Inflation: The Campfire Stands Primed and Ready

“Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts, and even beyond their expectations or desires, become ‘profiteers’, who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, become so utterly disordered as to be almost meaningless and the process of wealth-getting degenerates into a gamble and a lottery.”

The Economic Consequences of the Peace

Chapter VI: Europe After the Treaty

By John Maynard Keynes, 1919

The positive economic impact of government stimulus coupled with central bank money printing stands clear in 2020, as it offsets the impact of a government mandated shutdown of the economy. Given reopening and the massive forced savings of consumers accumulated during the shutdown, as the economy reopens and consumers can spend these unwanted savings, the economy will play catchup and likely snap back much faster then commonly perceived. Thus, economic growth will likely accelerate as the year progresses with activity accelerating late this year as the economy prepares for the availability of a vaccine and a return to normal. Unfortunately, as the economy regains steam next year, the negative intermediate term aspects of all this stimulus will rear their ugly heads as the massive additions to money in circulation, hidden by the downturn, will become clear in an upturn.

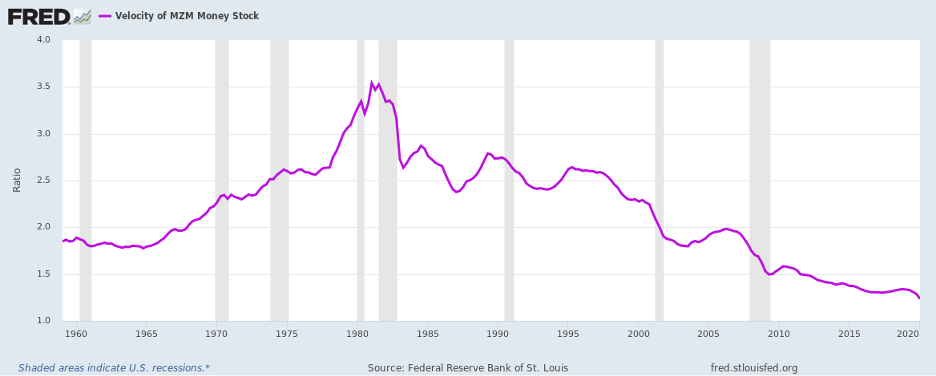

In a recession, economic activity shrinks. As a result, people buy fewer things and the demand for money falls. Thus, money circulates less or, what in economese is stated in the following terms so it sounds sophisticated, “Monetary Velocity Slows”. Here is what the latest long term chart of Monetary Velocity for MZM, the broadest aggregate of money in the US Economy, looks like:

As is clear from the chart, “Monetary Velocity” slows during a recession and typically picks up afterward, as economic growth recovers. This year, Velocity took a dip down, as is normal in a recession. And next year, it should rise as things return to normal. The well-known equation for Money and how it circulates in the economy is:

M*V = P*Q

M = Money

V = Velocity

P = Price

Q = Quantity

If we were to use this to examine the recent changes in Money and their projected impact on the economy, here is what we would find:

M = +60% or 1.6x its prior level

V = -7.5% or 0.925x its prior level

Or:

MV = 1.1985x its December 2019 Level

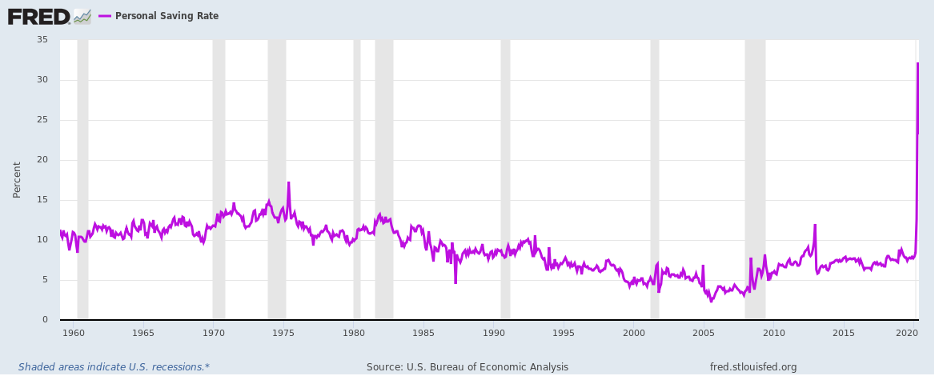

In other words, the aggregate of the two has risen significantly. And, as in any equation that purports to approximate the real world, it should balance. Now, let’s examine the other side of the equation: PQ. We will start by examining consumer savings followed by spending. Based on recent government data, the US Savings Rate hit 32% in April and dropped back to 23% in May. As the following chart demonstrates, this contrasts with the norm for the past several decades when the US Personal Savings Rate averaged 7% – 8% :

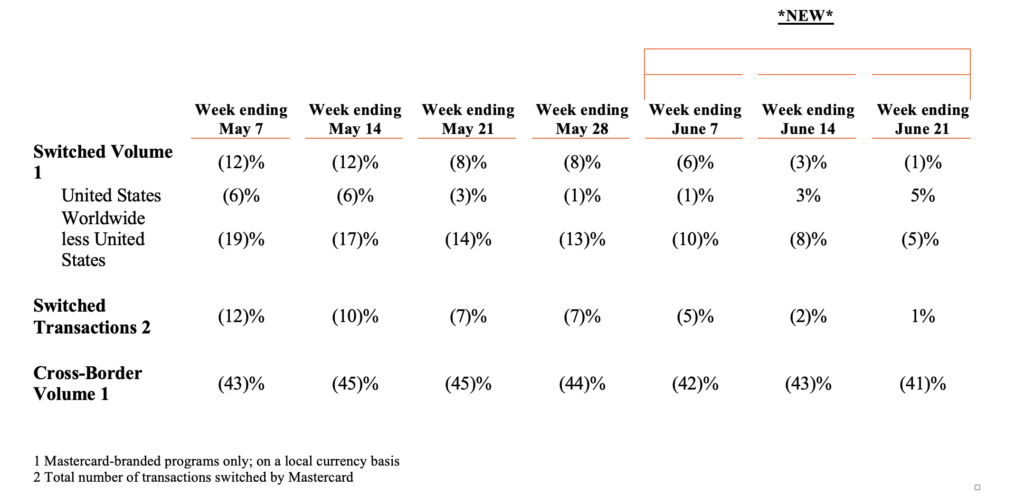

In other words, the Savings Rate spiked to 4+x normal in April as the government forced consumers to stay home. And now, as reopening advances, it has fallen to just 3x normal. If one were to think about this from a non-economic viewpoint, the consumer was forced to save as all the places she or he normally spent money were closed and travel became restricted. The money literally went into the bank. And now, as reopening allows the consumer to start to spend money as normal, money began to stop flowing into the bank account and instead began to flow into the real economy. The following data released by Mastercard on June 24, shows the shape of the spending recovery:

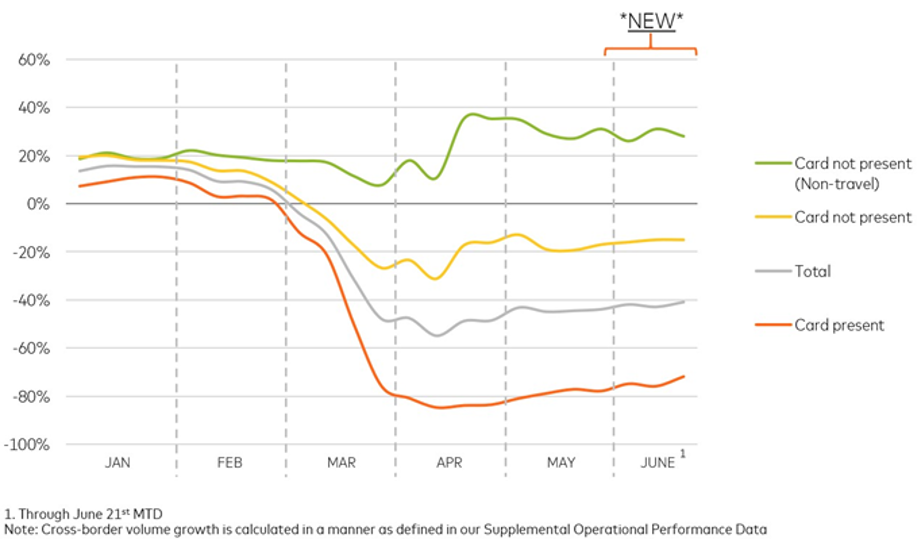

As the above table makes clear, core card spending volumes recovered in the US over the past two months and now stand up on a year over year basis. The data also demonstrate that cross-border volumes, which drive travel, hotels, restaurants, … still remain over 40% below year ago levels. The following chart makes clear this divergence:

So, as indicated in the above data, while stay-at-home spending exploded upward, all other spending collapsed, leaving overall spending some 40% below normal, as “Card Present” transactions remain down over 70% year-over-year.

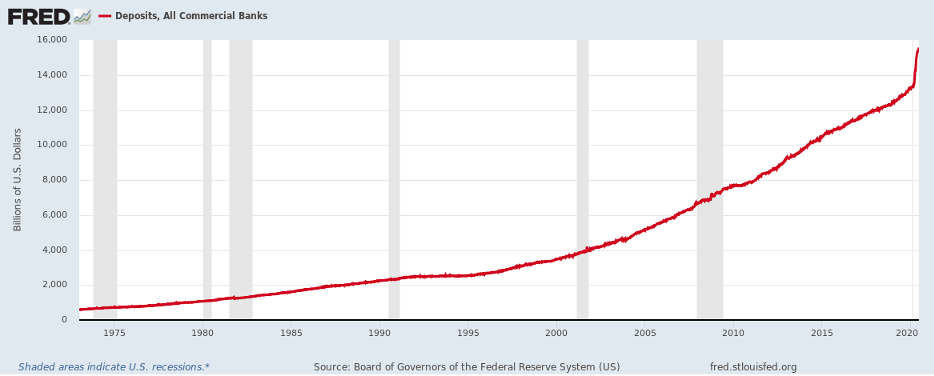

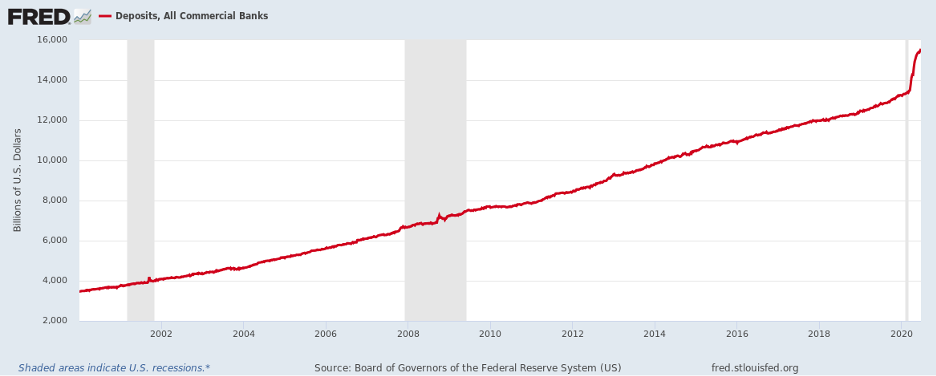

This brings us back to PQ in the above equation. If MV stands up ~20% and the Quantity of goods stands much lower, Price, according to the equation, should stand up significantly. But inflation continues to collapse. So, how to reconcile these two opposing forces. One way would be if the money went under the mattresses of the consumer. And this appears exactly what occurred:

And if we examine just the past 20 years, the chart looks as follows:

In other words, the consumer took ~$2.3 Trillion and put it under the mattress in the form of bank deposits that pay ~0% interest. And this all happened from February to June. If the Consumer acted in this manner over 12 months, there would appear almost $7 Trillion in additional savings or 33% of the GDP produced in the U.S. in 2019. And if we take $2.3 Trillion out of the amount of Money in the above equation, the effective change in M in the above equation is zero. Thus, with Money effectively flat and Velocity down, the inflation results all make sense.

The real question is what happens when the economy reopens and all this money comes into play. Other data, which breaks down the savings data by income level, show the savings have mainly occurred among the Top 25% of wage earners. These earners represent a disproportionate portion of spending in areas such as travel, restaurants, retail, … With the epidemic shutting down this portion of the economy, they have been unable to spend. However, as the economy opens up, they will want to resume as much of their normal lives as possible. And once a vaccine comes to market in Q1 2021 and the population can reach some form of herd immunity, spending in this key cohort likely will make up for lost time. In other words, a tsunami of spending will hit the economy starting in late Q1 2021 or in Q2 2021 as consumers will once more feel comfortable in their favorite restaurant, watching their local sports team live, and attending a movie.

Now let us return to the equation above. With much of the $2.3 Trillion moving back into the real economy, the effective change in M above will turn strongly positive. At the same time, V, the rate at which money circulates in the economy, will start moving upward. Thus, MV should rise strongly. On the other side, there will occur a recovery in the amount of goods and services transacting in the economy or Q should rise nicely. But with a sudden surge in demand, pricing should begin to recover for these goods and services. For example, prices for key commodities related to the global economy already have begun to move upward strongly. Should the global economy really recover, these prices should rise even more. Couple this with the amount of money created and rising global protectionism, then inflation should move upward, in a similar fashion to what occurred in the early 1970s.

Given the likely sequence of events and a similar position of the economy to that of the late 1960s and, before that, the late 1930s, while Inflation remains quiescent currently, it should begin to awaken from a long slumber. With the Federal Reserve massively expanding the Money Supply, The Campfire Stands Primed and Ready with plenty of combustible fuel. All it needs is a match in the form of resumed consumer spending. And, once it ignites, it should throw off quite some warmth with spectacular flames. (Data from the Federal Reserve coupled with Green Drake Advisors analysis.)

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2020 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.