Global Economic Quarterly, Part 3: Scenes from Abroad

Views From the Stream

Views From the Stream

The Monthly Letter covers two major topics this month. First, we provide Part 2 of our Global Economic Quarterly. The Global Economy continues to bifurcate across multiple economic spheres. With the US reclaiming its growth, other countries that have been able to grow by selling to the US will find their paths more difficult. However, this will not change the fundamental growth shift whereby Emerging Markets continue to outgrow the Developed Economies. To every rule there stands an exception. This may come in the form of the US, as the various bills passed over the past two years by the US Congress act as a Marshall Plan for America. Second, for the Federal Reserve lags are long and indeterminant. Silicon Valley Bank merely became the first casualty due to its leveraged investment portfolio and poor hedging. While a few other bodies have floated to the surface, this stands the appetizer before the main course. That lies ahead over the next year as the economy slows and turns down. In other words, expect more to come as the commercial real estate sector takes it on the chin. For those who study the history of the Federal Reserve, the following stands clear. The Fed does not really know the impact of its moves or how deep the impact will be until things get out of control and/or start to break in the economy. Stay tuned for more updates as the true impact reveals itself. Third, as always, we close with brief comments of interest to our readers on a variety of current topics relevant to the economy and the markets.

Global Economic Quarterly, Part 3: Scenes from Abroad

A Dragon Tamed

Despite the reality of China’s economic situation, the Chinese Communist Party (CCP) continues to stick with its 5% to 6% long term economic growth targets. This contrasts to the reality of the 3% or less growth attained in 2022. And whatever growth the CCP reported last year, numerous private reports indicate that real growth stood significantly below the official reports. It is important to note that this occurred despite $300+ billion in incremental investment incentives provided last year. Such a disconnect, between the reality on the ground and the aspirations of the CCP, will continue to produce massive overinvestment into the Chinese economy. For example, BYD, one of the flagship Chinese EV companies, possesses capacity to build 2.6 million vehicles out of which it produced and sold just 1.75 million vehicles in 2022. With the government cutting back on its subsidies, its Q1 2023 sales totaled just 260,000 vehicles, which would imply just 1.1 million vehicles sold in 2023 should that rate continue and a mere 42% of its overall capacity. Despite this reality, the company plans to expand its capacity to 4.3 million units during 2023 and sell 3.6 million cars in 2024. This goal would represent a number more than twice the cars it sold in 2022.

For China, this stands the preeminent issue. In order to meet its economic growth goals, it continues to invest well beyond the point of reason. Local governments have announced plans to spend 12.2 trillion Yuan in 2023, ($1.8 trillion) on infrastructure, power production, and industrial plant, up 17% from 2022. This increase of $260 billion, while it will add ~1.5% to its GDP Growth, will just create more and more capacity that its domestic markets can not absorb. The only choice becomes exporting its way out of its overcapacity. And with industrial capacity equal to 30% of Global Industrial Production, this represents a lot of capacity. This increase in capacity does not include Central Government spending. With other countries domesticating supply chains and beginning to shut themselves off from the country’s mercantilist economic policy, continued Investment will only create more surplus capacity. And while 2023 growth will benefit from a reopening bounce, similar to those that occurred in the US and Europe, the outlook for 2024 remains in doubt. The only way to achieve the type of growth targeted once the reopening bounce fades would stand through massive Investment and a revival of Real Estate. Assuming Consumption is 35% of the economy, which may be a stretch, and assuming it grows at 3% Real or 6% – 8% nominal, it would create ~1% point of GDP Growth. This would then leave over 4%+ real growth to occur via Real Estate, Trade and Investment. China already stepped on the Trade accelerator in 2022, when its Trade Surplus expanded from $677 billion to $877 billion or by $200 billion. Considering that its 2022 GDP rose “3%” to $18.2 trillion, trade accounted for 40% of its 2022 GDP Growth. If the economy grows 5% this year, then GDP would reach $19.1 trillion. The real issue stands 2024. To grow another 5%+ would equate to $1 trillion in GDP. Assuming that China grows its Trade Surplus by $200 billion in 2024, which appears a tall order, and assuming it grows Consumption by 3% real, then it would need to grow Real Estate and Infrastructure by $600 billion to achieve its growth goals or 7.5% real. While Real Estate may bounce with the CCP now encouraging investment into Real Estate once more, there still exists massive oversupply, especially in the 70% of the country outside the major metro areas. Should Real Estate prove difficult to revive, then Infrastructure would stand the only salvation for the economy. And its growth would need to reach massive proportions. China could do this by accelerating its investment into technology, as it seeks to dominate this key area where the rest of the world possesses an edge. But the result stands clear: a massive surplus of technology goods for which China might have difficulty finding a home. A simple example will make this issue clear. The U.S. put sanctions on Yangtze Memory Technology Corporation, more well known as YMTC. To keep YMTC from going bankrupt, the CCP provided $7 billion in funding over the past year. In addition, the CCP funded numerous Chinese semiconductor equipment companies to create the equipment that YMTC needs to complete its new plant. The Chinese Government recently announced it would complete this plant and bring it online in 2024. Just recently, it began an investigation into Micron Technology, the leading U.S. semiconductor memory manufacturer. Clearly, the CCP plans to ban Micron’s products in China and replace them with YMTC’s products, once its plant comes online. (We note that since this was written, this action has occurred.) This would stand similar to how it acted in the chemical industry, steel industry, healthcare equipment sector, … on its path to grabbing Global Market Share over the past 20 years. However, the world no longer stands the same, as countries recognize China’s economic policy as a one-sided attempt to put their companies and economies out of business to dominate the globe. In response, countries around the world started to tariff its surplus production out of their markets. Should China follow this path, the U.S. and Europe would respond to preserve their economies. They likely would ban any product containing YMTC chips and require every importer to provide Certificates of Origin demonstrating where every component in any technology product originates. But, to recognize this reality, would force the CCP to vastly lower its growth targets to 2% to 3% GDP Growth. For the CCP, this would represent an existential threat to its continued dominance in China. As a result, it appears that a clash between the CCP aspirations and the willingness of the world to take its surplus goods stands ahead. And the only acceptable outcome outside of China stands A Dragon Tamed, whereby China stops dumping its surplus goods onto the world stage. Unfortunately, this seems an unlikely outcome which will inevitably lead to rising economic tensions and an outright Trade War between China and the rest of the world.

Galumphing Elephants

India remains the best fundamental growth story in Asia and potentially across the globe. The country stands in a similar position to China in 2000. It is urbanizing and industrializing at the same time it creates the necessary infrastructure for the two. These fundamental economic forces should enable the country to sustain its strong growth rate for the next decade. By the time 2030 rolls around, India should stand one of the economic powers of the globe. And, with China’s population shrinking, the country should become the most populous as well. Real Estate remains a key driver. After an 8 year downturn, the Residential Real Estate market bottomed in 2020. Inventory continues downward, now at only 18 months in the Top7 Cities compared to 45 months at the bottom of the market. Prices continue their upward trajectory, rising over 10% year over year in February. And Affordability remains reasonable at a 35% Home Loan Payment to Income Ratio, well below its peak of 53% in 2012. With the Housing Market Likely on a multi-year upswing, Housing development should follow.

On the Industrial side, Government Investment continues to rise in real terms and relative to GDP. From just 1.7% of GDP in F2020, the year ended March 2020, Government Capital Expenditures will reach almost 3.5% of GDP in F2024. Real Growth in GDP from F2019, despite the Pandemic, will exceed 15% by the end of this Fiscal Year. This means India will more than double real Investment into its economy over the past 5 years. In addition, the country continues to focus on developing its Manufacturing with a goal to more than double its Exports in Real Terms by 2030. While until recently this seemed a tall order, due to the competition from China, with the world looking for alternatives to Chinese capacity, India stands to benefit. Apple, for example, chose India as one of its key manufacturing hubs. Other companies, in a less public manner, have put India on the map as a destination for their new products. With this as backdrop, India should hear the sound of Galumphing Elephants for years to come.

The Sun At Noon

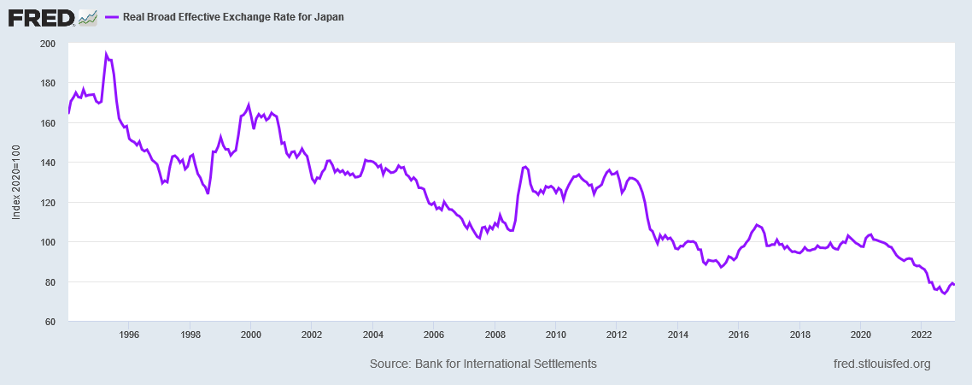

Japan continues to benefit from a policy focused on improving its Global Competitive Position. This policy reflects the Bank of Japan’s (BOJ’s) focus on Yield Curve Control and willingness to flood the market with Japanese Yen. In effect, the BOJ used Yield Curve Control to enter into a significant depreciation of the Japanese Yen’s real value, what economists call the Real Effective Exchange Rate or REER. The following chart demonstrates this policy over the recent past and over the past 30 years:

With exports a significant driver to its economy, preventing a collapse in exports stands a key portion of its economic policy. As the chart demonstrates, Japan significantly lowered its REER in stages over the past 30 years. The latest drop occurred in the past two years, when Japan dropped its currency’s value another 20% to protect and enhance its economic growth. That Warren Buffet’s Berkshire Hathaway took a position in Japan’s trading companies, which focus on import-export business, stands no fluke. He clearly views them as a primary beneficiary of Japan’s continued move to lower its REER to boost the rate of economic growth.

This policy already positively boosted GDP Growth and raised Inflation. And, with the usual lag, Wages appear set to follow. The average Japanese citizen should finally see some benefit in real wage growth after 30 years of stagnant real wages. In addition to the fundamental repositioning of the Japanese currency, the government, faced with the threat from China, announced it will double defense spending as a portion of GDP. This will act as an additional stimulus and investment program for the country. It should underpin its growth, as it faces headwinds from slowing US growth, and prepare for a world in which geopolitics matter once more. With a combination of these policies, the Japanese economy appears to be enjoying The Sun At Noon, as the positives of these policies impact the economy today and the costs will be borne at some indeterminant point in the future.

Tiger Tales

For the countries of Southeast Asia, the travails of China stand their gain. In a zero sum game, when it comes to the share of global manufacturing, the Great Power conflict between China and the US will drive manufacturing initially to these countries as the top global corporations seek to diversify their supply footprint away from China. For countries like Malaysia, Indonesia, and India, this will underpin their growth, acting as a major capital investment program into their economies. Already, companies have moved portions of manufacturing out of China. And this trend should only accelerate as companies, such as Ford, announce plans to cease future investment into China. They have recognized that their assumption, that they could build a business in China despite the China – US rivalry, stands contrary to such a geopolitical clash. Furthermore, they have recognized the reality of China’s Made in China 2025 Policy. Not only does that policy mean China wishes to domesticate all manufacturing, which they assumed would benefit them as they built out a footprint in China, but this manufacturing will occur with Chinese companies supplying the domestic marketplace. Thus, foreign entities can expect their market positions to erode over time, some slowly and others quickly, as the government funds companies to displace them in the marketplace. With this reality running in the background, continued investment into China to improve and grow their existing operations will likely prove good money after bad. Their best course of action stands relocating their operations elsewhere over time in a way that does not antagonize the Chinese government. In effect, they must navigate a graceful exit while recreating the wheel elsewhere. As a result, Vietnam now produces 20% of Samsung’s mobile phones. Malaysia assembles numerous technology products. Indonesia continues to leverage its raw materials to create a presence in the EV supply chain. And India looks to fill the role as the “global manufacturing hub”, taking advantage of China’s woes. They and Apple appear set to make India one of the prime countries where Apple recreates its supply chain. For Apple, it will represent “low cost” manufacturing. For India, it represents an opportunity to build a technology supply chain within the country’s borders. It appears a win-win for both parties.

The only wrench in Southeast Asian Countries’ and major corporations’ plans will prove the US government. The US currently seeks to re-domesticate portions of its manufacturing that it allowed to relocate elsewhere. This stands especially true for technology. Thus, the CHIPs Act likely represents only the first salvo in recreating a domestic industrial sector. With the difference between technology goods and industrial goods blurring, this concept extended to automobiles, such as EVs, which effectively represents moving the auto supply chain back to the US. And it easily could extend to multiple other aspects of the industrial economy, such as HVAC, industrial controls, … where computer controls and the Internet of Things are intimately intertwined with the basic industrial goods. There exists almost no industrial good today where computer controls do not intrude. In addition, advanced manufacturing technology, such as 3D Manufacturing and Robotics, represent another aspect of industrial goods that could find themselves under the rubric of “technology goods”. Reshoring this capacity and preventing export of the technology knowhow would represent another cog in rebuilding US manufacturing capacity with the ability to fill the factories of the future with US capital goods and advanced materials supplies. Finally, should the US consider the reality of potentially fighting a war in the Pacific or supporting other countries in such a war, major portions of basic manufacturing capacity will need to relocate to US shores. Already, the inability to fulfill missile orders with existing capacity is forcing a reexamination of the military supply chain. The Pentagon likely will stand up or subsidize the necessary industrial capacity to meet this demand. And with the line between military industrial parts capacity and other industrial parts capacity quite blurry, this will represent the first steps down this path. Other areas of manufacturing, such as pharmaceutical ingredients and generic drugs, where countries such as India possess major positions, could come into the crosshairs as the US considers what could happen if overseas supply lines were cut suddenly. Fortunately, the major portion of this journey stands in the medium term future for now allowing Tiger Tales of growth to dominate the story line for the next few years.

The Old Man Arises

For Europe, the war in Ukraine represented a huge shock. Despite the US telling the Europeans not to tie their economies to Russia for the last decade, the Europeans focused on what they thought best for their economic growth, tying themselves to cheap Russian energy and Chinese demand for their capital goods to drive their manufacturing economy. With the war in Ukraine, this strategy proved feckless. It created risks to Europe’s collective national security and tied them to the ally of their enemy in a war. This forced a total rethinking of their economic and foreign policy. With the loss of Russian natural gas, Europe’s industry stood at risk of becoming uncompetitive on a global basis. In response, Europe moved to undo over a decade of policy and to reconsider its “Green Initiative” as framed by the Green Energy lobby. They moved to increase LNG imports by both increasing current imports through existing facilities and moving to create additional capacity to accept such cargoes. Nuclear energy was relabeled as Green Energy due to its lack of emissions. Stop gap measures, such as restarting plants that burned coal and other fossil fuels came into place. And, to prevent numerous companies from going out of business and consumers freezing due to inability to pay for high priced fuel, the governments put in place massive subsidies. Germany alone put in place a € 300 billion program to subsidize energy costs.

Europe also moved to respond to the threats represented by China’s ambition to dominate all industries of the future and the US move to restore its manufacturing capacity. It announced its own series of subsidies to replicate what the United States put in place through the CHIPs Act, Inflation Reduction Act, and Infrastructure Act. And while that might prevent goods from traveling from the US to Europe as Europe supplies its own goods, it does not address the fundamentally cheaper manufacturing in the US due to less expensive energy costs. Nor does it address the massive state subsidies provided by China to its industry. Utilizing these subsidies, the Chinese government built numerous global scale industries through providing funds to pay for plants and R&D for its companies. This created phalanxes of domestically controlled companies to drive its exports and to fill every ecological niche in its economy. (Note: Chinese R&D often represents foreign patents reworked and filed in China which then allows the Chinese companies to block foreign competitors.) In order to address both its fundamental competitive disadvantage with the US and the threat from China, Europe just announced the first global Carbon Border Adjusment Tax (CBAT). This tax takes clear aim at the US and its cheap hydrocarbon energy as a way to tariff US goods out of its market. And it takes aim at China by putting massive tariffs in place on its goods due to the significant amount of coal fired power that the country utilizes. With Europe running a trade surplus with both the US and China, this blatantly protectionist measure likely will produce massive trade frictions with both countries. And while this might protect its industry and markets over the short term, over the intermediate term it likely will push both countries to take a harsher stance on trade with the EU. The US likely will respond with its own tariffs equal to whatever Europe puts in place. And with Europe benefitting from a large trade surplus with the US, Europe will likely end up with the short end of the stick as more goods are produced in North America and the US. On the other side of the Eurasian Continent, China already stands on the pathway to displacing the capital goods it imports from the Europe. The country continues to ramp its own facilities to produce the capital equipment necessary to manufacture advanced technology goods as well as to manufacture advanced industrial parts and goods. Given this, while it may protect its economy in the short term as The Old Man Arises, it likely will not solve its long term competitive disadvantage nor the desire of China and other Developing Economies to manufacture their own goods as they move up the economic development curve.

Samba or Salsa?

While Brazil dominated the past decade of growth in South America, it appears the winds of change continue to blow that favor other countries on the continent. The minerals of the future, such as Lithium, sit naturally in other countries. And the minerals of the past and future, such as copper, similarly come from elsewhere on the continent. Thus, for the first time in many years, it appears likely Brazil will not lead the charge as other countries compete with it to attract capital and knowhow to drive their economies in its place. As a result, despite its massive devaluation of its currency, Brazil’s economy continues to struggle. And the political fight between the two main parties does not help its cause. Each side seeks to paint the other as a creature of criminal activity thus deserving of prison and removal from the political scene. And with the country seemingly divided between the two main parties, dysfunctional government appears set for some time.

On the other side of the Andes, countries such as Chile, Peru, and Argentina began to reap the benefits of their mineral wealth tied to Electric Battery production. This will put them in a position to drive fundamental economic growth and raise living standards should they properly manage this bounty. The risk, which has held South America back from its economic potential, stands the tendency for leftist regimes to view these resources as patrimony. This discourages the foreign capital needed to develop these resources and retards economic growth. In this vein, Chile recently announced that its government would renegotiate the lithium contracts with foreign companies to ensure the state mining company, Codelco, would own a majority in each of the mining ventures. Should Chile not ensure that the companies earn a return on their capital commensurate with the risk and that they get properly compensated for the capital already invested, the country would see foreign capital for needed investment seriously retarded. This movie played out in the past for these countries, which created an environment in which the countries ultimately suffered economically from the adoption of such policies. While the jury stands out in deliberations before delivering its verdict, the question for South America remains: Samba or Salsa?

A Climb Interrupted

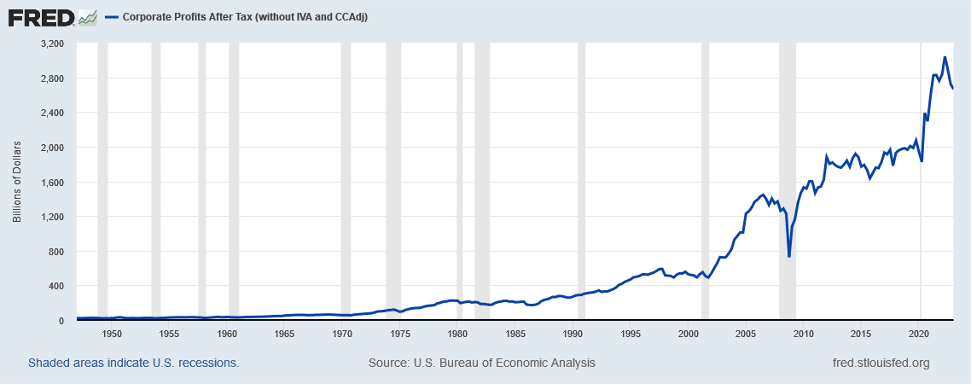

For the US economy, the strength leached out as the Federal Reserve decided to raise Interest Rates aggressively. And while its actions initially showed in Housing and Commercial Real Estate, as it normally does, the impact of its actions began to spread elsewhere in the economy. As the following chart makes clear, Corporate Profits peaked last year and began to turn down:

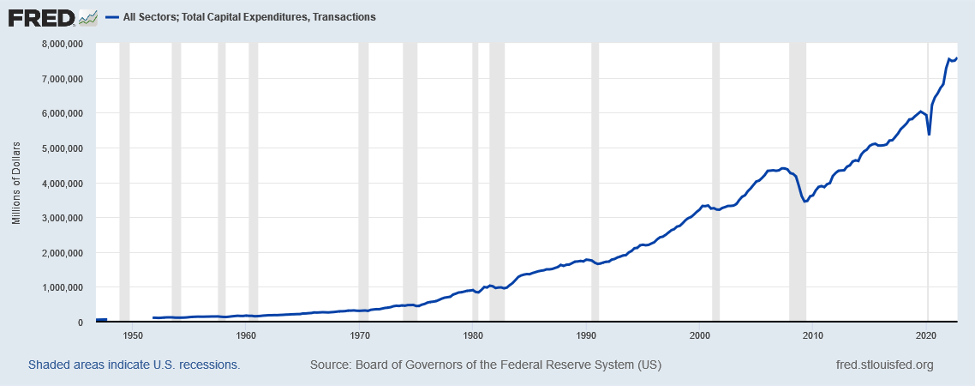

Corporate Profits lead many aspects of the economy including Capital Spending and Employment. As the following chart illustrates, Capital Spending appears to have stalled out before following Corporate Profits downward:

And, given the normal lag of 6 – 9 months, Capital Spending should start to turn down during H1 2023, impacting the Capital Goods sectors of the economy. And, in fact, recent government data suggest that Capital Spending turned down in Q1 of this year and continued to turn down in April as domestic absorption of capital goods fell last month. Government data lags, but corporate reports confirm this turn of events, Nvidia notwithstanding. And the impact on jobs is already apparent. The JOLTS Data, Job Openings and Losses, appears to have rolled over. And Continuing Unemployment Claims has turned up:

As this Graph makes clear, once Unemployment Claims turn up, they “auto-correlate” in economic parlance. In other words, they continue to go up. And normally, once they turn up, they don’t turn down until after the next recession ends.

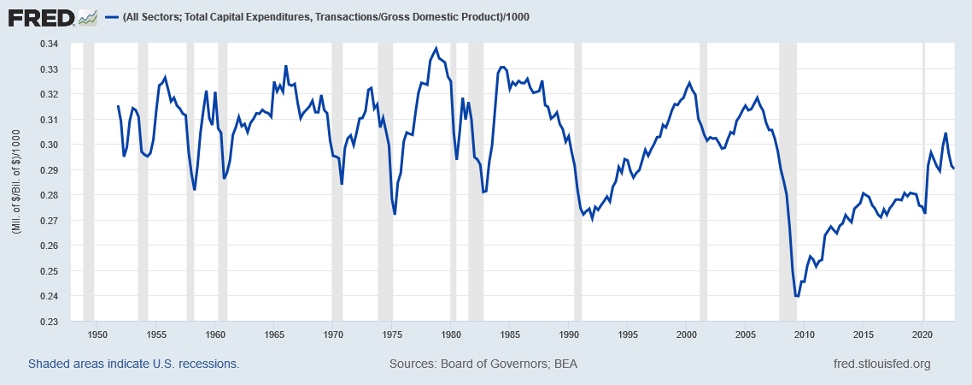

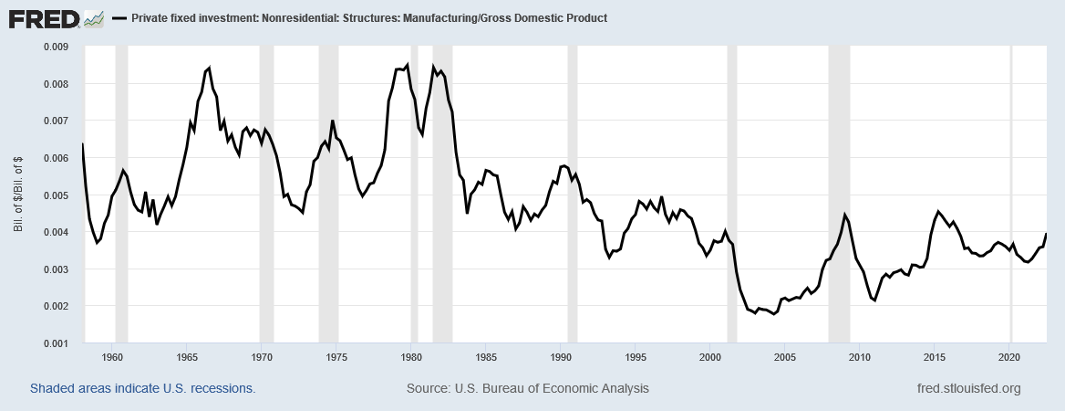

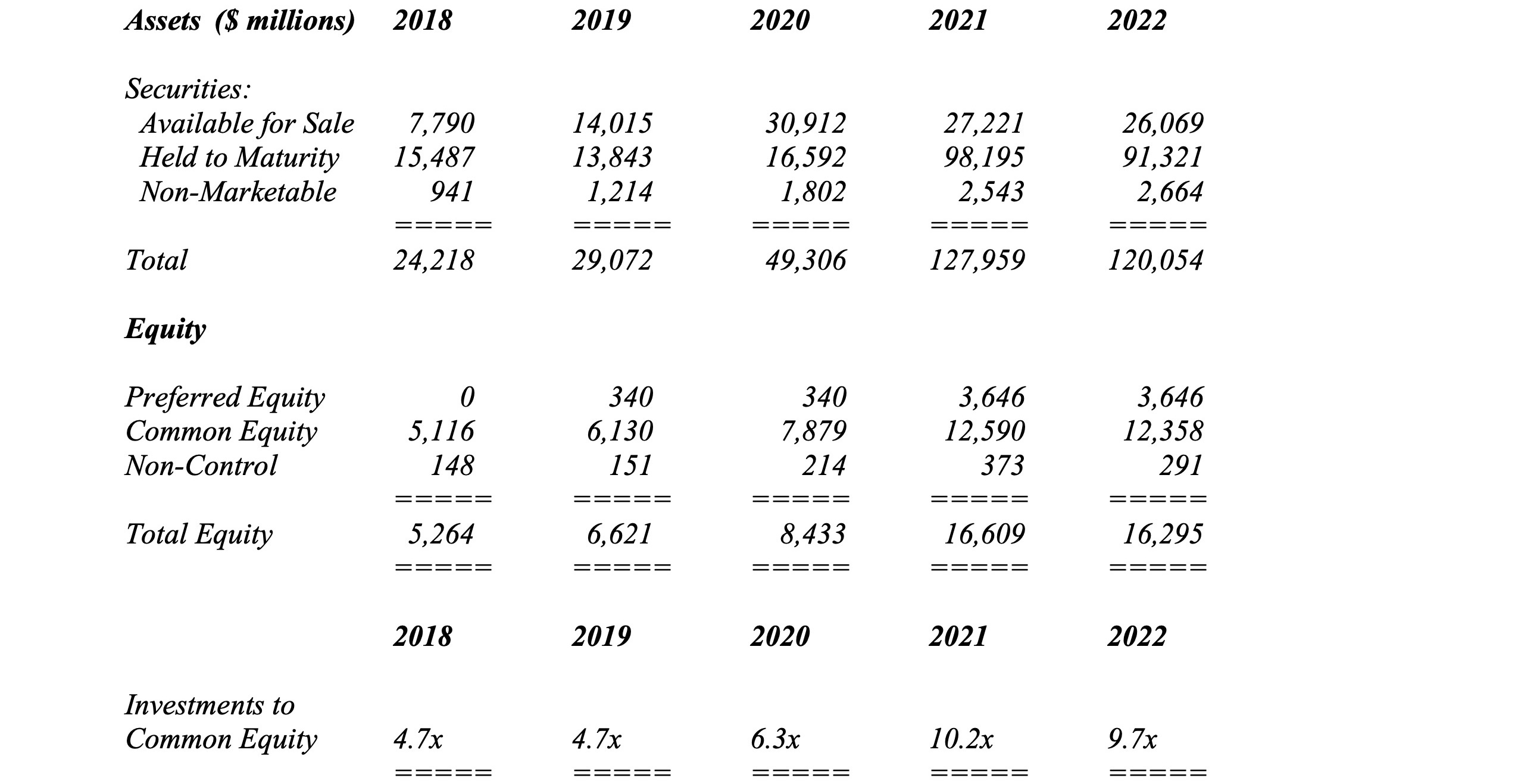

For the US, there does appear a silver lining. Capital Spending relative to GDP bottomed after the 2007 – 2009 Recession and continues its recovery relative to GDP. For the United States, this stands an unmitigated positive given the massive underinvestment in productive capacity over the past 20 Years.

And while there may occur a pullback in the upcoming recession, spending appears on track to normalize back to levels seen before 2000 and the WTO, when corporations began to move capacity overseas. Of course, this change in corporate behavior reflects the reality of rising National Security concerns coupled with the United States entering into the type of incentives that countries such as China, Japan, Vietnam, India, Germany, Italy, and others provide for plant location. And should the United States focus on the reshoring of Supply Chains, a huge Capital Spending boom could ensue, as the US produces less than 50% of the goods it consumes. And in some vitally important sectors, such as pharmaceuticals, the US imports over 70% of the ingredients used to manufacture drugs and imports over 50% of the pills consumed in the country, according to FDA and GAO data.

However, for corporations, this may prove a mixed blessing. Corporate Profit Margins stand at record levels relative to GDP, a level last seen during World War II:

What stands less well known are Corporate EBITDA Levels. (EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.) This represents pre-tax corporate cash flow before spending on such things as Capital Expenditures or Working Capital. These levels have stood fairly constant for the past 50 Years. However, Corporate Profit Margins grew significantly as corporations exported their production to other parts of the world, Capital Expenditures fell in real terms, and the Depreciation charges they took fell significantly as a result. All of this boosted Corporate Profit Margins and increased their cash flows. Should Capital Expenditures rise in real terms, this movie will run in reverse. Depreciation charges will rise and Corporate Profit margins will fall. In addition, available cash after Capital Expenditures will fall as well. While good for the US, there appears no free lunch for corporations.

For the US, data indicates a Recession on the horizon. Whether Corporate Profits, Employment, or Capital Expenditures, there appears a downturn under way. Already, areas such as Real Estate and Manufacturing stand in contraction. Other areas will follow as bank lending standards continue to tighten to recessionary levels. And with states already exhibiting tax collection shortfalls compared to projections, state spending cuts will follow as night follows day. For the US, it will be A Climb Interrupted. But the Climb should continue in short order, as the massive government incentives to reshore production in semiconductors, autos, and other areas of technology roll out. The following Chart illustrates the bottom in manufacturing investment relative to GDP that occurred over the past several years and the potential for massive breakout on the upside as the United States reshores large portions of its manufacturing base:

And when the need to put in place significant additional defense industrial capacity combines with the above, a Capital Spending boom driving strong economic growth appears waiting on the other side of the Recession. For the US, indeed, it will be A Climb Interrupted.

The Fed Who Cried Wolf, Part 2:

LTCM in Drag

&

The Slow Motion Train Wreck Begins,

Recreating the S&L Crisis

(Originally Written March 25, 2023)

The recent collapse of Silicon Valley Bank and of Signature Bank reminded me of an earlier era and the collapse of another financial institution back in the late 1990s. That institution, Long Term Capital Management (LTCM), a well known firm on Wall Street, became front page news due to its illustrious founders and its intertwining with all the major firms on the Street. John Merriweather, the former Vice Chairman and head of bond trading at Salomon Brothers founded the firm. In the late 1980s and early 1990s, Salomon Brothers stood one of the dominant bond trading firms on Wall Street, similar to Goldman Sachs or JP Morgan today. In fact, it is rumored that the bond trading part of the firm effectively made all the profits for Salmon Brothers. Joining John Merriweather at Long Term Capital Management were some of Salomon’s top traders as well as well as Myron Scholes and Robert Merton, both of whom would win the Nobel Prize in 1997 for creating the Black-Scholes formula. They used fancy mathematics to drive arbitrage profits in the bond market. This produced strong returns of 21%, 43%, and 41% in its first three years of the firm’s existence for investors, from 1995 – 1997. However, after the first couple of years of successful investing, LTCM faced real competition in 1997, as other firms duplicated its bond strategy. This meant returns started to drop for its investors. In order to maintain its returns, the firm invested in Emerging Market debt and foreign currencies. Unfortunately, a financial crisis began in Thailand in July 1997 in Asia. This eventually spread to the other countries in Southeast Asia such as Indonesia and South Korea. The Federal Reserve stepped into the fray to get the US banks to rollover the debt and the IMF to inject billions of dollars. This put pressure on LTCM’s returns, turning them negative in Q2 of 1998. In addition, the firm saw the spreads in its core bond portfolio go against the firm as Salomon Brothers disbanded its bond arbitrage department as it moved in a different direction. This would not have been a problem except for the leverage the firm utilized. At the beginning of 1998, the firm possessed $4.8 billion in capital. Against that capital it held $125 billion in debt and $1.25 trillion in derivatives. Leaving aside the derivatives for the moment, the firm possessed a leverage ratio of 25 to 1. Then in August and September1998, Russia went bankrupt. By the end of August, the firm had lost 40% of its capital, leaving it with less than $3 billion in capital against over $125 billion in liabilities. Because its operations were intertwined with every major firm on Wall Street, the Equity Markets took a dive fearing for the financial system. In stepped the Federal Reserve that organized a rescue of the firm and subsequent orderly liquidation in order to prevent a major financial crisis. In addition, the Fed cut interest rates to provide downside protection to the economy. Once the Federal Reserve cleaned up the mess and the markets realized the damage contained, markets took off into the 1999 – 2000 Technology Bubble against the Fed easing. This, of course, forced the Fed to quickly reverse course and raise rates aggressively.

The recent collapse of Silicon Valley Bank should stand as no surprise. With the Federal Reserve dropping rates to 0%, speculative excess occurred in the markets focused on technology in 2020 and 2021, much as in the 1999 – 2000 period. It occurred in both the public markets and in the private Venture Capital (VC) funds. This led to massive funding of money losing ventures that possessed strong stories about their future potential, but unproven business models. Many of these firms’ futures depended on displacing entrenched competitors with vastly larger resources, much as occurred in the late 1990s. To no surprise, many of these firms continue to struggle as their business models prove unsuccessful in the marketplace. In addition to the Equity that they raised, these firms took on Venture Debt, debt specifically structured for companies with no cash flow to service the interest expense or paydown of principal. Typically, this type of debt comes from Private Credit or Structured Credit funds that charge rates of 13% to 20% or more and demand warrants or options with potential for Equity ownership on top of the interest charged. In other words, these funds knew that a significant portion of the lending portfolio would default and charged rates sufficient enough to compensate for the expected losses. As these funds raised Equity directly from investors, they did not touch the regulated banking system and typically understood the risks that they needed to underwrite.

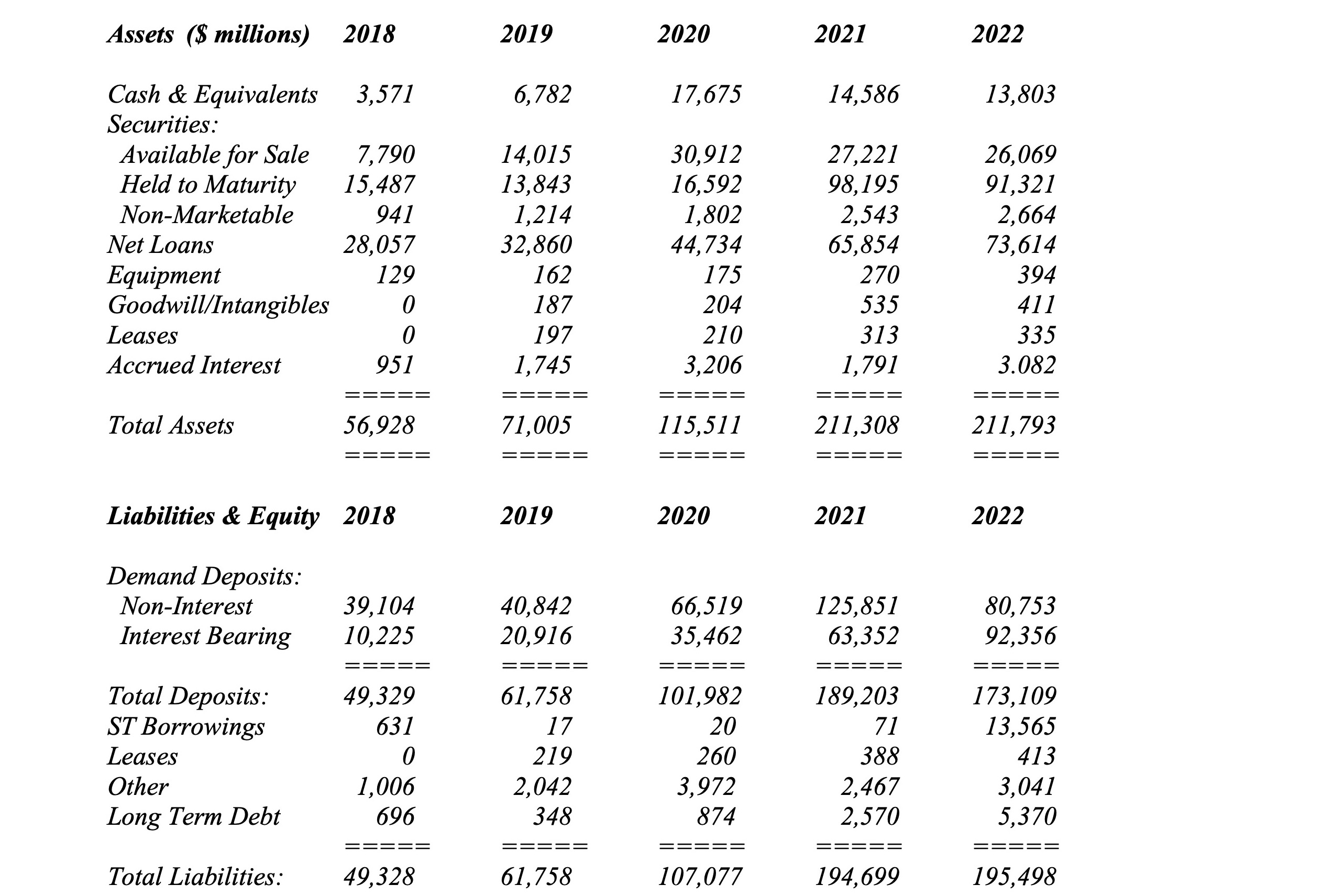

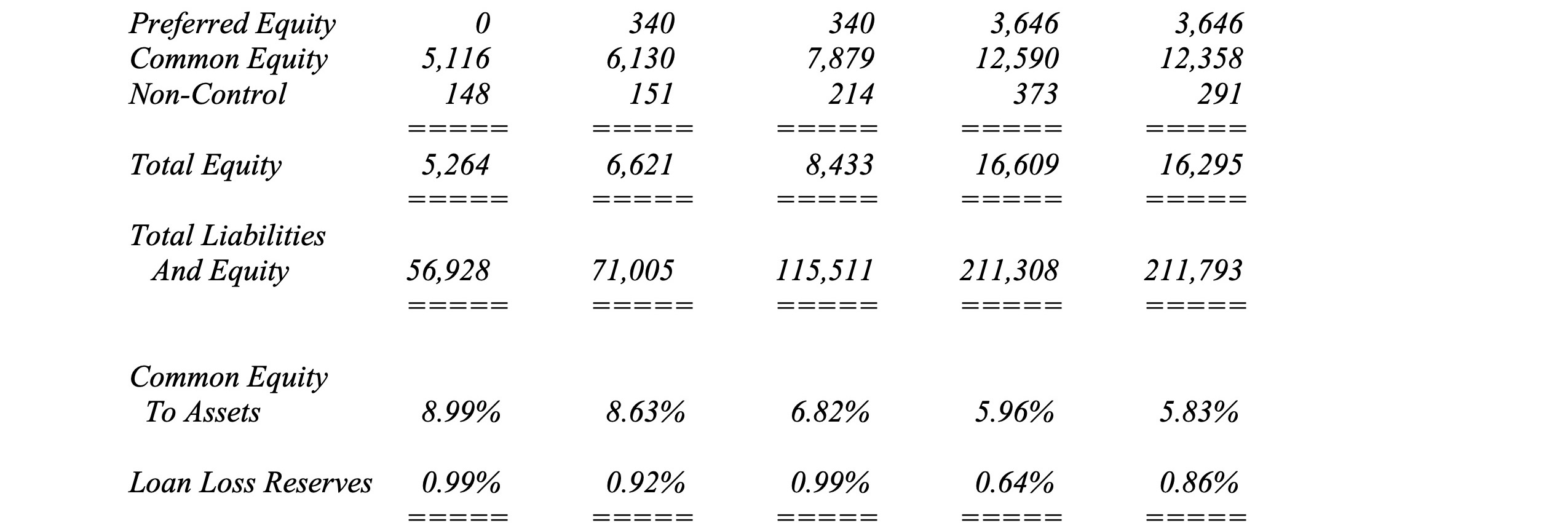

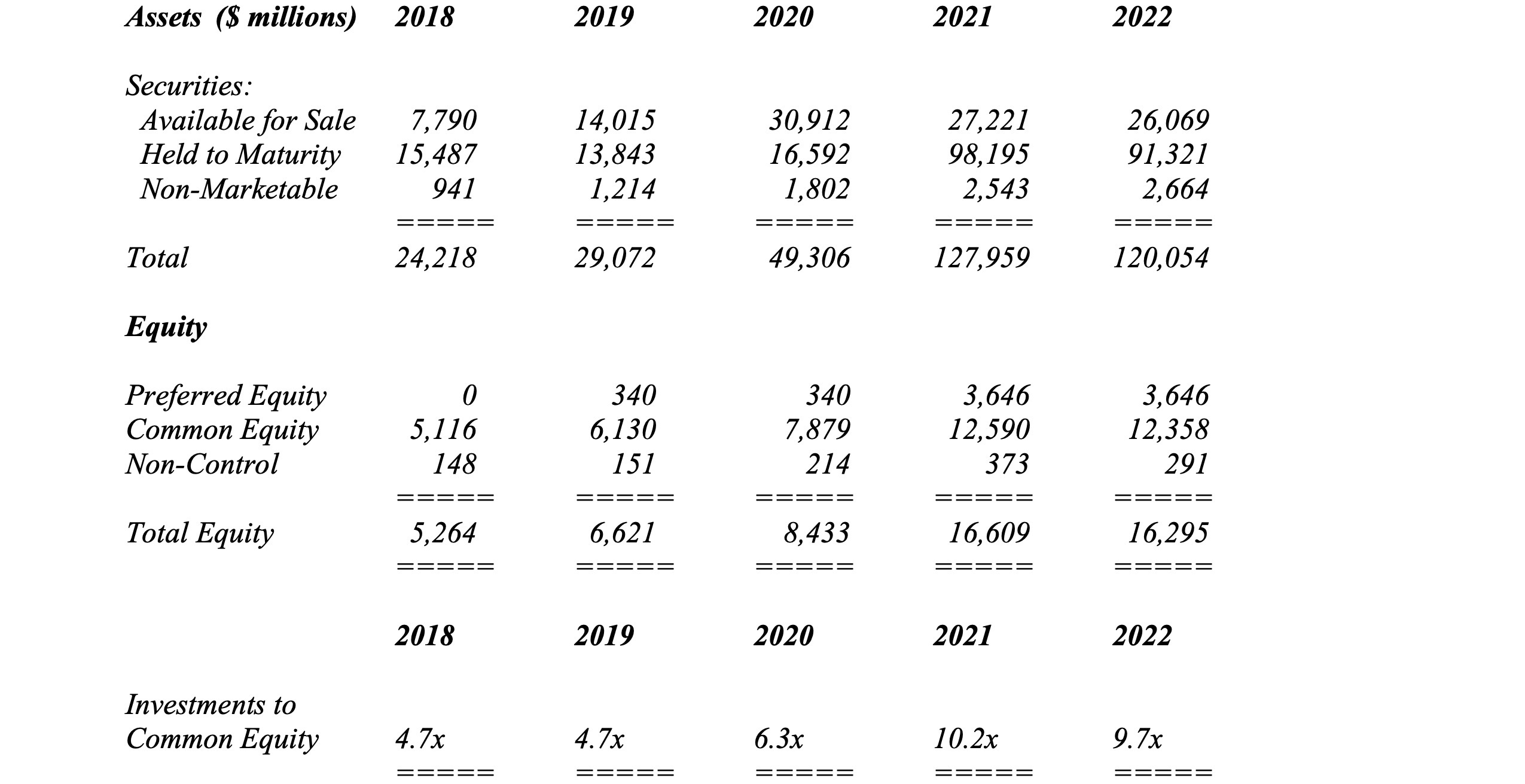

Against this background stands Silicon Valley Bank (SVB) or what is legally known as SVB Financial Group, as the bank had changed its name a number of years before. The following table shows the progress of SVB’s Balance Sheet from 2018 through 2022:

Data from SVB Financial Group SEC filings including Annual Reports and Form 10-K.

As the data above makes clear, SVB quadrupled its assets in just three years and grew its loan book over 100%. Typically, financial institutions, especially banks, grow at a much slower rate to manage their assets properly and control credit quality. SVB violated these norms as it rode the boom in Silicon Valley upward. In addition, it appears management turned a blind eye to the risks they were actually incurring for the bank. First, a significant portion of its loans consisted of Venture Loans, which typically have higher loss rates. Loan Loss Reserves stand at 0.86% of Gross Loans. JP Morgan, an institution with much lower credit risk, showed Loan Loss Reserves at 1.74% of Gross Loans as of Year End 2022. Should SVB just revalue their loans to this conservative number, an additional $653 million in Loan Loss Reserves should appear on SVB’s Balance Sheet on their $74.25 billion in Gross Loans. Disaggregating their loans by category shows the following:

Loans ($ millions):

Investor Dependent 6,713

Innovation C&I 8,609

=====

Total Venture Loans 15,322

Securities Lending 1,966

For the $15+ billion in Venture Loans, a Loan Loss Reserve in excess of 1.74% seems appropriate. At just 3%, an additional $190 million in Loan Loss Reserves should exist at a minimum. The next category, Securities Lending, represents loans secured by the stock of C Level Executives at these start-ups. With the same logic applying here, the would add another $25 million in Loan Loss Reserves. This brings the total additional reserves to $215 million on top of the $653 million above.

Second, a closer look at the Balance Sheet reveals some critical underlying issues:

If we were to think of SVB like an investment fund by excluding the cash from the ratio, the fund stood levered at a 9.7x when looking at the Ratio of Investment Assets to Equity. If we removed the additional amounts for the understated Loan Loss Reserves, then the ratio rises to 10.4x. In other words, SVB acted as a highly levered investment fund that did not hedge against Interest Rate risk. And what were the results, one might ask, of this fund? In the Available for Sale Securities, SVB lost only ~$2.6 billion in 2022, which flowed through to its Equity. However, the bigger issue stood its Held to Maturity Securities. While the Balance Sheet showed $91.3 billion in value in the Asset column, the notes to the Balance Sheet show only ~$76.2 billion in Market Value. While not levered at the 25 to 1 level of Long Term Capital Management, unlike LTCM which marked its portfolio to market and stood solvent when rescued, SVB possessed ~$15.1 billion in unrealized losses not flowing through its Income Statement or Assets. With total Common Equity of just $12.4 billion, the firm stood insolvent. Thus, once Venture Capital firms realized the Emperor Had No Clothes, they fled in droves, creating a run on the bank.

The larger issue stands the massive amount of low rate assets sitting in the banking system balance sheet. The Federal Reserve encouraged banks to issue mortgages and Commercial Real Estate (CRE) loans as well as to buy long dated U.S. Treasuries in 2020 and 2021. For the large systemically important banks with massive derivatives portfolios, hedging this exposure against interest rate increases proved straight forward, as their operations already embedded these types of activities. For the small and mid sized banks, these loans sit underwater should they find themselves in a situation where they possessed insufficient liquidity and faced forced sales. In effect, the entire universe of small and mid sized banks stands at risk of a Run on the Bank as the Federal Reserve recreated the conditions that led to the S&L Crisis in the 1970s and 1980s.

For those unaware, the S&L Crisis possessed origins in government policy instituted during the 1930s. At that time, the FDIC was created to protect small depositor funds. As a quid pro quo to the banking industry for imposing FDIC insurance premiums, the government agreed to limit the rates that depositors could earn on their savings to below market rates. This occurred through the Federal Reserve’s Regulation Q, which placed hard limits on the amounts banks could pay depositors. This effectively subsidized the industry to ensure its profitability. This worked well until the inflation that occurred in the late 1960s and into the 1970s. To address this inflation, the Federal Reserve raised rates well above the legal limit these institutions could offer. This led deposits to flee these institutions, especially large ones. Large depositors easily could move their funds into government securities. In addition, unlike today, there existed no possibility for these institutions to hedge their interest rate risk in their loans. As rates rose and deposits fled these institutions, many of them faced liquidity crises as they possessed short term deposits against long term mortgages. In addition, their loans stood valued well below the valuation on the banks’ books. When a Run on the Bank occurred, there existed no possibility for these institutions to remain solvent. This led to the failure of many of these institutions, as the government did not provide sufficient funds for the FDIC or Federal Reserve to rescue them. In addition, in the 1980s, there occurred a housing bubble similar to what occurred from 2002 to 2007. When the housing bubble burst in the late 1980s, it only added to the solvency issues for the industry.

If we fast forward to 2023 and the current banking crisis, it appears eerily reminiscent of the “S&L Crisis” and the asset-liability mismatch that occurred when Inflation rose. In order to prevent a recurrence of the 1970s and 1980s outcome, the Federal Reserve created the Bank Term Lending Facility (BTLF). This facility allows banks facing a “Run on the Bank” to swap their residential mortgage loans, Treasury securities, and U.S. Agency securities at face value for cash. In other words, they will realize any losses due to negative spreads on their funding over the maturity of the loan or security and not find themselves in a situation whereby they become insolvent due to forced liquidation whereby they must immediately realize the loss on the security or loan. While subject to criticism, the Fed put in place a practical solution. It addresses the “Run on the Bank” risk while recognizing that the credit risk on these US issued securities and current mortgage loans stands minimal. For all practical purposes, ultimately these loans and securities are “Money Good”. They will either get paid off at maturity at their face value or get paid off before maturity at their face value. (For those with questions on residential mortgages in a recession, the Dodd-Frank legislation imposed strict criteria that effectively eliminated a large portion of those with below 700 credit scores from eligibility for a mortgage while requiring real down payments, making it less likely homeowners will default and banks take any losses on their mortgage portfolios.) In either way, there exists no real loss unless the institution stands forced to sell in today’s interest rate environment. This solution thus provides the banking system a security blanket that will prevent them from becoming insolvent in the event of a Run on the Bank.

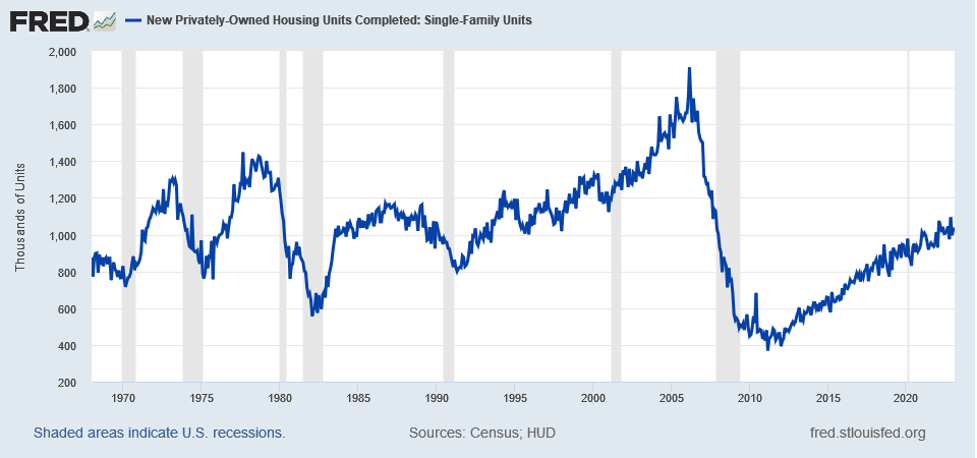

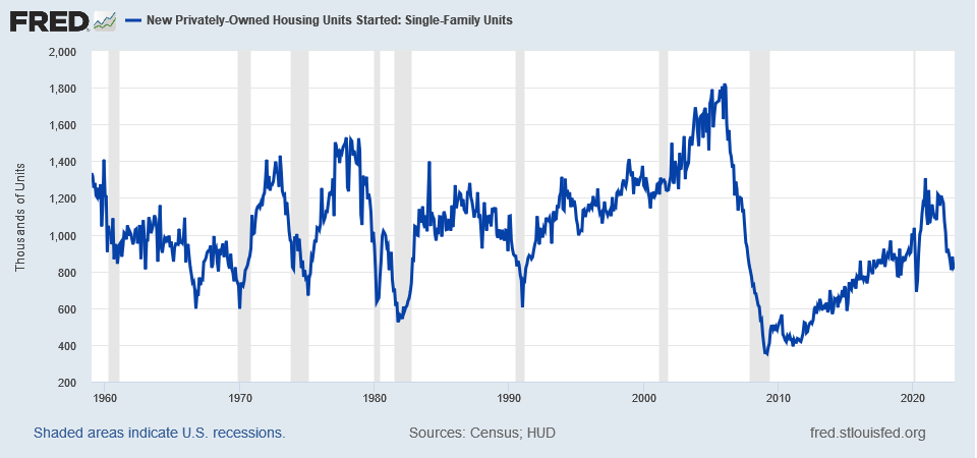

For the US economy, SVB and the other banks which recently failed represent a warning sign. Typically, these events occur as a prelude to a wider conflagration in the economy. Numerous data points, such as the Challenger Layoffs and Goods Demand, already support this contention. And this remains prior to the economy absorbing the true impact of the rise in interest rates. For example, Housing Completions remain in an upturn:

Yet, Housing Starts have rolled over:

As Completions continue and are not replaced by Starts, numerous impacts will roll through the economy, whether for labor, materials, manufacturing, transportation, taxes, or other areas. Another corner of the economy stands at risk as well. Small business interest rates went through the roof, rising from 5% in early 2022 to an estimated 8%+ as of February and headed to 9%+ by mid-year 2023. As they see the impact of this rise on their businesses’ profits and cash flow, hiring will naturally slow and investment will come under pressure.

All these impacts, as well as numerous others, such as the true fallout from the 2020 – 2021 Tech Bubble, stand yet to come. The players, which represent the facets of the economy, stand set on the stage. The backdrop paints a picture of a Fed Recreating the S&L Crisis of the 1970s. And, as the curtain rises, a train starts go off the tracks and a wolf howls, in what appears a Slow Motion Train Wreck. For the Fed Who Cried Wolf, it appears the real Wolf, in the form of a Recession, stands set to feast on the economy’s flock at some point over the next year. And with the Fed focused on Inflation at the cost of all else, it appears the townspeople will not come to the defense of the flock until the Wolf has feasted to its heart’s content.

Contained, Those RPMs, and There’s No Place Like Not Home

Finally, we close with brief comments on Contained, Those RPMs, and There’s No Place Like Not Home. First, containerboard manufacturers are facing a difficult time. Demand dropped as the consumer got released from home detention due to the Pandemic and the industry ramped the Supply to meet the artificially boosted demand during the Pandemic. With supply growing, demand falling, and capacity utilization headed down, even if the US avoids a recession, we see the industry as Contained. Second, global travel continues to accelerate as China’s and Asia’s travel recoveries continue. Airline Global Revenue Passenger Miles (RPMs) continue to rise and now stand at 93% of their 2019 level. With travel continuing its strong growth, it won’t be long before Those RPM|s blow past their pre-Pandemic level and reach new heights. And third, Consumers continue to shift their spending away from the Goods they consumed profusely during the Pandemic. Besides home construction headed downward this year, companies like Home Depot expect their revenues to drop in 2023 as Consumers continue to shift their dollars towards the Services they could not have. As a result, we see that There’s No Place Like Not Home.

In Closing

Should you have any questions on how the above issues or the items discussed in our accompanying cover letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer