The Saudi Put vs Green Energy Machine Part 2

The Saudi Put vs Green Energy Machine Part 2: Harvesting Returns

“The shape of a good’s market demand curve varies from one good to another and from one market to another. In particular, market demand curves vary in the sensitivity of quantity demanded to price. For some goods, a small change in price results in a large change in quantity demanded; for other goods, a large change in price results in a small change in quantity demanded.”

Chapter 2: Demand and Supply

Microeconomics: Theory and Applications

By Edwin Mansfield, 1970

“Catch a parrot and teach him to say ‘supply and demand,’ and you have an excellent economist.”

Attributed to both:

Thomas Carlyle, 1881

Irving Fisher, 1910

Electric Vehicles (EVs) continue to come down the cost curve. With the future rushing forward, R&D and capital investment horizons have become shorter and shorter, as global automobile companies and their suppliers position for crossover by 2025. New entrants, such as major technology players, position themselves to participate in both EVs and AVs (Autonomous Vehicles) by aligning themselves with the major car companies or suppliers that possess strong manufacturing capabilities as well as leading edge IP (Intellectual Property). However you slice it, the race to the start line accelerates with survival at stake for the existing players and billions of dollars of market share up for grabs for the new entrants.

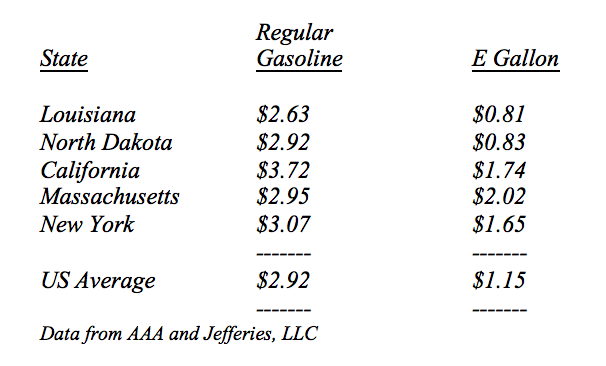

For the major oil producing countries, this future nightmare inexorably moves forward to supplant their key end markets in gasoline and diesel fuel. At best, global oil demand peaks in the 2030s, at worst by the late 2020s. The economic issue comes down to the following comparison of fuel costs between running a car on gasoline as opposed to electricity. As shown below, even in the high cost states for electricity, E Gallons are cheaper than Gasoline Gallons:

Once EVs cost no more than the typical car today, that possesses an internal combustion engine and runs on gasoline, the economics will move in EVs favor. And as they do, charging stations will proliferate, making it just as easy to recharge the battery as to fill the tank with gas. Most industry participants expect this economic crossover, for the average car, to occur between 2022 and 2025.

With a limited window, the major oil producers, such as Saudi Arabia or Russia, must focus on maximizing their revenue, while they still can control their own destiny. This becomes a tricky trade-off between price and volume. Given the nature of oil demand, which is fairly sticky in the short run or what economists would call inelastic, producers have incentive to manage the market to grow volumes and simultaneously to raise prices to siphon off as much revenue as possible without hurting demand growth. Simply put for Saudi Arabia, the difference between $40/barrel for their oil and $60/barrel for their oil comes out to a small $200 million per day or $73 billion per year, assuming they export all 10 million barrels a day that they produce. For Russia, that number works out to more than $90 billion, given their higher production of 13.4 million barrels per day. For all of OPEC excluding Russia, this totals ~$290 billion per year. Over a decade that works out to an additional $700 and $900+ billion for Saudi and Russia, respectively. And for OPEC plus Russia, this totals almost $4 trillion. That’s not chump change no matter how you look at it. At the same time, the major producers must not let prices create incentives for countries like the US or Brazil to ramp up production massively to a level that swamps the market. In other words, the oligopoly of OPEC plus Russia, which controls over 50% of global production, must manage price carefully. And given the nature of commodity markets, overshoots seem inevitable. Thus, oil prices collapsed into the $20s when Saudi Arabia moved to discipline producers outside of the oligopoly for their runaway production growth. And more recently, oil prices hit $80 per barrel for Brent as global inventories came into long term equilibrium.

With the Green Energy Machine bearing down on them, the time premium on the Saudi Put is eroding. And while it still represents a long term put, its expiration date is coming into focus. Given this reality and the acceleration occurring in EV investment, oil producers must focus on Harvesting Returns in order to maximize their revenue over the next decade. After that, oil will enter the long slow decline as new commodities, such as lithium and rare earths become the key raw materials of the Green Energy Era. And while the Saudi Put dominates the early rounds of the 15 Round heavyweight title bout, the Green Energy Machine scored numerous points that position it to win as the fight moves into the middle to late rounds, creating a new heavyweight champion of the world. (Data from OPEC, IEA, Jefferies LLC, and AAA coupled with Green Drake Advisors analysis.)

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2018 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.