Commodities, Thank You For The ESG Driven Boom, Part III: Decarbonization, Disinvestment, & The Law of Unintended Consequences

For those who wish to understand the recent spike in energy prices, they need only look at the normal lagged impact of recessions on investment into Commodities or any other Manufactured Good coupled with the current environmental push to “Decarbonize” the world. In a normal recession, companies pull back on investment as profits fall and cash flow gets squeezed. This leads to a period of underinvestment into any consumer good as well as all the inputs throughout the supply chain from assembled components to parts to commodities. Once the recession ends, with demand recovering and prices following, profits and cash flow rebound, leading to rising capital investment with a lag. This then restores the normal relationship between supply and demand in one to three years from the time that capital investment recovers. If investment only needs to occur in existing plants, capacity can grow in a short amount of time, usually 12 – 18 months. However, if demand rises rapidly, then companies must build new plant to fulfill those orders. New plants typically take 2 – 3 years to construct plus permitting time, thus creating a longer lag between when demand and supply come into balance. Either way, things tend to balance out over the short to intermediate term.

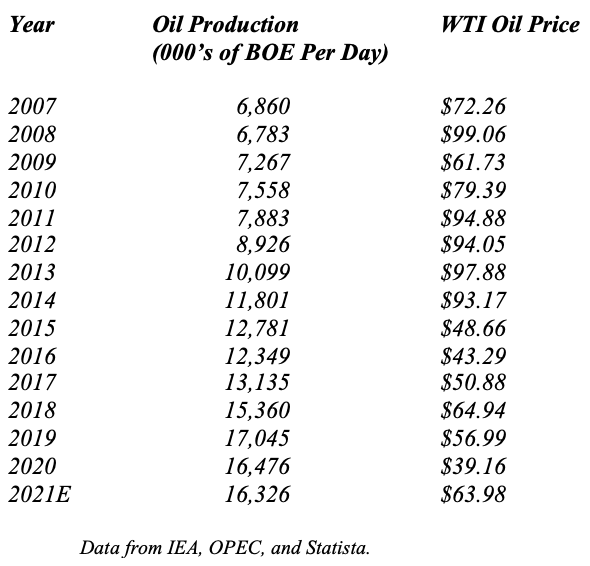

Of course, this ignores all kinds of real world issues that can get in the way. For the past decade, the expansion of drilling using fracking technology for oil and gas production made the United States the low cost producer of energy outside of the Middle East. This type of drilling enabled economic production at a cost of $45 – $60 per barrel, depending on the location. The basins in the Southwest, such as the Permian, represent the low end of this cost curve, while those up in the Bakken in North Dakota represent the high end of these cost curves. The innovation provided by this technology allowed the U.S. to move from a major importer of oil to self-sufficiency and to become a net exporter of energy:

US Oil Production more than doubled over the past decade, despite the drop in Oil Prices. With strong economic returns, energy producers possessed the incentive to produce more oil and natural gas.

However, as the chart above demonstrates, despite the recovery in oil prices in 2021, oil production will continue to decline this year. This seems to contradict normal economics, whereby a rise in prices incents producers to increase supply. Two factors, both political, stand in the way. First, the Biden Administration banned new oil and gas leases on Federal lands. While this ban currently sits in the court system, it will slowly but surely impact U.S. production as federal lands comprise over 25% of all U.S. production today. Second, the ESG driven, Decarbonization drive impacted public energy companies, putting pressure on management to decrease investment into oil and gas drilling, known as Disinvestment, and reallocate resources into Green Energy projects. Given that production from the vast majority of wells declines anywhere from 8% to 25% per year, cutting oil and gas investment will impact a producer’s ability to maintain, let alone grow, production.

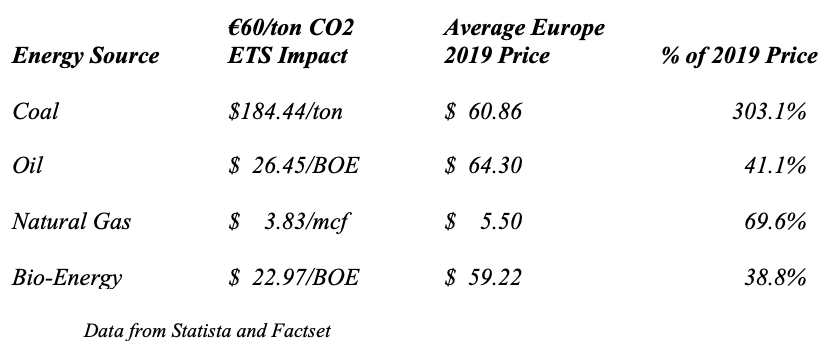

This political pressure excludes the new Carbon Taxes and Disclosure requirement that governments continue to impose to push Green Energy, such as wind and solar. A quick look at the European Union’s (EU) Emissions Trading Scheme (ETS) will illustrate the Carbon Tax issue. The EU ETS Price Per Ton for Carbon reached €60/ton of CO2 recently. When viewed in a standardized format by source of energy, it increases the cost of energy anywhere from almost 40% to over 300%:

As the data above indicate, the Carbon Tax creates a significant increase in energy costs across the board. This ultimately flows through the production of all commodities and goods, as all mining and manufacturing requires energy to drive production. This raises both mining and goods production cost significantly and creates end goods inflation for the consumer.

While the SEC continues to debate what ESG Disclosure requirements to put in place, the EU already implemented significant Disclosure requirements: The EU Taxonomy for Sustainable Investment (EU TSI) and the EU Sustainable Financed Disclosure Regulation (EU SFDR). Under the EU TXI, the EU will require businesses to disclose their revenue alignment with the EU definition of “Green Business” activities. For a business like steel, there currently exists a zero chance to meet the definition of green. Second, the EU promulgated the SFDR to pressure asset managers to classify their assets as meeting the Paris Treaty Climate Transition benchmarks. This would require the companies in which they invest to decrease Greenhouse Gas Emissions by 7% per year. When coupled together, these regulations effectively raise the cost of capital to any company that does not move to meet the EU goal for Net Zero Emissions aggressively. And, to do this, given current technology, will require higher costs to manufacture goods and commodities. Thus, increasing prices to meet the higher cost of capital and to implement new technology.

Lastly, the move to Green Energy creates the potential for sudden spikes in demand for traditional fossil fuels. The current situation in Europe with Wind Power exemplifies this risk. Wind Power production dropped as Wind Speeds fell in 2021 to 7.8 meters per second vs “normal” speeds of 8.6 meters per second, according to Orsted, a major operatory of Wind Farms. In other words, the wind did not blow as much. This “surprise” obviously led to lower electricity production from the Wind Farms throughout the EU, which the EU seemingly did not incorporate into its planning. Now, even a small child knows that the weather changes from year to year. Coupled with the closure of coal fired electric plants over the past decade and high demand for LNG globally, this led to a supply squeeze on natural gas short term and skyrocketing energy costs.

While politicians seem surprised by the escalation in Energy Prices, they logically follow from the move to implement ESG driven regulations upon the Energy Sector. This includes Decarbonization and Disinvestment in Fossil Fuels. And while politicians lament the price increases, blaming market forces for the consequences of their actions, Consumers find the ensuing spike in their fuel, heating, and electricity bills no laughing matter. Elected politicians now find the best of intentions forgot to consider the true economic impact of their policies coupled with The Law of Unintended Consequences. Given the Supply constraints and increasing costs pushed onto energy producers, as governments focus on lowering CO2 production, coupled with increasing Demand from natural global economic growth, as the Global Economy recovers from the Pandemic, Energy prices naturally will trend upward as increased demand meets limited supply and higher costs of production. However, for Commodity Energy Producers, they will sing in rousing chorus: Thank You For The ESG Driven Boom.

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2020 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.