I Can Tell A Lie Part II: Government Pensions, The Taxpayer, and Broken Promises

“The practice of funding has gradually enfeebled every state which has adopted it. The Italian republics seem to have begun it. Genoa and Venice, the only two remaining which can pretend to an independent existence, have both been enfeebled by it. Spain seems to have learned the practice from the Italian republics, and (its taxes being probably less judicious than theirs) it has, in proportion to its natural strength, been still more enfeebled. The debts of Spain are of very old standing. It was deeply in debt before the end of the sixteenth century, about a hundred years before England owed a shilling. France, not withstanding all its natural resources, languishes under an oppressive load of the same kind. The republic of the United Provinces is as much enfeebled by its debts as either Genoa or Venice. Is it likely that in Great Britain alone a practice, which has brought either weakness or desolation into every other country, should prove altogether innocent?”

Book V: Of the Revenue of the Sovereign or Commonwealth

Chapter III: Of Public Debts, Part V

The Wealth of Nations

By Adam Smith, 1776

“Our Constitution protects aliens, drunks, and U.S. Senators. There ought to be one day (just one) when there is open season on Senators.”

Will Rogers, Daily Telegram #2678, March 6, 1935

Politicians like to promise things. They like to promise more spending on roads, schools, police, services, labor peace, and everything else under the sun. They don’t like to pay for them or to tell the voters what these things might actually cost the voters in taxes, fees, or interest down the line. From a politician’s standpoint, telling these truths might cost them votes or, even worse, an election. So, politicians do their best to kick the can down the road, pushing the costs onto some future generation of voters long after they have retired from office.

Unfortunately, in kicking the can down the road, eventually the bill does come due. One of those areas now coming due relates to the pension promises politicians made to government workers to buy labor peace over the past 30 years. For private workers, these promises long ago went away, as companies went bankrupt trying to meet their obligations or terminated their plans in order to survive. But, for politicians, the beauty of pensions relates to their long term nature. It takes 20 or more years before the bill comes due and the government entity must shell out money to pay them. Thus, making large pension promises today becomes the ultimate kick the can down the road as taxes and fees will need to rise 20+ years from now. When those bills come due, the current politician will have retired and not have to address them. Some unlucky office holder in the future will need to tell the public the truth.

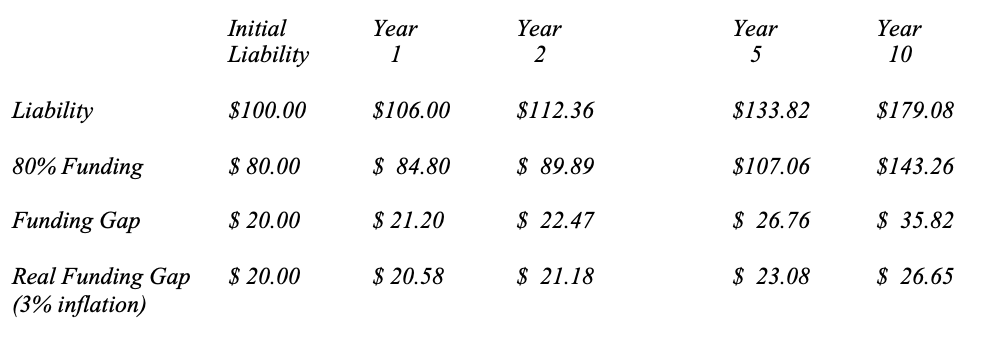

For municipalities and states, the moment of truth appears at hand, as the pension promises of the 1980s and 1990s come due. For the average municipality or state, this will not represent an issue as they have funded 80%+ of their pension obligations or limited their obligation by terminating the plan and funding the hole with a long term sinking fund. However, for a significant minority, there exists a problem. They did not fund their pensions as needed, in order to pay for everyday expenses without needing to increase taxes. Think of this as working, for the average citizen, but not putting a penny into retirement savings. As retirement approaches, the costs of such a choice become apparent. For politicians, this fell under the rubric: avoid the voters wrath. However, the problem with not funding properly comes down to the size of the liability. The liability, unfortunately, compounds over time. In other words, it grows and grows and grows. And so does the dollar amount between the liability and the amount of money to pay for it. The following example will show what happens assuming that the liability grows at just 6% per year:

As this simple example makes clear, the funding gap almost doubles over 10 years on a nominal basis. But, more importantly, increases over 30% in real terms. The typical government pension plan steps up payments as the worker’s tenure increases coupled with a recognition of higher wages. This means the Pension Liability grows faster than inflation. So, even though a municipality or state may contribute regularly to maintain funding at a specific level, 80% in the above example, not only does the Gap grow in nominal terms, but it grows in real terms. In other words, even though funding payments are growing at twice the level of inflation, the Gap continues to grow. Should tax revenue growth slow or a recession intervene to cause funding to fall short, the Gap will grow even faster. Thus, the percent of tax revenue dedicated to employee pensions will naturally rise, unless the government raises taxes to cover the shortfall. This is just what every politician wants on her or his watch.

As one might imagine, this is not popular with the citizens of any city, state, or town that must increase taxes just to continue to provide the same level of service. In fact, one might say that any administration that pursues such a plan of action might find itself an endangered species. Thus, most pensions sit underfunded across the nation. For those who believe that such problems confront only Democratic cities, the numbers reveal a different conclusion. Assuming that a major city wants to close the gap over 30 years, the following cities, representing the Top 10 underfunders, would need to raise taxes 20% to 27% and dedicate these funds to worker pensions only: Chicago, Houston, Austin, Dallas, Baton Rouge, Fort Worth, Oakland, Phoenix, Jersey City, and Pittsburgh. As one can observe, four of the top 10 cities are in Texas, a traditionally Republican state. In contrast, the Democratic moniker does appear to apply at the state level. The following states have issues that would require a tax increase of 10% – 25% to solve. In order of greatest tax increase to least, the states are: Illinois, New Jersey, Hawaii, Connecticut, Kentucky, Massachusetts, and Pennsylvania. Of these seven states, only Kentucky is traditionally Republican, while Pennsylvania swings back and forth. (One should would note that Pennsylvania has one of the lowest state tax rates in the country at ~3%. So, while solving the state’s problem would require a 10% increase in taxes to 3.3%, it is tiny compared to Illinois where taxes are already ~5% and an increase of 27% would raise rates to 6.3%.) The issue comes down to the voting booth. Municipal employees only make up 3% to 7% of any city or state work force. It is difficult to get the other 90% of the population to subsidize pensions for a small portion of the work force, when they are not eligible for pensions in general. In fact, much of the populace questions why public workers get a pension and they must fund their 401(k)s. This creates a natural conflict between the promises politicians made to buy labor peace and the willingness of the populace at large to honor those promises when the bill comes due. And when states, such as New Jersey, attempt to solve the problem by raising taxes on a small portion of their citizens, these citizens have a tendency to flee to lower tax jurisdictions, surprising only the politicians that enacted the solution as tax revenues massively fall short of plan.

As the above analysis illustrates, Government Pensions sit underfunded across the land. While this appears manageable for the majority of jurisdictions, a real minority stand in financial straights with a high likelihood of Broken Promises to government workers as The Taxpayer revolts. For the politicians who bought labor peace through pension promises, little stands in the way of them enjoying a long, prosperous retirement. However, for The Taxpayers who were promised labor peace with little cost to them, such deliberate actions by the politicians exemplify the “I Can Tell A Lie” mentality as politicians demonstrate that their primary goal is to get reelected and not the best interests of The Taxpayer, their constituent. (Data from Center for Retirement Research, State Annual Reports, Moody’s, and S&P coupled with Green Drake Advisors analysis.)

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2019 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.