007 time frame, home prices subsequently came under pressure. In the late 1990s, home prices went sideways for almost 5 years. Should either of these occur coupled with a recession, mortgage lending and mortgage backed securities could experience much higher than expected losses.

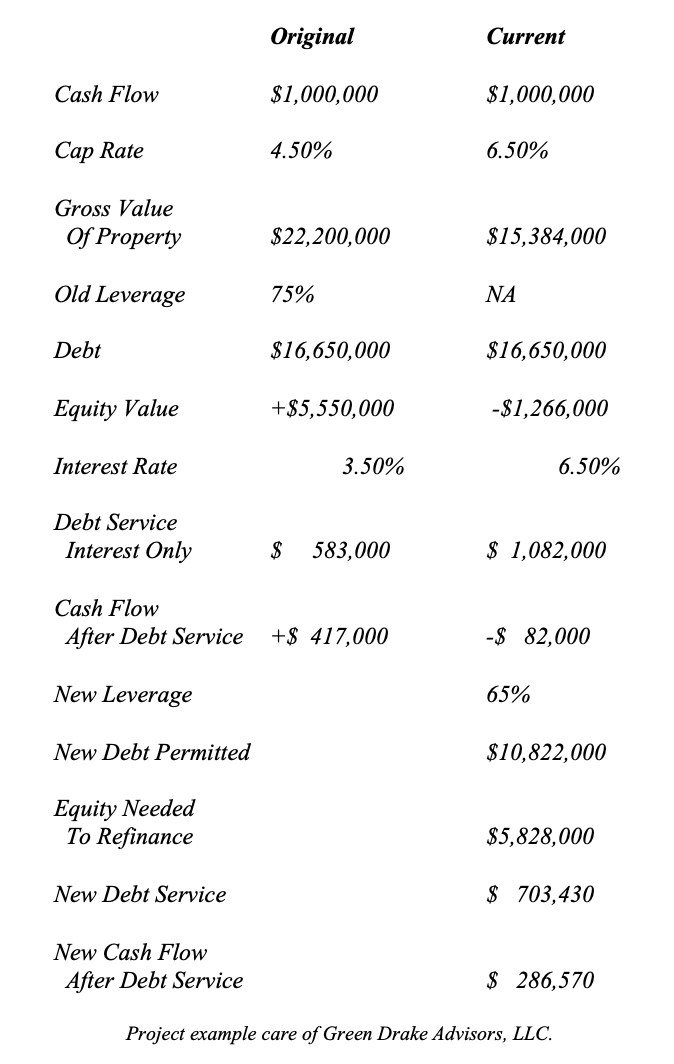

Banks face a different challenge over the next few years. This centers around their large commercial real estate portfolios. With Cap Rates rising, numerous buildings stand effectively bankrupt as their debt exceeds the value of the buildings. A simple example will make clear the issue these institutions face with their Commercial Real Estate Loan Portfolios:

As this simple example demonstrates, with the rise in Cap Rates, a previously profitable project now stands underwater with 100% of the Equity wiped out and the operating cash flow unable to support the Debt Service at the new interest rates, let alone the necessary cap ex to maintain the building over time. And, while the crisis will not occur until the loan matures and the building must refinance, the bank which lent against the building will need to take a Reserve on its Balance Sheet regardless of the building’s ability to meet its current debt service obligations. In addition, even at the lower level of debt as per the New Leverage, the cash flow after interest expense stands 30% lower for investors. With $23.8 trillion in commercial real estate, the overall potential write-off stands large.

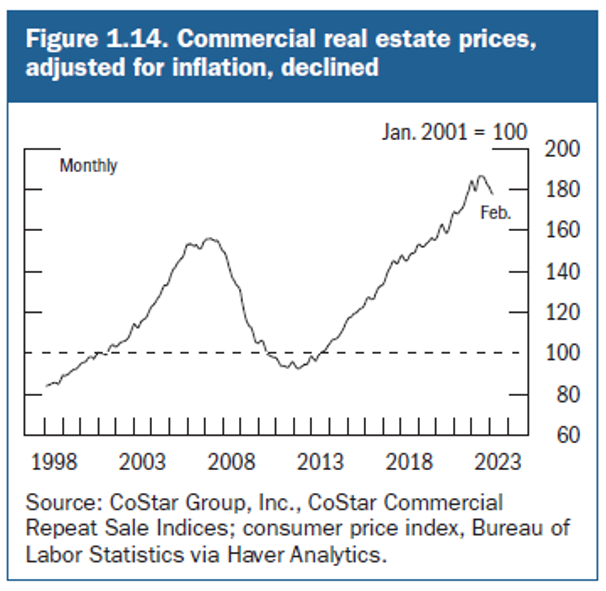

And while regulators focus on assets such as office buildings and multi-family apartments, there stands a broader list of commercial real estate at risk. For example, self storage facilities witnessed a boom in building as the Pandemic induced demand coupled with low interest rates encouraged large additions to capacity. Unfortunately, demand growth slowed while supply accelerated. As in any industry where this occurs, price came under pressure. New Rents peaked in H1 2022 and stand down 15%+ in many markets. Numerous projects stand underwater as the expected cash flow will not appear and a recession would just add to these projects’ woes as vacancy rates rise. Add into the mix a rise in cap rates, then the stage is set for a reset in valuations for this area. For those lenders who lent against these projects, they should prepare to take back the keys. As the debt comes due on office building, self storage, multi-family, and other commercial real estate assets that were not conservatively financed, the workout departments of banks should be busy 24 hours a day, 7 days a week starting sometime in 2024. And as the following chart demonstrates, once commercial real estate prices roll over, they tend to continue down for some time:

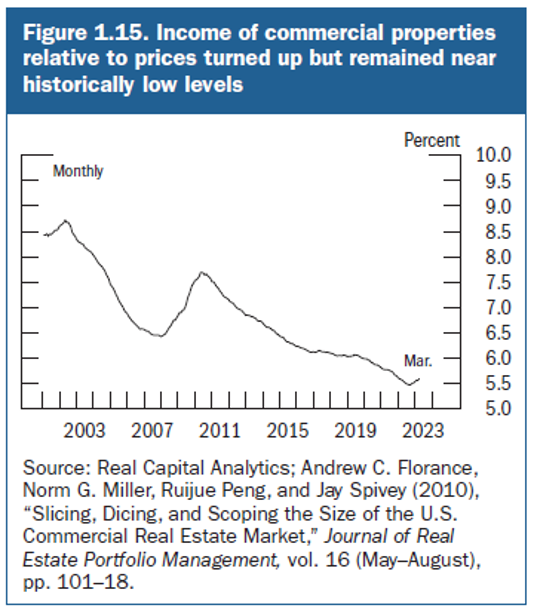

This reflects the long term nature of the Commercial Real Estate Cycle, whereby it takes several years to flush out underwater projects and buildings before a bottom can form. Once a building is under process, it rarely does not complete unless a crash occurs, such as the oil price crash in the 1980s. Thus, supply keeps coming as the economy turns down. That explains why the commercial real estate cycle typically lags the economic cycle. There exists one other important point investors should keep in mind. The Federal Reserve’s report indicates Income of Commercial Properties stands near lows not seen since the Great Depression of the 1930s:

Thus, investors need to keep a wary eye out for a long term turn in the Cap Rate Cycle, whereby Cap Rates rise from cycle to cycle.

In addition to commercial real estate, banks possess large exposure to Leveraged Loans. These loans typically are to a mix of middle market and smaller companies that have less financial wherewithal when the economy turns down. Leveraged Loans on the banking systems balance sheet exceeded $1.4 trillion in 2022. With rates for small to mid size business floating with interest rates, the recent increase in interest rates by the Federal Reserve drove these floating rates from less than 5% last year to over 10% this year. While the impact on these companies stands delayed due to the lag before it impacts their cash flow, these loans should start to bite in the second half of 2023. And, in 2024, stress in this area should start to float to the surface even without a recession. In a recession, these loans typically see a spike in non-performance with loss rates rising to 2x to 3x current levels.

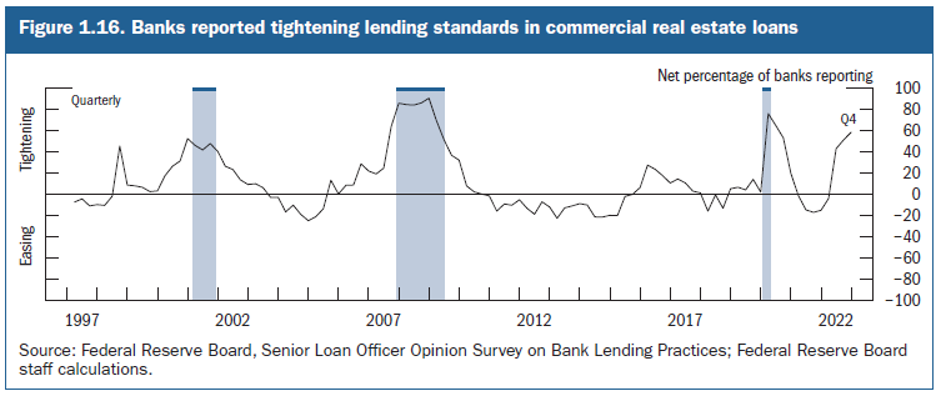

In response to these pressures, commercial banks continue to tighten loan requirements. As per the Senior Loan Officer Survey, bank lending standards reached their tightest level, outside a recession, since 2007. The following chart illustrates this rise:

The last two times this occurred, 2007 and 2000, a recession followed within 12 months as the tightening in credit standards put the squeeze on the economy.

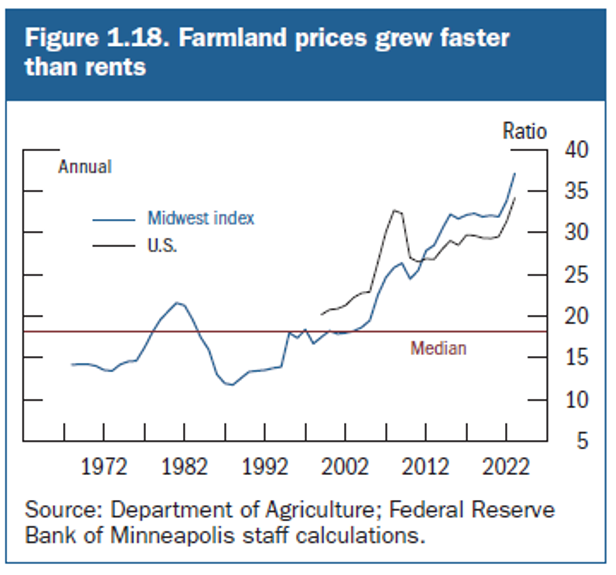

One other area of real estate should bear watching: Agricultural Land. While this only affects a small subset of banks, a true turn in the agricultural land cycle could have a significant impact on agricultural communities across the U.S. With the recent rise in crop prices, the value of Agricultural Land exploded upward. And prices, as a multiple of the rents, exploded upward as well. The following chart demonstrates this level of land speculation:

At 38x for Midwest Land, this land yields just 2.63%. Should Cap Rates for agricultural land rise, which should come as no surprise to anyone, then Acreage could come under significant pressure. Just a return to 32x, which stands high in a historical context going back to the 1970s, would result in the value of farmland falling 16%. And a return to pre-QE Era prices would lead to multiples dropping to 25x or less. This would cause agricultural land prices to drop almost 35% from today’s levels. And should crop prices, which drive rents, drop 15% – 25%, the value of the land could fall 50% or more. At an additional $3.2 trillion in exposure for agricultural banks, this represents a not trivial amount. In many ways, this exposure stands similar to what occurs with Mineral Rights for Oil & Gas properties, whereby the multiple of cash flow rises when oil prices goes up and then collapses as oil price drop.

Lastly, Private Credit assets grew strongly over the past several years. From less than $600 billion in 2018, Private Credit assets exceeded $1 trillion in 2021, growing over 65% in just 3 years. For any credit asset, such growth typically leads to problems as the portfolio of loans matures. While there clearly exists an issue, few markdowns to date have occurred. Already, even with a growing economy, a number of technology companies have entered liquidation. While this will not impact banks, it will impact credit availability in the overall economy, cutting off credit to marginal borrowers that cannot qualify to receive credit through traditional channels. In addition, it could impact the valuation of assets and companies throughout the markets, as these lenders typically provide the unsecured debt that sits behind the secured lenders and senior lenders. Should this debt become scarce, then valuation multiples on companies would fall, potentially in a significant manner. So, while a small part of the overall credit markets, it possesses a disproportionate impact on asset values across cycles.

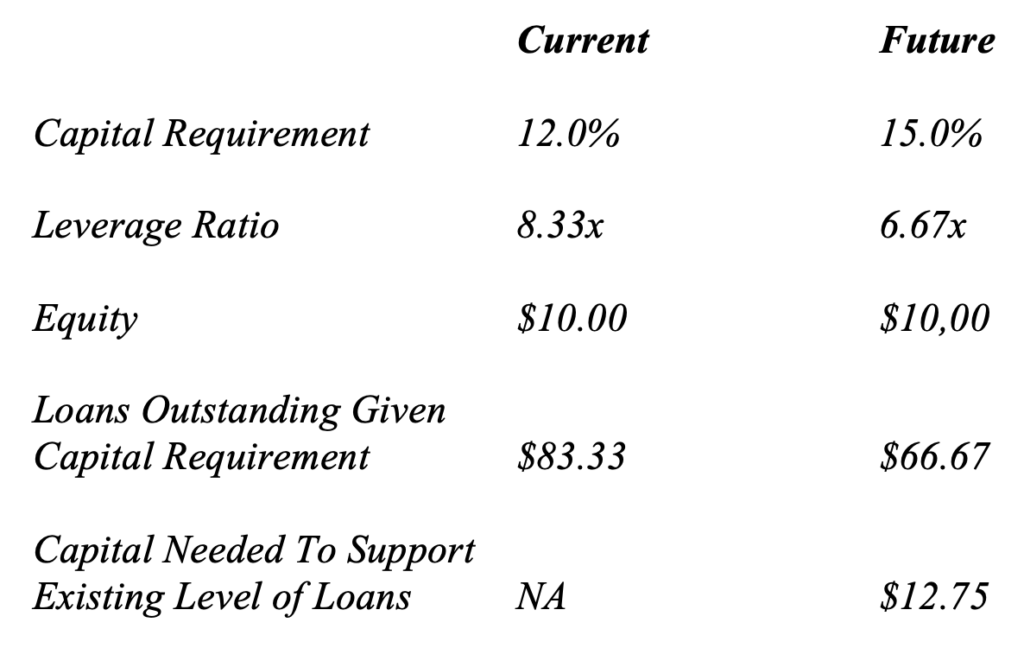

Hiding in the background, behind the downturn in the Credit Cycle, sit recent moves by the Federal Reserve to implement the Basel III Standards. These standards would require banks to increase their capital levels from the current 12% to 15% relative to their balance sheets. Even without a downturn in the economy, this move will require banks to significantly increase their Capital Ratios over the next few years. And despite the transition period, banks will need to meet 80% of the rise in Capital Ratios by the end of 2025. In other words, they will need to reach 14.4% from the current 12.0% requirement. The following illustrates the impact on bank balance sheets and their ability to lend:

As the above math makes clear, just to support the current level of loans on a bank’s books, the bank will need 27.5% more capital. This, at a 10% Return on Equity for the average bank, represents close to 3 Years of Earnings that a bank must add to its balance sheet with No Loan Growth and No Dividends Paid. In other words, Credit Growth must come to a halt. The only alternative is for the bank to shrink its loan book by 20.0% to meet its Capital Requirements. So, by requiring banks to reach 80% of the new Basel III Capital Requirement in Year 1 of the transition period, the Fed will engineer a shrinkage of credit in the financial system. Historically, creating such a result produces only one outcome, Recession. And not only does this action precipitate a Recession in a growing economy, it exacerbates any Recession already underway.

With Credit beginning to deteriorate, banks moved over the past year to protect their balance sheets. But this occurred in the vein of the farmer barring the hen house doors after the fox visited the chicken coop. Already, numerous “shovel ready” real estate projects stand unfunded. With the Cost of Capital significantly higher than over the past few years, these projects cannot produce returns to both meet their debt service and investor expectations. And as existing projects complete and face insolvency, the Credit Markets will face a test. Add to this the numerous real estate investments that need to refinance to significantly higher rates over the next few years, then things could get really interesting. Lastly, with the cost of capital rising, numerous companies outside the real estate sector will face stress to their businesses as debt service costs drain away cash flow that supported growth and the needs of the business. All this will slow the economy and potentially tip it into Recession creating more stress for banks and other providers of credit. With the Fed cutting them off at the pass to bring Inflation under control, it appears the economy will bear the brunt of its actions. And for Consumer Credit, Bank Credit, and Private Credit, It’s A Cycle.

Lightweights, Made in the U.S.A., and The Bionic Human

Finally, we close with brief comments on Lightweights, Made in the U.S.A., and The Bionic Human. First, Container Cargo continues to shrink. As the world moves to more regional production due to geopolitics, it is remaking the logistics that go around it. Maersk projects that Global Container Volumes will shrink 1.5% – 4.5% in 2023. As a result, Container Ship Loads will remain Lightweights compared to prior years for years to come. Second, U.S. manufacturing investment continues to rise, despite the slowdown in the economy. This reflects the government economic incentives to move production home as well as national security moves to ensure the U.S. can meet critical needs. As a result, we see rising levels of Made in the U.S.A. across the land. And Third, scientists continue to advance their ability to grow parts of the human body in the lab, utilizing a patient’s own cells, for implant back into the patient. Epibone just received IND status from the FDA for its process to grow a patient new cartilage to replace damaged knee cartilage from a variety of injuries. Should their trial succeed, it would enable another part of us to be good as new despite injuries and the aging process. As such, it represents another step along the way towards The Bionic Human. (For those with interest, more information can be found at https://orthofeed.com/2023/07/25/epibone-to-start-clinical-trials-for-knee-cartilage-grown-in-lab/.)

In Closing

Should you have any questions on how the above issues or the items discussed in our accompanying cover letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer