Global Economic Quarterly, Part 2, Scenes From Abroad: A Slowing Dragon & An Elephant Leading The Charge

Views From the Stream

Views From the Stream

The Monthly Letter covers three topics this month. First, we provide our Global Economic Quarterly, Part 2: A Slowing Dragon & An Elephant To Lead The Charge. China drove Global Growth for the past two decades. However, structural maturity of the economy, the aging demographics of its populace, and the rising geopolitical rivalry with the U.S. portend major changes to its ability to grow in the 2020s. Whether real estate, exports, or its limited ability to displace foreign production, traditional sources of growth no longer appear able to drive growth at that seen for the past several decades. This portends a major change for China and in how the Global Economy will grow over the next decade and beyond. Fortunately, for the Global Economy, India appears set to step up to take China’s place in driving Global Growth. It’s economy appears set for a multi-year run of high growth. This will be driven by the Real Estate Cycle turning upward, after a 7 Year downturn, and the Capital Spending Cycle following over the next one to two years. Second, we provide a deep dive into the US Economy in our Global Economic Quarterly, Part 3 – United States: Middle Age, National Security, & The New Climb. And Third, as always, we close with brief comments of interest to our readers on a variety of current topics relevant to the economy and the markets.

Global Economic Quarterly, Part 2, Scenes From Abroad:

A Slowing Dragon & An Elephant Leading The Charge

Come gather ’round people

Wherever you roam

And admit that the waters

Around you have grown

And accept it that soon

You’ll be drenched to the bone

If your time to you is worth savin’

And you better start swimmin’

Or you’ll sink like a stone

For the times they are a-changin’

The Times They Are A-Changin’

By Bob Dylan, 1965

For the Global Economy, The Times They Are A Changin’. China, which drove the Global Economy from its entry into the WTO in 2000 until 2020, continues to have a series of economic issues, not the least of which stands the massive inequality in China. While its command economy continues to fundamentally slow, the leaders in China have yet to face this economic reality. As a result, the country continues to focus on achieving unsustainable growth targets. At the other end of the spectrum stand countries like India. Their fundamental growth prospects sit where China sat in the late 1990s. In other words, these countries possess long term sustainable grow above the global average. Layered on top of this stands a return to the Cold War where strategic location of industries and assets matter. As the fundamental economic forces combined with Geopolitics continue to come to the fore, Global Economic Growth appears set to realign along new axes for the next one to two decades.

A Slowing Dragon

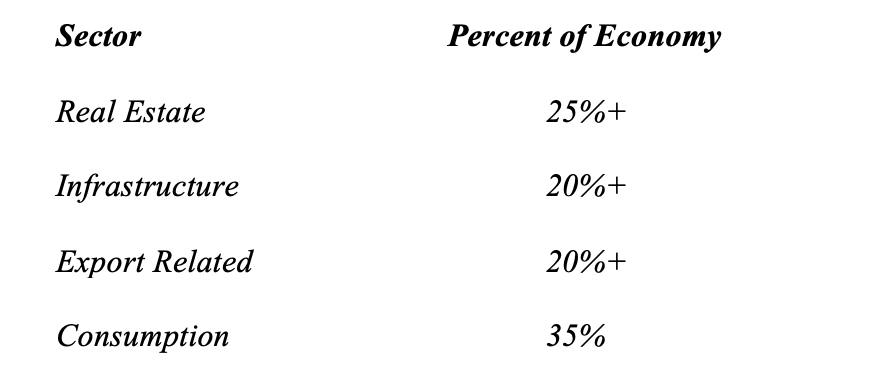

For China, regardless of the economic policies the Chinese Communist Party (CCP) adopts, economic growth will slow. This relates, as documented prior, to the structure of the economy. As best as can be determined by impartial outside observers, the economy breaks down as follows:

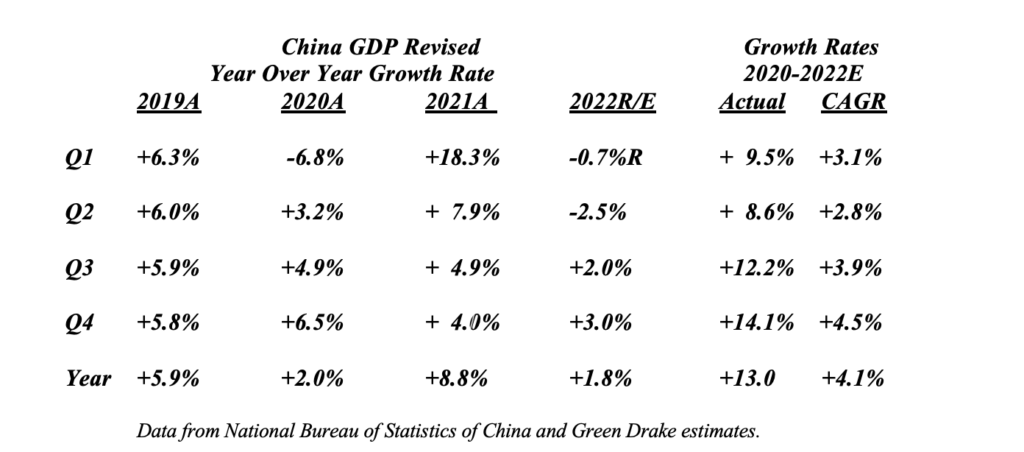

And while China claims that it possesses 55% as Final Consumption, the country clearly includes non-Consumer Consumption in that number. This brings a revisit of China’s Quarterly Year-Over-Year (YOY) Growth. The following table updates the data last published in January using the official data from the country’s statistics agency:

As Shakespeare once said, “Something is rotten in Denmark” or in this case China with its economic statistics. China reported its Real Estate Sector grew +3.7% YOY in January and February and fell just 2.4% in March. On the ground data indicate that Floor Space Sold fell 13.8% YOY in January/February and fell 23.2% YOY in March. In addition, Floor Space Started fell 22.1% YOY in January/February and 25.6% in March. If we assume just the 22% fall for the all of Q1 and the 25% of the economy Real Estate represents, that would produce a drag of 5.5% on GDP. In other words, China’s GDP fell Year Over Year in Q1. So, if we recast China’s 2022E GDP to reflect on the ground reality for Real Estate, the following picture emerges:

And this assumes that the government steps on the Fixed Asset Investment (FAI) bandwagon to keep up growth. In Q1 of this year, FAI grew 12.2% YOY in January/February and 7.1% in March or 9.3% for the Quarter. Should the CCP continue this push, it likely will create even more overcapacity for the economy as Manufacturing FAI accelerated to almost 12% in Q1. Given the reality of the Real Estate markets, the 2021 Reported GDP remains suspect as well. For China, reality continues to set in. And despite the best efforts of the CCP, on the ground data continue to indicate that the economy entered a secular slowdown in 2020. With A Slowing Dragon, the world will need to look elsewhere for growth.

An Elephant Leading The Charge

While China faces secular headwinds, India stands in the opposite corner of the ring. The country appears set to benefit from secular tailwinds that will propel its growth over the next decade. Unlike China, after a 10 Year Housing Downturn, it appears India’s Housing Market has turned upward. Affordability stands at the best levels since FY2003 and FY2004. (For those unaccustomed to this nomenclature FY stands for Fiscal Year. India’s FY ends on March 31, so FY 2004 would mean the period from April 1, 2003 to March 31, 2004.) The following chart shows the ratio of Home Loan Payment to Income since FY2001:

As the Graph demonstrates, the Affordability Ratio stands at almost a two decade low. And Urbanization sits where China sat in 2000, at just 35%. Furthermore, India only builds 500,000 homes per year despite its population of ~1.4 billion people. If it normalized to just US levels relative to population over the next two decades, the country would construct over 5 million homes per year. And unlike China, Real Estate comprises only 6% – 7% of India’s GDP. Furthermore, Absorption continues to run ahead of starts. All the ingredients stand in place for a sustained upturn.

In addition to the Real Estate Cycle turning upward, the Indian Government continues to invest in Infrastructure. This Investment bears fruit in the form of higher Productivity Growth, as numerous economic studies show and creates a positive multiplier impact on the economy of 1.4x – 1.8x. India’s Gross Fixed Capital Formation (GFCF) to GDP peaked at 36% in FY2008 and fell steadily through FY2016. Since then, it appears to have put a bottom relative to GDP, with the ratio averaging 27% to 28% over the past 5 years. With the government focused on driving economic growth, this ratio should at lease maintain its current level if not rise over the next few years. Lastly, with Real Estate bottoming, Capital Spending stands not far behind, as large companies have cleaned up their balance sheets. The Bad Debt in the banking system has seen a major improvement. Bad Assets with peaked at 11% in FY2008 continue to drop, falling to 7% in FY2022. In addition, the Debt to Equity Ratio for the Top 600 Non-Financial listed firms fell from 1.0x to 0.6x. In other words, the balance sheet of both the Banking System and corporations stands much improved. With India’s fundamentals turning upward in multiple ways, it appears for the Global Economy there exists An Elephant Leading The Charge.

Commodity & Industrial Tigers

For those who wish to understand the strong growth in places like Indonesia or Malaysia or Vietnam, it boils down to a few simple pieces of data. First, these countries possess strong natural resource positions and agricultural sectors. This makes them clear beneficiaries of the current commodity boom. Second, they possess large industrial sectors. For example, Indonesia is ranked the 10th largest manufacturer in the world. In addition to traditional manufacturing, these countries process the mined raw materials and/or agricultural products into upgraded products through their own industrial base. Much of this is legislated, whereby raw materials can no longer be exported to overseas locations for processing, as the countries consider this part of their patrimony. As a result, these countries receive large Foreign Direct Investment (FDI). For a country like Indonesia, this amounts to over 4% of GDP. And third, these countries possess government spending focused on infrastructure development, which tends to improve productivity and GDP Growth. And these same governments subsidize the movement of industry to their countries in order to build up their industrial bases. Lastly, with commodity prices having risen to their highest levels in over a decade, those economies that possess strong natural resource positions have benefitted from strong increases in trade inflows and from increased investment. This combination of factors led a country like The Philippines to post 8.2% YOY GDP Growth in Q1 2022, Vietnam to grow 5.2%, and Indonesia and Malaysia to each grow ~5.0%. For these Commodity & Industrial Tigers growth will stay strong as far as the commodity eye can see.

Rising and Setting Suns

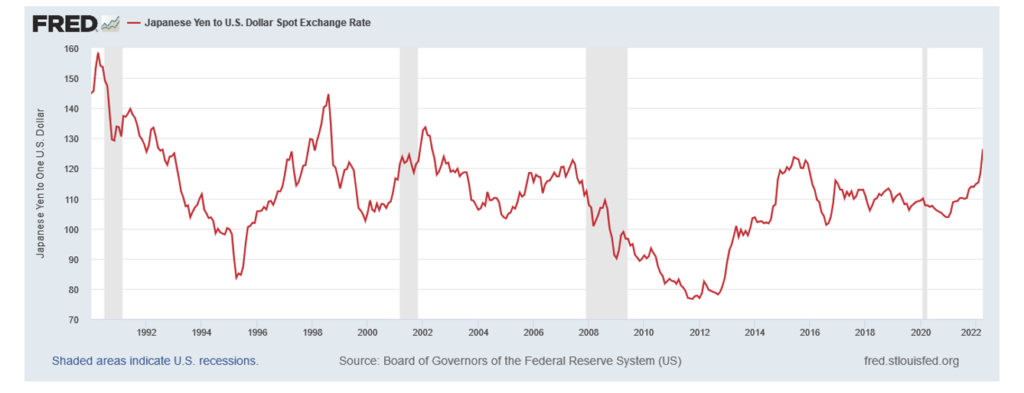

The Japanese Central Bank continues to dominate the scene. It imposed Yield Curve Control (YCC) on the debt markets. In other words, it agreed to infinitely fund the Japanese Government, print gobs of money, and keep interest rates low. While the first two seem consistent, as funding large budget deficits, by definition, consists of printing lots of money, the third objective remains a jarring contrast. For as inflation heats up, which tends to happen almost 100% of the time when a Central Bank monetizes government debt, there will be increasing pressure on interest rates to rise to reflect the rise in inflation. In addition, YCC typically produces a weakening currency, which is itself inflationary. The Yen stands at levels last seen in May 2002.

With all these inflationary pressures starting to build in the economy, the Japanese Ministry of Finance started to object to the Central Bank’s policies over the last couple of months. The Japanese Government rightly fears a currency crisis or a rapid rise in interest rates as the markets begin to bet against the Bank of Japan (BOJ). Further signs of rising discontent with BOJ policy can be seen in public opinion polls. Evidently, the public objects to the real levels of inflation in the Japanese economy as their incomes continue to fail to keep up. The data on inflation in Japan remain suspect just like the data in the US. While the Japanese government reports just 2.5% CPI, the Producer Price Index rose 10.0% YOY in April. Somehow, it seems unlikely that the CPI stayed as low as it did. With political pressure on the BOJ continuing to rise, it seems just a matter of time until the BOJ must abandon its YCC policy. While Japan will benefit from China’s reopening, this likely will find an offset in BOJ policy. Given this Japan seems destined for both Rising and Setting Suns.

An Old Man At War Once Again

For Europe, the Winds of War once more blow over the Continent. And while war today limits itself to Ukraine, the risk stands ahead for the Continent that the designs of Russia will clash with Western Europe and war will find a greater theater in which to play. For the moves of Russia over the past decade, resemble those of 1930s Germany, swallowing countries one by one. For Germany, the victims were Austria, Poland, Czechoslovakia, … For Russia, they are Georgia, Crimea, Belarus, and now Ukraine. With this in the backdrop, Europe’s economy stands at risk over the intermediate term as the threat of economic warfare and retaliation comes home. Since Donald Trump became President, the United States warned the Europeans that to depend on Russia for energy and other critical inputs into its economy put the EU at risk in any confrontation with Russia. Germany, in particular, did not listen, shutting its nuclear energy plants over the past decade and importing massive quantities of natural gas from Russia. Unfortunately, this warning became prophetic as the strategic vulnerabilities created over the past decade come to the fore in the Ukraine conflict. And this entanglement with a long term, strategic rival will create significant costs for the EU economy as Europe reorients its industry and writes off significant investment into Russia.

In the meantime, the European economy continues to undergo a cyclical recovery from the Pandemic. Due to its significant goods exports, Europe benefitted disproportionately from the massive stimulus put in place by governments to combat the Pandemic. In addition, the European Central Bank (ECB) put in place its own version of Quantitative Easing (QE) following the US Federal Reserve. All this led to a strong recovery in 2020 and 2021. However, with governments pulling back stimulus and consumers moving from a focus on goods consumption back towards a balance between goods and services, European manufacturing started to slow. In addition, due to some critical inputs from Ukraine, which shut part of the auto industry, and the shutdowns in China, due to its COVID policies, European manufacturing faces additional issues, some long term and some transitory. Reflecting these issues, the PMI Export Order Index collapsed to 44.4, indicating a significant contraction in exports ahead. And this drop occurred before the buildup in inventories in the U.S., which will likely lead to an Global Inventory Correction. The following OECD Leading Economic Indicator chart would support such a slowdown:

And the current level of the Eurozone Flash Composite Output PMI of 54.9 remains consistent with 2.25% EU Growth. Lastly, with the Fed reversing course in January, entering a tightening phase of monetary policy, the ECB followed shortly thereafter in March. Rates are set to rise and money to contract. And with Central Banks around the world raising rates, a slowdown in global growth seems inevitable. Despite these facts, some forecasters predict Europe will outgrow the US this year, just as they have for the past five years when the US actually outgrew Europe. With the fundamental economic forces arrayed against this outcome, Europe seems destined for a repeat of the past five years. And with An Old Man At War Once Again, economics will come more and more to resemble the Cold War with all the associated restraints on trade and travel coupled with significant military spending last seen in the 1980s. Finally, as Europe shifts to this new equilibrium, the words of Winston Churchill will likely ring forth once more. As Winston Churchill stated to the UK House of Commons in his ascension speech in May of 1940:

“I would say to the House, as I said to those who have joined this Government, I have nothing to offer but blood, toil, tears and sweat. We have before us an ordeal of the most grievous kind. We have before us many long months of toil and struggle.

You ask what is our policy. I will say, it is to wage war with all our might, with all the strength that God can give us, to wage war against a monstrous tyranny never surpassed in the dark, lamentable catalogue of human crime.

You ask what is our aim? I can answer in one word: Victory. Victory at all costs. Victory in spite of all terror. Victory however long and hard the road may be. For without victory there is no survival.”

The reality of the geopolitical situation with Russia and China now dominates, forcing changes long resisted by those who benefited from the status quo. And with countries such as Sweden and Finland willing to forego neutrality to become members of NATO, the potential for the New Cold War to intensify continues to rise as The Winds of War blow once more across the Continent.

A Turn to the Left

For South America and the key economies, such as Brazil, Chile, Peru, Argentina, and Columbia, politics continue to drift to the left. This will have significant implications for investment and growth over time. Just as in the 1970s, governments continue to move to raise taxes, lower returns, and redistribute wealth. The driver behind this movement stands the massive wealth created over the past 20 years and the concentration of this wealth in a few hands. As governments effectively nationalize many of the key assets, by draining off the returns on capital, future investment will become more difficult to attract. In Chile, the new government will propose a new constitution which it plans to put up for a plebiscite. This is due to the overwhelming vote to move forward with reforming the economy and political system last year. The new draft constitution contains over 499 provisions. As part of the economic reform, it undoes the private water rights system, which is highly unpopular, and touches on other property rights. It includes provisions on gender equality, eliminates the Senate, and enshrines numerous other provisions that will create significant changes in the law. As the populace realizes the level of change, polls now show a mixed reception with the overall citizenry. While its fate stands unclear, some provisions will likely become law, regardless of whether or not the new constitution passes. In Peru, the government plans to raid the pension system to provide support to the populace due to the significant inflation of the past two years. The government hopes this will fill the gap due to the limitations on raising taxes to fix the problem. And in Columbia, the leading candidate after the first round of voting is a leftwing candidate who will face off against a right wing populist. No matter who wins, the current establishment stands in the crosshairs.

Meanwhile, the Continent’s economy continues to recover slowly from the Pandemic. Despite a commodity boom, most economies have just recovered to their 2019 levels for the most part. Brazil’s economy stands little ahead of its 2019 level. The same goes for Peru and Argentina. Should the commodity boom continue these economies could grow as investment moves to expand their production. The one exception is Chile, where growth is nicely above 2019. One key restraint to growth stands the need to address the level of government debt in many continues. In Brazil, the Federal Government now shows a balanced Primary Budget while the provinces and SOE’s (State Owned Enterprises) show a surplus, after much hard work. Unfortunately, as often occurs in politics, after undergoing the pain to get to a neutral or positive fiscal position the government plans to cut a variety of taxes to reduce inflation and put more money in the average person’s pocket. With an election ahead, the politicians continue to jockey to put themselves in the best position ahead of the vote. While the cyclical recovery continues across South America, with A Turn To The Left, the political changes will impact how the countries grow, how governments allocate resources, and how the spoils of the system are distributed across groups.

Global Economic Quarterly, Part III – United States:

Middle Age, National Security, & The New Climb

“The stock market has predicted nine of the last five recessions.”

Paul Samuelson

Newsweek, 1966

Nobel Prize in Economics, 1970

For the United States, the transition to the middle innings of an economic recovery always creates waves. The industries that led the recovery out of a recession stall out and pull back while new sectors of the economy take the lead to drive fundamental expansion of the economy. Typically, this occurs at the point whereby the Federal Reserve raises rates. And in the transition, growth typically slows while the markets worry about a recession. But normally, no recession comes and the economy reaccelerates after the Federal Reserve finishes normalizing rates and money from the emergency levels created during the recession and utilized to support the early recovery.

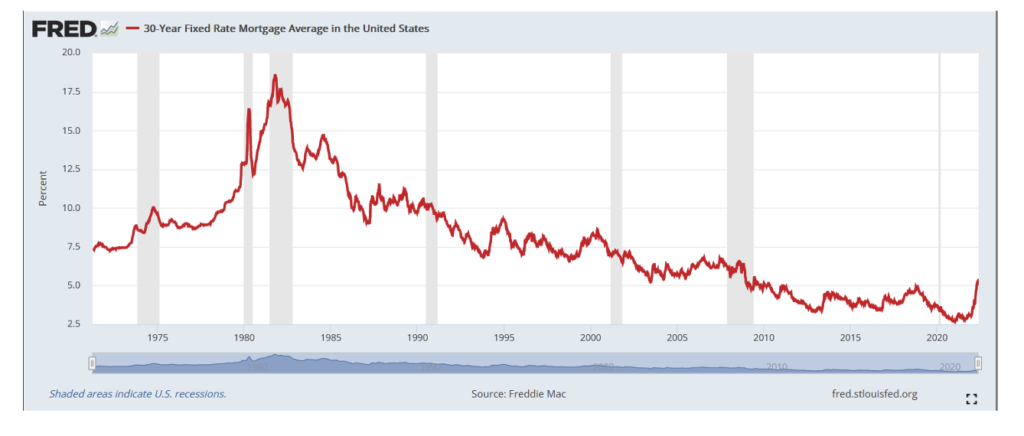

Autos and Housing typically lead the recovery period for the economy. They are interest sensitive industries and respond to the drop in interest rates. In this case, the Federal Reserve’s Quantitative Easing provided an additional boost to the normal interest rate boost by lowering long term interest rates well below the level that would have occurred naturally. With the Federal Reserve changing policy in January, interest rates responded. In particular, Mortgage Rates quickly undid the artificial boost provided by the Federal Reserve:

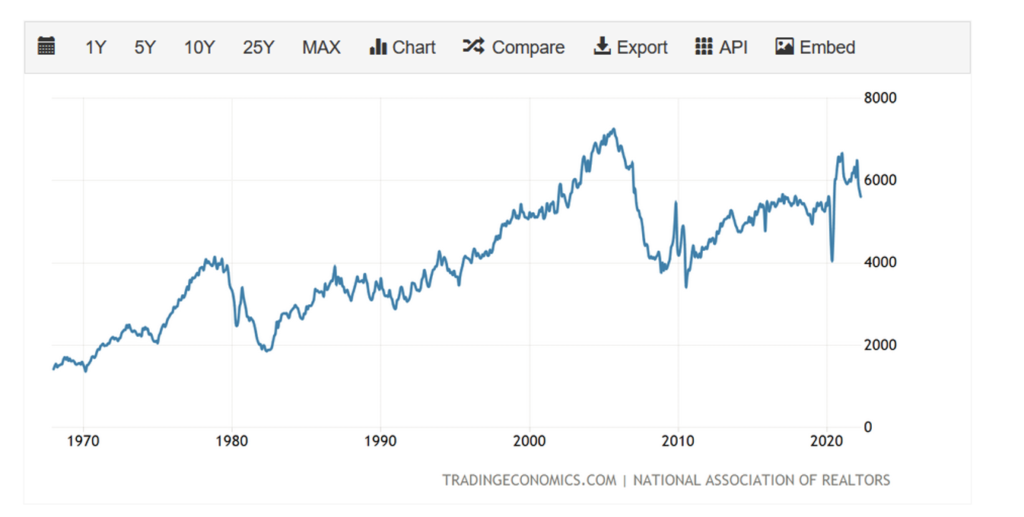

And the impact to Housing stands clear. Mortgage Refinancing collapsed, dropping over 90% year over year. And Existing Home Sales have slowed from an over 6.5 million annual rate to just a 5.6 million rate:

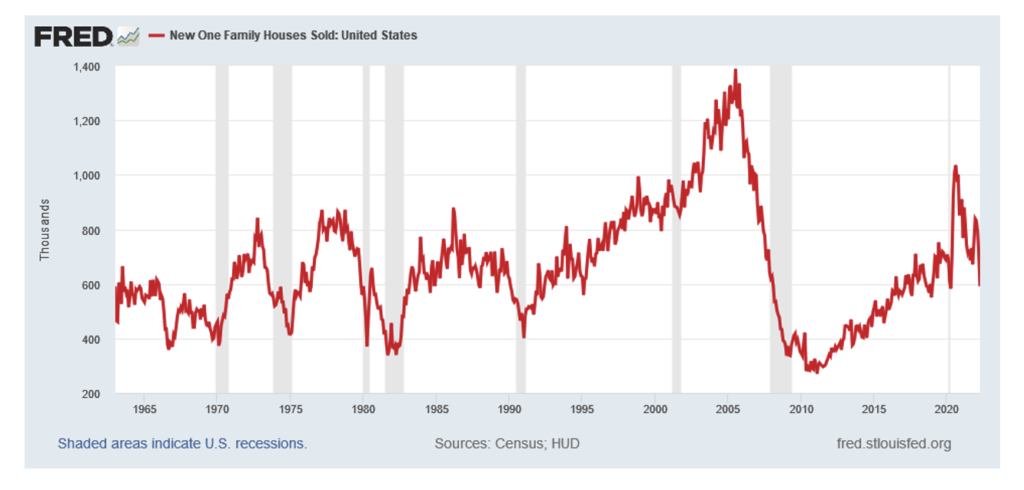

This drop reflects contracts from February, when Mortgage Rates stood below 4%. With rates now over 5%, additional slowing ahead should be expected. This already can be seen in New Single Family Home Sales, which have returned to their 2018 level:

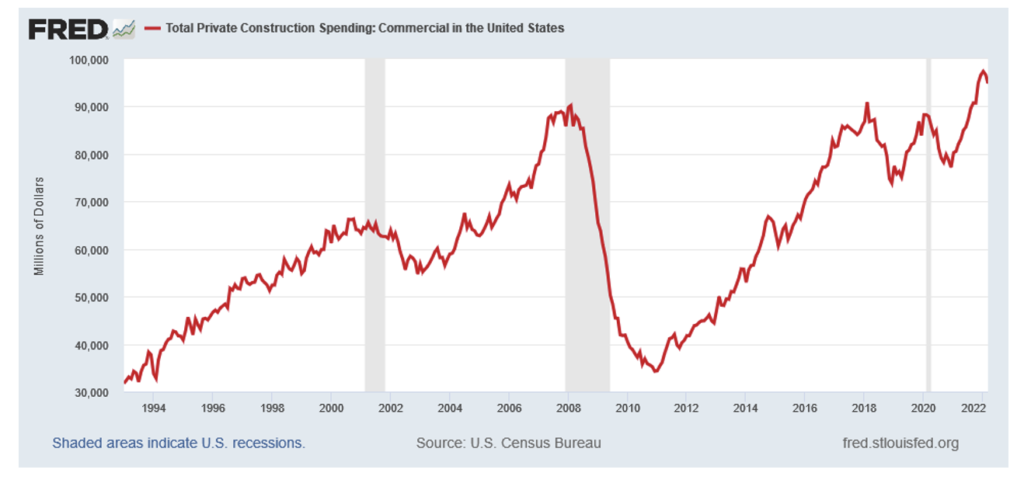

With Housing slowing, the impact of a cyclical downturn began to spread throughout the economy. Housing Retailers, such as Home Depot and Lowes, reported accelerating negative unit growth as 2022 progressed. Unit growth fell 8% to 15% in the most recent quarter for these retailers. With demand collapsing, prices of inputs turned down as well. For example, Lumber Prices dropped from over $1,500 per mbf (thousand board feet) in April 2021 to just $700 today. As Housing continues to slow, demand for everything from appliances to electrical wire to copper pipe to PVC will drop. Slowly, but surely, this will spread through the economy, impacting everything from the demand for labor to trucking to commodity prices. This can already be seen in the Private Construction data, which appears to have made a top:

The other early sector of the economy, Autos, due to supply chain disruptions and affordability issues, never produced a normal recovery. Instead Auto sales headed south after a short early bounce as prices became unaffordable for the average consumer and dealers had no inventory:

With Supply Chains normalizing and shortages disappearing, Autos should actually become a mid-cycle industry this time, unlike its normal early cycle role.

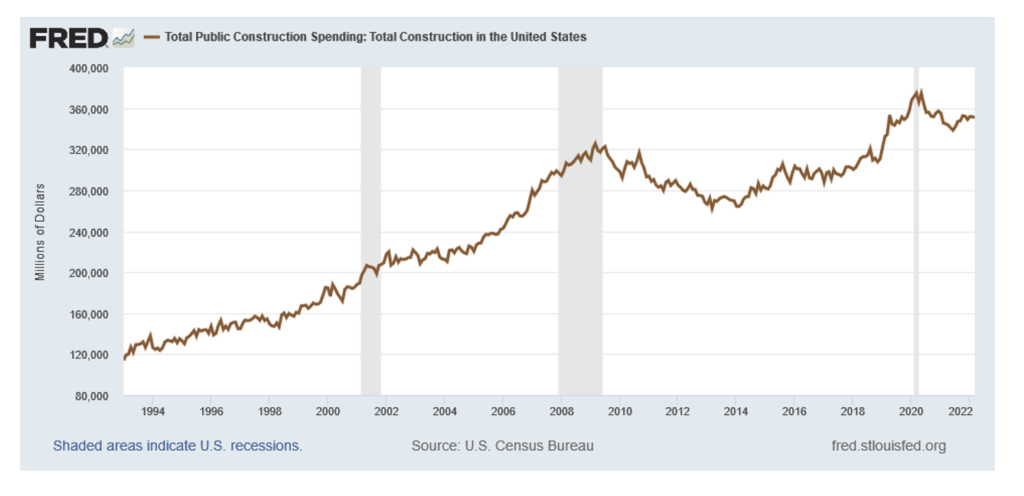

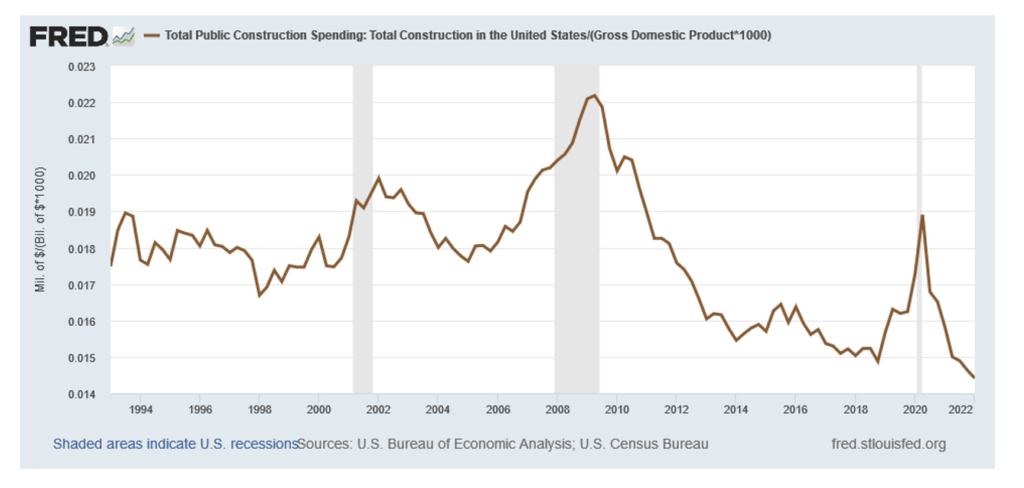

As often occurs as the economy progresses and a Presidential Election approaches, Public Construction appears set to take off. The Infrastructure Bill structured the spending to start in 2023 and accelerate into 2024 and peak in 2025, after the Presidential Election. The economic data demonstrate a Public Construction bottom forming:

However, when viewed relative to GDP, Public Construction appears woefully inadequate:

While spending headed upward under the Trump Administration, it collapsed under the Biden Administration. While the Infrastructure Bill sounds large at $1.2 trillion, it actually only provides for an incremental $550 billion in spending over five years or just $110 billion per year. In 2021, US GDP totaled ~$23 trillion. According to the Congressional Budget Office, US Real GDP will rise 3%+ and Inflation will total ~4% in 2022 for a Nominal Growth of 7%+. This means 2022 GDP should reach $24.6+ trillion. The $110 billion rise in spending will add 0.44% to spending, bringing spending back to ~1.9% of GDP, the normalized level from 1993 – 2012.

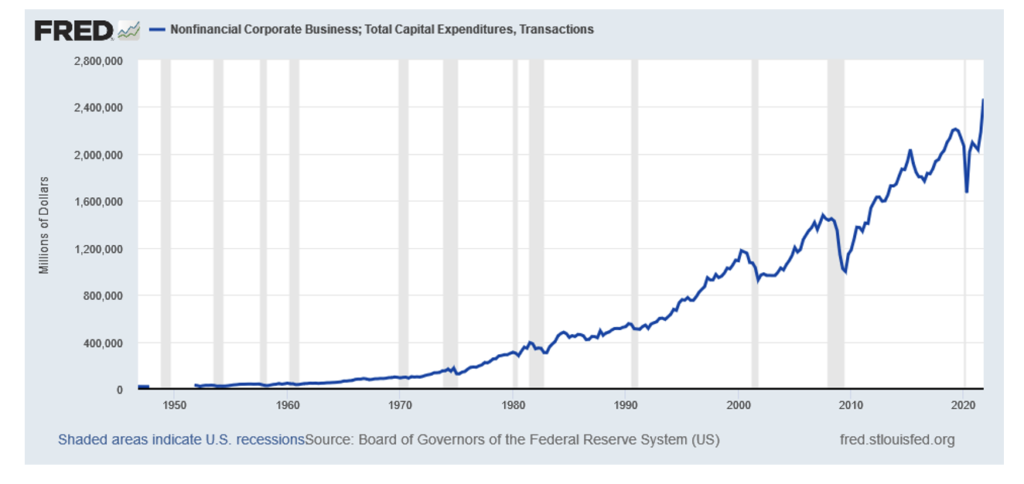

While this level of spending will return spending to where it needs to be, it will not make up for the deficit from 2012 – 2018. In addition, with geopolitics now producing a large shadow over all government decisions, National Security will continue to rise as a critical component of all government policy. Private Capital Spending will likely become the main channel of transmission for this policy. This will occur as the Federal Government moves to re-shore production from overseas for technology, to shore up the US industrial base, and to ensure the US gets its fair share of future production for new critical industries such as Electric Vehicles. Overall capital spending already headed upward this cycle, reaching new heights:

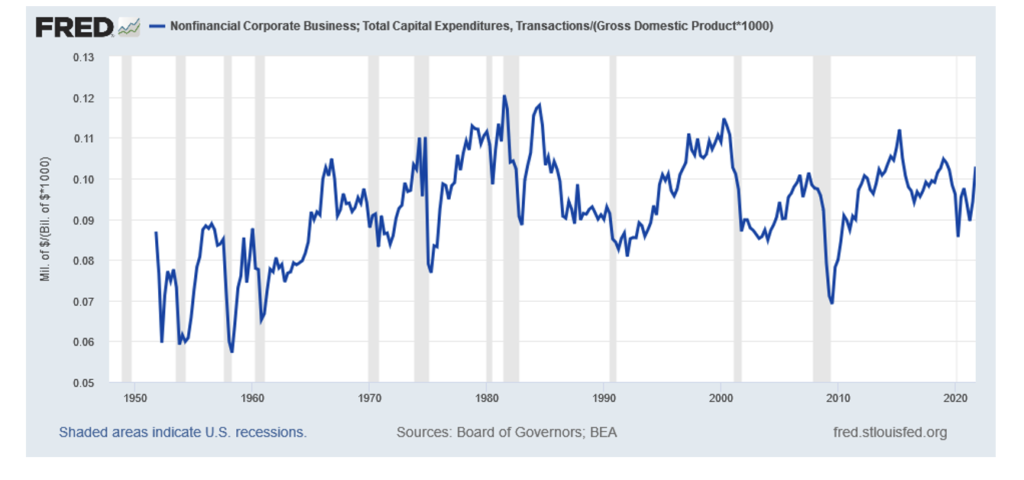

And relative to GDP, it returned to strong levels:

However, when broken down into critical components for National Security, there still exists huge room for improvement. The following chart of investment into Industrial Equipment relative to GDP still shows a significant shortfall relative to levels in the 1980s and 1990s:

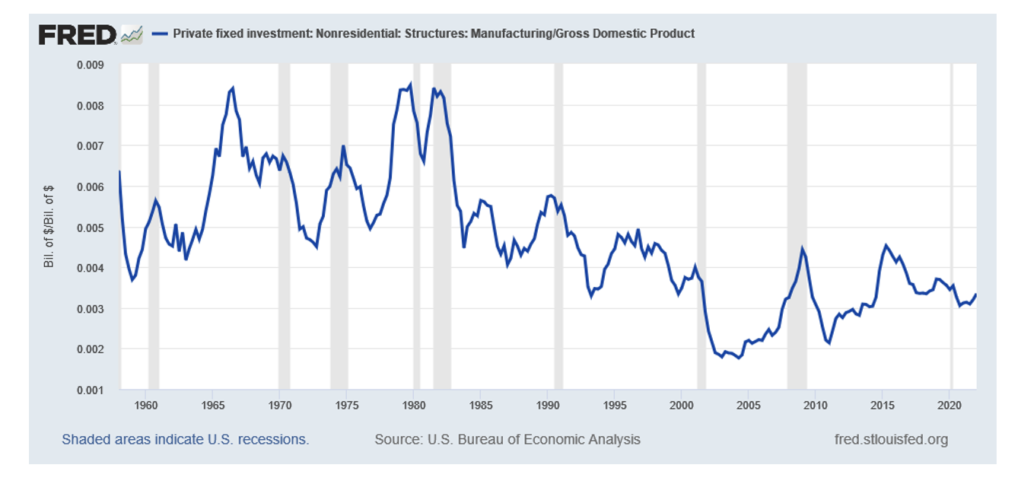

On the positive side, it appears to be bottoming and heading up relative to GDP. Manufacturing Structures Investment shows a similar tale:

With a nudge from the government, this could take a significant swing upward. And given the undersized industrial sector at less than 11% of GDP, this would create a big positive for economic growth and productivity. The US possesses a long runway to reach the 18%+ of Germany’s GDP and 20%+ of Japan’s GDP related to Manufacturing. If National Security becomes the overriding factor for the US, then massive onshoring could easily ensue. A simple example will make this clear. In the Pharmaceutical Industry, according to the GAO, the US imports 52% of finished drugs and 73% of active ingredients. (See the January 2022 report titled: Drug Safety: FDA Should Take Additional Steps To Improve Its Foreign Inspection Program.) Such a state of affairs stands inconsistent with National Security and the ability to supply the US population with needed drugs in wartime. Regardless of the desire to lower costs by large drug companies, the US Government could easily justify forcing this production back home.

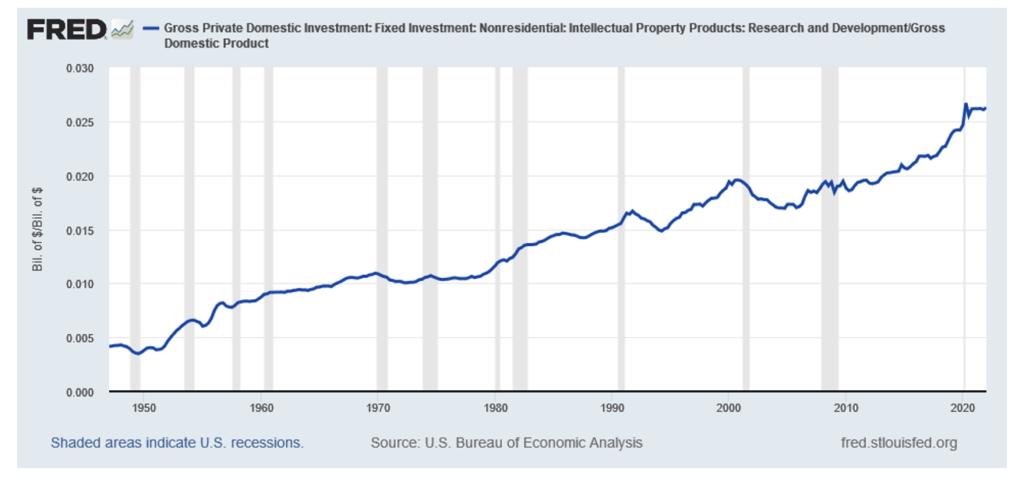

In support of achieving this goal, the key metric for the United States continues to flash a strong green signal. That stems from US R&D spending, which continues its 70+ year upswing relative to GDP and remains tops in the world, despite China’s subsidies of its industry:

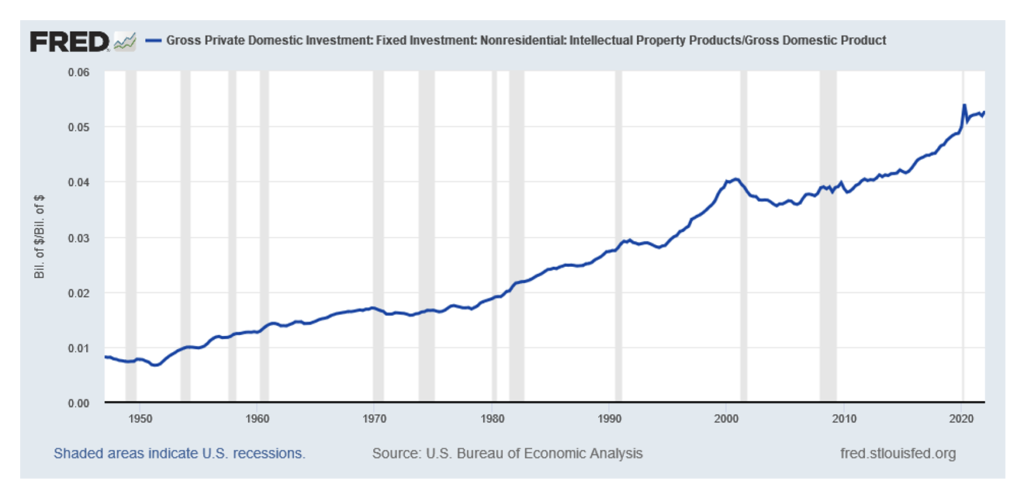

And investment into all types of IP Products continues its relentless rise as well:

With these positives and some backing from the government to ensure the US possesses the industrial base it needs and to re-establish America’s pre-eminent role as a technology manufacturer, the country could easily meet its National Security needs and ensure strong growth for a decade or more.

For the US, the Economic Cycle continues its transition to Middle Age. This transition appears set to match those of past cycles where the economy slowed before reaccelerating. But the shape of the reacceleration will resemble more that of the 1980s and 1990s, which were driven by Investment into the economy to support America in the Cold War and by a National Strategy to ensure the country remained a leader in technology and technology production. During those decades, National Security concerns trumped all. With the 2020s set to look very different from the past two decades, the economy will take on a new shape to drive its growth, underwriting those sectors that will meet the geopolitical needs of a New Cold War. With the economy transforming itself once more, it appears ready to make The New Climb to heights yet unfathomed.

Cooling Off, JOLTed, and Nickeled and Dimed

Finally, we close with brief comments on Cooling Off, JOLTed, and Nickeled. First, according to recent analysis, Americans replaced their HVAC (Heating Ventilation & Air Conditioning) equipment at a record pace due to Work At Home. This was over 20% above the norm. Recent cooling in demand indicates that this demand may normalize over the next few years back towards long term levels. Given this, we see the industry Cooling Off. Second, a researcher at the Federal Reserve, took the data from the Job Opening & Loss Turnover Survey (JOLTS) and compared it to traditional data from newspaper ads during the 1960s. He concluded that current Job Vacancies, at 7% of Employment, stand 40% above the late 1960s/1970s levels of 5% – 5.5%. Whether the data is correct or not, given the tightness in labor markets, employers feel JOLTed today. And third, scientists at Dalhousie University in Halifax, Canada in combination with Tesla scientists, developed novel, high density, battery technology. These batteries are smaller than current batteries, yet carry more charge. This novel, Nickel based battery can last over 100 years. The battery utilizes little or no Cobalt and limited amounts of Lithium. Given the potential for this battery to move into the mainstream later this decade, current battery technologies may feel Nickeled and Dimed.

In Closing

Should you have any questions on how the above issues or the items discussed in our accompanying cover letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate

Chief Executive Officer