The Federal Reserve: Back on the Highway

The Federal Reserve: Back on the Highway

“Velocity is a function of real income and the interest rate. Consider first the effects of a change in the interest rate on velocity. An increase in the interest rate reduces the demand for real balances and therefore increases velocity: when the cost of holding money increases, money holders make their money do more work, and thus turn it over more often.

The way in which chages in real income affect velocity depends on the income elasticity of the demand for money…[W]e have seen that the income elasticity of the demand for money is less than 1. That means that velocity increases with increases in real income…

The empirical work reviewed in Section 7-4 makes it clear that the demand for money and, therefore, also velocity do react systematically to changes in interest rates and the level of real income. The empirical evidence therefore decisively refutes the view that velocity is unaffected by changes in interest rates and that fiscal policy is, accordingly, incapable of affecting the level of nominal income… [E]xpansionary fiscal policy can be thought of as working by increasing interest rates, thereby increasing velocity, and thus making it possible for a given stock of money to support a higher level of GNP.”

Macro-Economics

Chapter 7: The Demand For Money

By Rudiger Dornbusch and Stanley Fischer, 1981

(Stanley Fishcher, Vice Chair Federal Reserve, 2014 – 2017)

Over the past 10 years, the Federal Reserve relived its 1930s experience in a nostalgic return to yesteryear. The financial system went broke. The demand for money rose. And interest rates and velocity collapsed. The only missing ingredient from this nostalgic cocktail was deflation. That bugaboo from the 1930s that bankrupted a large portion of the economy and sent unemployment soaring to over 25%. To prevent a repeat of deflation, the Fed massively expanded the monetary supply to offset the decline in credit growth and the velocity of money. Using this “Quantitative Easing” (QE), the Federal Reserve prevented true deflation from spreading across the economy and undermining the ability of businesses to fund their operations and to repay their debts. In addition, by artificially creating negative interest rates, the US central bank intervened to stimulate the economy in the absence of federal action to support final demand and jumpstart economic growth. And finally, by providing life support to the patient, the Federal Reserve put a backstop under the consumer and the housing market turning the tide and setting in motion a massive recovery in housing prices. All of this from printing little pieces of paper.

However, as with anything, any good idea taken to an extreme becomes a bad idea. After successive bouts of QE, the Fed faced that old saw, the law of diminishing returns. In addition, with a change in Congress and the Presidency, the federal government once more moved to support the economy by growing Federal spending and enacting a tax cut. In this environment of supportive economic policies and the ensuing faster economic growth, having negative real interest rates that stimulate the economy further makes no sense in a late cycle economic environment. With this as background, the Federal Reserve is moving to normalize interest rates slowly but surely.

The reason to normalize interest rates now comes down to velocity and inflation. Velocity is the speed at which all the little pieces of paper representing currency circulate in the economy. And inflation is the lagged result of rising tightness for goods, services, and labor in the economy. With inflation on the rise from fundamental economic forces and growth accelerating due to the pro-cyclical policies enacted at the federal level, velocity should increase, reinforcing the upward move in inflation. There is a simple equation for velocity:

MV = PQ

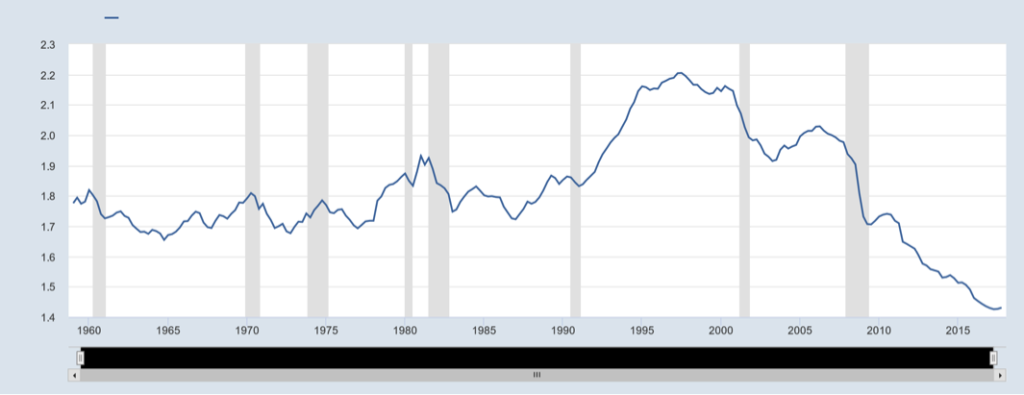

In other words, Money times Velocity, which is how quickly money turns over in the economy, equals the Quantity of goods times the Price. The Federal Reserve used QE to put lots of Money into the US economy to offset the decline in Velocity that occurred post the recession due to the bankruptcy of the US financial system and the need to recapitalize the banking system. The following chart from the Federal Reserve Economic Database shows how Velocity slowed post-Recession:

Velocity of M2. Chart Courtesy of Federal Reserve of St. Louis.

As the chart also demonstrates, Velocity bottomed recently. This bottoming means that the faster pace of economic growth, with a lag, began to impact Velocity, causing all the pieces of paper the Fed created to circulate more quickly in the economy. And in order to prevent Inflation from accelerating dramatically, Price in the equation above, the Fed entered into anti-QE late last year to remove Money from the economy and offset the Velocity increase.

With interest rates normalizing and Velocity on the rise, the Federal Reserve can now envision returning to the monetary policy that it utilized from 1945 through 2007 and the traditional monetary tools with which it is comfortable. However, in the transition, Chairman Powell must move gingerly so as not to cause a new recession prior to reaching the holy land of traditional policy. Essentially, the Fed will need to err on the side of caution, allowing the economy to overheat and recreating the mid to late 1960s lest it end up back at the zero bound and need to go back to some form of QE. With the path clear for the Federal Reserve and traditional monetary policy ahead, the Fed will soon be Back On The Highway it has travelled many times before. (Data from the Federal Reserve coupled with Green Drake Advisors analysis.)