Currency Wars Part VII: Populism and The Coming Un-Civil War

“Princes and sovereign states have frequently fancied that they had a temporary interest to diminish the quantity of pure metal contained in their coins; but they seldom have fancied that they had any to augment it. The quantity of metal contained in the coins, I believe of all nation, has accordingly been almost continually diminishing, and hardly ever augmenting. Such variations, therefore, tend almost always to diminish the value of a money rent.”

Chapter V: Of the Real and Nominal Price of Commodities, Or

Of Their Price in Labour, And Their Price in Money

Book I: Of The Causes of Improvement In The Productive Powers of Labour,

And of the Order According To Which Its Produce Is Naturally Distributed

Among The Different Ranks of the People

The Wealth of Nations, Adam Smith, 1776

“Nevertheless, if we contemplate a society with a somewhat stable wage-unit, with national characteristics which determine the propensity to consume and the preference for liquidity, and with a monetary system which rigidly links the quantity of money to the stock of precious metals, it will be essential for the maintenance of prosperity that the authorities should pay close attention to the state of the balance of trade. For a favourable balance, provided it is not too large, will prove extremely stimulating; whilst an unfavourable balance may soon produce a state of persistent depression.

…

Regarded as the theory of the individual firm and of the distribution of the product resulting from the employment of a given quantity of resources, the classical theory has made a contribution to economic thinking which cannot be impugned. It is impossible to think clearly on the subject without this theory as a part of one’s apparatus of thought. I must not be supposed to question this in calling attention to their neglect of what was valuable in their predecessors. Nevertheless, as a contribution to statecraft, which is concerned with the economic system as a whole and with securing the optimum employment of the system’s entire resources, the methods of the early pioneers of economic thinking in the sixteenth and seventeenth centuries may have attained to fragments of practical wisdom which the unrealistic abstractions of Ricardo first forgot and then obliterated. There was wisdom in their intense preoccupation with keeping down the rate of interest by means of usury laws (to which we will return later in this chapter), by maintaining the domestic stock of money and by discouraging rises in the wage-unit; and in their readiness in the last resort to restore the stock of money by devaluation, if it had become plainly deficient through an unavoidable foreign drain, a rise in the wage-unit, or any other cause.”

Chapter 23: Notes on Mercantilism, The Usury Laws, Stamped Money,

And Theories of Under-Consumption

The General Theory of Employment, Interest, and Money

By John Maynard Keynes, 1935

To date, a relative truce stands in the Currency Markets. Developed Economy currencies fluctuate within a band, traveling from the low end to the high end of the band and back over time. Thus, the value of the Euro and the currencies that made up the Euro prior to its creation have fluctuated between $0.90 to $1.50 with a central tendency of $1.20. Given that the Purchasing Power Parity exchange rate between the US Dollar and Euro equals $1.18, this makes sense. Emerging Economy currencies can depreciate should these economies run into difficulties as a way to stimulate exports and investment in their economies. While this leads to undervalued currencies, prior to the past 20 years, this did not create an issue for Developed Economies, as the Emerging Economies did not have access to these markets. And even when granted access, Developed Market economies allowed EM Depreciations to continue. Thus, with a set of rules in place to govern actions, each government knows which policies it can access given its place in the world order, preserving the peace.

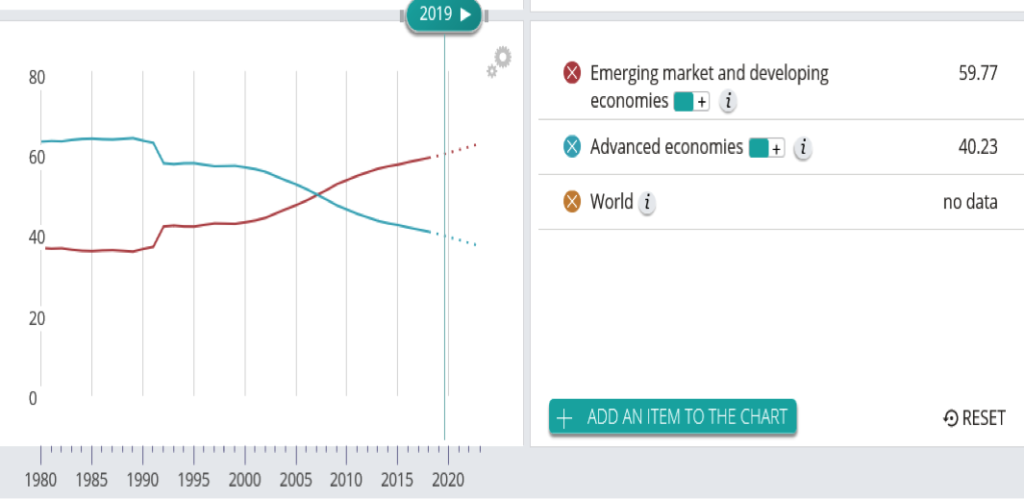

There exist two fundamental problems with this. First, due to the massive growth in Emerging Market Economies over the past 20 years, the impact of such policies has grown significantly, whereby it harmed DM growth over the past decade. Second, due to the massive growth in Emerging Market Economies, the world economic order sits in flux with a new order yet to emerge. Thus, the lines that define a country’s place appear blurry today and the assumptions used to set up the rules no longer hold. Simply put, these assumptions, which fit the world of 1980, stand inconsistent with reality, given the massive change in the global economic order that occurred over the past 40 years. In 1980, the Emerging Economies truly were emerging and comprised less than 37% of the Global Economy. However, as the following chart demonstrates, Emerging Economies, when measured under PPP, which measures their real economic output, now comprise the majority of the Global Economy:

Chart courtesy of IMF, www.imf.org.

In fact, as the chart demonstrates, the EM now accounts for ~60% of Global Economic Output. This result should come as no surprise, as it is merely the Law of Compounding writ large. If Country A grows at 5% and Country B grows at 3% over a long enough time period, Country A will always become bigger than Country B, even if Country B was 2 – 3x its size to start. With the DM allowing the EM into their markets, through NAFTA and the WTO, this became the inevitable end point, as the DM institutionalized the EM growing at 4% – 6% while limiting DM growth to 2% – 3% or less. With the EM already 37% of Global GDP in 1980, it was only a question of when, not if, it would become bigger.

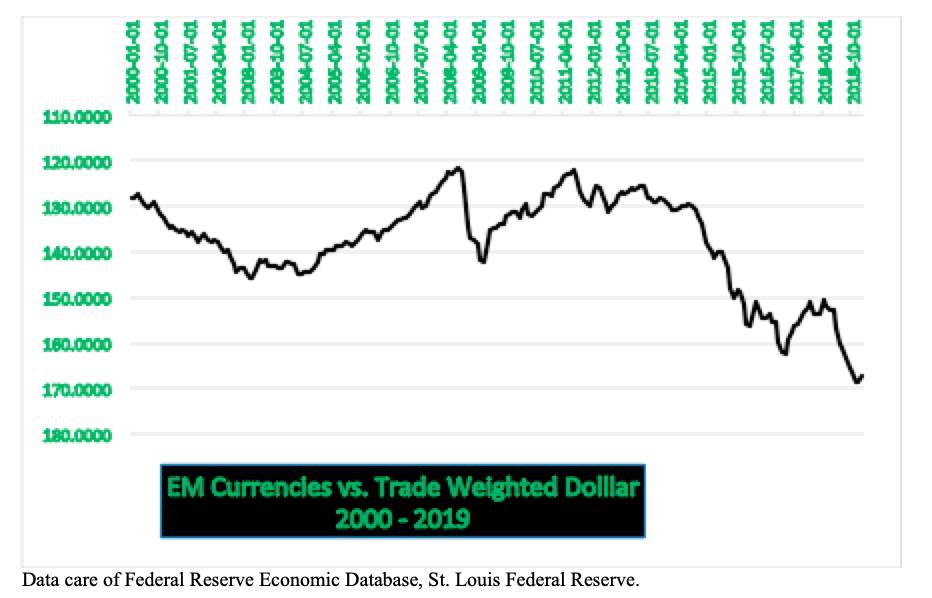

On top of this, the EM did not play by the rules of the game, as the DM expected, when these trade agreements were put in place. This came mainly through the currency depreciation channel. The EM Economies massively cut the value of their currencies in the 1990s in order to benefit their manufacturers once market access was granted. However, as the benefits of this depreciation wore off by 2012 – 2013, they could not resist the temptation to use this lever once more in 2014 – 2018, despite having become the majority of the global economy. The following chart demonstrates these Currency actions:

While this solved the EM economies short term economic problems, it created a new, long term bigger issue for the EM economies relative to the DM economies. With a decade of little to no economic growth combined with stagnating or declining living standards, delivered to the average citizen in most major DM economies, DM populations began to grow restless. They watched the rest of the world prosper while they suffered under the treaties that were sold to them as creating a better life. Then, just as the party was starting in 2013 – 2014, their economies took another blow as the EM Economies used currency depreciation to have the DM shoulder the burden of the EM slowdown. As one might say, not what the doctor ordered.

While global elites preached the virtues of globalization to the average citizen over the past two decades, they delivered lemons. Or in the well known words of Marie Antoinette, they said, “Qu’ils mangent de la brioche.” (Let them eat cake.) Unfortunately, this did not go over well with the French peasants. Due to crop failure, the 1789 French peasant did not have the flour to make the cake. So, telling them to solve their problem using something they did not possess came across as callous and uncaring. As one might say, this ended badly for the French aristocracy in a small bloodbath called the French Revolution. In a similar vein, the citizens of today’s DM Economies do not have the ability to benefit from the movement of factories out of their home countries to around the world. If anything, they suffered a crop failure, in the closure of factories and the loss of high paying jobs. In response, the governments run by the elites told them to get a job. It is hard to get a job that no longer exists, even if you are willing to relocate within a country. And the only jobs available were low paying, low skill positions. If anyone wonders at the populist revolt moving around the DM world, understanding this fundamental failure of governments provides clarity as to the cause and to the reason populism will not go away anytime soon.

With Populism in ascendance, new governments have begun to replace those dominated by global elites. The one thing these new DM governments find in common, whether on the right or the left, is a dislike for the current rules of the global economy. They appear one sided, with the DM populations on the short end of the stick. And, these new DM governments appear ready to act upon this to move things in a direction that would aid their citizens. In addition, these new populist governments have begun to recognize the importance of currency in solving these issues. There is already a mini-revolt in Europe against the Euro. For those who missed it, Italy proposed putting in place an IOU from the government called the BOT, that would act just like currency. However, the leader in this area is the United States, which already issued a warning to China on depreciating its currency. With the US having taken a large hit from the WTO and the currency devaluations, such a move became inevitable. It seems logical that the US, having recognized the currency issue in attempting to deal with China, will systematically address other key currencies from countries like Brazil, India, … For the US, there will be no choice if it wants to address trade. The EM represents almost 60% of US imported goods. And China does not represent the critical country for a number of US sectors. For example, China buying some US soybeans will not solve the US farmers fundamental global competitive problem. However, undoing the 50% cut in the value of the Brazilian currency will, as Brazil stands the number one rival to the US globally in soybean exports. Such a correction, across the board against a basket of currencies, would make the US extremely competitive on a global basis and likely displace numerous counties’ exports. Imagine what would occur if the US undid the 30% currency devaluation executed by the EM over the past 4 years. Such a move would vastly improve the global competitive position of the United States at the expense of many EM economies, making the US the low cost producer globally in many industries. And if the US devalued against the EM, the European Union (EU) and Japan would have no choice but to follow, lest the US displace their goods in global markets. For the EM, it would come as a shock as they found themselves on the wrong side of currency moves for the first time in 40 years.

Given the ascendance of Populism, it appears only a matter of time until the DM economies focus on currency devaluation by the EM. The mandate for these populist governments focuses on faster economic growth and improved living standards. Inflation stands as a second order consideration and only if it gets out of hand. Given this mandate, they will act to remove all impediments to such an outcome. Clearly, EM devaluation acts as a massive impediment to this outcome. And, as such, it must become one of the principal foci for these governments. With the EM economies using currency over the past 40 years as one of the principal means to solve their problems and maintain their growth, DM retaliation in the currency markets logically lies ahead. For the US and other DM economies, these actions would end the massive drag that put their economies on the defensive, merely serving the same medicine to the EM economies as they endured. However, this Coming Un-Civil War over currency would represent a true escalation, as the DM economies fought back to reclaim their economic growth. Such a move would leave the EM economies in shock, as the policy channels followed over the past 30 years shut, forcing these countries to take the bitter pill of true economic adjustment and watching their hyper-charged economic growth come to an end. They would become the victims of their own success as well as feeling the brunt of The Golden Rule: “Do Unto Others As You Would Have Them Do Unto You.” Having followed “Do Unto Others” for over 40 years, they will now have to endure “Do Unto You” with all the messy economic consequences. For the world, this will look familiar as the globe once more experiences a true currency war with all its messy fallout. (Data based on information form US Census Bureau, Federal Reserve, and US Bureau of Economic Analysis coupled with Green Drake Advisors analysis.)

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2019 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.