The Consumer

The Consumer: Alive and Well and Living In America

“Before a man, when he gets up in the morning, can put on a coat, ground must have been enclosed, broken up, drained, tilled, and sown with a particular kind of plant; flocks must have been fed, and have given their wool; this wool must have been spun, woven, dyed, and converted into cloth; this cloth must have been cut, sewed, and made into a garment. And this series of operations implies a number of others; it supposes the employment of instruments for plowing, etc., sheepfolds, sheds, coal, machines, carriages, etc.

If society were not a perfectly real association, a person who wanted a coat would be reduced to the necessity of working in solitude; that is, of performing for himself the innumerable parts of this series, from the first stroke of the pickaxe to the last stitch which concludes the work. But, thanks to the sociability which is the distinguishing character of our race, these operations are distributed amongst a multitude of workers; and they are further subdivided, for the common good, to an extent that, as the consumption becomes more active, one single operation is able to support a new trade.

Then comes the division of the profits, which operates according to the constituent value which each has brought to the entire work. If this is not association, I should like to know what is.”

That Which Is Seen, and That Which Is Not Seen

Part 6: The Intermediaries

By Claude Frederic Bastiat, 1850

“The amount that the community spends on consumption obviously depends (i) partly on the amount of its income, (ii) partly on the other objective attendant circumstances, and (iii) partly on the subjective needs and the psychological propensities and habits of the individuals composing it and the principles on which the income is divided between them (which may suffer modification as output is increased). The motives to spending interact and the attempt to classify them runs the danger of false divisions. Nevertheless it will clear our minds to consider them separately under two broad heads which we shall call the subjective factors and the objective factors. The subjective factors, which we shall consider in more detail in the next Chapter, include those psychological characteristics of human nature and those social practices and institutions which, though not unalterable, are unlikely to undergo a material change over a short period of time except in abnormal or revolutionary circumstances. In an historical enquiry or in comparing one social system with another of a different type, it is necessary to take account of the manner in which changes in the subjective factors may affect the propensity to consume. But, in general, we shall in what follows take the subjective factors as given; and we shall assume that the propensity to consume depends only on changes in the objective factors.

The principal objective factors which influence the propensity to consume appear to be the following:

- A change in the wage unit …

- A change in the difference between income and net income …

- Windfall changes in capital-values not allowed for in calculating net income …

- Changes in the rate of time-discounting, i.e, in the ratio of exchange between present goods and future goods …

- Changes in fiscal policy …

- Changes in expectations of the relation between the present and the future level of income …

The fact that, given the general economic situation, the expenditure on consumption in terms of the wage-unit depends in the main, on the volume of output and employment is the justification for summing up the other factors in the portmanteau function ‘propensity to consume’. For whilst the other factors are capable of varying (and this must not be forgotten), the aggregate income measured in terms of the wage-unit is, as a rule, the principal variable upon which the consumption-constituent of the aggregate demand function will depend.”

Chapter 8: The Propensity To Consume I: The Objective Factors

The General Theory of Employment, Interest, and Money

By John Maynard Keynes, 1935

For the average American, it has been a tough two decades. However, things are looking up, finally. Fundamental economic growth is accelerating. Wages are rising at a rate in excess of inflation. And, a growing economy coupled with tight labor markets is encouraging businesses to invest, once more, in ways that should improve productivity, accelerate economic growth, and increase wages even more. Whether they live in Elkhart, Indiana or Colorado Springs, CO, or Jacksonville, FL or Sacramento, CA, there are opportunities for Americans across the economic spectrum to participate in the growth of the economy.

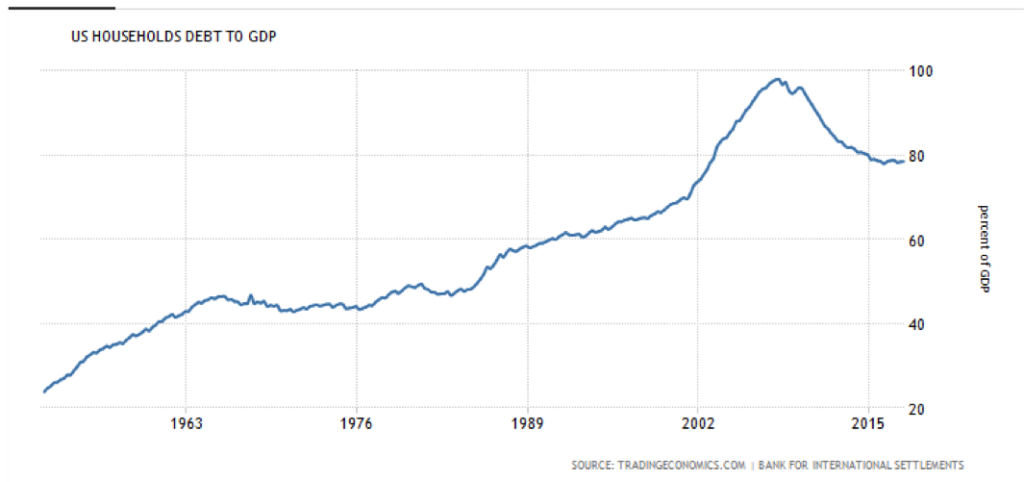

While Corporate America has yet to get its financial act together, with Corporate Debt to GDP at record levels, Households have cut their total debt outstanding significantly. And while not back to 1980’s levels, it stands significantly below its peak in 2007:

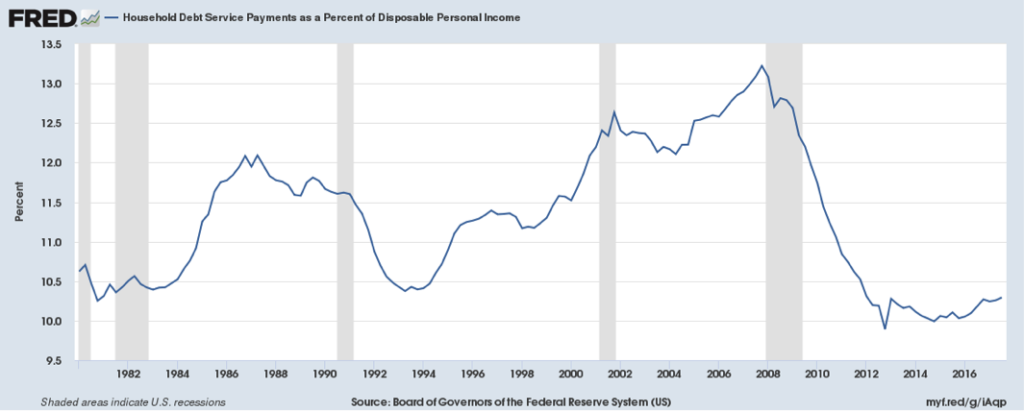

And with the significant drop in interest rates over the past decade, Households interest burden fell even more:

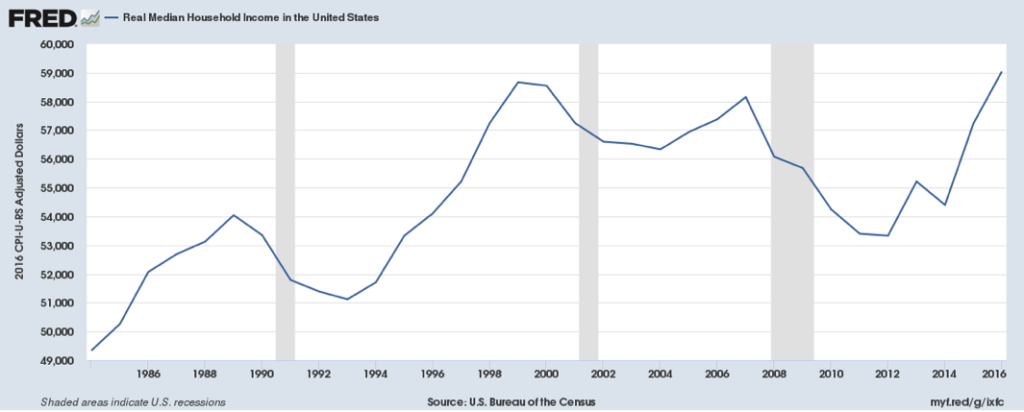

And even should interest rates normalize, as the Federal Reserve raises short term interest rates and allows for shrinkage of its balance sheet, the ratio would only rise slightly, given the rise in consumer incomes. As the chart below illustrates, Consumer Income is rising at a fairly strong rate, similar to the way it rose in the 1990s, allowing it to offset these interest rate increases:

Furthermore, as the chart makes evident, Real Median Household Income stands above its 1999 level for the first time ever. With the growing economy supporting employment and wages, the Consumer can believe that this trend will continue for the foreseeable future. On top of this positive backdrop, the Consumer benefitted from the recent tax cuts as well. This comes in two forms: a direct reduction in the overall taxes they pay and indirectly through increased income as businesses share a portion of their tax cuts with their employees. And this benefit even applies to the lower income earners. So, for a Household earning $40,000 per year, despite the costs of healthcare, rent, and gasoline rising, they will see their after-tax disposable income grow. This contrasts with the period from 2012 – 2016 when healthcare ate all of the incremental income they earned and then some. Given all this, for the first time since the 1990s, the Consumer stands in a strong position with a tail wind at her or his back.

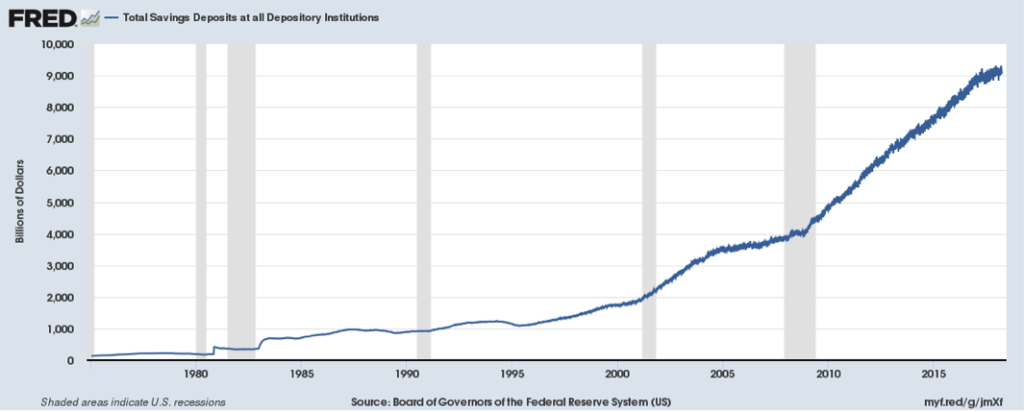

Coupled with the above stands the massive Consumer savings poised to earn interest. Consumers hold over $9 trillion in deposits sitting in banks earning close to nothing.

If interest rates on these savings rose just 1%, the Consumer would find an incremental $90+ billion in their pockets pre-tax. Already, numerous institutions outside the banking industry are targeting these deposits, as they can afford to offer more than the largest banks currently offer. Should rates continue to rise, the pressure on the large banks to raise the rates they are paying would rise, lest they see their core deposits walk out the door.

With clean balance sheets, rising incomes, and rising interest income, the consumer stands positioned to sustain economic growth. And with Consumer Debt Service below levels that preceded the consumer boom in the 1990s coupled with relaxation of the draconian rules imposed by Dodd-Frank, the key components to sustain a multi-year bonfire appear in place. All that remains to materialize the flames is the spark to launch such a blaze. With economic growth making the transition to late cycle, which will support consumer incomes, this spark may already be in place. And with the consumer set to take center stage, the script will center around the coming conflagration that reminds all, once more, that The Consumer is Alive And Well and Living In America. (Data from the Federal Reserve, US Census Bureau, and Bureau of Economic Analysis coupled with Green Drake Advisors analysis.)

Confidential – Do not copy or distribute. The information herein is being provided in confidence and may not be reproduced or further disseminated without Green Drake Advisors, LLC’s express written permission. This document is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy securities or investment services. The information presented above is presented in summary form and is therefore subject to numerous qualifications and further explanation. More complete information regarding the investment products and services described herein may be found in the firm’s Form ADV or by contacting Green Drake Advisors, LLC directly. The information contained in this document is the most recent available to Green Drake Advisors, LLC. However, all of the information herein is subject to change without notice. ©2018 by Green Drake Advisors, LLC. All Rights Reserved. This document is the property of Green Drake Advisors, LLC and may not be disclosed, distributed, or reproduced without the express written permission of Green Drake Advisors, LLC.