The Beginning of the End

For the Global Economy, Late Cycle stands as a euphemism. The Global Economy sits in Extra Innings, as governments attempt to prevent the inevitable back half of the cycle. Each side continues to bring in their relief corps of pitchers. However, the ability of the pitchers to handle the batters coming to the plate continues to deteriorate. And the likelihood of one of them hitting it out of the park continues to rise. In China, despite multiple rounds of required reserve cuts and additional fiscal stimulus, economic growth continues to slow. The economy then took it on the chin from the Coronavirus, in what appears a boxer’s Standing 8 Count. While the economy will bounce back once the quarantines are lifted, as the Chinese government likely will do whatever it takes, with the boxer already woozy, the next blow likely will lead to a knockout. In the US, the Federal Reserve reversed course from its policy of raising rates and pulling money out of the economy, as it became clear that continuing down this path would cause a recession in an election year. However, with unemployment low and resources tight in the economy, typical negative late cycle issues have shown early signs of rising from the mud, where they have lain dormant. As they continue to come into view, the Federal Reserve likely will reverse course once more. And, unfortunately, this likely will occur at the same time as many of the natural economic cycles roll over after a long expansion. In Europe, nationalism continues to rise as the European experiment continues to produce economic goose eggs. The latest elections from Ireland and Germany continue this trend. And with the EU beginning to disintegrate, economic issues will continue to come to the fore. Despite the appointment of Madame Lagarde to head the ECB, the populace continues to grow restless with the pitchforks getting sharpened. For the Emerging Markets, troubles in China will create troubles at home. With many EM economies betting their futures on China, the long term problems there coupled with a secular growth slowdown will reverberate across the EM globe. While in the near term, post-virus, the Global Economy will mount a snapback, creating strong global growth in H2 after a weak Q1 followed by a mediocre Q2, these forces, already set in motion, represent the Beginning of the End for the Global Economic Cycle, with the short trip to the summit ahead followed by the long trip back down the mountain.

Dragon Sickness & Recovery & Dragon Sickness Again

For China, the Coronavirus illustrates the competing demands on the government. Initially, the government attempted to hide the virus outbreak and keep it quiet. But, as the virus spread, containing the virus became a national health emergency. By not addressing this early on, the crisis forced China to effectively shut down the economy in order to manage the spreading disease and panic. And while the draconian measures appear to enable those fighting the disease to make progress and the Chinese government shows early signs of trying to get the country back to work, quarantines remain in many major metropolitan areas due to the highly contagious nature of the virus. (Due to the refusal of China to allow Western scientists into the country to track down the origin of the virus, many speculate that this virus originated from the bio-weapons facility in Wuhan, as a mutated bat coronavirus. This is due to the 14 day incubation period and the highly contagious nature of the virus, allowing it to spread without any outward sign. Typical bat coronavirus is not contagious and not easily transmitted from the bat to humans without physical contact.) Recent economic data indicate the severity of the problem. Chinese consumption stands 40% below normal. Freight traffic dropped 45% year over year. Air traffic stands down almost 80%. Oil consumption and natural gas consumption collapsed domestically, leading China to declare Force Majeure on imports. According to the International Energy Agency, due to the collapse in demand in China and the spillover from the Chinese economy, global crude oil consumption will drop 435,000 barrels per day in Q1 instead of growing 1.2 million barrels per day, a swing of over 1.5 million barrels a day. February Industrial Production in China appears down 15% or more. Whatever statistics the Chinese government prints, reality indicates the economy shrank in Q1 for the first time in decades.

While the bad news sits on the front page of the newspaper, the Chinese economy likely will trace the typical economic pathway seen by economies after severe, short term contractions. After the rubber band is pulled taught, once it releases, it snaps back rapidly to normal and beyond to make up for the tension. In China’s case, this likely means economic growth explodes upward exiting Q2 as the normal snapback occurs coupled with additional stimulus, to ensure economic growth heading into China’s once very 5 year meeting of the Chinese Communist Party in 2021. Thus, Chinese growth could approach double digits in Q3. Of course, if the Coronavirus crisis drags on, Chinese growth will continue to suffer during Q2 with the snapback not occurring until late Q3.

For China, while COVID-19, as the virus is known to the WHO, will dictate the short term swings in the economy, the longer term malaise and clear secular growth slowdown will not disappear. Chinese Investment stands at almost 45% of GDP. For an economy with much of industry already built out, an in place highway and rail system, export share of global trade having peaked, the labor force shrinking, and labor income levels rising into middle income status, such Investment stands well above sustainable levels. For China, Investment to GDP will shrink rapidly over the next decade as its economy must adjust to these factors coupled with a world less willing to take its goods and the inevitable conflict with Developed Market economies as it attempts to steal share from their core industrial and technology industries. For the DM looking to protect their economies and recapture their economic growth, the likely end game appears a world divided into a Chinese and DM spheres with some EM economies dealing with both, but most forced to choose sides, due to the fight over technology. Should Investment to GDP shrink to 25% or less, a reasonable target for a more mature economy, Chinese growth will face a 2% of GDP per annum headwind. And with Investment to GDP falling coupled with a shrinking labor force, Chinese growth could rapidly slow to 3% or less per annum over the next 5 years. And, in fact, some data, prior to the virus, indicated that real Chinese economic growth might stand closer to 3% than the 6% number the government publishes. For China, unfortunately, Dragon Sickness & Recovery will quickly lead to Dragon Sickness Again, likely starting in the 2022 – 2024 time frame.

A Setting Sun

Japan continues to face both short term and secular issues. As recent data show, the Japanese economy shrank 1.6% in Q4 compared to Q3 and over 1% on a year-over-year basis. This decline stems from the increase in the consumption tax implemented in the fall coupled with the global inventory correction. And this comes before any impact from the Coronavirus this quarter. Given the economic dislocations in China, leading to reduced exports from Japan and a collapse in tourism from China, Japanese GDP will likely fall again in Q1 both sequentially and year-over-year. This will produce another recession in Japan despite the implementation of Abenomics. For Japan, this represents a second recession in just five years.

With a recession in the background, a series of difficult decisions lies ahead. From a cyclical perspective, the government must deal with the recession. Fortunately, the global inventory cycle stands near a bottom. And should Chinese actions to contain the Coronavirus succeed, as appears possible, then the Japanese economy would begin a cyclical rebound in Q2. However, this does not solve the longer term issues for Japan. The country must increase spending on defense, to meet the challenge from China, at the same time as it must provide social benefits to an aging population, to meet social program requirements, at the same time as it must raise tax revenue, to fund its needs. Furthermore, Government Debt to GDP continues to rise and already crossed the 200% threshold and demographics forecast a shrinking population. In addition, with the Made in China 2025, exports of high value goods to China continues to come under pressure. This comes on top of a United States looking to localize more production. The only out will fall to government spending and spurring domestic consumption. In addition, the government will likely move to monetize the government’s debt via the Bank of Japan, using some form of Modern Monetary Theory. For Japan, A Setting Sun will dominate its future.

Tiger Taming Southeast Asia’s Tigers continue their investment led growth, despite the issues emanating from the virus in China and the looming longer term adjustment for the global economy. Malaysia is expected to grow 4.0%, Indonesia 5.0%, and Vietnam 6.0%+. The Philippines joined this growth club over the past few years by tripling Investment spending by the government, driving its growth rate to 6%+. However, as a significant portion of these countries’ growth comes from exports to China for reexport as processed or final goods product to Developed Markets, estimated at 35%+ of their exports, the disruption from the virus will weigh on Q1 growth. In addition, with China’s export led growth strategy starting to take on water, tying their economies to China’s industrial growth may turn into a double edged sword. And this will occur prior to the United States seriously focusing on redomesticating manufacturing for global strategic reasons. Furthermore, certain Southeast Asian economies already have begun to exhibit the limits to these types of growth plans. Thailand and Singapore experienced secular growth slowdowns over the past decade. And Malaysia’s growth slowed as well despite its actions.

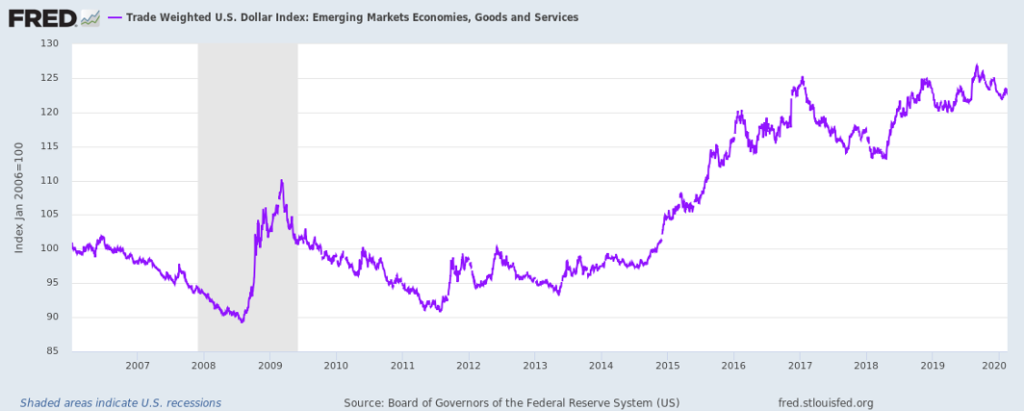

This growth slowdown occurred despite the significant depreciation engineered in their currencies over the past few years. As the below chart indicates, the EM countries engineered a 25% rise in the value of the US Dollar against their currencies over the past 5 years:

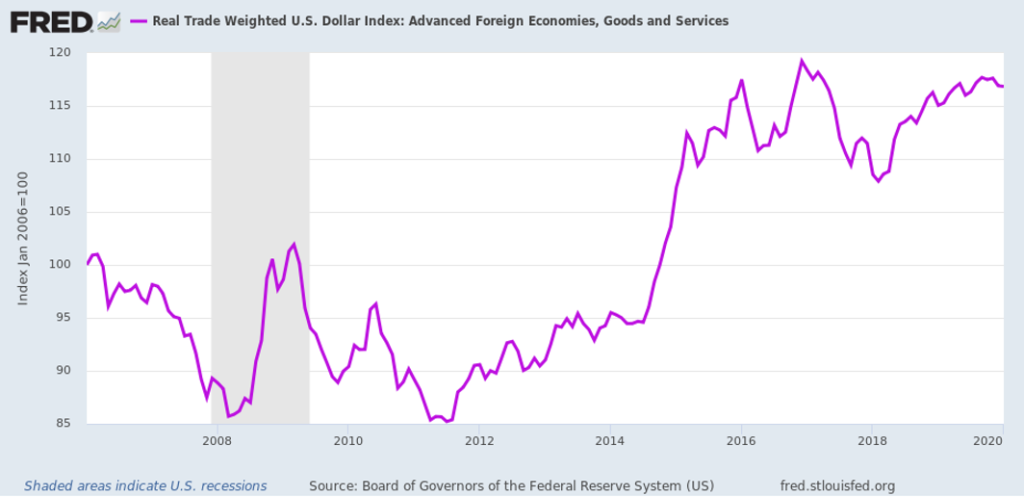

While the United States has yet to enter the currency markets to reverse the levitation of its currency and the associated growth hit due to EM depreciations, political pressures are rising to address this issue. And once they come to the fore, the United States could move aggressively to address this issue. Already the US Dollar appears to have peaked against the Major Currencies:

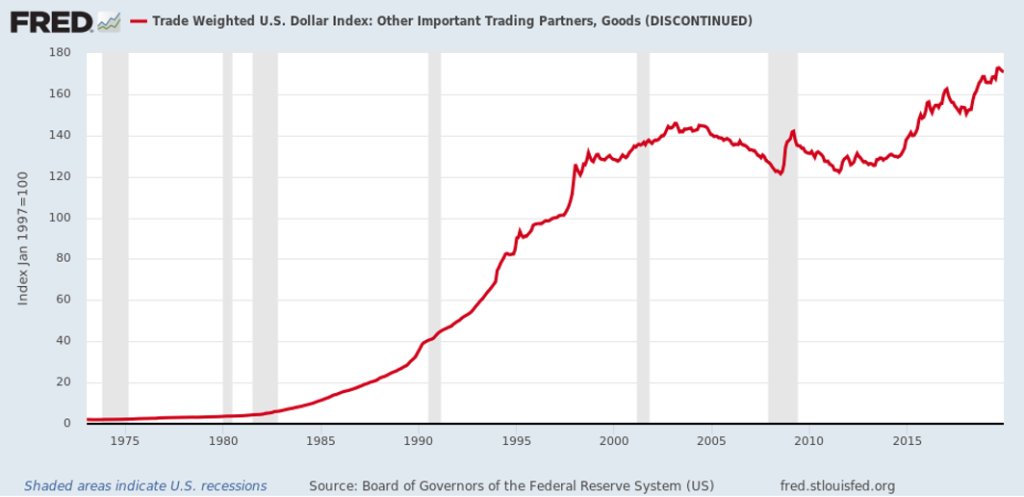

This comes as the U.S. Federal Reserve engineers a mini-QE and interest rate cuts. With the likely outcome of the next U.S. recession being a reprise of the 1940s, with both money growth and inflation accelerating, the natural direction of the US Dollar will become downward. And, from a long term perspective, the currency possesses a long way to move on the down side against the EM Currencies, as the following chart demonstrates:

Should the US move in this direction, then the Asian Tigers would find additional drag on their economies on top of their maturing economic positions. And Tiger Taming would become the norm not the exception, providing a jolt to a way of doing business over the past 50 years.

Elephant Credit

The fallout from the collapse of the Non-Bank Financial Sector (NBFS) continues. India grew only 4.5% in 2019, Q4 over Q4. This represents the slowest growth in years. Both the auto sector and housing shrank in 2019 as credit became cut off. India now possesses between 150 and 200 major housing projects that stand in limbo, without access to credit. And while India will benefit somewhat from the end to the Global Inventory Cycle, its economy stands less open than many of its brethren. Although, it will take a hit in Q1 as the Coronavirus impacts intermediate goods it receives from China for export in final goods. The key to a true growth acceleration lies with the government rescuing numerous NBFS institutions that stand just one foot from the grave. And while the true survivors have begun to receive access to the capital markets, the walking wounded need an immediate blood transfusion followed by major surgery to return them to the line of duty. Today’s status looks like the typical aftermath of a credit induced binge, much as in the US in 2009. And while the agricultural sector continues to recover from last year’s massive rains, the country will need Elephant Credit, in the form of rescues, from the government, in order to truly restart growth.

The Beat Goes On

Despite the issues in China and the obvious hit to Brazil’s commodity sector, the Brazilian economy stands ready to accelerate as the economy benefits from the massive currency depreciation of the past three years. With the undervalued currency cut by a further one third, leaving it valued at one half its fair value according to the OECD, using Brazil as a base for manufacturing becomes a logical outcome. Foreign Direct Investment numbers over the past 12 months indicate theory matches reality as the country received $78.3 billion in FDI or 4.3% of GDP. Other economic statistics indicate that Brazilian growth continues apace despite the headline noise about the economy. Unemployment fell to 11% in December. And multi-national corporations continue to report reasonable growth for the country whether in the hypermarkets or in cellular demand. The only place the growth appears missing stands in the GDP statistics, which indicate the economy grew only 1.1% in 2019. Notwithstanding such a headline number, it remains clear that The Beat Goes On and likely will accelerate once the global Coronavirus impact passes.

Old Man Reality

For Europe, especially Germany, global trade stands as an important driver of economic growth. And any moves in global manufacturing produce a magnified impact. The Global Inventory Correction over the past two years coupled with a slowdown in global trade disproportionately impacted Germany, sending its economy effectively into a recession, with ripple effects on the remainder of Europe. With the downward move close to an end, it appeared that Europe stood poised to benefit from a turn in the Global Inventory Cycle. Semiconductors already turned upward in 2019 and manufacturing appeared poised to follow in H1 2020. The Orders to Inventory Ratio for the Purchasing Managers Index (PMI) turned upward, signally an imminent turn in manufacturing production. Then along came the Coronavirus, hitting China’s economy. This may push out the turn by a few months, depending on the virus’s spread, but likely will not derail the cycle. For Europe, this will come as welcome relief after Brexit.

However, the turn upward in Global Manufacturing will not make the underlying economic issues go away. For Europe, a day of reckoning lies ahead as economic reality rears its ugly head. For the Economic Reality for Europe indicates the EU, as constructed, only benefits select countries, leaving other countries behind with little to no real growth and flat to declining living standards for their citizens. Should any politician stand up in front of the electorate and state that they will deliver lower real earnings and higher unemployment, they would become the recipients of boos and rotten tomatoes and need to scamper off the stage. They also might not have a job waiting for them. With the inevitable result of the economic policies adopted by the EU on full display after 20 years, the electorates in those countries left behind now understand the consequences of these policies. And they continue to search for alternatives that would restore the growth they enjoyed prior to the Euro coming into existence and their local currencies disappearing. Unfortunately, the obvious solution, a breakup of the EU and a return to the European Common Market, stands anathema to the countries that benefitted from the current situation. However, with the United Kingdom showing the path to exit and the reality of limited consequences to such an exit, other countries will feel the pull to follow the Brits down this pathway. The obvious candidates stand Italy and Spain. With Italy already having one foot out the door, the EU put Madame Lagarde, the former French Finance Minister, in charge of the ECB, as a last ditch attempt to keep Italy in the EU. However, how much power Madame Lagarde really possesses to change the institutional inertia at the ECB remains to be seen. Should the ECB not adopt a significantly more proactive economic policy and push for significant fiscal stimulus, especially by Germany, to drive economic growth upward, the path of least resistance for the laggards in Europe becomes another messy exit. In other words, should the ECB continue to play the fiddle while Rome burns, the world likely will witness the premier of the Italian soap opera Itexit followed by the Spanish soap opera Espexit. With this Old Man Reality ahead, there stand no easy answers for the EU.

The Climb To The Top

For the United States, the economy continues to track the late cycle bounces seen in the late 1990s and late 1960s that concluded those economic cycles. The January PMI Indices for both manufacturing and services indicate a similar economic reacceleration to those seen in 1999 and 1967. And while the Coronavirus likely will impact February and March and much of Q2, the Global Inventory Cycle, a snapback in China, additional global central bank stimulus, and the domestic Housing Cycle should underpin economic growth.

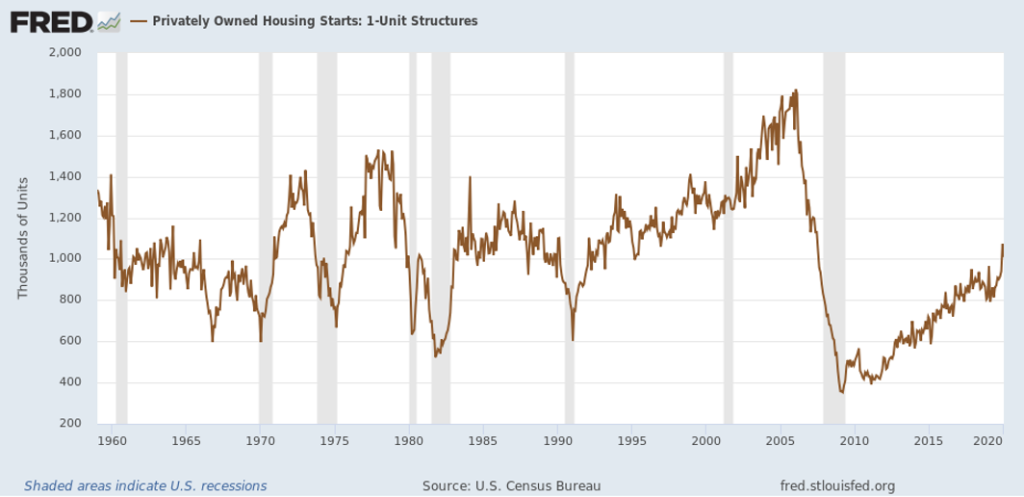

The Housing Cycle continues onward, much as in the late 1990s. As the following chart demonstrates, single family starts recently exploded to the upside as interest rates fell:

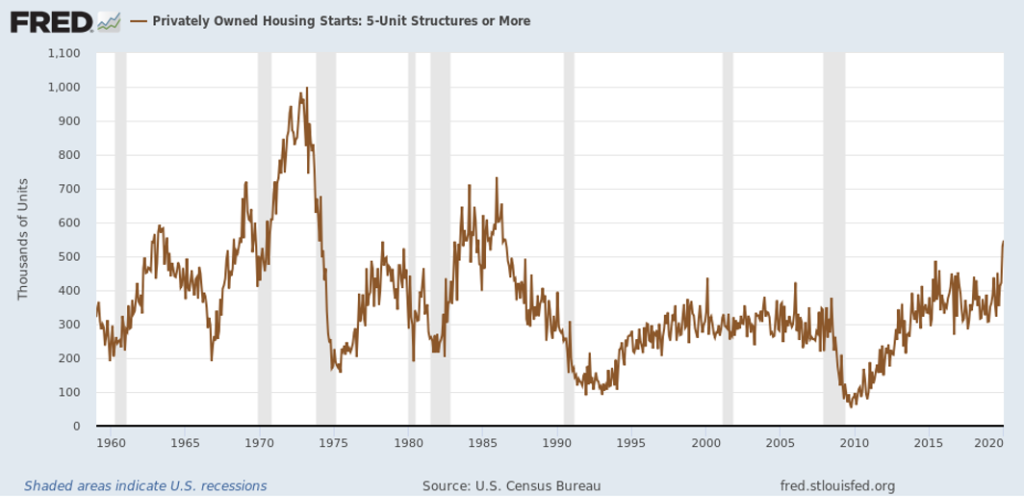

This rise mirrors what occurred in 1998, which should come as no surprise. Multi-Family Starts exploded upward as well recently, to their highest levels since the 1980s, as capital continues to flow into the commercial rental sector:

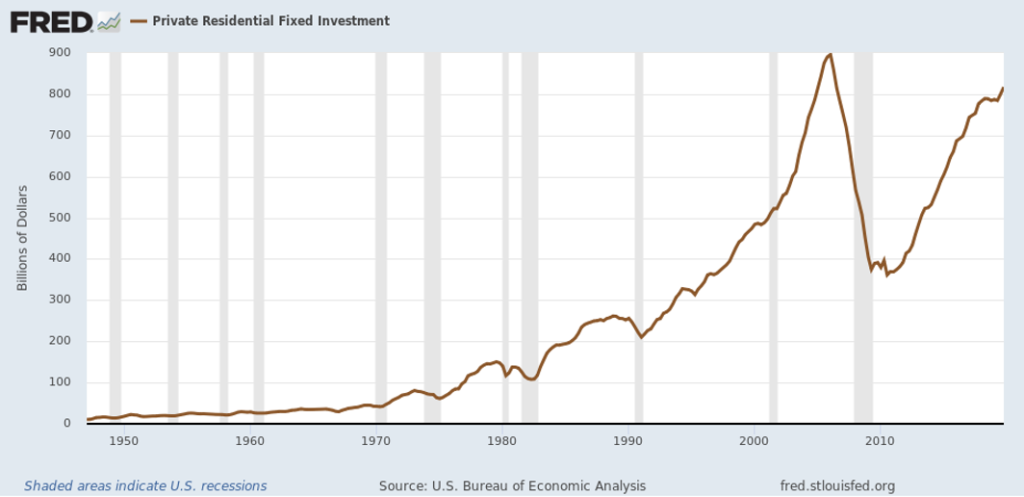

And with the explosion upward in starts, Residential Fixed Investment spending headed upward once more:

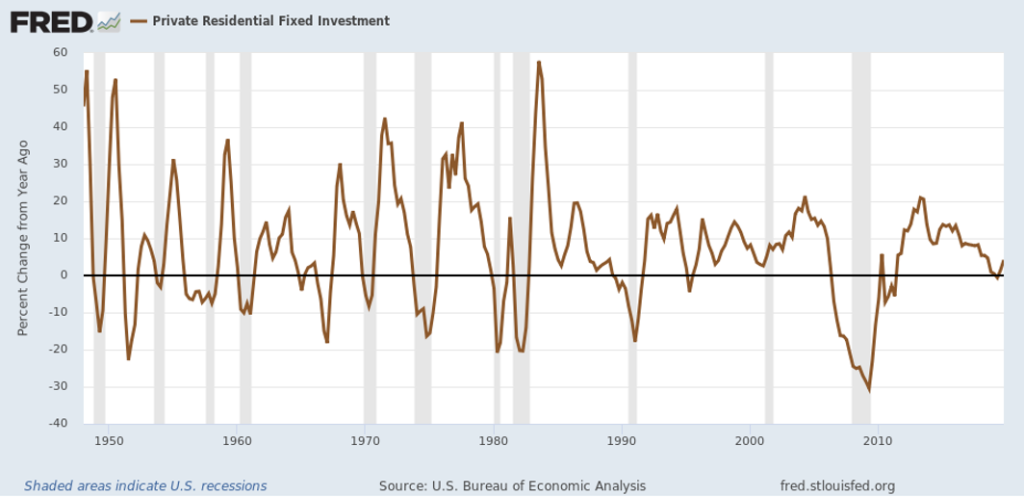

And began to accelerate on a year-over-year basis:

As Housing permeates everything in the economy from copper usage to plastic to manufacturing to labor to banking to insurance to consumer spending, it should produce a salutary impact on economic growth.

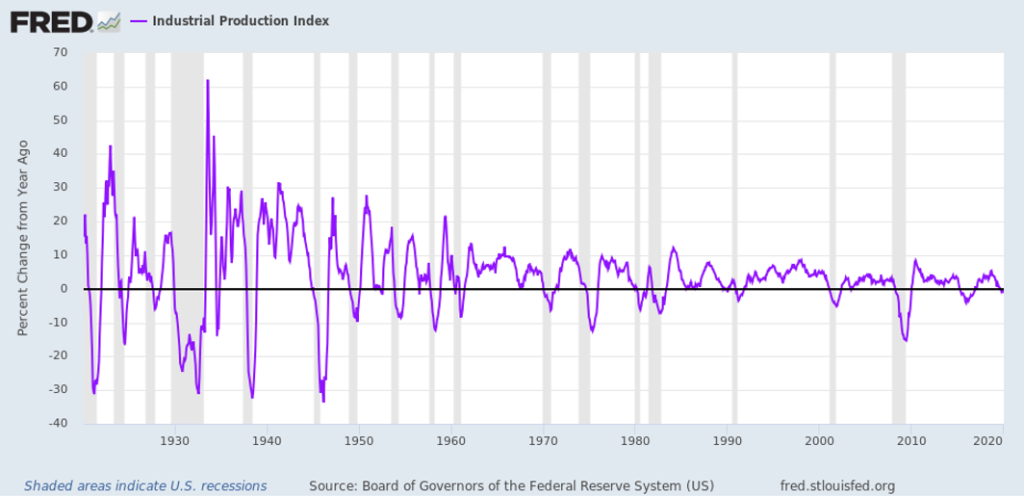

This bounce in Housing will come just in time to offset an issue on the industrial side of the economy. Besides the impact of the Global Inventory Correction, the US suffered from the Boeing woes, leading the company to shut down airplane production temporarily. Estimates put this growth impact at 0.5% of GDP for Q1 and potentially a similar impact in Q2. As the following chart shows, Industrial Production turned slightly negative on a year-over-year basis recently, but not nearly to the extent it did in the 2014 – 2016 time frame:

The pullback, to date, looks more like 1998 than 2015. With the looming snapback in China’s industry and Boeing likely to resume production shortly, as its plane finally receives the green light from the FAA, US Industrial Production will likely turn upward again, reinforcing the growth impetus from Housing.

However, all is not coming up roses in the economy. Fundamentals for Commercial Real Estate continue to erode. Defaults on commercial properties, such as hotels, turned upward over the last year, a fact not lost on Senior Loan Officers at commercial banks. The Federal Reserve’s Senior Loan Officer Survey shows a clear tightening trend for Commercial Real Estate. In addition, areas such as Self Storage continue to add significant amounts of capacity leading to revenue growth but no income growth from facilities, as margins come under pressure. Despite what appears a potential top in Commercial Real Estate, Non-Residential Construction rose 3% in 2019. However, that belies the underlying reality. Private Non-Residential Construction actually fell 2.7%. Only a 7.3% rise in Public Construction masked this weakness. Furthermore, ratings agencies began to reexamine corporate debt ratings. As previously documented, U.S. corporate debt remains an accident waiting to happen.

The recent downgrade of Kraft to junk status illustrates this risk. The bonds dropped almost 10% the day the downgrade occurred to junk status. And this was during a bull market for bonds. Should the economy hit a real soft spot, such as a recession, a large number of bonds could find themselves no longer investment grade leading to a stampede for the exits, with deleterious economic impact to the companies and the economy.

With the US economy standing in a late cycle position, various props for the economy continue to slowly disappear. However, with the Housing Sector heading upward and Industrial Production likely to follow later this year, the economy should provide one last move upward. And with Consumer Spending continuing to grow and Government following the typical election year script, the economy should continue onward and upward. This would stand as the classic Final Hurrah for the economy before the inevitable plunge as the US makes The Climb To The Top.

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2020 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.