Beginning a New Climb

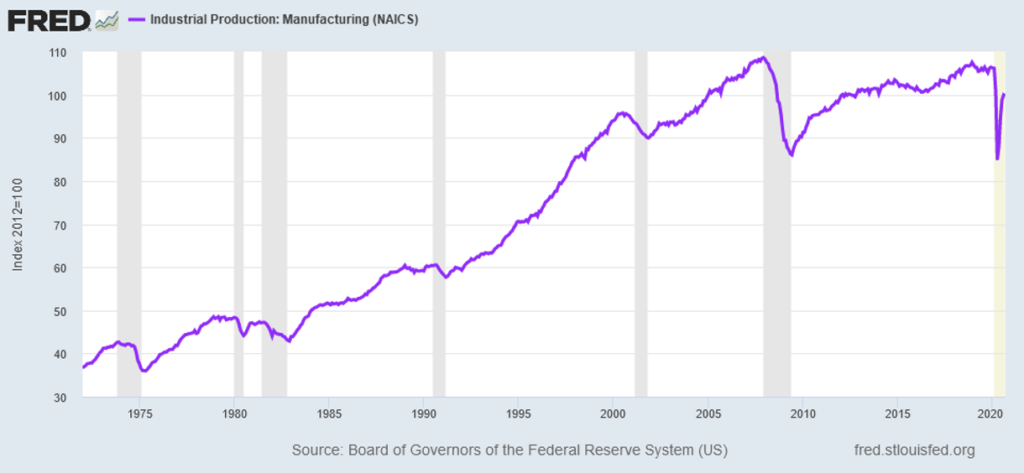

For the US, the Pandemic undermined a year headed for strong economic growth. Prior to the Pandemic induced lockdowns, US Industrial Production (IP) turned up, as the Global Inventory Cycle moved from contraction to expansion. However, the Pandemic short circuited the upturn, as lockdowns rolled through the US and Global Economy. With the economy reopening, IP turned upward strongly, closing the gap with its pre-Pandemic level:

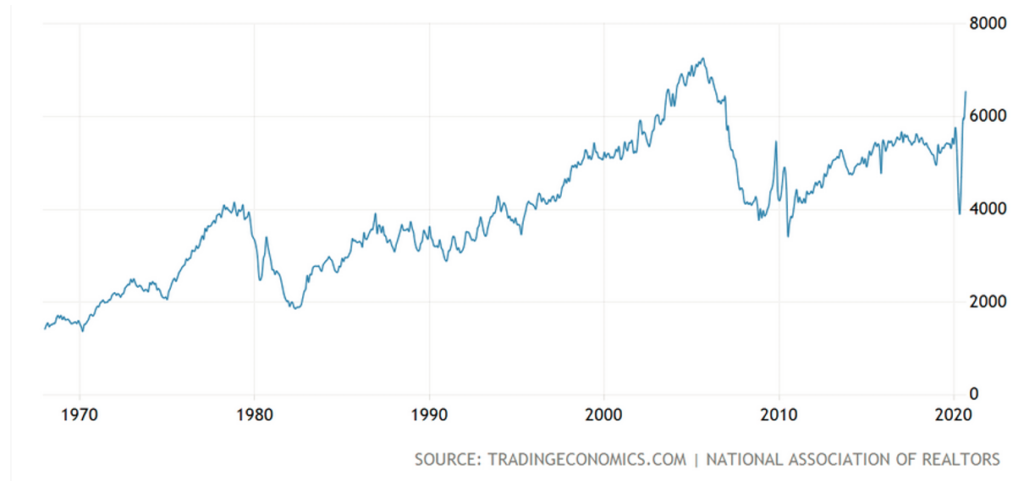

Underpinning this recovery stands a blowout Housing market in 2020. Existing Home Sales hit an annualized rate of 6.540 million in September compared to just 5.4 million in September 2019, the highest rate since the Housing Bubble in 2006.

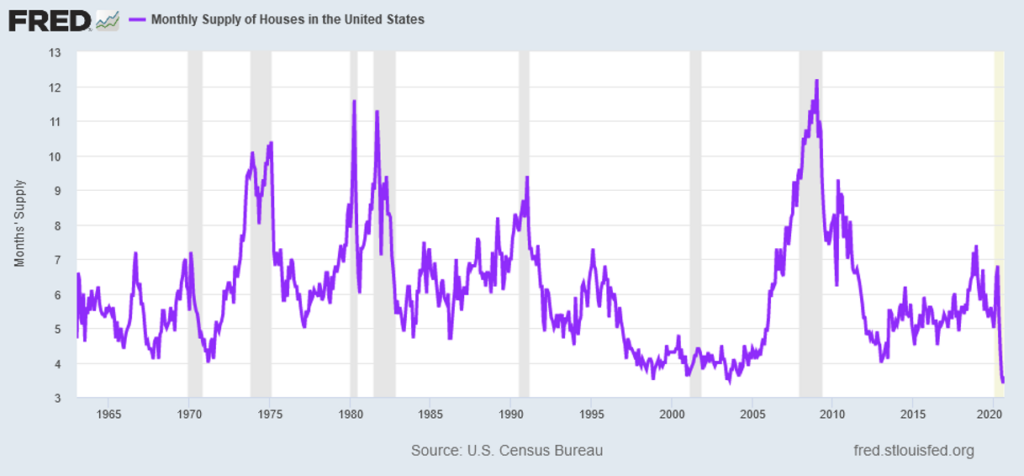

These bubble like volumes drove Housing Inventory down leading to a record low in Months Supply of Existing Homes:

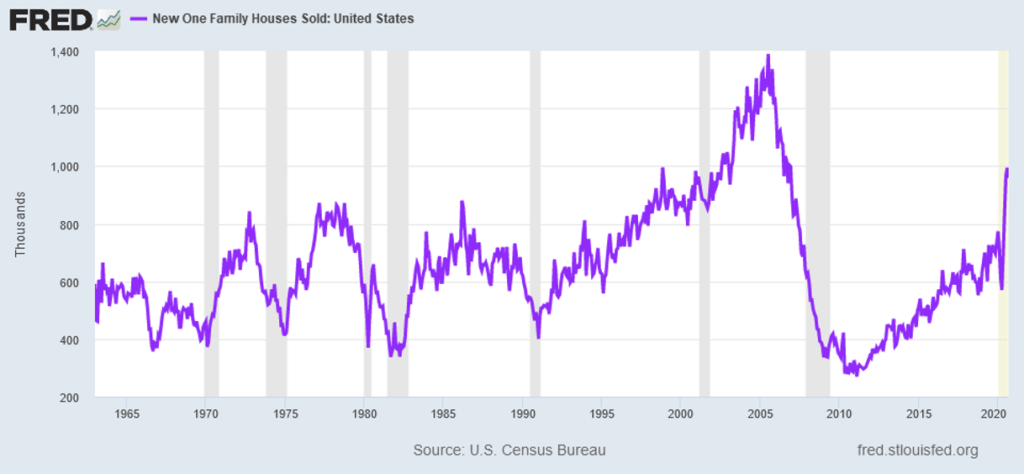

In turn, with an effective shortage of Existing Homes, due to the flight from major metro areas, New Home Sales took off:

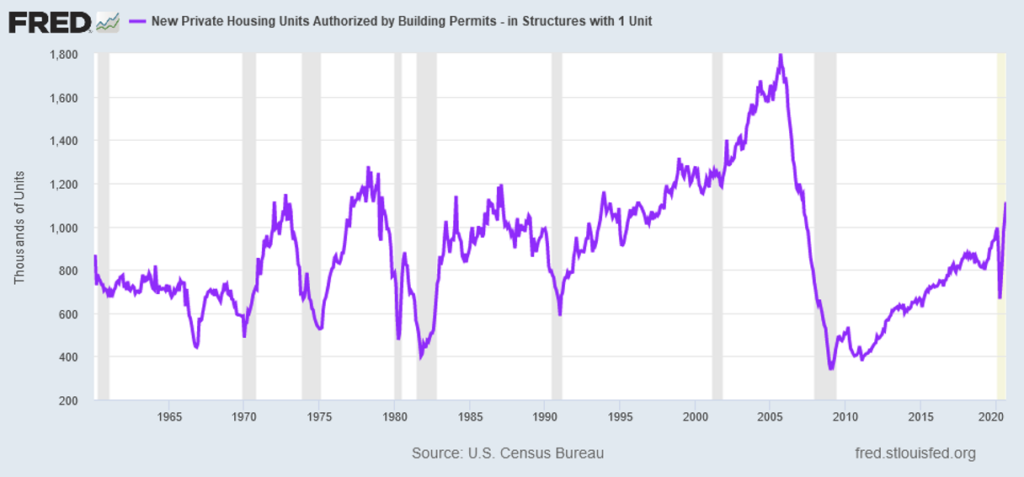

Similar to Existing Home Sales, New Home Sales hit a rate last seen in 2006 and above the peaks of 1998, 1986, and 1978. In turn, this drove Single Family Permits back towards their peaks of prior decades, only exceeded during the Housing Bubble:

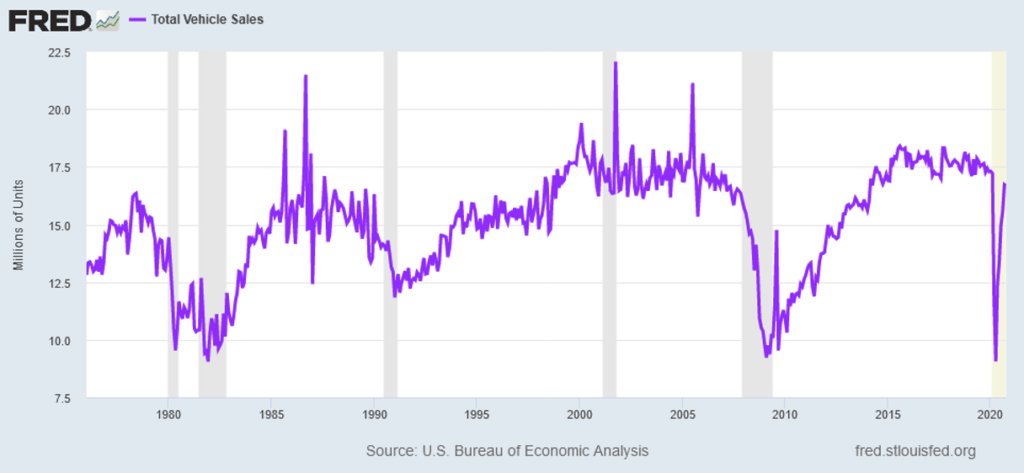

And, if one turns to Autos, the picture looks extremely similar to Housing, with sales recovering to their pre-Pandemic levels already:

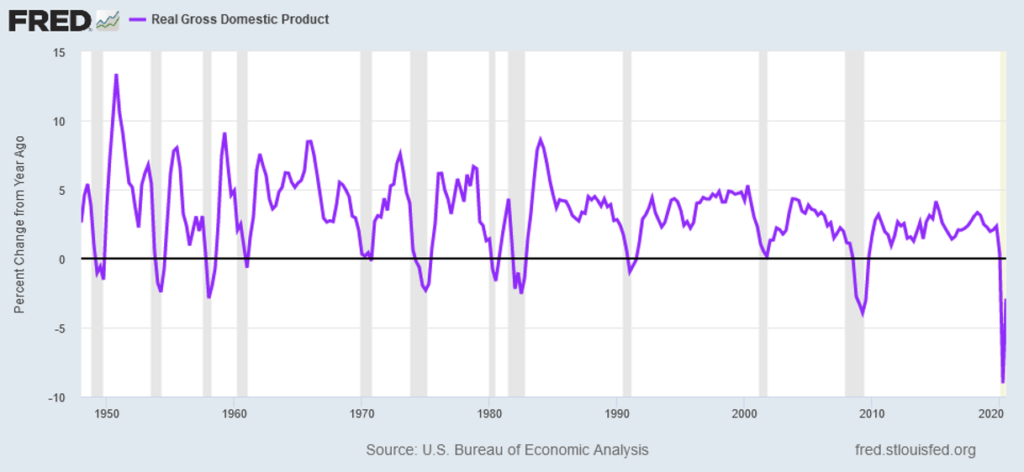

If one did not know better, this looks just like the contractions and recoveries from the 1950s. In those recessions, the US exhibited a sharp downward spike followed by an equally sharp recovery. In today’s case, the depth is greater, but the spike upward towards recovery stands equally sharp:

For the US, the recovery looks more and more like a normal recovery. Housing and Autos continue to lead with manufacturing just behind, as factory output races to catch up with demand and inventories need to be rebuilt. Following close on their will come travel, leisure, and capital spending, as profits recover, employment grows, and consumers resume their daily lives. With the US Beginning A New Climb, new heights stand ahead as economic growth drives onward and upward. (Data from The Federal Reserve, Trading Economics, Eurostat, National Association of Realtors, national economic databases, and public sources coupled with Green Drake Advisors analysis.)

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2020 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.