I Can Tell A Lie: Government Promises & The Pot Of Gold At The End Of The Rainbow: Part 1

“[P]rices do not play the same allocative role with public goods as they do with private goods. Prices are a rationing device in the case of private goods since they determine who consumes how much. With public goods this is not the case. Since everyone by definition consumes the same quantity of G once it has been provided, a pricing scheme plays no allocative role. The only function of a pricing scheme would be to determine how the costs of financing the public good are to be shared among the users.

While on efficiency grounds there is no reason to prefer benefit pricing to any other financing scheme, on equity grounds there may be considerations, depending upon the value judgment that is made about distribution. Just as in a private goods economy there are an infinite number of Pareto-optimal allocations of resources, so in a public goods economy there are too, each one differing from the other by having a different distribution of welfare or utility. Some persons will be better off and some worse off in comparing any two efficient allocations. The financing scheme in conjunction with the initial ownership of resources will determine which of the Pareto-optimal allocations is achieved (assuming one is achieved).”

Public Sector Economics

Chapter 4: The Theory of Public Goods

By Robin W. Broadway, 1979

Politicians and the governments they serve like to make lots of promises. In these promises stand the opportunity to serve the populace while ensuring the individual politicians and the governing parties they serve successfully achieve reelection. Sometimes these promises are simple, such as building a new road or repaving an existing one. But sometimes they are complex, such as promising pension payments or medical services, with far reaching consequences little understood at the time of the promise. For the United States as a country, such promises include Social Security and Medicare, two large government programs, that were established in 1935 and in 1965 respectively. When those programs were established, the United States and its population stood in a very different place. And the liabilities stood at very small levels relative to the overall economy. But with population growth, lengthening lifespans, and advances in medicine, these liabilities grew at exponential rates. As a result, they stand at multiples of current US GDP.

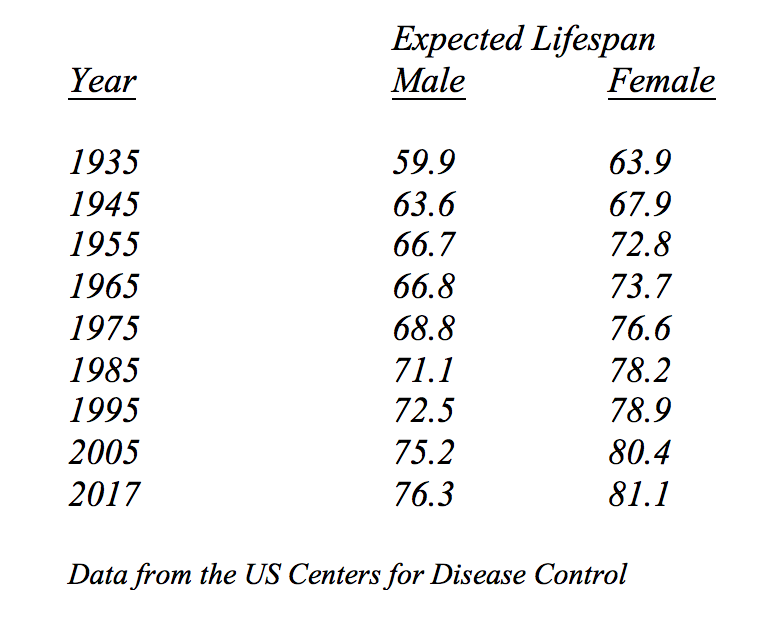

To understand the path from hither to yon, a few simple facts are in order. We will start with lengthening lifespans, as these are at the crux of the matter. The following table makes clear the assumption at the time of adoption of Social Security, with an expected retirement age of 65, and the reality today:

As the above Table makes clear, the average American did not live to see Social Security in 1935. But today, the average American can expect multiple years of payments. For the government, this created a problem. And in fact, in 1982, under President Ronald Reagan, there occurred a Social Security “Crisis”. Just a few years earlier, there occurred a crisis under President Jimmy Carter. To fix things, Social Security was indexed with a COLA (Cost of Living Adjustment) in the 1977 and the tax rate raised from 2% to 6% over time. This fix would supposedly save the program for the next 50 years. Unfortunately, the fix lasted less than 5 years. With revenue tied to wages, which were rising less than inflation, and expenses tied to inflation, inflation soon ate up any surplus projections. Thus, a Crisis occurred just a few years later. To solve this “Crisis” and to avoid any individual politician or party from taking blame for what was to come, a bipartisan commission was established chaired by the former head of the Federal Reserve, Alan Greenspan. To solve the Crisis, the government chose to accelerate the increase in taxes, make benefits taxable, and raise the age of eligibility for future workers. These actions supposedly would prepare the government for the eventual retirement of the Baby Boomer generation. It would build up a surplus that could then be drawn upon to pay future benefits. Of course, none of these moves proved politically popular, but Congress hid behind the aura of the bipartisan commission.

Let’s fast forward from 1983 to 2018. The pending retirement of the Baby Boomers stands pending no longer. Their official retirement began in 2012, while early retirement started in 2008 – 2009 due to the recession, and will continue through 2030. With this wave of retirements, the following 3 things ensued:

1.) In 2010, tax revenues, through incoming payroll taxes, stopped covering payouts due to regular retirements coupled with early retirements. Payments of interest to the Social Security Trust Fund averted drawdown for a few years by enabling the Trust Fund to continue growing.

2.) Social Security Trust Fund drawdown began in 2018, four years earlier than the date projected just last year.

3.) Complete Social Security Trust Fund depletion will occur in 2034, according to the latest Trustee Annual Report. Should a similar fate befall depletion as the beginning of drawdown, depletion could occur as early as 2030.

None of this sounds good. In fact, if we view Social Security the same way as a corporate pension plan, then it possesses an Unfunded Liability of $32 Trillion. And no, that is not a typo. As indicated above, politicians and governments make promises they do not understand. For corporations, the cost of their pension promises became clear in the 1980s when the accounting authorities forced these liabilities onto their balance sheets. For the US government, they only become clear when the money dries up.

To this looming crisis, let us now add the fiscal position of the United States. In investing, there is an old but true saying:

“Balance Sheets Don’t Matter Until They Matter.”

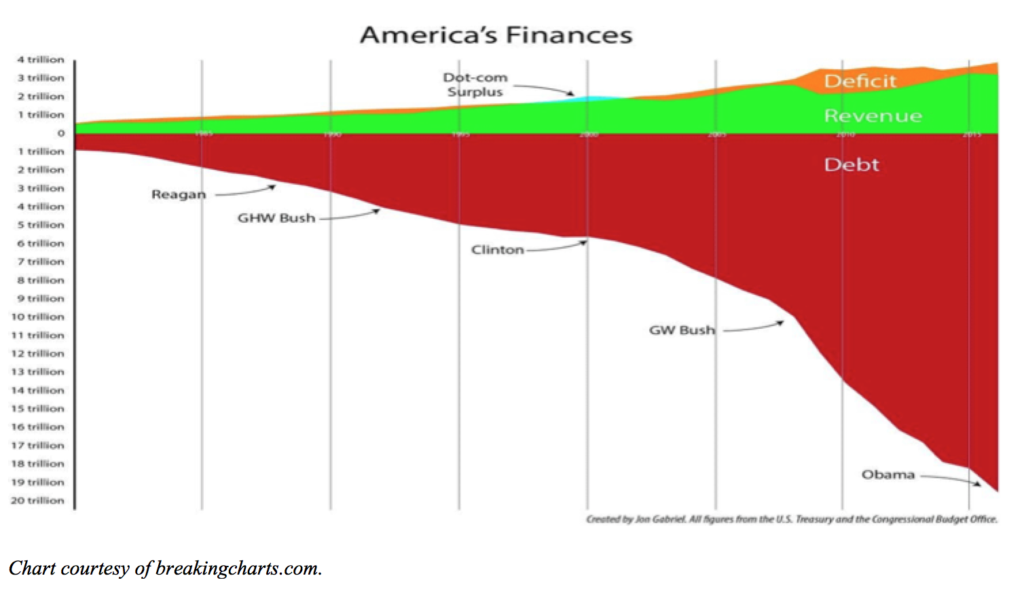

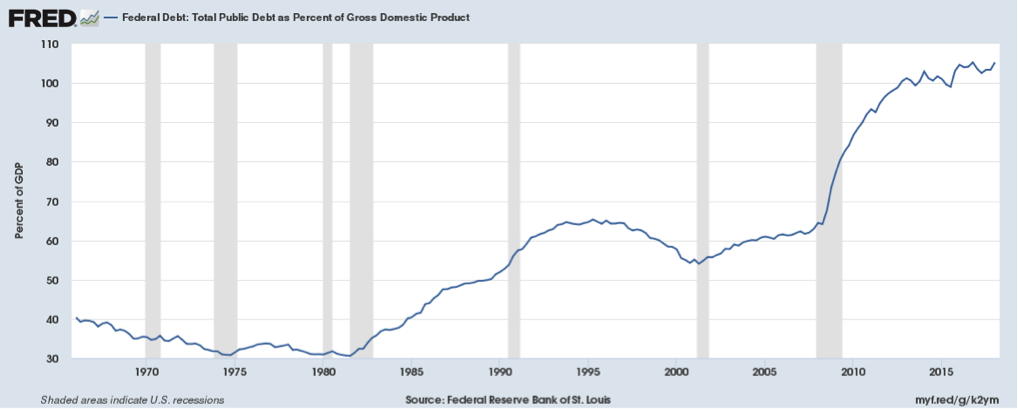

What this means comes down to the following. In normal times, banks and other lenders feel comfortable extending credit to corporations. However, when times get tough, bankers examine balance sheets very carefully. They pull back lending to those with leveraged balance sheets and even conservative lending endures more scrutiny. Regulators step in to ensure there are no exceptions. Now, what is the current status of the US Government. The following two charts provides some perspective:

And the following chart, care of the Federal Reserve:

As the charts illustrate, the US debt stands high relative to GDP. In fact, it stands at over 100% of GDP. And this balance sheet will only see higher levels as the massive tax cuts enacted last year roll through the government budget.

Given where the US sits, there exist a series of unpleasant solutions to the problem. None of which will prove politically popular. And this will occur before the true cost of the debt the government accumulated over the past decade comes due. Before examining the US “solutions”, an examination of Japan’s experience in addressing this same problem will provide a glimpse of what is to come here in the US. Japan went through a similar issue a decade ago. In order to solve the issue, Social Insurance Taxes were raised from 13.9% to 18.3%. This meant, for the average worker, that even though wages rose, the tax increases ate up much of the rise in wages, as a result, living standards went nowhere for a decade. In 2018, the last of these increases will occur, allowing the Japanese actually to collect a higher paycheck.

Now imagine it is 2025 in the US. Not only does the Social Security Trust Fund appear headed for bankruptcy but the Medicare Trust Fund as well. (The Medicare Trustee’s latest Annual Report to Congress projects depletion in 2026, requiring draconian cuts to providers. Outside organizations estimate Medicare’s unfunded liability at over $48 trillion today. Whether it truly stands at this level depends on whether or not one believes that the government will ultimately create something akin to Europe’s and Japan’s price regulation in healthcare.) On top of this, the government’s interest cost soars as debt continues to pile up on the balance sheet of the country. From 2.25% rate on $20 Trillion in 2018, costs have risen to 6% in 2025, similar to its cost in 2000, on $30 Trillion in debt. This increased the country’s interest cost from $450 billion in 2018 to $1.8 trillion in 2025. Fortunately, strong growth of 3%+ allowed the country to maintain its Debt to GDP at ~100%. Entitlements and interest expense threaten to crowd out all other expenditures, meaning no money would exist for the military, courts, roads, or any other basic function of government. Congress stands between a rock and a hard place. It’s choices stand as follows:

- Cut Social Security benefits for existing retirees by something in excess of 17%. This is the cut required in 2018 to balance things. So, kicking the can down the road means the costs rise even more.

- Cut Social Security benefits for future retirees by something in excess of 21%. This is the cut required today with a similar outcome to kicking the can down the road in the above choice.

- Raise Payroll Tax Rates by 5%+ to pay for the cost. Entitlements and mandatory outlays are projected to grow by over 5% of GDP from 14.5% today to almost 20% of GDP by 2026.

- Raise the eligibility age for Social Security at a more rapid rate.

- Create a National Health Service and regulate medical prices.

One might note that all these choices are politically unpopular. However, this situation came from 40 years of kicking the can down the road since 1983. The likely outcome for Americans seems some combination of all of these as Congress promised a Pot Of Gold At The End Of The Rainbow, which of course no one can ever reach. And once the reality sets into the average voter of what Congress hath wrought, the anger in politics seen today might look like a picnic.

While the future appears difficult and filled with many hard choices, the US over its history rose to the occasion over and over again to do what was necessary. Americans are realists. When they are told the truth, they act as needed. While politicians to date have espoused the phrase: “I Can Tell A Lie”, as the wiggle room disappears over the next 5 years, the truth will out. President Dwight Eisenhower summarized this best in his Farewell Address in 1961 when he stated:

“Throughout America’s adventure in free government, our basic purposes have been to keep the peace; to foster progress in human achievement, and to enhance liberty, dignity, and integrity among people and among nations. To strive for less would be unworthy of a free and religious people. Any failure traceable to arrogance, or our lack of comprehension or readiness to sacrifice would inflict upon us grievous hurt both at home and abroad.”

For the United States, reality stands ahead. But with Americans having made hard choices and sacrifices in the past, to strive for less would be unworthy of a free people. (Data from Medicare Trustees Annual Report to Congress, Social Security Trustees Annual Report to Congress, Congressional Budget Office, Federal Reserve, and the Hoover Institute coupled with Green Drake Advisors analysis.)

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2018 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.