Stimulating a Late Stage Economy: The Final Hurrah

The Global Economy stands in a late cycle position with a slowdown underway. Numerous countries either sit in recession or continue to experience decelerating growth. This mostly stems from the rush to push goods into the United States in 2018 prior to the imposition of tariffs, overstating the true underlying growth of the Global Economy, and the hangover that ensued when the U.S. Federal Reserve misinterpreted the tariff rush with true economic growth. This occurred at the same time the Chinese government squeezed its Shadow Banking sector, tightening credit to its economy. As a result, the Global Economy needed to deal with not just an inventory adjustment and the typical manufacturing contraction that ensues, but credit tightening in the two largest economies in the world. This led to a much sharper global slowdown in 2019 than most expected. In response, over 30 Global Central Banks eased over the past six months. In addition, countries such as China and India acted to stimulate their economies. Based on leading indicators, such as the China Credit Pulse, their actions will bring success in 2020.

However, such success will not come without costs. Profit margins around the globe likely have peaked for this economic cycle. With growth once more accelerating, labor costs and input costs likely will reaccelerate. As businesses raise prices to offset these cost pressures, inflation should rise in response. Inflation already sits at the high end of acceptable ranges in numerous countries, due to the late cycle nature of the Global Economy. Should it accelerate from here, Central Banks likely would act, as in the past, to restrain further increases. Any slowdown would put further pressure on corporations, likely leading them to cut costs, including labor costs. Should that morph into a consumer spending slowdown, then a negative feedback loop would ensue, plunging the Global Economy into recession. While this potential scenario should not create an issue in 2020, as the Global Economy reaccelerates, this scenario should assert itself in 2021 and 2022 given the likely sequence of events coupled with another downturn in the Global Inventory Cycle.

Dragon Middle Age

For China, adjusting to Middle Age continues to prove difficult, as certain realities force themselves upon the economy yet policy has yet to acknowledge this fundamental change in economic growth. China’s leaders continue to push on the two traditional levers that drove its economy over the past 20 years. First, the country continues to build out industries via State Owned Enterprises (SOEs), in areas such as chemicals, healthcare, and technology, forcing Intellectual Property (IP) transfer or stealing it, using government funds to do so. China’s recent investment into creating a chemical Polycarbonate industry to service its needs stands as a classic example of this. China will add 20%+ to global capacity of Polycarbonate between 2018 and 2020, to meet domestic demand and then some. This will drive global operating rates, outside of China, into the low 70’s % in the rest of the world, forcing most foreign chemical companies into a money losing position as China cuts off its markets from imports. This cutting off of foreign imports will ensure its domestic industry earns profits. China will then export any excess production to international markets, further exacerbating the imbalance they created between global supply and global demand. For existing producers and the countries where they are located, this will prove problematic. (As this industry did not exist in China beforehand, one might wonder where the technology originated.) Second, the government continues to push on the Investment lever to reaccelerate its economy, despite Investment still comprising almost 45% of GDP, well above normalized levels given its stage of economic development. The latest move concerns Local Government Bonds (LGBs). In China, a significant portion of Investment comes through the local governments. They issue LGBs and contribute the proceeds as Equity to build infrastructure and manufacturing plant. The projects, funded with this 25% “Equity” contribution from the local governments, then borrow the remaining 75% from State Owned Banks. Of course, with proper accounting, the project funding comprises 100% Debt. China recently changed the rules, lowering the required “Equity” contribution by the local governments from 25% to 20%. This will increase their ability to fund projects by 25%, providing significantly more stimulus next year for the same amount of LGB issuance. The following illustration will make this clear. Let’s assume a Local Government could invest ¥100 million into projects. Under the prior rules, this would allow ¥300 million in borrowing for a total investment of ¥400 million. However, with the drop from 25% to 20% “Equity”, the same ¥100 million supports ¥400 million in borrowing, enabling ¥500 million in investment. As this money is deployed in 2020, public Investment should reaccelerate, aiding economic growth.

On top of these two “traditional” measures to drive its growth, China continues to implement normal monetary and fiscal stimulus policies, that one can see utilized in the U.S. or Europe. The People’s Bank of China (PBOC) over the past year lowered interest rates, lowered Required Reserve Requirements, and injected Money into the system. Fiscal stimulus increased as the overall government budget deficit expanded over 1% relative to GDP. This looks no different than any Western economy. And the results should look similar, faster economic growth next year. When coupled with the “traditional” measures above, China’s economic growth should accelerate in 2020, especially as the Global Inventory Correction comes to an end in the first half.

However, these actions to maintain 6%+ growth and avoid the Middle Income Trap will play out across a maturing economy with fundamentally lower organic growth coupled with, what will likely become, an increasingly difficult external trade environment and the resultant impact on Foreign Direct Investment (FDI). First, typical levels of Investment to GDP for an economy that stands at China’s stage of development sit in the mid-20’s not the mid 40’s. In other words, Investment to GDP stands 15% to 20% above normalized levels. Continuing to invest at such levels can only produce massive amounts of assets unable to deliver returns to cover their cost of capital. Second, with capacity utilization across many areas of the economy sitting at 55% to 65%, continued Investment makes little economic sense. For example, Capacity Utilization in autos stands below 65%. Yet, more auto plants sit under construction. Third, massive overcapacity puts stress on the ability of assets to produce cash flow to service the massive amounts of debt China, as a country, put in place. And while the government can purchase the debt and cancel it, such actions by governments historically lead to massive inflation, which would undermine China’s focus on social stability. One need only examine France and the 1920s to see what happened when a government moves to monetize significant amounts of public debt. When the French Central Bank did so, inflation exploded in the country and the currency collapsed. And Fourth, as China disregards normal economic rules to continue to grow its economy, outside countries will continue to progressively cut off their markets to Chinese goods and shut down capital flows into the country.

China’s actions to become the supplier to the world at the expense of every other country’s industry produced a global reaction over the past five years. While the actions of The United States make the front page, movements by other countries will impact China as much if not more over the intermediate term. For example, recent actions by Taiwan continue to have reverberations across China. Taiwan enacted legislation to encourage to encourage Taiwanese companies to relocate manufacturing production back to Taiwan. As a result, manufacturing investment in Taiwan grew over 40% year over year in 2019, real estate demand soared, and economic growth accelerated. However, FDI into China fell 55% year over year. With multi-nationals relocating supply chains out of China, such an impact multiplies exponentially. Given this growing impact on its economy, there should exist no surprise on China’s actions to lower local government equity requirements into projects as it seeks to mitigate this impact. At best, this will come as a neutral impact on the economy. More likely, this represents a multi-year drag as Investment to GDP heads towards normalized levels.

In addition, China continues to consolidate industries into massive state controlled entities, effectively making them SOEs. Besides cementing government control, this action creates large domestic companies that can potentially dwarf foreign competition around the globe, enabling China to use them as an arm of its foreign policy. For example, the government announce it plans to consolidate the steel industry into 10 companies that initially control 60%+ of China’s capacity. With China producing 50% of the world’s steel and the larger consolidated companies likely possessing a 10%+ share of the Chinese market, these behemoths could each produce 5%+ of global steel, more than most countries. With state control becoming more explicit, the likely global reaction to these entities will only rise.

Combined with the massive growth in Debt to GDP, a shrinking population, and low to negative productivity growth, these actions by the Chinese government will likely ensure a more difficult transition to lower growth. In fact, such a transition could occur abruptly in the early 2020s, as the country runs out of exports to displace and markets in which to sell its ever growing capacity, disrupting global growth. Until then, the government appears set on a course of once more to the well, which is running dry, and postponing the day of reckoning. Unfortunately, in economics, postponing the bad usually only makes the downturn much worse when it comes. For China, Middle Age and all the issues it brings appear inevitable despite the actions of those in charge with a potential trip to the emergency room and long hospital recovery ahead.

The Setting Sun

For Japan, the maturing of China represents a double threat. First, as China attempts to maintain an unsustainable level of growth, the country continues to move to displace imports of high value goods. This will impact Japan’s critical exports of a variety of machine tools and other capital goods. Second, Japan will face competition in global markets from newly capitalized Chinese companies, backed by the Chinese government, that will attempt to wrest global market share from Japanese companies. This will put pressure on Japanese companies’ growth and global competitive position. Third, with China demanding local production from numerous entities, Japanese companies will continue to face pressure to move production from Japan to China if they wish to continue to sell goods in China.

Domestically, the recent increase in the VAT produced the expected front running of consumption. While not as high as during the last VAT increase, the rise in consumer purchases became notable for all hard goods, such as TVs, autos, washing machines, … Payback for this frontloading will occur in Q4 and Q1 putting additional pressure on the economy. Prime Minister Abe promised additional government stimulus to offset. However, with government Debt to GDP already at 200%+, the finances of the government appear a shambles. While governments can do anything in the short term, there exists no free lunch. With default unlikely and an austerity program with massive tax increases and spending cuts nowhere on the horizon, the likely path of least resistance stands through Door #3, monetization of debt by the Bank of Japan (BOJ).

The only things going for Japan appear the Global Inventory Cycle, an upturn in domestic Housing, and the U.S. continuing to allow it to sell cars and machinery manufactured in Japan into the U.S. markets. These should all benefit 2020 growth, after the VAT payback, enabling Japan to enjoy accelerating growth next year. However, the longer term issues will likely come to the fore as Japan wrestles with the next downturn in the Global Inventory Cycle in the 2021/2022 time frame and a potential global recession in the early 2020s. With A Setting Sun, difficult choices lie ahead for the country.

The Tiger in Stride

Southeast Asia continues to grow at a rapid pace. With 600 million people and GDP equivalent to $8 trillion at PPP, it stands a potent force in the global economy. Currently, the rejiggering of Global Supply Chains provides a tailwind, as companies move production out of China, leading to increased foreign Investment or FDI. Malaysia, Vietnam, and The Philippines benefit disproportionately from this trend, with other countries such as Indonesia participating as well. Malaysia is expected to grow 4.5% this year, Vietnam over 7%, The Philippines almost 6%, and Indonesia ~5%. Even slow growers, such as Thailand, are expected to grow 3%. With companies continuing to relocate global capacity here, growth should remain strong over the near term. U.S. pressure to move manufacturing plant back to the United States likely will not erupt into a major issue until after the next Presidential election. (Please see What’s Good For GM Is Not Good For America, Part 3: Whack-A-Mole, National Security, and The Coming Domestic Content Legislation in last month’s letter.)

In addition to this fundamental growth, these countries find themselves the recipient of infrastructure investment dollars from China, through its Belt & Road Initiative program (BRI). These investments carry a double-edged sword, as countries have realized, due to the risks to sovereignty from the debt China wants to pile on countries for effectively vendor financing. (Sri Lanka stands as the prime example of the risks from accepting such debt.) Thus, countries have put on hold projects previously approved and moved to renegotiate much of this investment. For example, Malaysia just finished renegotiating a railroad construction project led by Chinese companies. The cost of the project was magically renegotiated down from 65 billion ringgit to 44 billion ringgit. In addition, Malaysian company content will rise to 40% and 70% of the workers will be Malays. This comes after other portions of the rail line experienced price reductions of a third or more and similar increased Malaysian content. With China continuing to want to build its influence in Southeast Asia, these projects will continue, just at much fairer terms for the countries involved. Combined with the relocation of global supply chains in the near term, The Tiger in Stride should continue for some time.

Elephant Finances

India continues to lumber along, with its fundamental growth constrained by the collapse of its Non-Bank Financial Companies (NBFCs). Over the past 5 years, these companies financed a significant portion of all auto sales in the country, through consumer loans, as well a large part of the housing industry, through loans to developers and through mortgages to those wishing to own a home. This role became necessary as State Owned Banks continue to lumber under the weight of large bad loan, yet to be cleaned up by the government. With default rates higher than planned on these loans, large AAA NBFCs, supposedly well financed, collapsed under the weight of these bad debts. As NBFCs comprise 40%+ of the financial system, this became bad news for the economy. Overnight, auto sales collapsed as buyers could not obtain loans for their purchases. Sales of 4 wheel vehicles are down 22% year over year and sales of 2 wheel vehicles are down 37%. In addition, financing for developers continues to dry up. As normally occurs when the financial sector collapses, ripples reverberate throughout the whole economy. Recent data on industrial production confirm this impact as IP shrank year-over-year in the latest statistics, despite consumption of consumer hard goods continuing to grow. Should India not address its financial system, recapitalizing it, more and more ripples will flow out from this collapse, threatening the economy with an 1800s type of outcome, including a nasty recession. However, it remains unclear whether the government in New Delhi stands ready to undertake this costly expense.

India faces other issues as well. With a late monsoon, producing drought initially, the monsoon turned into one of the wettest on record, producing the most rainfall since 1994. This left crops, hurt by the heat and late start to the season, now facing floods, leaving millions of acres of land underwater. This will hurt India’s spring sown crops, such as wheat, pulses, and cotton. With agriculture representing 15%+ of GDP and over 50% of the population employed in agriculture, this will create a new challenge to the government until the winter crops, such as rice, rapeseed, and chick peas, become harvested in the spring. The task for the Indian government will consist of delivering food and financial assistance to those devastated by nature’s wrath this year.

The government, despite already strained finances, promised help recently. This help likely will require more deficit spending and a reversal of the current government’s promise to address its budget deficit. While markets desire some amount of probity from the government, events appear to have overtaken market desires, providing the government little choice but to address the farm issues, to ensure its political position, and to address the NBFCs in order to prevent a manufacturing collapse. With Elephant Finances at the fore, it remain to be seen how the current government of Prime Minister Modi handles itself.

Samba in the Streets and The Latin American People Speak

For Brazil, life continues to improve after several tough years. Economic growth remains positive, underpinned by a cheap currency and strong FDI. FDI now stands at almost 4% of GDP. And despite disruptions, such as the national trucking strike or the Vale dam collapse, employment and industrial production trend upward. In addition, there exists real potential for Brazil to improve its finances. A pro-business regime sits in charge in Brasilia. And the Brazilian Congress remains focused on entitlement reform that would stabilize Brazil’s Debt to GDP and put the country on a positive financial trajectory. On the ground data, whether from global hypermarket companies or cellular phone companies, support the narrative of continued improvement in the underlying economy. Should Brazil remain on the current course, it will not be long before the Brazilian people Samba In The Streets.

Unfortunately, the rest of Latin America took steps onto an alternative pathway. This pathway includes riots in the streets and major damage to public infrastructure. In “stable” Chile, riots occurred over significant increases in subway fares. In Ecuador, protests originated in the cancellation of gasoline and other subsidies, causing the price of gasoline and heating fuels to rise 50% overnight. In Peru, the fight between the duly elected President and a corrupt Congress devolved into violence. And in Bolivia, the President abdicated after being accused of stealing an election and falsifying voting results. While each of these eruptions possesses a unique spark, the fuel for the explosions stands in the massive inequality in these countries and their inability to close the gap. Demonstrations and riots likely will continue over the near term as the average person presses the governments into moves to meet their demands. More than moves to merely placate the protestors in the near term appear needed as The Latin American People Speak Their Mind.

The Old Man Struggles

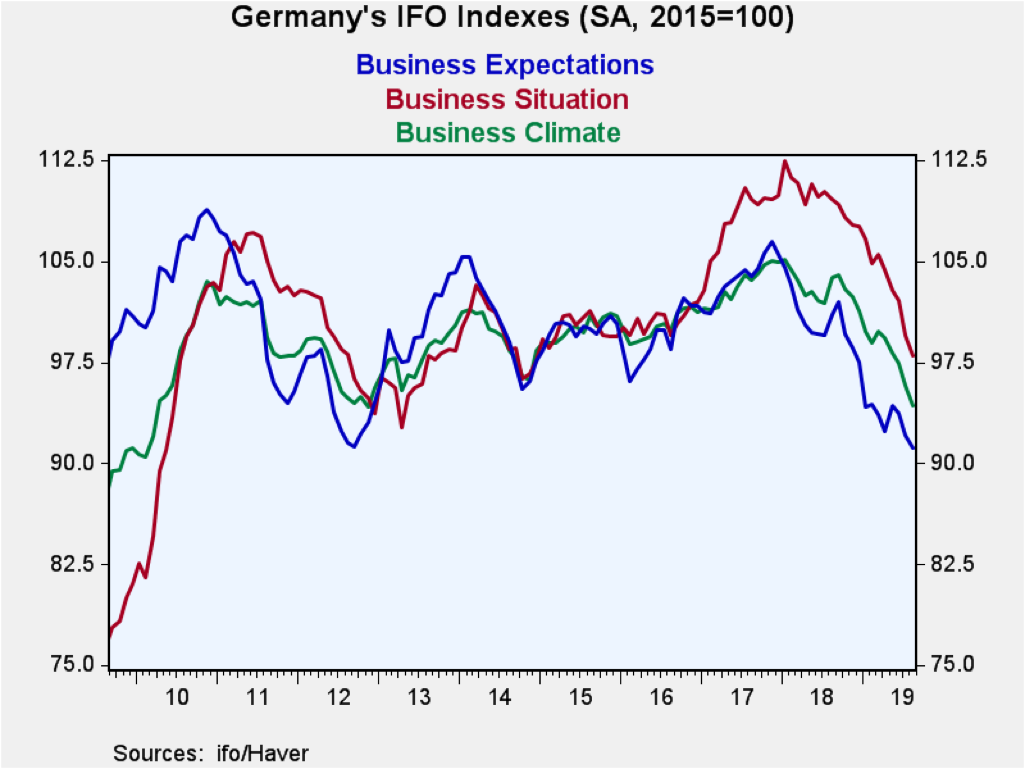

For Europe, it appears more of the same on tap with a curious twist. Despite all the noise in the press about Germany’s recession, EU growth remains ~1.1% – 1.2% year-over-year. Now, as one might imagine, this growth does not find itself equally distributed, as one might find after ladling a spoonful of batter into a pan to make a pancake. Rather it looks like stiff whipped cream still in the blender, with peaks and valleys rippling across its surface. On the positive side stand several countries in Central Europe, such as Hungary and Poland, along with France and some of the northern European countries. On the negative side stands Germany and Italy, Germany due to its manufacturing downturn and Italy due to the Euro. Overall, for Europe, the situation looks similar to the 2011 – 2012 slowdown, as the following chart of Germany’s IFO demonstrates:

As a result, the European Central Bank (ECB) moved to increase the amount of stimulus it delivers, in order to stave off a difficult result.

However, many of the critical issues in the EU, festering for the past decade, have come to the fore with the EU’s survival at stake over the long term. Indicative of the crisis ahead, the EU appointed Christine Lagarde, the former French Finance Minister, as head of the ECB, instead of an existing head of one of the national banks. This comes as no accident. With monetary policy now facing the Law of Diminishing Returns, the EU will need the ECB to act in concert with governments to continue to fund the bloc’s finances. And this crisis stems from the fundamental flaw that exists in the EU: Monetary Union without Fiscal Union. Reflective of this tension today, the EU long term budget for 2021 – 2027, currently under discussion, likely will reallocate significant resources to the major contributors to the budget, who suffer from a variety of economic ills due to this mismatch. Thus, Italy and Spain, losers under the current economic setup, stand to gain significantly under the new budget proposals as these proposals focus on youth unemployment, immigration, security, growth, and competitiveness. Of course, as resources become reallocated to the major economic powers, in a last ditch attempt to save the EU from splintering apart, countries that benefitted from past spending on infrastructure and social inclusion will get hit hard. This includes the CE-4 (Central European 4 of Hungary, Rumania, Czech Republic, and Poland) who benefitted disproportionately from these programs. It is estimated this spending added 1.50% to Annual GDP Growth Per Year for the past decade, which will disappear under the new budget. And with the vast majority of the traditional wage advantage between Central and Western Europe closing over the past ten years, the economic growth of these countries could slow significantly after 2020 as the EU reallocates this growth back to the core countries.

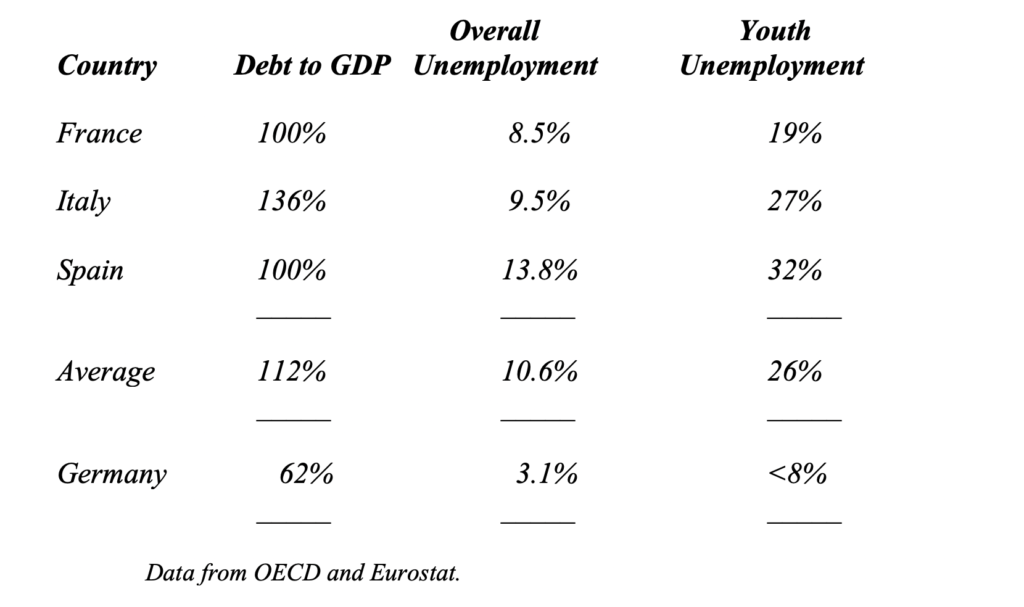

There appear other reasons for Madame Largarde’s appointment, as well. One of those relates to Modern Monetary Theory (MMT) and the likely utilization of this pathway by many of the key EU countries. The following data indicate why this will become necessary when these countries’ economic positions are compared to that of Germany:

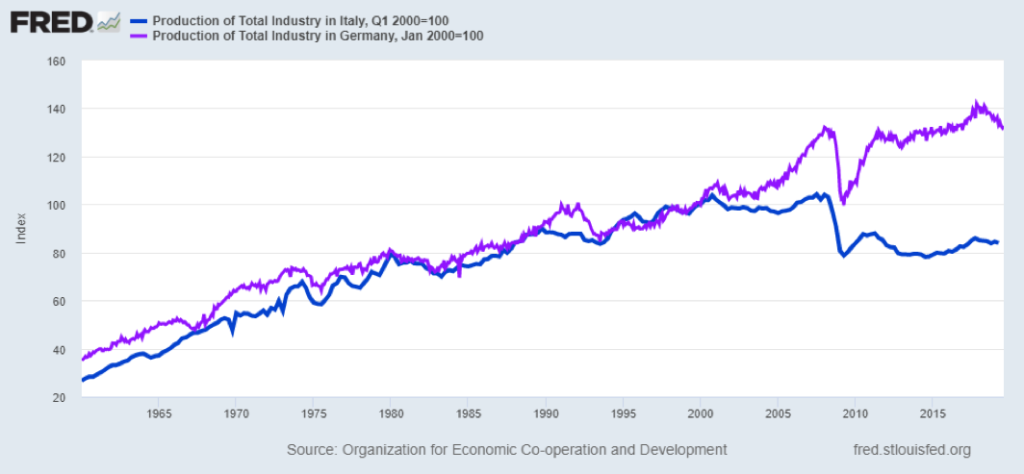

As the table makes clear, not only did Germany benefit from the creation of the Euro, but the other major powers in Western Europe suffered. The following chart, that contrasts the fortunes of the industrial sectors in Germany and Italy from 1960 – 2019, makes clear the divergence between Germany and Italy’s outcomes:

As one can see, Italy’s Industrial Production grew at the same rate as Germany’s from 1960 – 2000. Then came the creation of the Euro. Germany benefitted from the Euro keeping its currency valuation artificially low, enabling it to grow its exports significantly, while Italy saw the Euro strangle its industry, forcing a long term manufacturing contraction on its economy. Even with the current downturn in its manufacturing, German manufacturing production stands 32% above its 2000 level. In contrast, Italian manufacturing production stopped growing in 2000, then never recovered from the 2008 – 2009 Recession. It now sits 15% below its 2000 level. Should this gap between Germany and Italy not move towards closure over the next few years, the incentives for Italy to create an alternative currency to the Euro, such as the BOT, will become overwhelming. And should Italy return to its own currency, the economic pressure would rise on Spain to follow, lest it become uncompetitive with a depreciating Italian currency. These moves would follow the United Kingdom’s formal exit in order to preserve its sovereignty over the bureaucrats in Brussels. With The Old Man Struggles now coming to the fore, actions will focus more and more on closing the economic gap between the key European countries in order to preserve the whole.

The Climb to the Peak

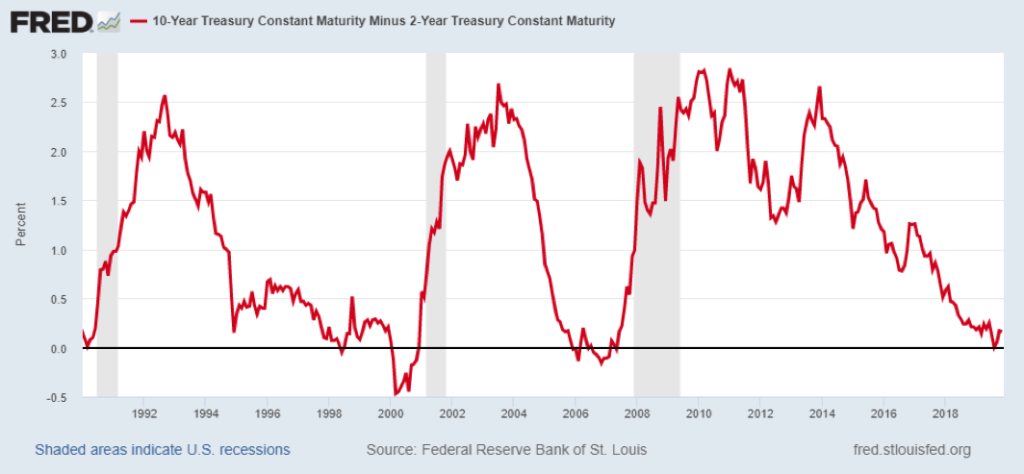

For the United States, while the media focuses on the US – China trade spat, the global inventory cycle and traditional late cycle economic factors continue to dominate the actual outcome. The Federal Reserve, as in 1998 and 1966, made a late cycle adjustment in rates. Coupled with a mini-QE to offset the troubles it created in the bank repo markets, this temporarily undid the flattening of the Yield Curve that the Fed caused by its mistaken tightening in 2018:

Effectively, these actions attempt to replicate the late 1990s outcome and delay a recession, for which it would take the blame, until after the Presidential election. Given the recent economic data coupled with company commentary on inventories, this extension appears on track with a 2 – 3 year reprieve for the U.S. economy in process, as the following data make clear.

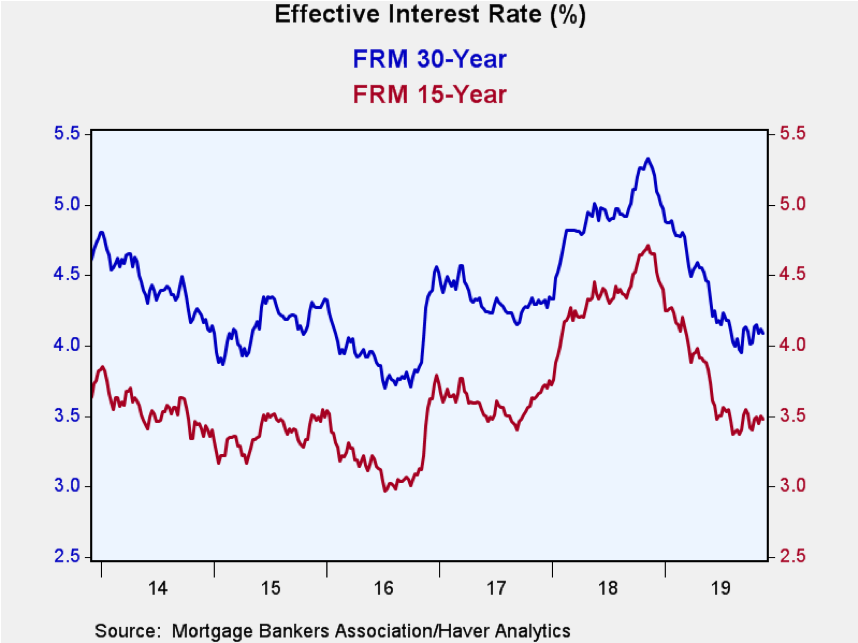

First, for the Housing market, the recent drop in interest rates acted as soaking rain after a period of heat threatened to wither the crops. As the following chart demonstrates, the drop in interest rates produced a significant reduction in mortgage rates:

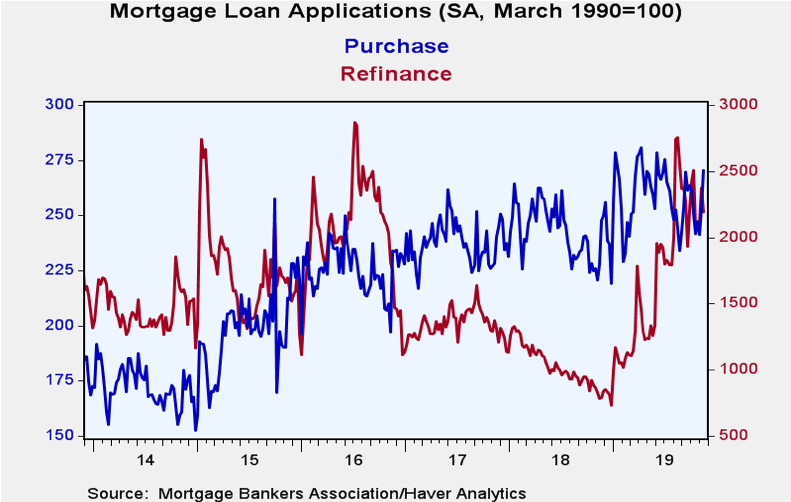

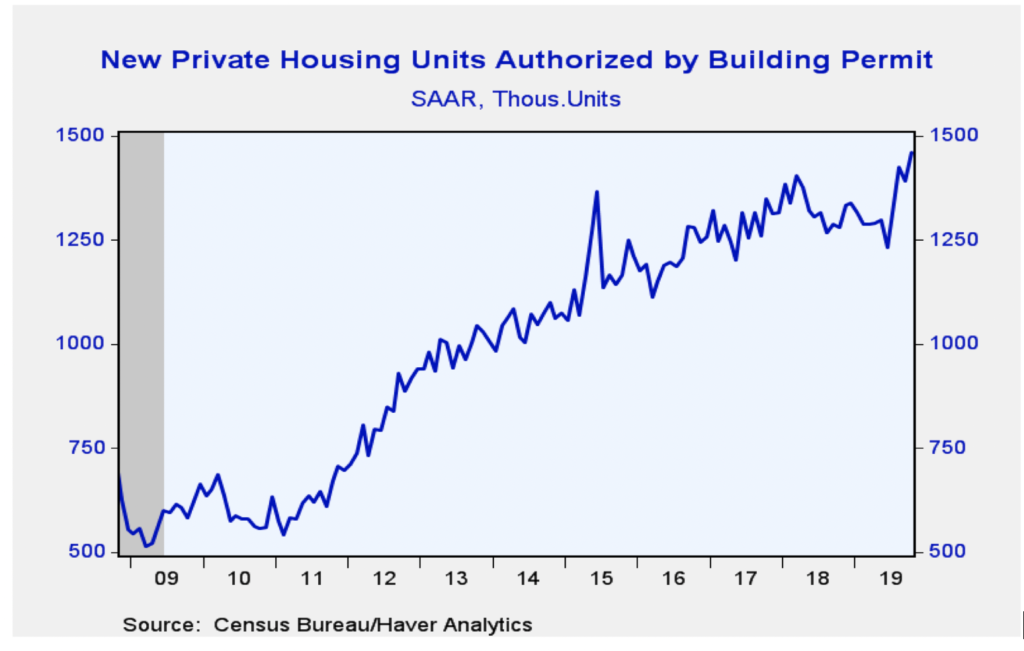

This led to a significant increase in Home Refinancings, adding support to consumer spending, and to a reacceleration in Single Family Home Orders. Companies, such as KB Home and Lennar, reported Orders for New Homes rose 12% to 15% recently. That New Home Orders accelerated upward again should come as no surprise. With the Millennials in their prime home buying years, as they transition from rental housing, First Time Home Buyers comprised 38.5% of all housing purchases in 2018. The following charts show the salutary impact of these lower rates in Refinancing Volumes and New Private Housing Permits:

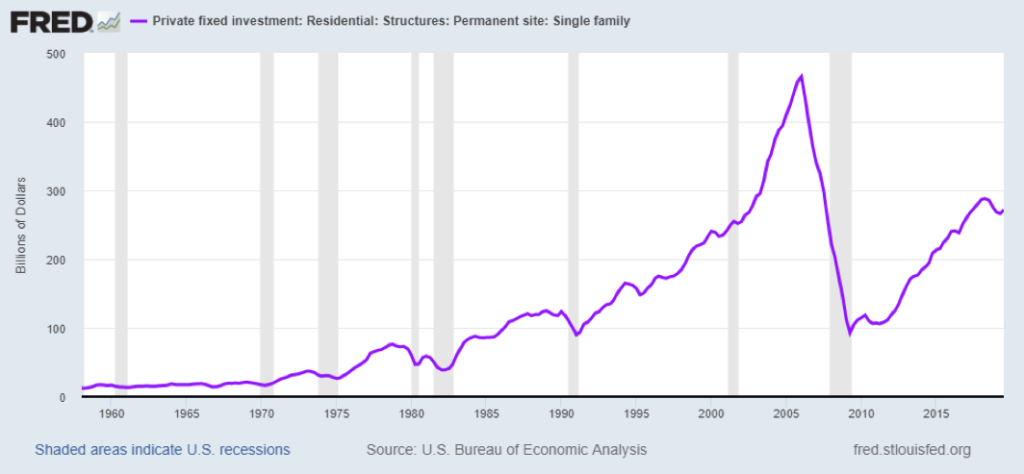

Given that Housing permeates almost every aspect of the economy, it should begin to impact the overall economy by year end 2019, with a rapidly growing impact in Spring 2020. As the following chart demonstrates, Single Family Home Investment already bottomed and turned up:

The impact of this turn appears underway as numerous suppliers into the home building industry raised prices recently. Door manufacturers announced price increases of 12% to 25% for exterior and interior doors. And Fiberglass Insulation suppliers just announced price increases of 8%, with a minimum of 5% expected to stick. More areas are expected to follow with price rises.

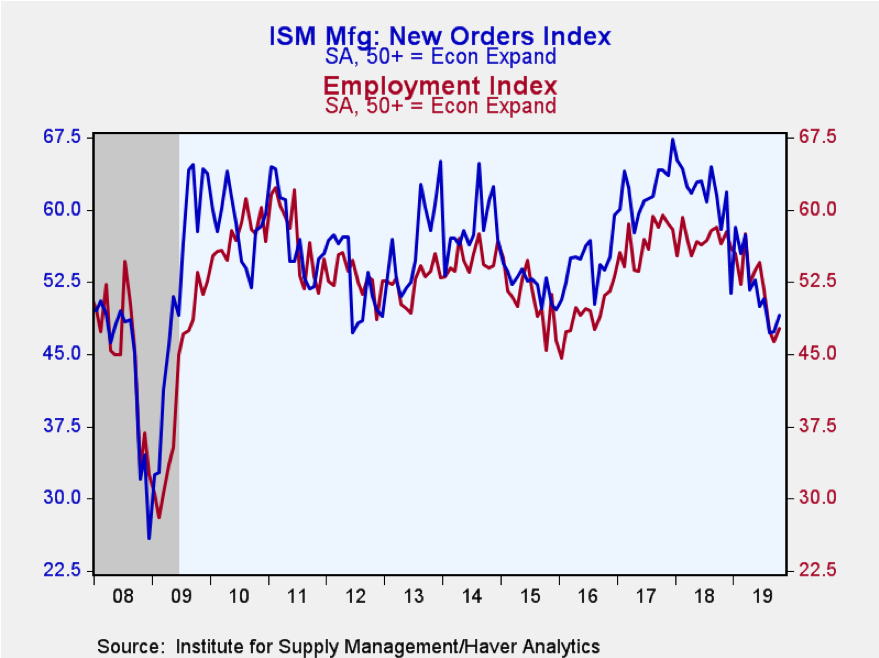

Second, for manufacturing, the worst appears over. While Industrial Production will show drops year-over-year for another couple of quarters, the ISM New Orders Index appears to have bottomed as in 2012 and in 2016:

The impact of this turn appears underway as numerous suppliers into the home building industry raised prices recently. Door manufacturers announced price increases of 12% to 25% for exterior and interior doors. And Fiberglass Insulation suppliers just announced price increases of 8%, with a minimum of 5% expected to stick. More areas are expected to follow with price rises.

Second, for manufacturing, the worst appears over. While Industrial Production will show drops year-over-year for another couple of quarters, the ISM New Orders Index appears to have bottomed as in 2012 and in 2016:

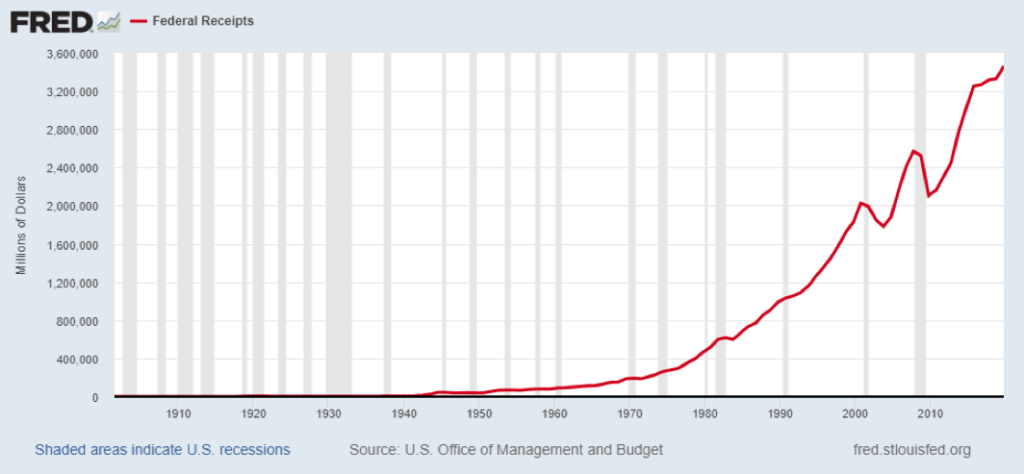

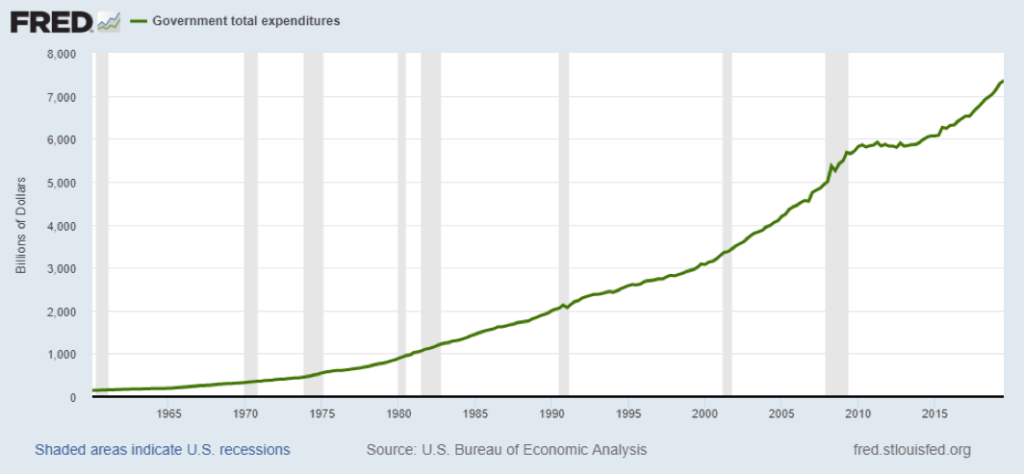

And governments uncanny ability for the money to go out just as fast, if not faster, than it came in. This stands doubly true with a Presidential election ahead in 2020, as governments look to accelerate spending:

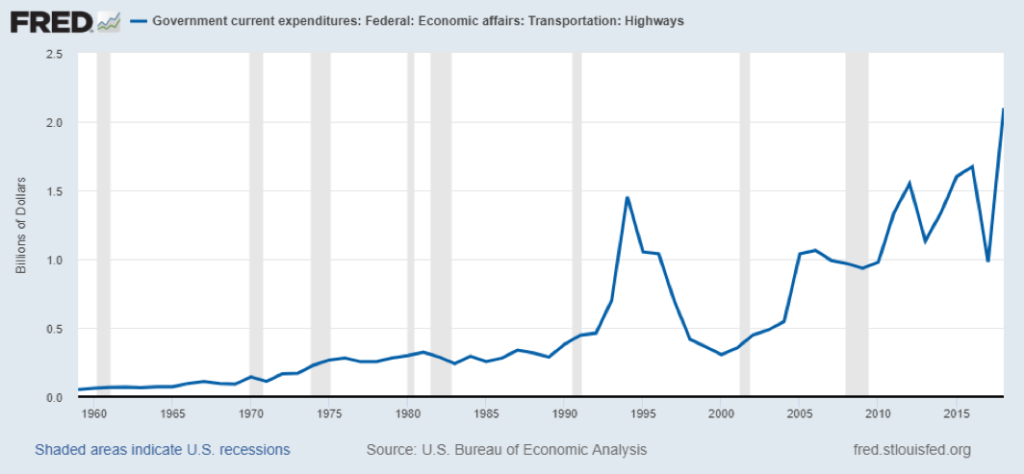

According to recent data, spending on things such as highways and roads accelerated this fall, growing 10% to 20% year-over-year in many states. The following chart shows Federal spending leaping to new highs:

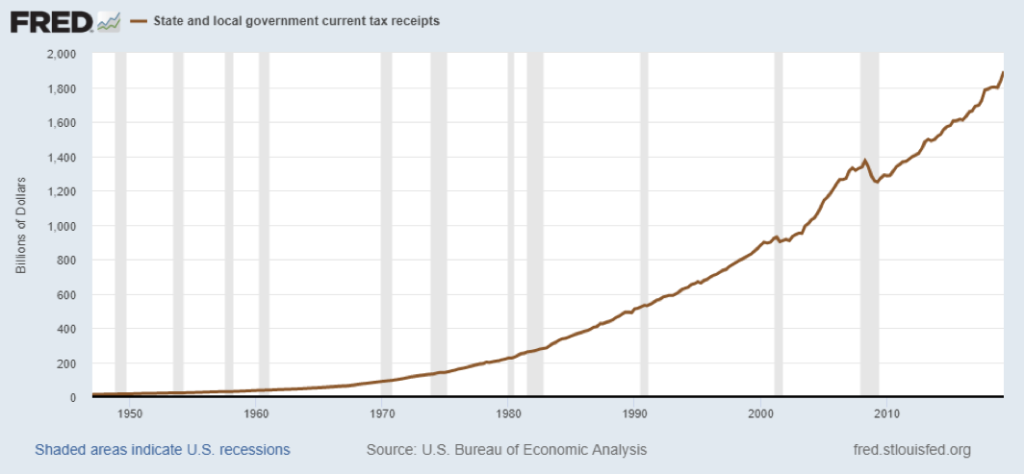

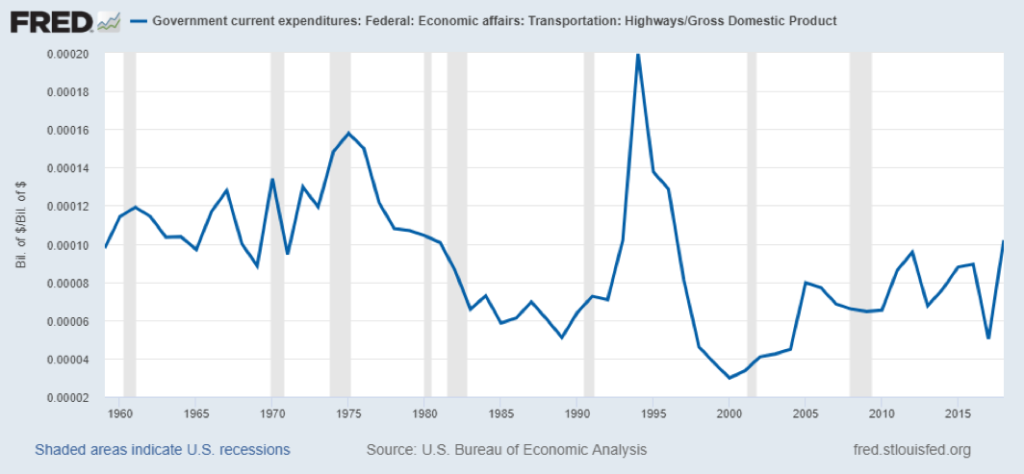

And while growth exploded upward, it just makes up for lost time, as the following chart demonstrates:

Federal spending on Highways averaged only 0.8% of GDP over the past decade and less than that since 1980. Prior to that, spending stood closer to 1.2% of GDP. With aging infrastructure, there exists significant room to move forward with a Highway Bill, as the government moves to make up for years of underspending and basic infrastructure needs replacement and/or upgrade. The recent construction of a new Tappan Zee Bridge in New York for $3.5 – $4.0 billion is just one example of aging infrastructure that needs replacement.

While the U.S. economy stands late cycle, it appears One Last Hurrah stands ahead. With New Single Family Homes leading the way, the economy should reaccelerate once more. When coupled with an end to the Global Inventory correction and early signs of revival in the Global Manufacturing chain, economic growth should bottom early in 2020 and reaccelerate from there. And with numerous global Central Banks lowering interest rates and injecting money over the past year coupled with government spending continuing to rise to offset the impact of slowing growth, a tailwind not a headwind will blow for the Global Economy. For the U.S., it will call once more to take to the trail onward and upward as the economy makes The Climb To The Peak. (Data from Federal Reserve, U.S. Census Bureau, Haver Analytics, OECD, Eurostat, and company reports coupled with Green Drake Advisors analysis.)

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2019 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.