Global Economic Quarterly Part 1: A Fed Who Cried Wolf – Transitory, Soft Landing, & Other Fables

Views From the Stream

Views From the Stream

The Monthly Letter covers two topics this month. First, we provide Part 1 of our Global Economic Quarterly. The Federal Reserve stands almost complete with its interest rate rises. At the same time, it will continue to drain liquidity from the economy. While there are a rising chorus of voices calling for a Soft Landing, due to the recovery in China and its impact on Europe, the economic data that lead economic growth put this in doubt and indicate a recession rushing down the tracks to arrive at Station U.S. in the not too distant future. Second, as always, we close with brief comments of interest to our readers on a variety of current topics relevant to the economy and the markets.

Global Economic Quarterly Part 1: A Fed Who Cried Wolf – Transitory, Soft Landing, & Other Fables

For those of us who remember our childhood stories, there is the famous fable of The Boy Who Cried Wolf. However, just in case this was somehow missed, the story goes as follows. A boy was set to watch the sheep. Should a wolf appear, the townspeople were to be aroused to fend off and potentially kill the wolf. Well, the boy got bored and wanted attention. So, he ran into the town one night and yelled “Wolf! Wolf!!”. The town’s people came running out to the field, only to find no wolf. They admonished the boy. And told him not to do this again. Just a few days later, the boy ran into the town and cried “Wolf! Wolf!”. The town’s people came running once more out onto the field, only to find no wolf and the sheep quietly sleeping. The town’s people admonished the boy once more. And believed he was totally focused on himself with no regard to the town. Just a few days later, the boy came running into the town and cried, “Wolf! Wolf!”. But no one believed him. He pleaded with the town’s people to come. But they refused, believing him to be lying once more. Unfortunately, the boy was telling the truth this time. And the wolf ended up feasting on the town’s sheep.

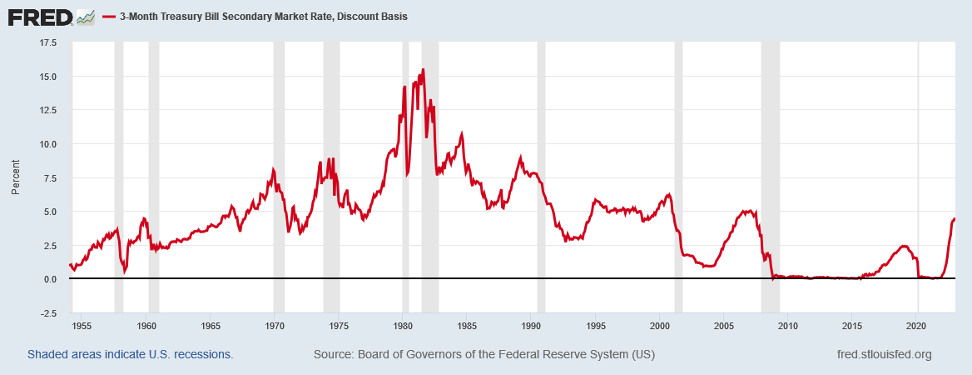

Such is the lot of the Federal Reserve. The Fed called Inflation “Transitory” when it turned out reality stood far from this view. And it kept insisting on Transitory until the evidence became so overwhelming it stood no choice but to treat Inflation as non-Transitory. In doing so, it launched a series of tightening measures not seen since the reign of Paul Volcker and his efforts to squelch Inflation in the 1980 – 1982 time period and before that in the infamous 1972 – 1974 tightening that led to the infamous 1973 – 1975 Recession. Both tightenings occurred against a backdrop of high Inflation. In those cases, the critical factor originated in the OPEC oil embargos and energy shortages of the 1970s. Today’s Inflation arose from the Pandemic induced goods shortages and issues with Global Supply Chains. As the following graphic demonstrates, the Federal Reserve acted aggressively, just as in the past, to slay the demon of Inflation:

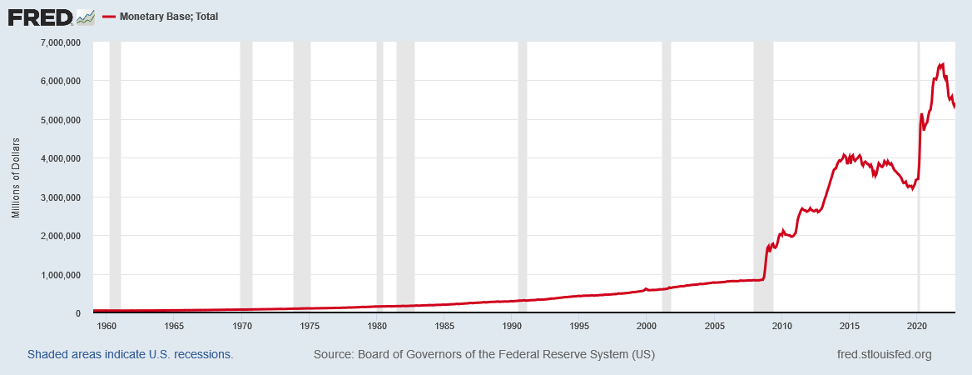

At the same time, the Federal Reserve aggressively removed the monetary stimulus it provided to the economy:

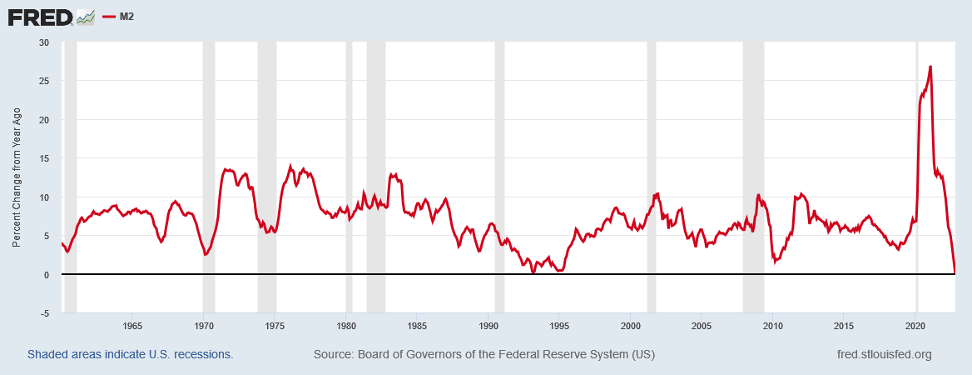

While the chart only runs through October 2022, based on the Federal Reserve’s announced policy of withdrawing $95 billion per month in money from the economy, the Monetary Base will have fallen from $6.4 trillion in December 2021 to just $5.2 trillion by the end of January 2023. (Please see the following link: https://www.federalreserve.gov/newsevents/pressreleases/monetary20220504b.htm where the Federal Reserve lays out clearly its Quantitative Tightening policy.) In other words, in just 13 months, the Fed shrank the Monetary Base by ~20%. And in real terms, deflated by the CPI, the Monetary Base shrank over 26%. Even in the infamous 1980 – 1982 Recession, Paul Volcker only shrank the real Monetary Base by 10% while, at the same time, the nominal Monetary Base rose by over 10% during that time frame. No wonder current monetary aggregates, such as M2 turned negative year-over-year in nominal terms, let alone real ones:

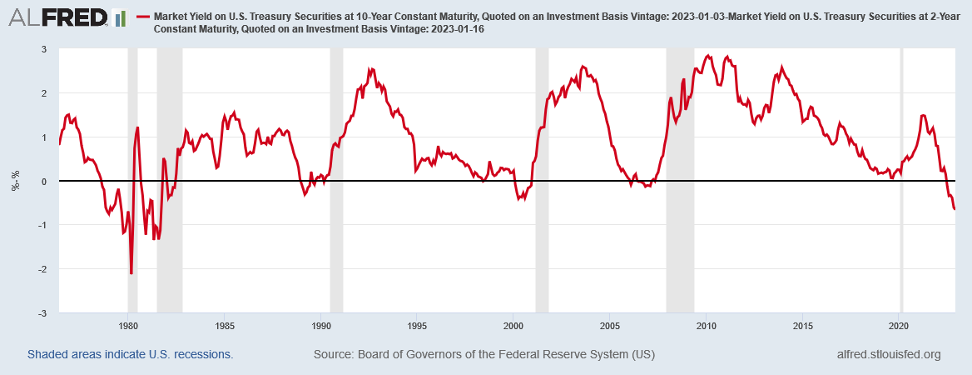

The inevitable result of these actions is either a “Soft Landing”, as the Fed still tries to argue, or a Recession. Multiple indicators continue to flash yellow warning lights of a Recession. One might say of the Fed, the lady doth protest too much. The first such indicator is the classic Yield Curve represented by the difference between the yield on the 10 Year Treasury Note and on the 2 Year Treasury Note:

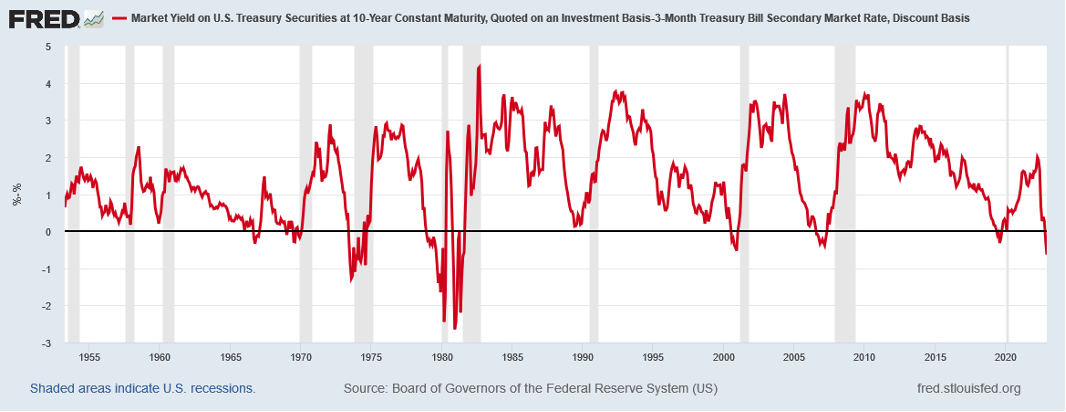

As is clear from the chart, this value turned negative in mid-2022. This Yield Curve typically leads economic growth by between 12 months and 18 months. Inversions, where the yield on the 2 Year stands above that of the 10 Year, at the levels experienced today, typically lead to contractions in the economy. This might stand a bit inconsistent with the Fed arguing for a Soft Landing. The other Yield Curve starts with the 10 Year Treasury Note and looks at the difference with the 3 Month Treasury Bill. This Yield Curve also turned negative as of November:

This version typically leads Recessions by 6 – 9 months. So, whichever version of the Yield Curve one prefers, they seem to come to the same conclusion which differs from the Fed’s continuing to talk of a Soft Landing for the economy.

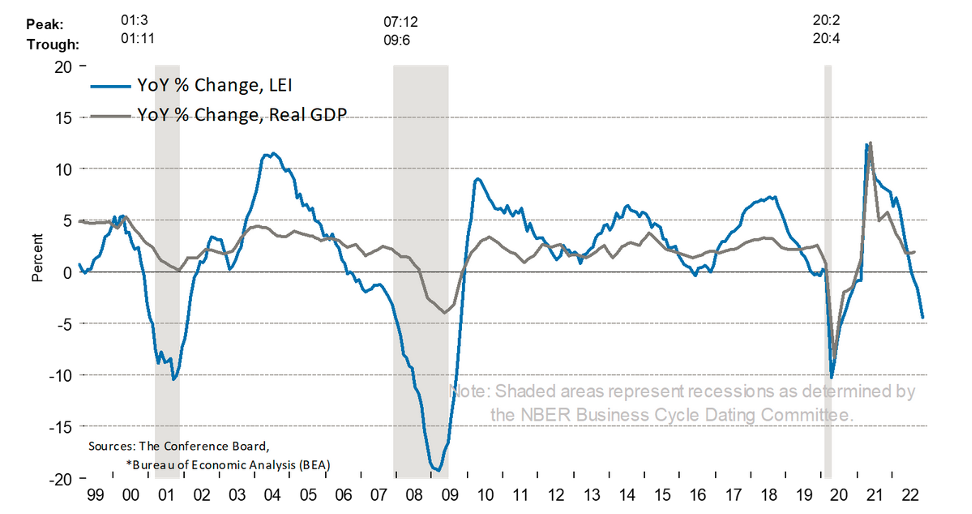

While one might state that to look at Monetary Aggregates in a vacuum makes little sense, other indicators outside the Federal Reserve confirm the message signaled by the Yield Curves. The most salient one stands the Index of Leading Economic Indicators published by The Conference Board. As published in their most recent release on December 22 (please see https://www.conference-board.org/topics/us-leading-indicators ), the YOY Change in the LEI turned negative and confirms the message delivered by the monetary aggregates and the Fixed Income Markets:

Chart courtesy of The Conference Board.

In fact, in the release, The Conference Board states: “The trajectory of the U.S. LEI continues to signal a Recession.” Unlike the Yield Curve, the LEI Index represents a broad overview of the U.S. Economy. It includes the following components:

- Average Weekly Hours in Manufacturing

- Average Weekly Initial Claims for Unemployment Insurance

- Manufacturers New Orders for Consumer Goods and Materials

- ISM® Index of New Orders

- Manufacturers’ New Orders for Non-Defense Capital Goods excluding Aircraft Orders

- Building Permits for New Private Housing Units

- S&P 500® Index of Stock Prices

- Leading Credit Index™

- Interest Rate Spread (10 Year Treasury Bonds Less Fed Funds)

- Average Consumer Expectations for Business Conditions

As the components make clear, they do not include items such as the Unemployment Rate, Consumer Spending, the CPI, … To the extent these comprise a statistic The Conference Board determined relevant to the economy, they sit either in the Index of Coincident Economic Indicators or the Index of Lagging Economic Indicators. For the record, the CPI sits in the Index of Lagging Economic Indicators where it makes up almost 20% of the Lagging Index. This, of course, brings to the fore the following question: why would the Federal Reserve focus on a Lagging Indicator to make Leading Economic Policy? A question the members of the FOMC seem destined to avoid answering and a Fable to be addressed at some indeterminate point in the future by the institution, likely with the word Never.

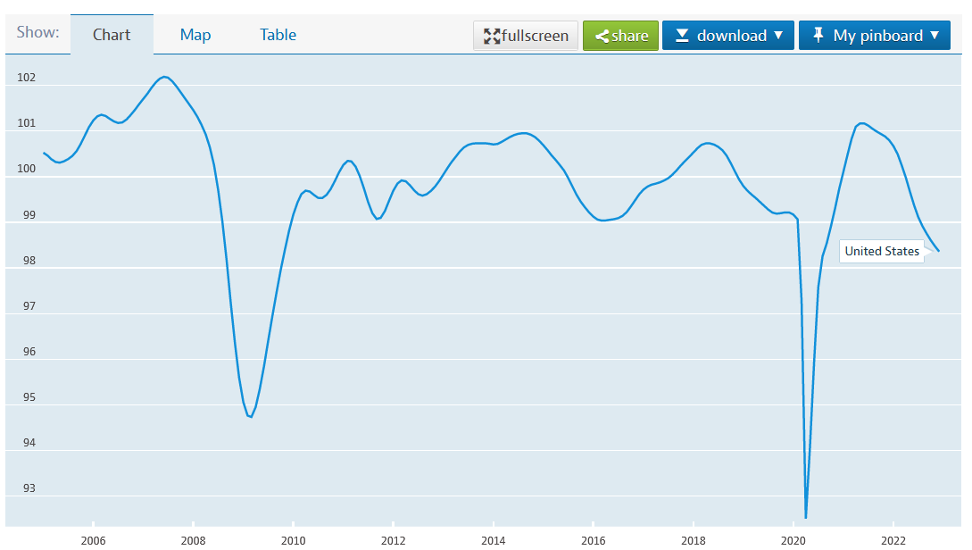

Other LEIs, such as the OECD Leading Economic Indicator for the US, look mirror images of The Conference Board. And they present a similar message:

Chart courtesy of www.oecd.org can be found at: https://data.oecd.org/leadind/composite-leading-indicator-cli.htm

And while numerous other indicators could trot forth to confirm the above data, that appears unnecessary given the strong record these indicators possess in predicting the path of the economy.

While phrases such as Soft Landing continue to come forth from the Fed, it appears their destiny lies in a similar fate to that of “Transitory”. The tides of history will sweep them away. And while one can argue that all economic phenomenon are “Transitory” given a long enough period of time, such thoughts bring little solace to the businesses or employees that must deal with Inflation or other economic issues that impact their well-being. And with A Fed Who Cried Wolf, espousing words like Transitory and Soft Landing, the Fed risks being treated like the boy in the Fable Who Cried Wolf. While their predictions might come true at an indeterminant point in the future, they lose all credibility along the way, given the gap between when they first espouse their views and when the reality occurs. With Recession on the horizon and fast closing on the U.S. Economy, it might behoove the Fed to fess up and tell the truth lest the Recession bring death and destruction just like the Wolf to the flock of sheep.

Bangkok Anyone?, Trading Down, and Harvesting The Ocean

Finally, we close with brief comments on Bangkok Anyone? Trading Down, and Harvesting The Ocean. First, with the reopening of China, Chinese tourists are beginning to reappear in places that they have been missed since the Pandemic began. One of those places is Thailand, a favorite of Chinese tourists. In 2019 Chinese tourists made up 28% of all visitors to Thailand. With Thailand’s tourism beginning to recover and arrivals already 53% of their 2019, Chinese tourists make up 60% of those still missing from its beaches and cities. Once COVID runs its course in domestic China, the Chinese tourism trade should pick up dramatically. For those offering them tour packages, we see the cry of Bangkok Anyone? ringing loud and clear. Second, consumers have finally eaten through a significant portion of the government largesse handed out during the Pandemic. As a result, they are returning to their penny pinching ways. The supermarket stands the epicenter where value brands continue to gain share at an accelerating pace. With a recession on the horizon, things likely will only get worse for the Consumer Brand companies as Consumers focus on Trading Down. And Third, algae blooms and seaweed have become major issues from the Baltic to the Caribbean. However, leave it to human ingenuity to come up with a solution. A Finnish start-up, Origin by Ocean (ObO), may have solved the issue. Finnish biochemist, Ms. Granstom, came up with a way to turn micro-algae and seaweed into products for the production of cosmetics, detergents, textiles, animal feed, and packaging as well as utilizing these problem plants to produce a plastic replacement. A full scale, commercial plant, backed by a major Finnish chemical group, Kiilto, and the European Union, will open in 2025. With human ingenuity once more at work, it won’t be long before it becomes common to be Harvesting The Ocean.

In Closing

Should you have any questions on how the above issues or the items discussed in our accompanying cover letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer