The Fight for Global Growth: Technology Leadership, Currency Wars, And The Death of the WTO

“Over against the prospective yield of the investment we have the supply price of the capital-asset, meaning by this, not the market-price at which an asset of the type in question can actually be purchased in the market, but the price which would just induce a manufacturer newly to produce an additional unit of such assets, i.e. what is sometimes called its replacement cost. The relation between the prospective yield of a capital-asset and its supply price or replacement cost, i.e. the relation between the prospective yield of one more unit of that type of capital and the cost of producing that unit, furnishes us with the marginal efficiency of capital of that type.”

Chapter 11: The Marginal Efficiency of Capital

The General Theory of Employment, Interest, and Money

By John Maynard Keynes, 1936

Over the past 40 years, the US followed a policy of helping the Emerging Market (EM) Economies to grow and become part of the global economy. This policy succeeded as the EM went from 20% of the Global Economy in 1980 to ~40% in 2000 rising to ~60% of Global GDP today. It raised the living standards of hundreds of millions of people. And the policies adopted worked well for all parties as EM countries and Developed Market (DM) countries grew and benefitted for the first half of this time period.

However, in 2000, this relationship changed. The WTO came into effect for global trade, replacing the GATT. For the uninitiated, the WTO stands for World Trade Organization, the current global trading agreement, while the GATT stood for the General Agreement on Tariffs and Trade, its predecessor. This move to the WTO did two important things. First, it gave market access to EM Economies to countries that had hitherto limited their access. These newly opened markets were the largest consumer markets in the world. At the same time, it gave EM Economies preferential treatment, such that they could exclude much of their economies and state owned companies from needing to abide by the same rules as the DM Economies in terms of trade and market access. Second, it changed the mechanism for addressing trade and market access disputes. Under the GATT, when one country developed a trade issue with another, it directly dealt with that country. Thus, disputes were settled government to government, with the aggrieved party utilizing traditional actions, such as tariffs and embargoes, to protect its economy from any predatory actions of another government. The WTO changed this relationship. Under the WTO, a new international body came into effect with the power to adjudicate any disputes. Thus, if the US possessed an issue with Indonesia, a panel of judges from other countries would decide the matter. And with the inclusion of numerous EM countries into the WTO, the probability a panel would consist of only EM judges rose significantly.

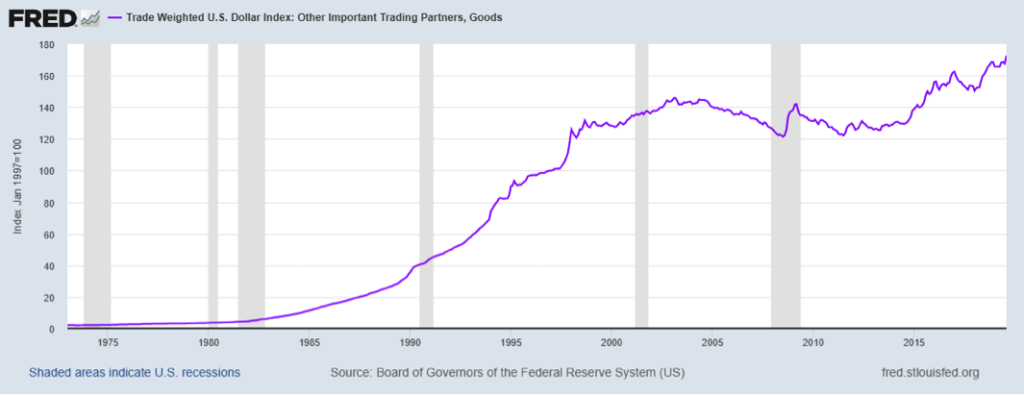

Any agreement depends on the players in the game fairly adhering to the rules and not trying to subvert them. Unfortunately, this change in rules led many EM countries to act to accelerate their growth by leveraging the new foreign markets open to them while protecting their home economies. These actions typically came at the expense of DM economies over the past 20 years. While China stands as the poster child for IP theft and protecting domestic markets, other countries, such as Malaysia, effectively followed similar actions, but with less publicity. Malaysia often requires foreign companies that wish to do business in the country to produce goods domestically. McDermott International found this out after it won a contract in Malaysia. It needed to create a Malaysian company and invest capital to create production capacity there. Other EM countries put safeguard tariffs in place to prevent goods from foreign countries to enter the country, when they believe such actions necessary to protect their home grown industries. Both Indonesia and India put tariffs in place to block Chinese steel and chemicals over the past few years. And, oftentimes, these EM countries put domestic content legislation in place requiring goods to be manufactured there. For example, Brazil possesses high domestic content requirements for mobile phones and autos sold in the country. Other countries, such as India, are notorious for this. Lastly, as documented in Currency Wars Part VII: The Coming Un-Civil War, February 28, 2019, EM countries weaponized their currencies, devaluing them 90% in the run-up to the WTO coming into effect in 2000. More recently, the EM countries devalued their currencies another 25% compared to the US Dollar since June, 2014. The following chart demonstrates the massive rise in the US Dollar and, of course, the massive drop in the EM currencies:

The US Dollar currently finds itself valued at more than 4x its value in 1990. Such a move produced the expected result, transferring economic growth from the United States to the Emerging Markets.

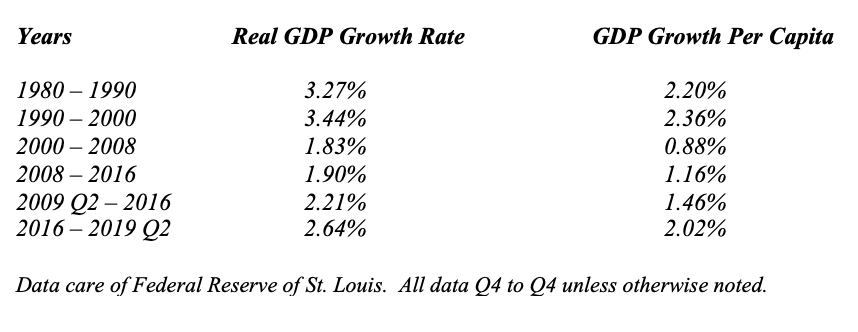

To understand the cumulative impact of these policies, which were sold to the public as enhancing growth and living standards in the DM economies, one need only look at the actual data. For the United States, the data stands as follows:

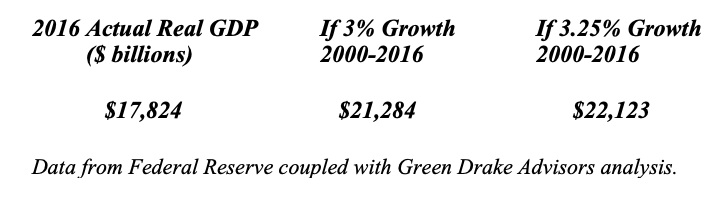

As the data demonstrate, the U.S. economy suffered from 2000 – 2016 under these policies. In simple terms, politicians and large public companies sold the populace a large can of worms. Instead of growing at 3% or better, including recessions, the U.S. economy grew at less than 2%. If it had just grown at 3% over the period, let along the 3.27% of the 1980s or the 3.44% of the 1990s, then the U.S. economy in 2016 would have stood at ~120% of its size then or 20% larger than it did. If it grew at 3.25%, as in the 1980s, the economy would have stood 124% of its size in 2016 or 24% larger than it did.

This is not chump change, no matter how one slices and dices it. At just 3% growth, this represents a missing $54,000+ in GDP per Capita. And if labor received just one third, 33%, of this as compensation, this represented $18,000 in missing income for each member of a family. And with Real Median Family Income standing at $76,000, this represents over 20% in missing income. This policy stands as one of the key reasons Median Family Income went nowhere from 2000 to 2016.

Given this reality, political reaction to policies that led to these poor results became inevitable. Technology became the first area to receive scrutiny. The U.S. government, belatedly, put the screws to technology transfer. While the headlines read “China” in addressing this issue, the problem stands much broader, as numerous EM countries want technology built in their country. And they then want companies to give them the keys to the kingdom. Given this, China will become just a starting point in addressing this issue. The government, through CFIUS and other methods, will continue to expand the limits on moving technology out of the U.S. Already, the government moved to limit foreign investment into technology companies broadly. And, with a brewing Cold War with China, inevitably, the U.S. government will require certain goods be manufactured in the good, old US of A. For companies used to doing research here then taking the new technology and building a factory overseas using cheap labor, life will change dramatically over the next 5 years as the U.S. focuses on maintaining its Technology Leadership and positioning itself to win a long term Cold War.

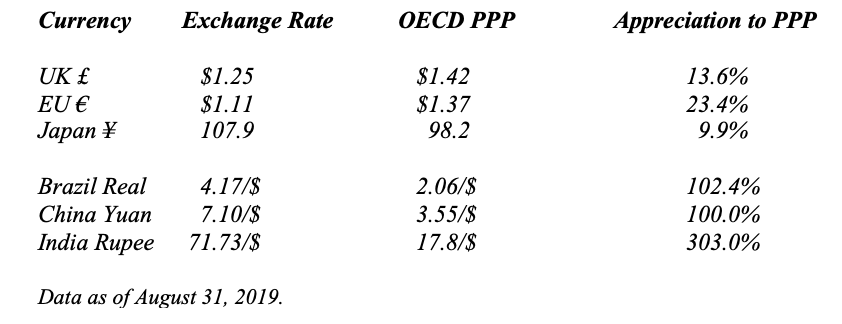

And to win a long term Cold War, domestic manufacturing must become globally competitive. Below is a chart that demonstrates the current overvaluation of the U.S. Dollar (US$) compared to many other major currencies:

As the table makes clear, the US$ stands slightly overvalued compared to the major DM currencies, but not massively so. In fact, the DM currencies stand within the long term range traversed over the past 40+ years, where they fluctuated between slightly undervalued to slightly overvalued. However, in contrast, EM currencies stand vastly undervalued, whether compared to the US$, the Japanese ¥, or the European €. Given the current exchange rates of EM currencies, coordinated Developed Market government action to correct this mis-valuation creeps closer and closer, as DM economies today stand under tremendous stress, producing significant political pressure to change policies, to say the least. Already, the U.S. moved to declare China a currency manipulator. This put in place the legal framework to address the expected devaluation by China, over the next year, to undermine the impact of the tariffs put in place by the United States and to help China’s economy at the expense of the U.S., Japan, and Europe. Should China go down this route, the U.S. likely will forcefully intervene in the currency markets, issuing massive amounts of U.S. Dollars and buying significant amounts of Chinese Renminbi. This action likely will be joined by the EU and Japan, lest their currencies significantly appreciate against the U.S. Dollar. One might note the Emerging Markets find themselves excluded from the impact of a potential Chinese devaluation. The reason stems from their active competitive devaluations to prevent China from lowering its currency relative to their currencies. With the U.S. loading its currency guns and Europe and Japan forced to follow, lest they lose global competitive position, Currency Wars appear imminent that will begin to undermine the economic strategy of the EM and change the balance of global growth.

And while moving to restore currencies to fair value will begin to redress the economic balance of power, this action will not address the inequities generated by trade rules under the WTO. To address these inequities will require a wholesale rearrangement of the global trading system. Already, the U.S. moved away from utilizing the dispute mechanisms of the WTO over the past two years. The country now addresses trade disagreements directly, country to country. Recent actions by the U.S. with Canada, China, Japan, Vietnam, The United Kingdom, … look surprisingly like a bygone era from the 1940s to 1990s, prior to the WTO, when the GATT ruled the global trading system. During this era, countries addressed issues directly with other countries. And, while large global companies might object, as these government actions often undermine individual company global strategies and the WTO judgments prove a more friendly forum most of the time, they benefit the U.S. and begin to address the skewed rules that currently exist, putting U.S. located companies at a disadvantage. As the U.S. becomes joined by other countries in negotiating their own deals with individual countries, the WTO will become less and less relevant to the actual functioning of the global trading system. And, as these actions accumulate, they will produce a tortuously slow Death of the WTO.

As the analysis above makes clear, disruptive change hurtles towards the global economic system. Whether corporate investment, currency valuations, or international trade, all stand at the precipice before the great plunge. And once the global system steps over the edge, chaos will reign until a new equilibrium comes into being. With The Fight For Global Growth breaking out into the open and with the United States acting to maintain its Technology Leadership and recapture economic growth lost to the Emerging Economies, Currency Wars and The Death of the WTO stand athwart the global economic ship, closing fast and prepared to engage. (Data from The Federal Reserve coupled with Green Drake Advisors analysis.)

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2019 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.