Global Economic Overview: An Old World Order Returns

Global rebalancing continues to quicken. With the US and China effectively abandoning the WTO for a bilateral trade agreement, the WTO suffered a mortal blow. This blow clearly arose from the gaming of the system by China over the past 20 years and the WTO’s inability to deal with the ensuing issues in real time. As a result, with the WTO no longer representing a vehicle that served US interests, a return to the world of the GATT became inevitable. In that world, countries dealt with each other directly over trade and international issues, bypassing third parties to create a result that served both sides interests. In addition, they felt no constraints from international organizations that sought to tell them how to enforce their laws or that an agreement with one country violated their deal with many others. And while the dismantling of the WTO stands in the first inning, as the ballgame moves forward, more and more countries will move to protect their interests over the objections of other countries.

As this occurs, the global economic order will more closely resemble that of the late 1800s, with numerous countries striving for global competitive and strategic advantage. Such an outcome means that many of the economic relationships that exist today will change as the traditionally more open economies of the West insist on a Quid Pro Quo for access to their markets. In addition, the traditional protectionist policies used by Emerging Market economies (EM), such as non-tariff barriers and requiring domestic production in key industries, will wend their way to the Developed Market Economies (DM). Furthermore, with the emergence of China’s overt global ambitions, countries will ally to stymie its future dominance of the global economy. Despite its size, China still remains vulnerable to a disruption of its export engine, which overtly represents 20% of its economy and much more if its interlinkages with the rest of its economy are included. Thus, more countries taking a GATT-like approach to trade to ensure they receive fair treatment seems inevitable.

Dragon Stimulus

Against this backdrop, the global economy continues to struggle to regain its footings. Despite stimulus of 5% or more of GDP from China, Chinese growth barely rebounded over the past few months. In fact, at only 6.4% growth projected for 2019, China will grow at its slowest rate since the 1980s. This broad based stimulus included tax cuts, infrastructure spending, debt relief, more government subsidies, required reserve ratio cuts, VAT cuts, and social security contribution cuts. In addition, local government bond issuance exploded in Q1. The fundamental economic problem China faces comes down to, what economists call, declining marginal returns. In other words, to add a dollar, or in this case a yuan, of GDP, China must spend more and more money. A country can spend money to stimulate itself. And this is appropriate under certain circumstances, such as a recession. However, to use it to create more capacity in a country already awash in excess capacity, means the GDP cannot service the debt taken on to create it. And despite making global promises to rationalize its excess capacity in areas such as steel, it continues to add to its already abundant productive base.

Recent economic statistics make clear this problem. Despite the massive stimulus, Chinese Industrial Production growth slowed to 5.4% Year Over Year (YOY), Fixed Asset Investment (FAI) 6.1% YOY, and Retail Sales to 7.2% YOY. In other words, the stimulus only buffered the rate of slowdown and did not accelerate the economy. Of course, more stimulus will follow, with the government likely opening the floodgates of money. This will only serve to add more capacity and increase the property bubble. These Chinese actions will only stopgap the two fundamental problems China faces as the tide just peaked and started to go out. The first is the Global Inventory Cycle, which acts on a 3 – 4 Year Cycle. This Cycle last bottomed in 2016 and peaked in 2018. It likely will begin to bottom sometime in late 2019/ early 2020. Once it bottoms, it will resemble the moves towards low tide when the waves come into shore a little more, temporarily, and then resume its exit, making up for lost time. The second problem will come home to roost in the 2020s. Over 70% of export products manufactured in Asia ultimately end up the United States or the European Union (EU) as the final destination. With the US manufacturing less than 45% of the goods it consumes and facing a global rival, the strategic interests of the United States will dictate that more goods become manufactured in the US with some additional capacity allowed in Canada and Mexico. While China may attempt to divert these goods to the EU, when it attempted to do this with steel, the EU put in place significant tariffs to keep the Chinese steel out of the marketplace. This long term reality will harm Asia’s export oriented economies and, in particular, China. Thus, China faces a significant long term drag on economic growth.

There stands one other potential factor that could compound this move towards low tide, creating a super low tide, as occurs when the Moon stands closest to the Earth. This would occur if the US comes down hard on China’s theft of Intellectual Property (IP). The US could embargo all goods from China that contain stolen IP. It could then demand that other nations respect US IP and embargo all Chinese goods that contain stolen IP. A simple example illustrates the problem China would face under such a scenario. China stole Micron Technology’s methodology to manufacture computer memory chips for Dynamic Random Access Memory (DRAM). This was well documented in an article on the front page of the business section in the New York Times, which showed the Chinese got caught red handed. For those unaware of its fundamental role in technology goods, DRAM is a critical component in every laptop, PC, server, … It permeates most technology goods. Should the US embargo all Chinese technology goods containing Chinese DRAM and demand the EU, Canada, Brazil, India, Japan, Mexico Southeast Asia, and Australia as well as nations in Africa and South America respect US IP and ban these goods, China’s technology industry would suffer a major blow. And this blow would come at a time when the remainder of its economy suffered a significant long term slowdown in economic growth. Despite the fire of Dragon Stimulus getting hotter as the year progresses, a fundamental long term slowdown stands ahead with the laws of economics reasserting themselves.

The Setting Sun

For Japan, this long term slowdown in China and Asian export growth will produce significant risks to economic growth. Over the past decade, Japan’s export oriented economy supplied the capital goods needed to build capacity in Asia for both Asian demand and for export to the rest of the world. With the rest of the world beginning to focus on serving their own demand with locally produced products, Asia must fill the lost export demand with local consumption. However, local standards of living across large parts of Asia will not support demand for many of the products being sold in the export markets. For Japan, with the focus on capital goods exports to create production capacity for these products, nothing good can come of this. In fact, the latest economic statistics bear this out. Japanese exports of machine tools fell over 33% in April. For Japan, this is just a taste of things to come in Asia. In addition to this headwind, the US began to make noises about the trade surplus and, in particular, the massive export of cars to the United States. While Japan produces over 8.0 million vehicles, it consumes less than 4.1 million, exporting another 4.1 million across the Pacific to the US. Labor costs in Japan do not stand below those in the US. Nor does it cost less to produce a car in Japan than in the United States. With Japan maintaining one of the most closed Western automobile markets, such a state of affairs will come under more and more pressure. With Japan facing serious obstacles to its long term economic growth, The Setting Sun appears at hand.

Elephant Slowdown

For India, economic growth continues apace and remains on track for over 7% for 2019. Exports have bounced back into growth territory and domestic credit growth remains strong, at over 12%. However, the economy has come under some pressure due to internal factors. A large domestic auto lender collapsed, harming credit to this vital sector of the economy. India, like China, possesses a large non-bank financing sector for risks the traditional banks will not shoulder. With this portion of lending shrinking, Auto Sales turned negative year over year and Industrial Production growth slowed, turning slightly negative on a year over year basis in March at -0.1%. Reflecting this impact, India’s Purchasing Managers Index continues to drop, hitting 51.8 in its latest reading. This is down from 54 in January and February and approaching the critical 50 level. With all this going on, the Royal Bank of India appears worried. They turned dovish and cut rates over the past couple of months. In addition to RBI actions, policy measures stand in the wings to support the economy. Already, the incumbent government recapitalized the banking system by 2.5% of GDP over the past few years. Should that not stem the tide, with a major election this year, action likely will occur to ensure growth remains on track. With an Elephant Slowdown in progress, watch for further actions by both the RBI and government to counteract this as the year progresses.

Latin Morning,

For Brazil, life provides mixed messages. While it is morning for the economy, it appears only partly sunny out. Economic data clearly indicate the economy is growing once more, whether in official government statistics, such as GDP or employment, and in company data, such as hypermarket sales or wireless phones. However, growth does not exhibit the typical bounce off the bottom seen after a long, deep recession that finally comes to an end. This does not appear due to any missteps by the current government, but due to the commodity nature of the economy coupled with the global inventory correction. With a large portion of the economy in commodity areas such as iron ore, international demand for these commodities impacts the economy significantly. And with a principle trade partner, China, experiencing real issues with its economic growth, this slowdown continues to create negative feedback for Brazil. In addition, with the global inventory cycle in a down leg, additional drag impacts the Brazilian economy.

Underneath all this drag, the government appears to be moving in the right direction to long term sustainable growth. The new government adopted pro-business policies and is attempting to shepherd social program reform through the Congress. Should the latter make it through the legislative gauntlet, even in a watered-down version, it would stabilize government debt to GDP near term and put the country in the position to lower this critical measure over the long term. This would lower the country’s cost of capital and likely improve sustainable economic growth. With the weather partly sunny now, it could turn mostly sunny by lunch time.

On the other side of the Continent, Chile, Peru, and Columbia continue to grow steadily. Chile, probably the best run economy in South America, likely will produce another year of steady growth at 3%+. It continues to do this with relatively modest inflation of 2% and a balanced economy. Peru continues to surprise in a positive manner. After growing 4% in 2018, the country’s growth should match last year’s strong print. And in Columbia, economic growth appears on a steady keel as well. After delivering 3.4% growth in 2018, the economy should grow over 3% this year. All in all for South America, it seems a lovely, lazy Latin Morning.

The Old Man Askew and The Elephant In The Room

Across the world, Europe continues to exhibit a bifurcation of growth. The economies of Central and Eastern Europe as well as the UK, those not controlled by the Euro as their currency, continue to grow at a reasonable pace. On the other hand, the Euro area economies continue to struggle, toying with recession and a politically, unsustainable level of low growth. This bifurcation is apparent to the average European as the statistics show countries such as Hungary and Poland growing at 4% – 4.5% while countries in the Euro area, such as France, Italy, Belgium, Austria, and Germany, are growing at less than 1.5%. Even the UK is growing at 1.8% year over year, with growth accelerating, despite the noise from Brexit and the negative impact from EU companies holding up investment until the dust settles.

The fundamental problem lies in Germany. Germany’s export dependence stands as both a blessing and a curse. When China industrialized over the past 20 years, it stood as blessing. China built plants and Germany supplied, along with Japan, much of the equipment that went into those plants. However, with China’s economy now reaching a level of maturity, whereby China now services its own demand across the vast majority of the economy, and other countries putting roadblocks in the way of China’s goal to grab additional global market share, such an economic strategy no longer works. And with China’s economy experiencing indigestion, Germany’s export orders turned negative last year, putting a drag on the EU’s economy.

In addition to the loss of a fundamental growth driver, Europe faces a struggle over the succession at the European Central Bank (ECB). Mario Draghi, who has led the ECB successfully since 2011, will step down in October at the end of his term. Germany and France both have their own ideas and will need to sign off on the choice. Of course, that is like trying to get oil and water to mix. The front runner currently is Erkki Liikanen, the former head of Finland’s Central Bank. He is considered a pragmatist who likely would continue Mario Draghi’s legacy. And while Mr. Liikanen stands for continuity, the ECB, even with continued QE, cannot solve the economic growth issue for Europe on its own.

For the EU, the real struggle will remain over the existence of the Euro in place of the lira, peseta, and drachma as well as every other currency that formerly existed. Italy experienced its worst streak of growth since the Great Depression over the last decade. It insists it will stimulate more and increase its budget deficit if the economy does not pick up. And with an Unemployment Rate of almost 11%, this would make sense. Spain saw its Unemployment drop from 26.3% in 2013 to a mere 13.7% today. And Greece’s Unemployment Rate stands at 18%. But without the ability to control their own currencies, these countries will be caught between political demands of their citizenry and the economic policies of the bureaucracy at the European Commission. There is only one true solution to restore economic growth. And it does not countenance the continued existence of the Euro in its current form. With Europe Askew and the likely policy staring everyone in the face, it seems only a matter of time until the Elephant In The Room charges through one of the walls opening the pathway to true economic growth.

The Climb To The Peak

For the United States, the economy stands in a late cycle position. Autos and Housing no longer underpin economic growth. They have handed off the baton to Government, Capital Spending, and the Consumer. As the following chart shows, Single Family Housing Starts appear to have peaked for the cycle:

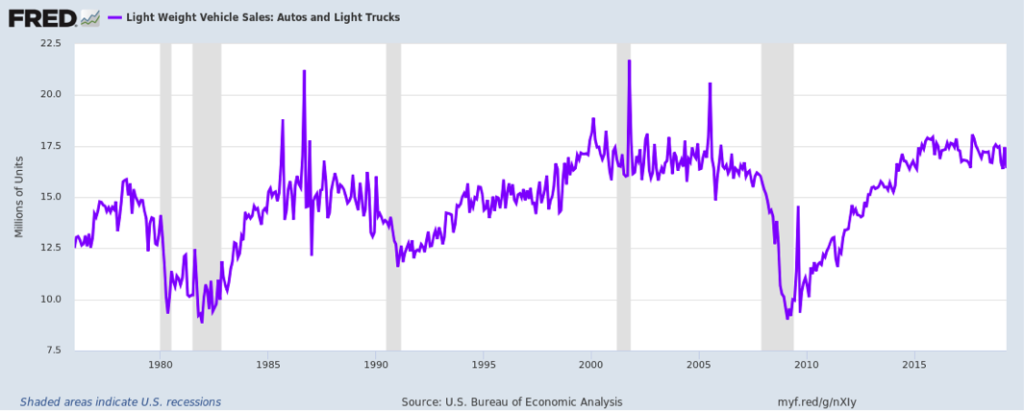

And Auto Sales have plateaued, as they typically do once they recover:

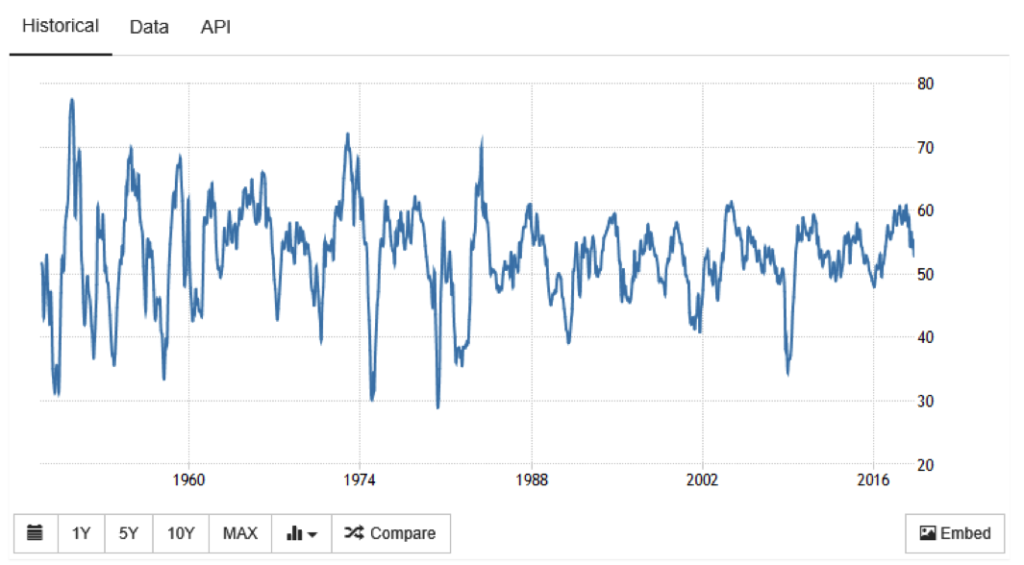

This leaves Capital Spending, the Consumer, and the Government to maintain economic growth. While the latter two continue to grow, with the Global Inventory Cycle in its downward phase, the US Purchasing Managers Index (PMI), published by the Institute for Supply Management, continues under pressure:

Chart courtesy of tradingeconomics.com

As the long term chart above demonstrates, the PMI will likely fall below 50 before turning upward. Hopefully, this will occur in a 1998 fashion as opposed to a 2008 plunge. And with China massively stimulating its economy and the rest of the world easing, this should occur.

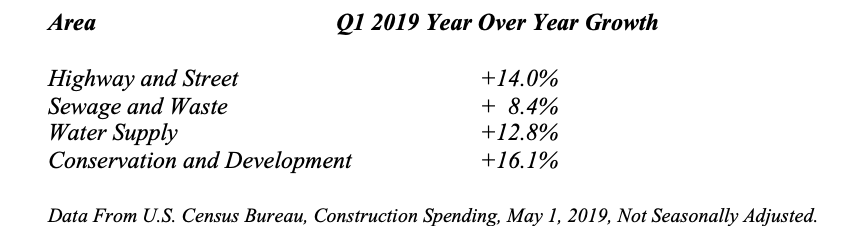

Government continues to do its part. In typical late cycle fashion and with a Presidential election next year, public spending is soaring. Public Construction Put In Place is up over 9% for Q1 2019 compared to Q1 last year. Key categories show this pattern:

This strength should continue into 2021, as politicians focus on reelection next year. And despite the government shutdown in Q1, the Federal government did not really act as a drag on growth. Thus, government is serving in its typical late cycle fashion of growing the economy.

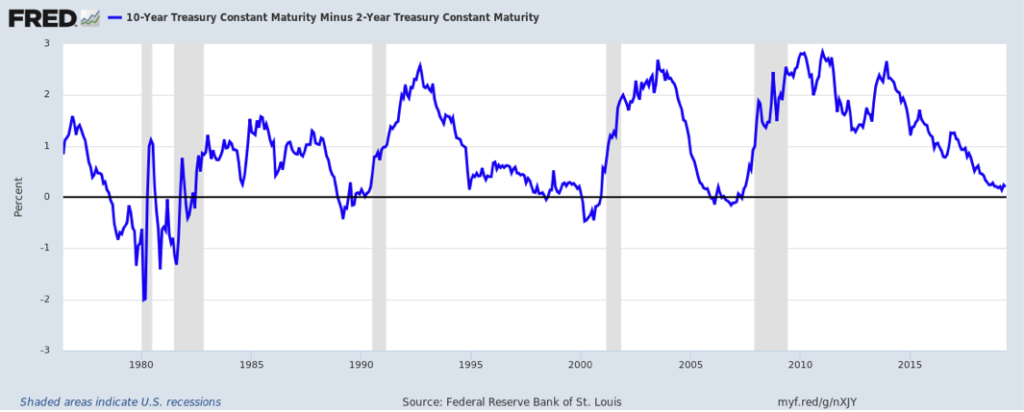

The one fly in the ointment continues to be the Federal Reserve. The Federal Reserve reversed course in Q1, stopping its tightening, but has yet to ease. The 10 Year less 2 Year Yield Curve continues to reflect this dichotomy:

It stands just above the Zero Line, waiting on the Fed. And the Fed continues to wait on the data, just like in Waiting For Godot. While Q1 GDP looked strong at 3.2%, part of it was inventory accumulation. Without that number, GDP grew only 2.5%. While the FOMC indicates it remains “data dependent”, by the time the data in the economy indicates a real problem that requires Fed easing, typically it is too late. This time, the Fed might bail itself out by having a pre-emptive rate cut to offset the potential drag due to trade. The fixed income markets continue to believe this is the case. And the Q2 economic data continue to set up to show a much weaker economy than in Q1, providing the political cover needed for the Fed to do what the markets indicate it should already have done. If the Federal Reserve takes the opportunity to act in such a manner over the next few months, the economic cycle would continue for the next couple of years, as occurred after 1966 and 1998. In those cases, Recessions did not happen until 2 ½ years later as the Fed responded to economic developments. With the global economy set to accelerate, Global Central Banks easing, foreign economies.

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2019 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.