The Great Game of Power: Multi-Point Competition, The Accelerating Arms Race, & Checkers, Chess, & Go

Views From the Stream

Views From the Stream

When I was growing up in the 1960s and 1970s, my family would play all kinds of board games. Of course, this was before the era of cell phones and video games. Whether Parchisi, Monopoly, Life, …, we always found a way to spend a rainy day. In addition, I would play Checkers and Chess with my Dad. As I got better at all of this, I devoured books on chess, learning I knew little about the game but getting better and better. Eventually, sometime in middle school, I outgrew the capabilities of my Dad to challenge me. Then I got involved with playing after school with my friends, when we weren’t shooting hoops or hitting a baseball. However, when I got to high school, I discovered a new game that I had never experienced: the ancient Asian board game of Go. For those unfamiliar with this game, the game is played on a 19×19 board with players alternatively placing stones on any of the intersection points. The goal is to control as much territory as possible, when there are no moves left on the board, while simultaneously limiting your opponent’s ability to control territory. You can also capture an opponent’s stones by encircling them and thus gaining control of your opponent’s territory. Thus, it is a game of strategy, where controlling one part of the board could provide an advantage in controlling other parts of the board. While I turned out to be just an OK player at Chess, the game of Go provided a much better template for my abilities. I took to it like a fish to water. By the time I graduated from high school, I had attained the lowest master rank of First Dan. (At that time, there was no distinction between amateur and professional rankings as there is today. You either attained the rank or you did not.)

This all occurred against the backdrop of the Cold War. The US competed with both Russia and China militarily, economically, and politically across the globe. Under such constraints, the US maintained a large military force in Europe and Asia. It fought two Korean Wars as well as the Vietnam War. It supported the growth of the US economy through infrastructure and R&D investment and created the industrial infrastructure needed to support the military. It ensured that the US economy grew at a rapid pace by encouraging capital investment into the industrial sector. And when faced with an industrial challenge, the government entered into private-public partnerships to ensure that the US possessed the necessary capacity in such critical industries as semiconductors. The government clearly refused to allow non-market communist countries from practicing predatory trade policy to eviscerate US industrial capabilities that were critical for economic growth and military capabilities. Made in America was not just a slogan, it was a matter of National Security. Lastly, the US supported countries around the world to broaden its reach. This provided critical access to strategic locations around the globe to meet the challenge posed by Russia and China and to provide the strategic umbrella under which its allies could thrive.

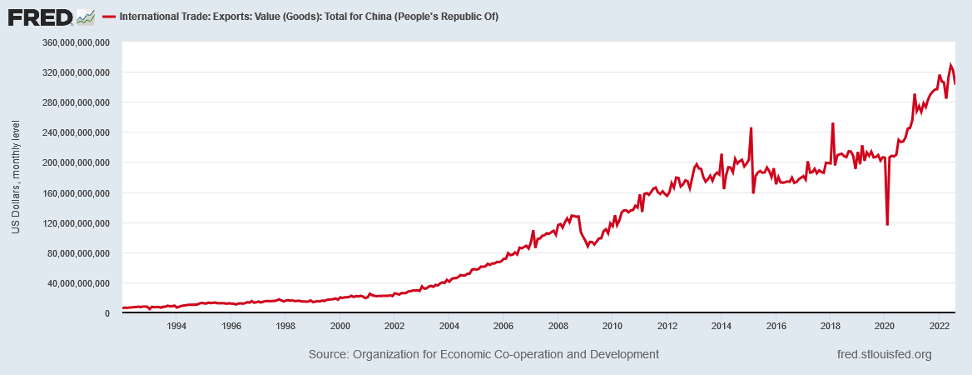

With the end of the Cold War, under President Ronald Reagan, during the 1980s, these policies became casualties of the United States effectively winning the Cold War. With the National Security driver now less important, this allowed large corporations to argue that the opening of hitherto closed foreign markets would accelerate US growth through exports. While initially this was true, as the US kept a keen eye on imports, the reality turned out quite different than the theory for doing so over the long term. With the opening of foreign markets, corporations positioned factories in these markets which enabled them to lower their manufacturing costs. They took advantage of foreign subsidies, did not need to pay US wage rates, and avoided US pollution, labor, and other laws. In addition, these factories could provide entry into the same foreign markets, as countries often required them as the price of market access. Despite US companies clearly playing global cost arbitrage and undermining US industrial capabilities, they argued the lower goods costs to consumers justified exporting jobs, investment, and economic growth. The entry into the NAFTA with Mexico merely accelerated these actions. As a result, the US trade deficit began to widen. From less than $6 billion per month in 1990, it rose to almost $40 billion by December 2020. With the entry of China into the global trading system in 2000, via the WTO, the United States allowed its global rival to utilize US end market consumption as a springboard to grow its industrial capacity and drive its economic growth. With the Chinese Communist Party providing massive subsidies to industry, Chinese companies were allowed to undercut US and Western rivals in the global markets. Holding out the carrot of access to the Chinese market, at the same time, Western companies flocked to China to add sales in this massive market to their revenue and to avoid having their businesses undercut by Chinese competitors. Reflecting these trends, Chinese exports exploded upward:

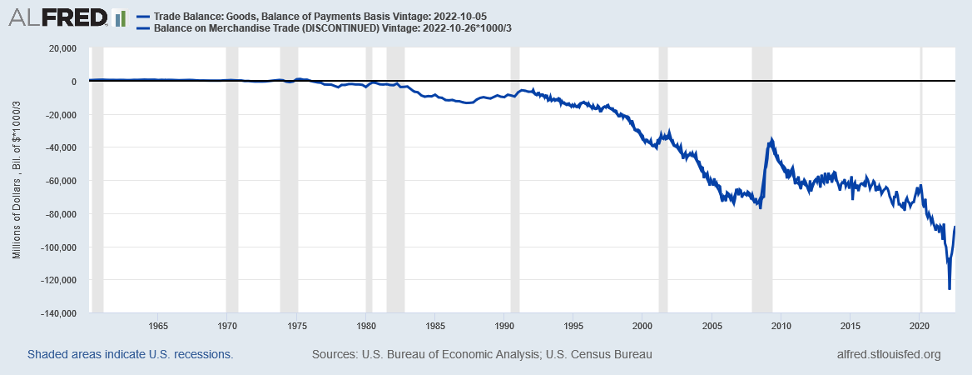

In effect, China leveraged the WTO to enable it to grab global market share and domesticate global supply chains in a classic application of Multi-Point Economic Competition with the US. And, US corporations, in the quest to access the Chinese market and lower their global cost position, put their interests ahead of those of the United States. Evidencing this reality, the US trade deficit exploded upward again, almost doubling from $40 billion per month in 2000 to $70 billion per month in 2006. The following graph illustrates the long term growth in the US Trade Deficit:

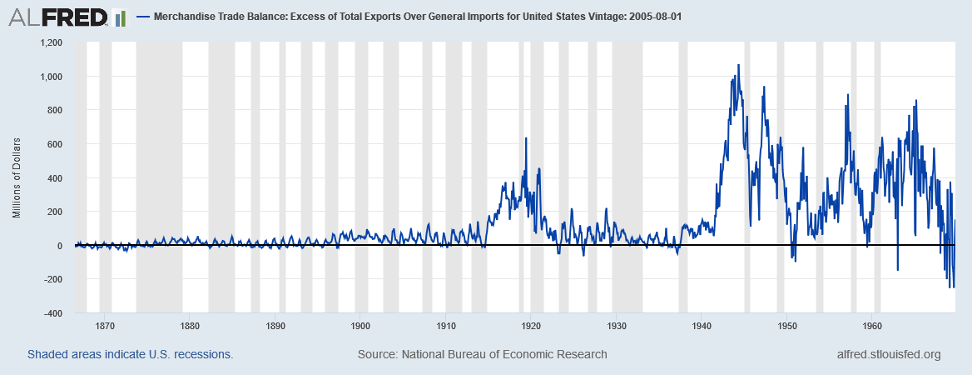

According to the Ronald Reagan Institute, the United States lost almost 70,000 small and mid-sized manufacturers from 1998 to 2018. (Please see the following link for the full report: https://www.reaganfoundation.org/media/358068/task_force_report_2021_manufacturing_renaissance.pdf .) To go along with this decline in the number of factories, the US ceded leadership in Manufacturing Productivity to the rest of the world. According to the World Economic Forum Global Lighthouse Network, the US possesses only 9 of the 90 Advanced Manufacturing Hubs around the world compared to 25 in Europe and 28 in China. (Please see the following report for more details: https://www3.weforum.org/docs/WEF_Global_Network_of_Advanced_Manufacturing_Hubs_2022.pdf .) A generation ago, the United States stood atop the board compared to its lagging position today. The following chart demonstrates how this contrasts with the long sweep of US history where the US traditionally produced a Trade Surplus as its industry stood globally competitive and a leader in advanced manufacturing:

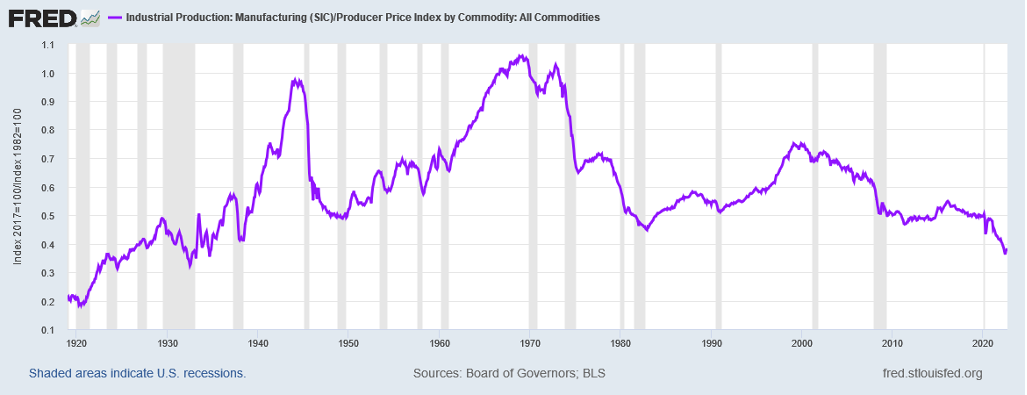

The compounded impact of this long term neglect of its Manufacturing by the United States most clearly appears in the Real Output of Manufactured Goods. After adjusting for the peacetime drop from the end of the Vietnam War and the winning of the Cold War, Real Output of Manufactured Goods peaked in 1998 and fell steadily since then:

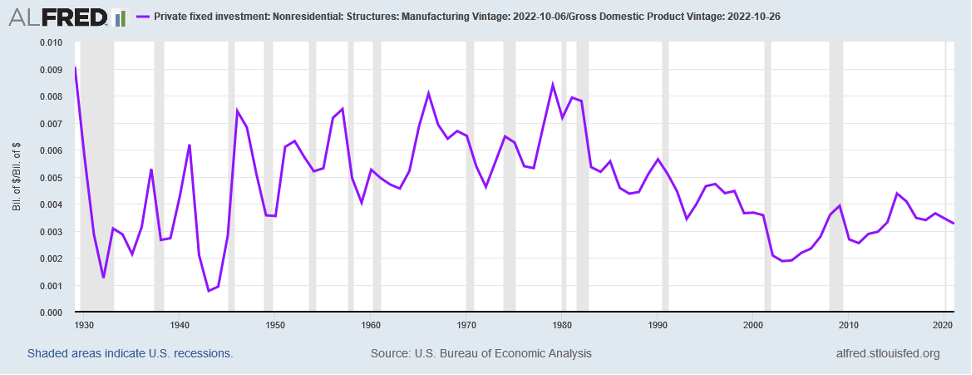

This Output now stands at a level last seen during the early stages of the Great Depression. Other data, such as the level of Manufacturing Investment to GDP, reflect this neglect as well, standing at levels last seen almost 100 years ago.

After allowing China and many other countries to wage economic war against it for the past 30 years, the United States finally began to respond to these challenges. This response came through two different channels. First, starting under President Trump and continuing under President Biden, the United States took action against foreign countries to protect U.S. industry. This occurred through both tariffs and the blacklisting of foreign entities. In addition, arms of the Executive Branch, such as DARPA, BARDA, the NIST, … moved over the past five years to shore up shortcomings in U.S. capabilities; entities such as CFIUS moved to prevent the transfer of advanced technology abroad; and the Department of Commerce finally began to look at the economy through a National Security lens. Second, recent Congressional Acts passed over the past year, began to shore up U.S. Supply Chains and U.S. Industry. These include the CHIPS Act and the recently passed Inflation Reduction Act (IRA). For those who have not read the IRA, the IRA focuses on creating a leadership position for the United States in areas such as Electric Vehicles, Green Hydrogen, …, the industries of the future that will drive economic growth.

A deep dive into both acts will illustrate how much they will change the global pattern of economic growth. The CHIPs Act allocates $280 billion over the next 10 years to the semiconductor industry. This breaks down as follows: $200 billion for scientific research and commercialization; $53 billion for semiconductor manufacturing, manufacturing research, and workforce development; $24 billion in tax credits for chip production; and $3 billion for leading edge technology and wireless supply chains. (Please see the following article for a breakdown done by McKinsey & Co., the global consulting firm: https://www.mckinsey.com/industries/public-and-social-sector/our-insights/the-chips-and-science-act-heres-whats-in-it .) Already, the early impact from the CHIPs Act stands visible. Intel Corp. announced a $20 billion investment into a new semiconductor facility it will erect in Ohio and Micron Technology announced it would invest $100 billion into a new facility in Clay, NY with $20 billion spent over the next 5 – 7 years. More will follow as the supply chains needed to meet these plants’ needs will add significantly to these down payments on reshoring semiconductor production. With economic subsidies that now match those provided by competing countries and strong limits on companies’ ability to export their intellectual capital to other countries, increasing portions of the global semiconductor industry will find itself located in the United States as the U.S. reclaims global market share.

While the CHIPs Act provides direct subsidies to build manufacturing plant and to create the next generation of semiconductor chips, the IRA provides a different route to create a domestic supply chain for Green Energy. It creates Production Tax Credits (PTC) and Investment Tax Credits (ITC) to drive down the economic cost of producing these Green Energy products in the United States as well as incentives for consumers to purchase US made production. These credits cut across all areas of the Green Economy. First, for EVs, the Act encourages battery manufacturing in the United States. For every battery manufactured, the Act provides a $35.00/kwh, 10% of the cost of the anode and cathode, $3/kg for polysilicon production, … for every battery produced in the US. With battery cells currently costing ~$130.00/kwh, this represents a significant portion of battery costs. Second, the Act establishes a $7,500.00 consumer tax credit for EVs (Electric Vehicles) that requires a significant portion of the critical minerals and advanced technology production to occur in North America. Third, the IRA provides an ITC of 30% for solar, wind, nuclear, biomass, and hydro energy production facilities. In addition, projects can opt for a PTC of $26/MWh (megawatt hour), which includes inflation escalators. Fourth, the ITC includes “adders” that could increase the percent of a project receiving a tax credit to up to 70% if located in the correct location or utilizing US manufactured product. Fifth, the Act provides $20 billion in low cost loans to build “clean vehicle manufacturing facilities” in the US. Sixth, the IRA provides a significant PTC for Green Hydrogen production. US manufacturers can produce Green Hydrogen today for as little as ~$3.00/kg (kilogram) with a sales price to customers of $3.50/kg. To deliver the Green Hydrogen to customers requires another $1.50/kg in liquefaction and transportation. So, Green Hydrogen producers total costs equate to ~$4.50/kg to deliver product to end users and lose money today. The PTC for Green Hydrogen totals $3.00/kg, which makes production essentially free to the manufacturer and builds in a significant profit for them. This will encourage the build out of Green Hydrogen production given the economics to do so. This would make these incentives similar to those provided under PURPA in the 1990s to build out waste-to-energy plants. Seventh, for Solar, the combined ITC along with credits for polysilicon and module production will encourage significant reshoring of solar panel production. And Eighth, the Act provides for these incentives to apply to Energy Storage. This will encourage the construction of storage facilities for excess energy to be utilized at night, when solar energy production ceases, or in peak periods to diminish the load factor on the overall electric grid. In addition to the eight factors cited here, there exist numerous other provisions in the Inflation Reduction Act, given its over 700 page length. Together, the CHIPS Act and the Inflation Reduction Act represent a major shift in U.S. strategy concerning its manufacturing, technology, investment, and economic growth. As the strategy unfolds, it will create major waves in how the U.S. economy grows and how it interacts with the rest of globe.

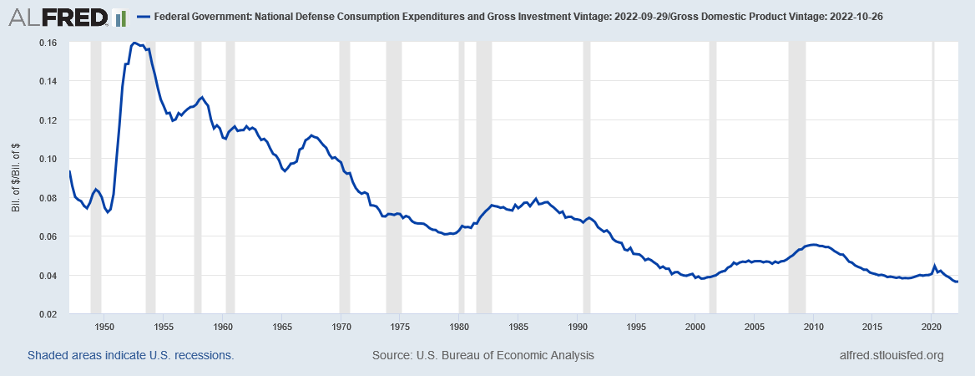

With the United States beginning to address the need for strong manufacturing to meet its National Security and Global Strategic Needs, Defense Spending stands the next major area to require focus. During the Cold War, Defense became the critical bulwark against totalitarian regimes, which represented a real threat to the US global economic system. With the end of the Cold War, this bulwark appeared less necessary, undermining arguments against using defense monies to support social programs. As a result, Defense Spending to GDP fell significantly over the past 30 years, despite a buildup during the Bush Administration and the Trump Administration’s attempt to reallocate resources to Defense, given the clearly rising challenge from China:

Defense Expenditures to GDP reached a new low in 2022 not seen since before World War I. Current levels of 3.6% represent less than half the levels of 7.5% -8.0% that were needed to win the Cold War against Russia, let alone the 10% – 12% of GDP that were required during the height of the Cold War in which the U.S. fought both the Korean Wars and the Vietnam War. With this secular decline in spending, the US became incapable of maintaining its armed forces at the levels seen during the Reagan military buildup, let alone those during the 1950s to 1970s. According to the Heritage Foundation’s 2022 Annual Assessment of U.S. Military Power:

“America is a global power with global interests. Consequently, its military is tasked with defending the country from attack and protecting its national interests on a corresponding global scale. The United States does not have the luxury of focusing only on one geographic area or narrow challenge to its interests. Its economy depends on global trade; it has obligations with many allies; and it must account for several major competitors that routinely, consistently, and aggressively challenge its interests and seek to displace its influence in key regions. It follows that its military should be commensurately sized for the task and possess the necessary tools, skills, and readiness for action. Beyond that, the U.S. military must be capable of protecting the freedom to use the global commons – the sea, air, space, and cyberspace domains on which American prosperity and political influence depend.

As noted in all preceding editions of the Index, however, the U.S. does not have the necessary force to address more than one major regional contingency (MRC) and is not ready to carry out its duties effectively. Consequently, as we have seen during the past few years, the U.S. finds itself increasingly challenged both by major competitors such as China and Russia and by the destabilizing effects of terrorist and insurgent elements operating in regions that are of substantial interest to the U.S. Russia’s large-scale invasion of Ukraine in February, 2022 is proof that war in regions of interest to the U.S. remains a feature of modern times – something that is not lost on China as it expands its military power and threatens Japan and other U.S. allies and partners in the Indo-Pacific region more aggressively. Poland, Germany, Lithuania, Japan, and several other countries have taken note of this and are committed to substantially improving the capacity, capability, and readiness of their military forces. The United States, however, has not made a similar commitment.”

Given the long term decline in spending, the report rates the U.S. military capabilities as Weak. In addition, the report points out that many of the key assets and technologies that the U.S. needs to meet its challenges abroad stand in short supply or non-existent. (For the full 200+ page report, please see https://www.heritage.org/military/an-assessment-of-us-military-power which provides an in depth review of the military.) This status of the armed forces stands inconsistent with meeting, once more, the global threats from totalitarian regimes.

The conflict with Russia in Ukraine made clear many of these shortcomings over the past six months. Should Russia have succeeded in Ukraine and threatened NATO, the U.S. would have had to deploy precious resources to Europe that are needed in the Indo-Pacific region. And with China’s aggressive military buildup and overt threats over Taiwan, this would have drained resources, making it impossible for the United States to respond in Asia. To shore up U.S. capabilities will require a dedication of national resources that Congress will need to make. However, in the meantime, U.S. allies in Asia realize the need to raise their spending to meet China’s growing military might. Japan, which possesses the seventh largest defense budget in the world, committed to raising its defense spending from ~1% of GDP to 2% of GDP over the next 5 years. This would move Japan from 9th in spending globally to 3rd, behind the U.S. and China. However, India, which currently stands 3rd globally in spending, continues to ramp its defense budget. Given that India and China have skirmished on their borders multiple times over the past 30 years, as China continues to attempt a creeping takeover of India’s territory, India continues to push up its ability to protect its territory and to produce the armaments necessary to do so. It’s latest budget dedicates over 62% of spending to arms produced on Indian soil. Australia, whose military spending bottomed at 1.6% of GDP in 2016, now spends ~2% of GDP on defense. And this excludes funds the U.S. added by agreeing to rebuild military ports for ships and airports for jet fighters over the next few years. Should China continue to ramp its belligerent tone and threats across Asia, defense spending likely will continue to climb across Asia in an Accelerating Arms Race.

The real problem the United States faces as the Arms Race heats up stands as follows. The U.S. possesses unprepared and shallow U.S. supply chains coupled with a bureaucratic Pentagon. With the undermining of U.S. manufacturing over the past 20 years and the offshoring of significant amounts of manufacturing capacity, the United States ability to fight a true war stands in question. The Pentagon, over the past 20 years, allowed defense contractors to utilize suppliers from around the globe in order to minimize the price tag on numerous costly weapons programs. That works during peace time. However, when wars cut off the supply from outside the country, this policy fails. Defense contractors utilize numerous parts and raw materials from countries with which the United States might find itself at war. For example, they have regularly purchased titanium sponge from Russia and microelectronics from China. The Pentagon, finally realizing the strategic vulnerability this policy created, now started to refuse product where either defense contractors could not identify clearly the source of all their components or they contained parts/raw materials from known and/or potential adversaries. This recent action will force a total rejiggering of defense supply chains. And if the defense companies need any further impetus, Congress plans to add a rider to the Defense Appropriations Act to end any Chinese presence in their products. There currently exist over 650 approved Chinese suppliers into the defense supply chain. Replacing them will require a huge undertaking by the U.S. over several years to locate, build, when necessary, and qualify new sources of supply. This transformation will take continued government intervention which can already be observed. DARPA and the Pentagon, utilizing funds authorized by Congress, underwrote the reopening of US refineries to process Rare Earth minerals as well as new U.S. magnesium production. They subsidized General Motors manufacturing plant to build super magnets instead of purchasing them from China. They have forced defense companies, such as Honeywell, to procure new sources of key alloys for their products to replace supplies from China. And this stands just the beginning. Numerous other projects will move ahead in what will likely become a major U.S. government led manufacturing initiative to recreate a large portion of the 70,000 plants lost over the past 20 years. Coupled with the initiatives outlined above, this should cause US Manufacturing Investment to GDP, which bottomed in 2001, to turn upward in a definitive manner:

Should the U.S. continue down this road, it will once more possess the Industrial Infrastructure to support a true war.

But this also will require major revamps of the Pentagon’s procurement process. The procurement process currently stands in a state similar to the old joke about a cow. The joke goes as follows: “What is a cow? A horse designed by a committee.” The Pentagon procurement process continues to produce Cows at a very slow rate. And legal challenges to decisions can delay things further or force the government to redo the whole competitive process. The United States does not have the time to wait on bureaucratic and legal processes to get the next systems in place. China continues to increase its military spending at a rapid rate, makes decisions quickly, and adds to its lead against the U.S. forces. The U.S. will need to vastly accelerate the pace at which it procures its existing armaments and develops new armaments in order to keep up with its global rival. Anything less will relegate the U.S. military to an inferior position in any clash with China. For example, even though Congress appropriated $11.8 billion to arm Ukraine, the Department of Defense utilized defense stockpiles to meet current needs in Ukraine and has only awarded $4 billion of the almost $12 billion in contracts to replenish stockpiles. And for areas where defense contractors will need to reactivate mothballed plants, the Defense Department has yet to make clear how future orders will enable these plants to stay active. With the coming need to rapidly ramp Defense Spending To GDP, the US DOD will need to solve this issue quickly.

At the foundation of the Multi-Point Competition and The Accelerating Arms Race lies the Grand Strategy of China. China continues to execute on its March to 2049. In this vision, China stands the dominant global power. With the industrial might in place, the financial plumbing connected, and its military strength accelerating, the country continues to position itself to dethrone the United States over the next 10 – 15 years. As President Xi Jinping stated to the 20th National Congress on October 16, 2022, in the opening of his speech:

“We have set the Party’s goal of building a strong military in the new era. We have implemented the Party’s thinking on strengthening the military for the new era, followed the military strategy for the new era, and upheld absolute Party leadership over the people’s armed forces. We held a meeting on military political work in Gutian in 2014 and improved political conduct through rectification initiatives. Having established combat effectiveness as the sole criterion, we have acted with resolve to focus the entire military’s attention on combat readiness. We have coordinated efforts to strengthen military work in all directions and domains and devoted great energy to training under combat conditions. We have carried out bold reforms of national defense and the armed forces system, and the military policy system. We have move faster to modernize our national defense and the armed forces and reduced the number of active servvice personnel by 300,000. With new systems, a new structure, a new configuration, and a new look, the people’s armed forces have become a much more modern and capable fighting force, and the Chinese path to building a strong military is growing ever broader.”

He later goes on to articulate the overarching goals for China over the next 5, 10, 20, and 30 years, for the success of the country under the Chinese Communist Party, as it approaches the centenary of the founding of Communist China. After covering domestic policy, he then addresses China’s global ambitions. In Section XII. Achieving the Centenary Goal of the People’s Liberation Army and Further Modernizing National Defense and the Military, he states:

“We will intensify military training under combat conditions, laying emphasis on joint training, force-on-force training, and high-tech training. We will become more adept at deploying our military forces on a regular basis and in diversified ways, and our military will remain both steadfast and flexible as it carries out its operations. This will enable us to shape our security posture, deter and manage crises and conflicts, and to win local wars.”

And if this message stands unclear, in Section XIII. Upholding and Improving the Policy of One Country, Two Systems and Promoting National Reunification, he goes on to further state:

“Resolving the Taiwan question and realizing China’s complete reunification is, for the Party, a historic mission and an unshakable commitment…We will implement our Party’s overall policy for resolving the Taiwan question in the new era, maintain the initiative and the ability to steer in cross-Strait relations, and unswervingly advance the cause of national reunification…

Taiwan is China’s Taiwan. Resolving the Taiwan question is a matter for the Chinese, a matter that must be resolved by the Chinese. We will continue to strive for peaceful reunification with the greatest sincerity and the utmost effort, but we will never promise to renounce the use of force, and we reserve the option of taking all measures necessary. This is directed solely at interference by outside forces and the few separatists seeking ‘Taiwan independence’ and their separatist activities; it is by no means targeted at our Taiwan compatriots.

The wheels of history are rolling on toward China’s reunification and the rejuvenation of the Chinese nation. Complete reunification of our country must be realized, and it can, without doubt, be realized!”

For the United States, such a bold statement represents a direct challenge to its position in the Indo-Pacific and its allies there and to its global standing. Unfortunately, for the United States, from 1990 – 2016, it played Checkers and Chess, while the Chinese played Go, quietly placing stones across the global strategic board to strengthen their quest to gain territory and worldwide influence, while the US placed none.

Only in 2017 did the United States realize the game it should play stood Go. In response the US moved to shore up its relationships with countries across the region, placing global strategic stones that could begin to counter China’s head start. To do so, it pulled out the playbook from the 1930s, used against Japan at that time. That was to oppose Japan by undermining its economy and its ability to wage war while at the same time allying itself with those countries that could help it to oppose Japan’s territorial aims, the strategy of containment. In order to achieve this aim, the United States formed the Quad, which became a formal alliance consisting of Japan, India, Australia, and The United States. As part of this, Australia will receive some of the most advanced military armaments that the US produces and will have access to US submarine technology. India now possesses the U.S. as a formal ally should war once more occur with China on their long border. And Japan, which already possesses an alliance with the U.S. and a strategic vulnerability with oil supply should China take Taiwan, knows the U.S. continues to focus more and more resources on the region and will aid it in preserving the status quo. Outside The Quad, the US renewed its relationship with The Philippines, whose territory in the South China Sea continues under creeping encroachment by China. The U.S. came to The Philippines aid in World War II, freeing it from Japan. Now it will defend it against China. Not only will The Philippines allow the US to send warships and troops to do combat training there, but it will allow the US Military to stage troops, planes, and ships there should a war over Taiwan break out. In addition, the two countries started discussion about the US building additional bases and facilities to defend The Philippines from China and to support operations elsewhere in the South Pacific. This stands a major change in policy and a recognition of the threat that China represents. The US and Indonesia have increased their cooperation and continue to hold joint military drills as part of the annual Garuda Shield exercises that includes countries such as Singapore, Canada, South Korea, and the United Kingdom. In addition to the Garuda Exercises, the US holds bi-annual exercises with the Malaysian Armed Forces. Malaysia also participates in the Five Power Defence Arrangements with Australia, New Zealand, and the UK. And Australia maintains a large air base in Malaysia that could serve US needs. The U.S. continues to look at other strategic locations that could create supply points for a future conflict.

With China focused on restoring its status as the most powerful country in the world, the United States faces its most serious challenge since the end of the Cold War. It must recognize the magnitude of the challenge and take the necessary action to protect its National Interests. It must totally discard the games of Checkers and Chess, as represented by the accepted global trade policy and economic norms from the 1990 – 2016 period, and move its focus to the game of Go, that utilizes a completely different board and set of rules, one that harkens back to the Cold War with its focus on National Security, National Defense, and Global Strategic Position. This new board and rules will require accelerating industrial investment to support economic growth, focusing on the defense requirements to blunt China’s rising military challenge, and positioning the country globally with allies committed to containing China who would support the U.S. in any future conflict. In order to succeed, America must place global strategic stones on the Go board faster to match the future actions of China and to counter the lead that China possesses. To not do so, would enable China to vastly outplay the United States, given its lead. And, in order for the U.S. to accelerate action in every sphere, it must clearly articulate the reality of the situation to the public so that the American people can understand the challenge and sacrifices ahead. No less of a sequence of stones will lead to success.

In October 1898, Theodore Roosevelt, in the wake of the U.S. victory in the Spanish-American War, stated the following in his The Duties of a Great Nation speech:

“There comes a time in the life of a nation, as in the life of an individual, when it must face great responsibilities, whether it will or no. We have now reached that time. We cannot avoid facing the fact that we occupy a new place among the people of the world, and have entered upon a new career. All that we can decide is whether we shall bear ourselves well or ill in following out this career. We can see, by the fate of China, how idle is the hope of courting safety by leading a life of fossilized isolation. If we stand aside from that keen rivalry with the other nations of the world, to which we are bidden alike by our vast material resources and the restless, masterful spirit of our people, we would perhaps for a few decades be allowed to busy ourselves unharmed with interests which to the world at large seem parochial: but sooner or later, as the fate of China teaches us, the safety which springs from the contemptuous forbearance of others would prove a broken reed. We are yet ages from the millennium; and because we believe with all our hearts in the mighty mission of the American Republic, we must spare no effort and shrink from no toil to make it great.

Greatness means strife for nations and man alike. A soft, easy life is not worth living, if it impairs the fibre of brain and heart and muscle. We must dare to be great; and we must realize that greatness is the fruit of toil and sacrifice and high courage.”

Of course, the fate of China to which Teddy Roosevelt referred was their defeat in the Opium Wars to the Great European Powers of the time, as the Great Game of Power played out in an earlier era. In China’s eyes, this began its “Century of Humiliation” which only ended with the Communist accension in 1949. Teddy Roosevelt, in this speech, went on to provide a warning related to those who thought the U.S. must not always come prepared to enter into war unforeseen:

“This nation is a great peaceable nation, both by the temper of its people and by its fortunate geographical situation, and is freed from the necessity of maintaining such armaments as those that cramp the limbs of the powers of Continental Europe. Nevertheless, events have shown that war is always a possibility even for us. Now, the surest way to avert war, if it can be averted, is to be prepared to do well if forced to go into war. If we don’t prepare for war in advance, then other powers will have a just contempt for us. They will fail to understand that with us unreadiness does not mean timidity: and they may at any time do things which would force us to make war, and which they would carefully refrain from doing if they were sure we were ready to resent them.

Moreover to go into war with a first-class power without adequate preparation is to invite humiliation and disaster at the outset. In the long run I firmly believe our people would win, but meanwhile there would be incalculable loss and suffering. Therefore it is to our interest to be prepared, both because thereby we are most likely to secure peace, and because, if war does come, we minimize by our preparation the chances of humiliation to the nation and suffering to the individual citizen.”

To come ill-prepared to a potential war over the island nation of Taiwan with China, who would represent a “first-class power” in the words of Teddy Roosevelt and which he would consider a war foreseen, would put the United States in a position for “humiliation and disaster”. And, as The Great Game of Power heats up and China demands what it considers its rightful seat at the Great Power table, much as Germany did in an earlier era during the late 1800s and early 1900s, the U.S. must prepare to defend itself and to simultaneously outmaneuver its global rival. With Multi-Point Competition raging, An Accelerating Arms Race lurking beneath the surface, Checkers, Chess, and Go playing out across the global game board, The Great Game of Power stands in full ascendance and in control of events that will leave no nation untouched as nations strive for dominance and the economic spoils that come with it.

The Return of the Bond Vigilantes, Sightings

For those living in England, the events of the last month look familiar to those who lived through the 1980s and 1990s. During those times, the “Bond Vigilantes” would reign in governments that let spending and budgets get too out of kilter with revenues. They would raise interest rates significantly, threatening budgets and the solvency of governments. And only when governments reined in their spending and/or raised taxes to pay for their policies, would the Vigilantes relent and allow interest rates to come back down. Such was the experience of the new Conservative government in the UK. They proposed additional deficits on top of a bailout of energy costs already causing spending growth. With the specter of uncontrolled deficits, the bond markets revolted, raising interest rates 0.3% or more overnight. The collapse in the bond market was such that the Bank of England needed to intervene in order to prevent pension funds, which had leveraged bets on rates staying low, from going bankrupt. And the government needed to backtrack on its economic proposals to buy breathing room from the wrath of the markets. For governments around the world, this reaction stands as a warning shot of the chaos that could occur should governments continue to pursue policies that drive up national debt relative to GDP with no end in sight. With early Sightings in hand and the UK held up as a poster child to governments everywhere, The Return of the Bond Vigilantes will bring a chill to politicians’ hearts as they come to crush their unfunded spending plans and force them to raise taxes or cut spending or both. (For those interested in the first piece in this series, please see The Wild West & The Return of Vigilante Justice published in March 2021 and available upon request.)

A New Partnership

In September, we entered into a new partnership with March Forward, a new multi-family office focused on all aspects of Planning for successful entrepreneurs and their families. The Partners of March Forward bring numerous years of Planning experience as well as in-depth and sophisticated capabilities across Financial, Estate, Intergenerational, and Philanthropic Planning that are now available to the clients of Green Drake Advisors. As part of the new Partnership, in addition to serving as CEO of Green Drake Advisors, I will serve as the Chief Investment Officer for March Forward. In such a role, I will build out their Investment capabilities for both public and private investing. All of the Investment capabilities that are built for March Forward will become available to the clients of Green Drake Advisors. As such, this will become a true Partnership in the best sense of the word, enabling both firms to serve their clients at a much higher level. Should anyone have any questions on this new Partnership or wish to discuss the new capabilities now available, please feel free to contact us. We are happy to answer any questions you may have and to discuss this with you.

Monthly Letter

This month, we wrote the major monthly piece on National Security as part of the email that goes out on MailChimp. As a result, we will skip the additional writings as this piece, in and of itself, equals both pieces. However, we will make this piece available in PDF format on the website for download for those numerous readers who seem to enjoy printing out the Monthly Letter and enjoying it at their leisure. The link is:

https://greendrakeadvisors.com/wp-content/uploads/2022/11/VFTS-11-17-22.pdf

Next month we will resume the normal format with a look at the Global Economy followed in January with our annual look at the investment markets.

Recent & Upcoming Travel

We plan no overseas travel until next year. Unfortunately, our new role seems to have filled up the calendar with little time for travel in the remainder of 2022. Our next trip will send us down to Washington, D.C. to speak to people on National Security and to meet with investors. We always enjoy traveling the US as it provides a new perspective on how the country’s economy can vary significantly between regions.

In addition to travel missing near term, the calendar prevented us from getting one or two last fishing expeditions on the calendar before the snows arrive. If we are fortunate and get a warm up in late November or December, we may play hooky from work, in order to enjoy the peacefulness of being on the stream. As such, we hope for such good fortune.

With that, we will report back next time in more detail on our travels around the country and our fishing exploits.

Yours Truly,

Paul L. Sloate

Chief Executive Officer