What’s Good For GM Is Not Good For America, Part 3: Whack-A-Mole, National Security, and The Coming Domestic Content Legislation

“National advantage resides as much in clusters as in individual industries. The presence of world-class buyer, supplier, and related industries in a nation triggers self-reinforcing benefits in upgrading competitive advantage in industry.”

Chapter 12: Government Policy

The Competitive Advantage of Nations

By Michael E. Porter, 1990

For Corporate America and most of the companies in the Global 1000, the current trade spat between the U.S. and China remains a logistical question. If, as a company, production cannot locate in China, where else in the world can it locate to maintain the same production cost structure, same access to foreign markets, and same transportation costs. The answer to this question depends on individual country labor costs, land and transportation availability, and tax incentives as well as a host of other factors. For the short term, at least, it appears that Vietnam and Malaysia are the big winners of the current corporate relocation out of China. New manufacturing plants continue to appear in former rice paddies across Vietnam, funded often by Chinese capital. Technology plants continue to arise in Malaysia, as companies take advantage of its workforce and logistical infrastructure. Other winners appear Indonesia, Thailand, The Philippines, and Taiwan. For all these countries, the lottery came early. For example, this movement out of China created an acceleration in Taiwan’s growth due to a massive rise in Investment to build plant there as opposed to Mainland China. And for Corporate America and the Global 1000, these actions enable them to maintain their current global competitive positions, cost structures, earnings, cash flows, capital investment levels, and returns.

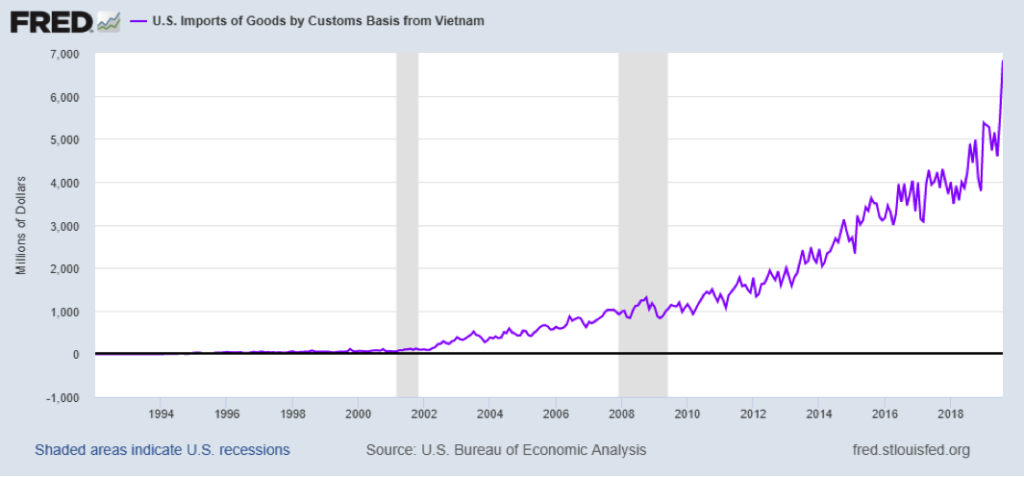

However, from a United States perspective, this appears a giant game of Whack A Mole. For those unfamiliar with this amusement park game, the goal is to hit the Mole when he pops up before he scoots back into his labyrinth of tunnels and pops up through another opening. In this case, replace “Mole” with Factory or Assembly Plant and replace “Opening” with Country. Thus, lost in the noise of the US-China trade dispute, the U.S. sent a warning to Vietnam concerning its trade surplus with the U.S., as the Vietnamese trade surplus continues to grow at a rapid rate.

Monthly Imports of Goods From Vietnam, U.S. Census Bureau data.

For the US to solve its issue with China only to see the same issue arise with Vietnam, Malaysia, and other Asian nations, represents no solution at all. The goal, ultimately, from a U.S. perspective, continues to focus on the following: re-domestication of industrial plant to once again supply the domestic market with domestic production. And while Chinese consumption may catch up to the U.S, the U.S. consumer market still remains the largest market for mid to high end consumer goods in the world due to its much higher standard of living. Given the numerous studies that demonstrate Investment drives Productivity and Productivity drives long term economic growth, reclaiming production of its own consumption, which would drive Investment, stands a clear national priority.

Furthermore, from a U.S. government perspective, there stands a major National Security issue that the country must address. In order to maintain the U.S. strategic position in the globe, protect its interests abroad, and ensure its ability to wage war when necessary, the country must maintain its industrial base and technological competitiveness. This just makes common sense. And with technology leadership, the control of space, and the ability to produce the necessary goods likely to dominate the outcome of the next war, ceding these industries to other nations would relegate the country to an inferior global strategic position. If the U.S. allowed this to occur, it could lead to other nations dictating terms of economic and strategic engagement, enabling large global strategic rivals, such as China and Russia, to gain the upper hand around the world.

When we combine Whack-A-Mole with National Security, What’s Good For GM Is Not Good For America, as optimizing a corporate footprint around the globe, to maximize the corporation’s position, now conflicts, in many cases, with the goals of the United States in growing its economy and maintaining its global strategic position. In other words, there clearly stands in one corner of the ring, the U.S. Government, and in the other corner of the ring, the Global 1000, as their interests are opposed. And they both have come out swinging. The U.S. Government led with a left jab, imposing tariffs on China, and the Global 1000 parried and countered with a left hook, moving factories to other Asian countries, as they acted to protect their interests. With both opponents now circling each other, looking for an opening to land the next blow, the logical next move by the U.S. government will be a feint, pretending to fire another left jab in the form of more tariffs against other countries, but then landing a kick to the groin, with a move toward Domestic Content Legislation or requirements for domestic production in key industries and their supply chains. And to ensure the effectiveness of this policy, it will finish the bout with a knockout right cross, punishing companies that do not comply with large fines and/or embargoing their goods produced abroad.

With corporations moving supply chains around Asia, little of consequence will occur for the moment. Corporations will incur some minor costs and little re-domestication of supply chains will occur. Furthermore, the “prevailing wisdom” in the financial markets indicates there exists little the U.S. government can do to change this outcome, with companies continuing to grow their overseas operations. However, in reality, there exists a significant number of legal tools, already approved by Congress, that the country could lever to change the terms of global engagement, if it chose to do so. These include:

- Trade Expansion Act of 1962, Section 232 – This allows the government to act when imports affect National Security. (Recently used for steel and aluminum. Potential action on Autos sits here.)

- Trade Act of 1974 – This falls into two categories. Section 201 authorizes the ITC to investigate the threat of injury from imports and the President to impose four year safeguards. Section 301 allows the U.S. Trade Representative to act against countries “unreasonably, unjustifiably, or discriminatorily restricting or burdening U.S. commerce.” (Section 201 recently used for washing machines and solar cells.)

- International Emergency Economic Powers Act of 1977 – This allows the government to freeze foreign assets and impose sanctions on foreign nations in “international emergencies”. (Recently used by both the Obama and Trump Administrations against Russia and Iran.)

- Export Control Reform Act of 2018 – This impacts the ability of foreign nationals to participate in research in “foundational” or “emerging” technologies. This was enacted as part of the reform and update of CFIUS to prevent the export of new technologies to other parts of the globe.

- Trading with the Enemy Act of 1917, as amended 1933 – This empowers the President to oversee and restrict any and all trade between the United States and its enemies in wartime or in peace.

And when these laws intersect with a large goods trade deficit, a desire to accelerate U.S. economic growth, and the need to stand toe-to-toe with a traditional global rival in China, anything becomes possible. While What’s Good For GM Is Not Good For America continues to rule the day, the forces to change the status quo, in National Security and Domestic Content, continue to gather. And once they gather in sufficient force, they will align to assault the fortified position of corporations today, leveling the WTO battlements, changing the playing field back to the GATT, and, once more, emphasizing the traditional mores by which countries govern their actions. (Data from the U.S. Census Bureau, Federal Reserve, and public sources coupled with Green Drake Advisors analysis.)

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2019 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.