Global Economic Quarterly Part 1: A Turn in Policy & There You Go Again

“There you go again.”

Second US Presidential Debate, 1980

Candidate Ronald Reagan to President Jimmy Carter

With the Pandemic headed into the rearview mirror, Central Banks around the world signaled their intent to normalize policy over the next year. This means, essentially, an end to non-traditional policy, such as Quantitative Easing (QE), coupled with a return to the type of monetary policy followed prior to the Pandemic, dependent on the country. Or, at least, that represents the picture as presented to the public by institutions such as the Federal Reserve and retold by the press. However, there exists a critical assumption behind this picture: the world of today requires the same policies or seeks to achieve the same policy results as prior to the Pandemic. Both of these represent questionable assumptions at best. And, if these assumptions turn out less than true, as governments desire a different economic result than before the Pandemic, then a different policy mix will ensue. Thus, A Turn In Policy may not mean what most observers assume.

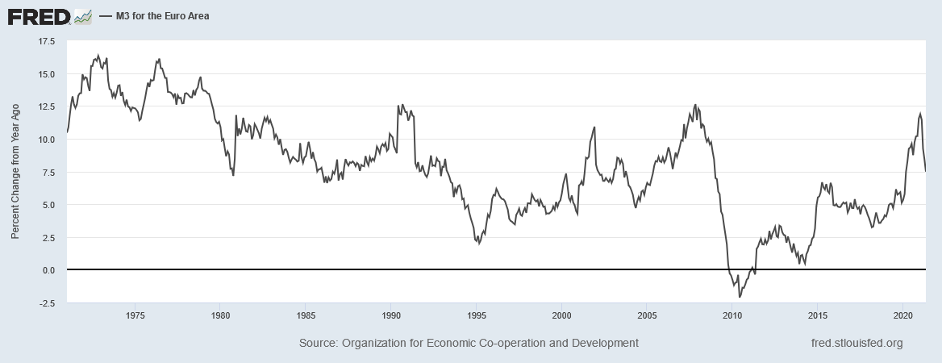

A simple example will demonstrate this issue. Prior to the Pandemic, the European Central Bank (ECB) utilized a policy mix that delivered little to no economic growth for a large portion of the EU. Specifically, the Southern European Countries, such as Italy and Greece, never shook off the aftereffects from the 2008 – 2009 Financial Crisis and Recession such that they produced real economic growth over the past decade. And, as pointed out in this month’s Views From The Stream, Italy’s economy stands at the same size as in 2000, when it joined the European Union. This poor growth stands in contrast to the growth obtained by the Northern European Countries. These economies all produced solid economic growth over the past decade. Should such an outcome continue, the odds of the European Union remaining intact stand somewhere between slim and none. The following chart illustrates the change in ECB policy over the past two years:

As the chart demonstrates, monetary growth returned to the level achieved from 2000 – 2007. During this time, money expanded at a pace that allowed for both inflation and economic growth. And given recent comments by Madame Lagarde, the head of the ECB, the ECB plans to continue its QE over the next one to two years to ensure that money growth accommodates economic growth. Thus, monetary policy will not look like the growth posted prior to the Pandemic.

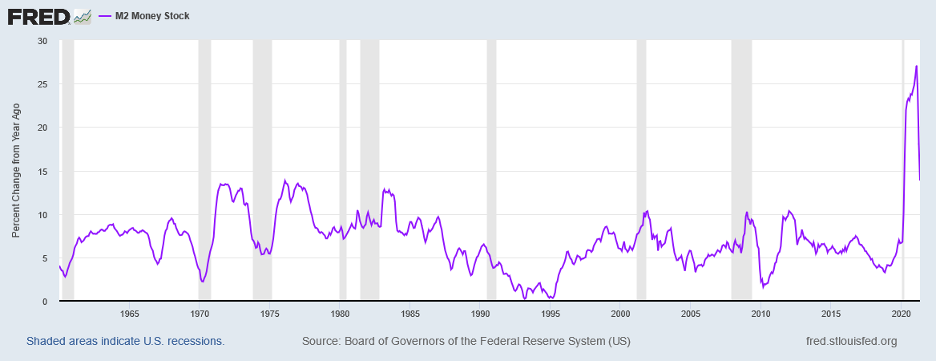

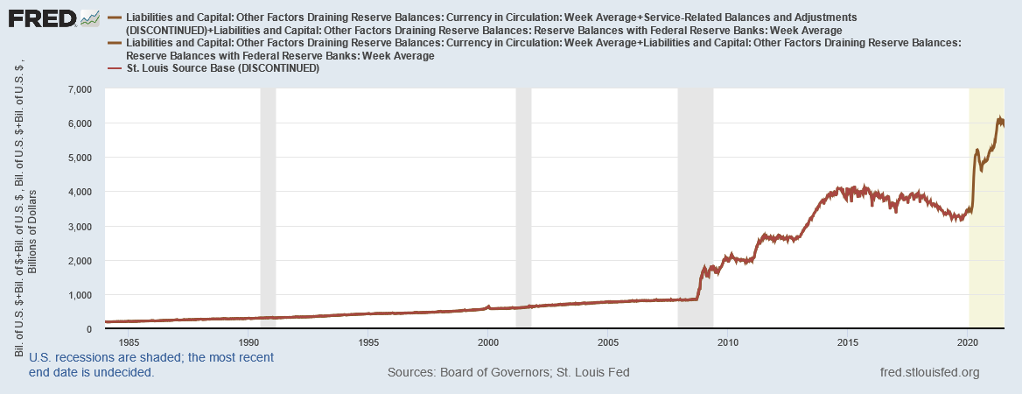

This then brings us to the US Federal Reserve. The US faces a global geopolitical environment that will require its economy to grow more rapidly to meet its challenges and fund its policy goals. This will require three things to happen simultaneously. First, Nominal GDP Growth must accelerate. Second, Fiscal Policy must maintain a neutral to expansionary posture. And Third, the Federal Reserve must control Interest Rates as it did in the past. The chart below lays out US M2 Growth Year-Over-Year, one of the core monetary aggregates:

The chart clearly demonstrates the emergency liquification of the US economy conducted by the Federal Reserve to support the massive government spending put in place to counter the Pandemic, with year-over-year money growth exceeding 25%. The last time this occurred was during the 1930s Great Depression and the 1940s during World War II. While many observers expect the Federal Reserve to normalize policy over the next 12 – 18 months to pre-pandemic monetary policy, in which the Federal Reserve shrank money to attempt to offset the massive increase created by QE after the 2008 – 2009 Recession, this seems unlikely. That attempt to rein in money led to shrinking money supply for several years, producing a significant economic slowdown starting in 2018, once the positive impacts from the 2017 tax cuts ended.

This stands the exact opposite of policy goals today. Given geopolitical realities, the US must accelerate both Nominal GDP Growth, to normalize US Debt to GDP, and Real GDP Growth, to support government objectives and increase Real Incomes. In effect, the US must run a wartime economic policy, much as China did over the past decade to boost its growth, in which the Federal Government runs massive budget deficits and the Central Bank finances the government. In addition, such policy would see the government manage interest rates at the same time as it creates significant inflation. And while the Federal Reserve may talk of “normalizing” policy, the political reality stands opposed to such actions. Thus, normalization likely means a return to early 2000’s money growth to ensure Nominal GDP Growth remains strong or the type of policy followed from 1937 until 1949.

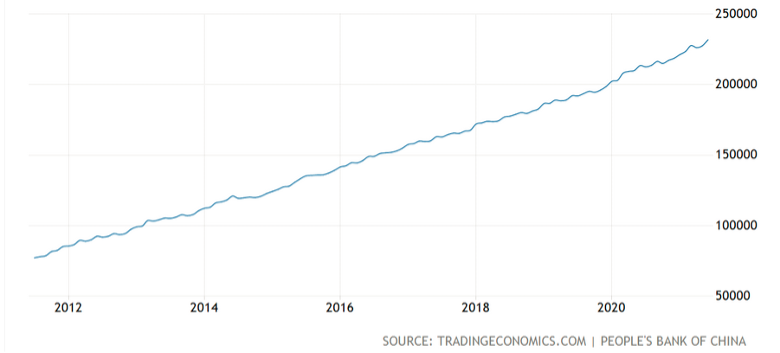

China may stand the exception of the larger economy Central Banks. The PBOC expanded money supply at a steady rate over the past decade, without interruption, and continues to do so. This supported, along with government spending, strong steady GDP Growth. The following chart illustrates the steady continued money growth:

Given China’s continued GDP Growth Rate of 6%+, as dictated by the Communist Party leaders in Beijing, monetary and economic policy likely will maintain a steady course for the foreseeable future, as this will continue China’s march to becoming the most powerful economy and country in the world no later than 2050 and the largest economy in the world by 2030.

For EM Central Banks, such as Brazil, the reality of their economies and inflation, will force their Central Banks to act. Already, a number of EM Central Banks have announced rate hikes. And more are expected to follow as inflation accelerates in many of these countries. This will put the EM economies much closer to “orthodox” monetary policy than Developed Market (DM) economies or China. The question that EM Central Banks will face over the next few years relates to the continued decoupling of the Chinese and US economies and the economic fallout. The EM economies benefitted as China grabbed global market share to goose its economy at the expense of the rest of the world. As the rest of the world organizes to put an end to this policy, EM economies and Central Banks will face difficult policy choices in terms of driving future economic growth. All of this will make Central Bank policy decisions difficult and continued rapid growth a challenge for many Emerging Market economies.

Layered on top of Global Central Banks enacting A Turn in Policy stands China’s Made In China 2025 economic plan. This plan seeks to make China independent of the rest of the world economically and to enable China to create surplus production in its Command Economy to export goods to the rest of the world and to undercut foreign companies and thus foreign economies from geopolitical rivals. And for those who think China stopped stealing global IP and ceased expanding production in China to displace foreign production over the past few years, as foreign nations protested this policy, nothing could exist further from the truth. This policy continues apace across multiple industries as China attempts to localize all production across supply chains, excluding raw materials, in a classic implementation of Mercantilist economic policy. A simple example of MLCC’s will make this clear.

MLCC stands for Multi-Layer Ceramic Capacitor. MLCCs are critical components in almost all electronics. And thus, stand as one of the key building blocks to manufacture technology products. China plans to follow the same game plan it followed with Ceramic Inks and with LCD Panel Production. China’s “localization” of Ceramic Inks stood at less than 10% in 2011. As China had developed a large end market for Ceramic Inks, the government decided that production should become localized, with Chinese companies supplying the vast majority of the domestic market. In order to accomplish this, China established a number of national champions. By 2016, these companies achieved a localization rate in excess of 85% and had established market share outside of China through exports of these products. LCD Panels exhibit a similar story. From less than 10% of global production in 2014, China grew its global share to almost 50% today. Funded by the Chinese government, China continuously expanded production over the past 7 years, even when the global industry lost money in 2019 on a cash basis. This forced competing countries to shutter capacity in the face of an onslaught of Chinese capacity.

Let us fast forward to today. In 2015, Chinese manufacturers of MLCCs possessed less than 2% global market share. By 2019, Chinese manufacturers of MLCCs held 8% of global capacity. By the end of this year, 2021, these same companies will grow their global share to 23%. In addition, with continued subsidies from the Chinese government, these companies continue to undercut pricing of Japanese, American, and European firms in global markets by 10% or more in order to gain share. China’s policy projects Chinese companies achieving a 40% – 50% global share by 2025 through continued capacity expansion funded by the central and local governments, creating a dominant global position at the expense of foreign rivals. In the immortal words of Candidate Ronald Reagan, uttered in 1980, “There you go again.”

Such economic policies continue to not play well in Washington, Paris, New Delhi, and Tokyo. With China focused on its Made in China 2025 policy, rising economic conflict with its trading partners seems inevitable. Companies continue to move the next generation of production out of China, lest they get caught in the crossfire. And with Washington, D.C. officially warning U.S. companies about the risks of doing continued business in Hong Kong, such next generation production flight should accelerate. Should the public in Western democracies become aware of these Chinese policies that are undermining Western companies and jobs, pressure will rise on Western governments to accelerate company exodus and to act to stop the impact on their economies from these Mercantilist policies. For companies such as Nike and Apple that have major operations in China, that continue to expand their presence there despite government requests to rethink these policies, the future may become difficult as they are forced to change their modus operandi. And for those who thought the Biden Administration policy towards China would ease compared to the Trump Administration, such ideals were crushed by the reality of China’s economic policy, leaving the Biden Administration little choice but to ratchet up Trump Administration policies. For Emerging Markets in Asia, this will produce some short term gains. However, with the U.S. focused on reshoring production across critical industries, pressure will grow on U.S. companies to relocate factories back to the U.S. for national security reasons. And with rising technology export controls, future technology production will have to occur in the U.S. across many new products, regardless of company profit goals. For China, without the domestic consumption base to support its massive production, such a change in policy will create significant economic problems. And Chinese economic growth should decelerate sharply after 2025, as the lagged impact of capacity relocation and an acceleration of decoupling come full swing.

Given the above, assumptions about Central Bank policy and Global Growth must endure deep inspection. Else, it will become easy to assume that the policies and economic growth in the 2020s will look much like the decade of the 2010s, when the fundamentals dictate a different outcome. With numerous cross-currents likely to effect everything from where basic parts for cars are manufactured to the location of high tech production across semiconductors, fiber optics, advanced materials, biotech, and robotics as well as other critical technologies, along with Central Banks more beholden to supporting national economic and geopolitical goals, country winners and losers will differ dramatically this decade. And with DM economies more focused on National Security and Geo-Politics, little will seem the same. For those used to the familiar guideposts of the past 20 years, it will come as a shock as they must adjust to the reality of A Turn in Central Bank Policy and There You Go Again.

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2020 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.