Retail Resurrection, Commercial Real Estate: A New Future, and The Great Game of Power: Trade & The Return of the Cold War

The Monthly Letter covers three topics this month. First, we provide perspective on the blurring of the lines between selling goods over the Internet and through traditional stores. Second, we return to the topic of Commercial Real Estate, for the first time in almost five years, in a piece titled The Past Is Not Prologue To The Future. Third, we provide an update in our Great Game of Power series. This month we review the emerging Trade War between China and the West and the likely changes to future trade networks; the Re-emergence of the Cold War with the Communist countries of Russia and China; and the emerging change in foreign policy that will return our relationship with China to that of the 1950s and 1960s. And Fourth, as always, we close with brief comments of interest to our readers.

Retail: Reports of My Death Are Greatly Exaggerated

“Industry structure has a strong influence in determining the competitive rules of the game as well as the strategies potentially available to the firm. Forces outside the industry are significant primarily in a relative sense; since outside forces usually affect all firms in the industry, the key is found in the differing abilities of firms to deal with them. The intensity of competition in an industry is neither a matter o coincidence nor bad luck. Rather, competition in an industry is rooted in its underlying economic structure and goes well beyond the behavior of current competitors.”

Competitive Strategy: Techniques for Analyzing Industries and Competitors

Chapter 1: The Structural Analysis of Industries

By Michael E. Porter, 1980

The Amazon juggernaut rolls on with revenue growing over 30% for its latest quarter. According to the press, the company is expected to squash the competition, putting all of retail out of business by leveraging its internet prowess. One need just look at the travails of the major department stores, such as JC Penney or Macy’s. In doing so, it is expected to come to dominate all aspects of retail, whether for clothes, home goods, groceries, auto parts, pharmaceuticals, … And given its rising focus on last mile logistics, whether by truck or drone, this is expected to come sooner than later.

However, hidden underneath the headlines is an interesting story, one that differs in many respects from the popular gospel. One, some might say, that puts the whole narrative of Amazon’s place in the universe in question. And it starts with the simple observation that not all of retail is rolling over and playing dead like Rover the dog. In fact, it appears large portions of retail are growing and prospering despite Amazon’s growth and the major retailers with significant resources are beginning to fight back, leveraging the integration of their physical store presence with the internet to blunt Amazon’s inroads and potentially roll them back.

The first part of understanding Amazon’s true impact on retail is to understand that 80% of all goods that move across its platform are by third party sellers. Whether for soap, books, dresses, or lawn mowers, Amazon only sells 20% of the goods on its platform. In other words, it serves in the capacity of an Ebay for most of its goods that it sells. Second, its free shipping, for its Amazon Prime Members, is beginning to really bite from a cost perspective. Its net shipping costs reached $7.2 billion in 2016 and are growing at a rapid rate. While Amazon, unlike any other company, has been allowed to grow revenues without growing profits for over a decade, eventually shareholders will demand earnings to go along with the revenues. And should Amazon ultimately have to produce profits, it will be faced with a choice. It will either have to price goods at a profit or limit its free shipping. Third, as Amazon enters more and more categories of retail, it is starting to come up against large competitors with strong positions in the marketplace that possess sophisticated customer data and the resources to leverage the data to drive the internet portion of their business. In entering the supermarket business, Amazon is essentially competing against the likes of Walmart, Kroger, and Costco. All possess significant scale and resources which enable them to respond to Amazon’s entry into their markets. In addition, as some of the largest purchasers of the goods they sell, their purchasing clout enables them to buy items at a significant discount to the price at which Amazon can purchase the same items from the manufacturers and distributors of those items. And fourth, its entry into new segments of retail is beginning to impact its Amazon Web Services (AWS) negatively. This is the most profitable and fastest growing portion of the company. Already, companies in some of the newer areas Amazon has recently entered have announced they are leaving AWS to put their cloud business with AWS competitors such as Google and Microsoft. In addition, looming in the background is the maturation of the cloud business. The overall cloud industry is estimated to have captured 54% of all computing loads by the end of 2017. By, 2020, this number will rise to over 90%. With the maturation of its key profit driver, the pressure on the rest of the business to actually grow profits will rise.

Recent data from numerous retailers makes clear that they continue to grow despite the Amazon juggernaut. For example, Urban Outfitters is growing its physical retail sales at the same time as its online sales, which represent over 35% of the company’s revenue, continue to grow at a rapid rate. Overall comp sales are rising in the mid-single digits. Home Depot continues to grow its comparable store sales at high single digits, with same store sales rising 7.7% in the US in its latest quarter. Going forward, the company plans to invest heavily in integrating its online presence with its ubiquitous stores to drive growth. Walmart’s comparable store sales were positive for the most recent quarter, growing 2.7%, with its online business growing at 50% year over year, faster than Amazon’s online business in the US. Nike’s Direct To Consumer business is growing at 29%, according to its latest public filings. Stitch Fix, an online only retailer which just filed to go public, appears to have higher profit margins than Amazon and growing just as fast if not faster. For all these firms, adaptation appears to be the mantra with significant progress apparent as they create models that leverage the internet and their strategic competitive position.

As the above data make clear, while Amazon continues its torrid growth, the remainder of the retail industry is responding by upgrading their internet presence and integrating it with their stores. At the same time, Amazon has been forced to buy stores, such as with the Whole Foods acquisition, or to come to terms with existing retailers, such as Kohls, to enable it to have a store presence. In essence, Amazon is beginning to look like a traditional retailer. As the lines between traditional retail and Internet retail continue to blur, it looks more and more as if numerous traditional retailers are adapting and thriving in this new environment. And with this becoming more clearly the future for traditional retailers, it appears as if for Retail, Reports Of My Death Are Greatly Exaggerated. (Data from company reports coupled with Green Drake Advisors analysis.)

Commercial Real Estate: The Past Is Not Prologue to the Future

“One of the keys to thinking big is total focus. I think of it almost as a controlled neurosis, which is a quality I’ve noticed in many highly successful entrepreneurs. They’re obsessive, they’re driven, they’re single-minded and sometimes they’re almost maniacal, but it’s all channeled into their work. Where other people are paralyzed by neurosis, the people I’m talking about are actually helped by it.”

“Some people have a sense of the market and some people don’t … I like to think I have that instinct. That’s why I don’t hire a lot of number-crunchers, and I don’t trust fancy marketing surveys. I do my own surveys and draw my own conclusions. I’m a great believer in asking everyone for an opinion before I make a decision. It’s a natural reflex. If I’m thinking of buying a piece of property, I’ll ask the people who live nearby about the area what they think of the schools and the crime and the shops. When I’m in another city and I take a cab, I’ll always make it a point to ask the cabdriver questions. I ask and I ask and I ask, until I begin to get a gut feeling about something. And that’s when I make a decision. I have learned much more from conducting my own random surveys than I could ever have learned from the greatest of consulting firms.”

“The worst thing you can possibly do in a deal is seem desperate to make it. That makes the other guy smell blood and then you’re dead. The best thing you can do is deal from strength, and leverage is the biggest strength you can have. Leverage is having something the other guy wants. Or better yet, needs. Or best of all, simply can’t do without. Unfortunately, that isn’t always the case, which is why leverage often requires imagination, and salesmanship. In other words, you have to convince the other guy it’s in his interest to make the deal.”

Trump: The Art of the Deal

Chapter 2: Trump Cards: The Elements of the Deal

By Donald J. Trump and Tony Schwartz, 1987

From the bottom of the real estate markets in late 2011, real estate assets have appreciated significantly. This is due to falling interest rates, which have provided a tailwind to the multiples of property cash flow, and the growth of the cash flows themselves, as occupancies rose and rents increased. And it did not matter which asset class the investor chose in real estate, whether office buildings, homes, apartments, warehouses, hotels, or data centers. They all appreciated. For the investor, it was a matter of being in the right place at the right time.

However, with the acceleration in economic growth in 2017 and the Federal Reserve raising interest rates, the landscape is changing. Whether it is the rise in labor and materials, the increase in taxes, the increasing volumes of supply, or the rise in carrying costs, all will contribute to making the real estate investor’s path to strong returns more difficult. And that path will only get more treacherous the longer the expansion continues.

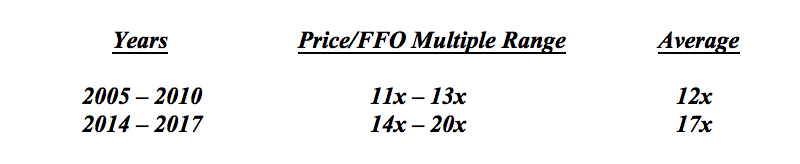

Firstly, the rise in interest rates will lower the multiples of cash flow that investors should expect. The table below lays out how multiples have expanded for the public REITs (Real Estate Investment Trusts) over this economic cycle as the Federal Reserve put in place Quantitative Easing, which artificially lowered interest rates:

As the table makes clear, multiples of cash flow have risen by over 40%. So, if the investor bought a property in late 2011 or during 2012 as the market was bottoming, they would have seen their property appreciate at more than 7% per year if rents and occupancies stayed flat. As both rents and occupancies rose significantly for every real estate asset class except malls, allowing the cash flow from the property to rise at 5% to 10% per annum, real estate investors easily earned 15% to 20% compound returns on their properties over the past 5 years. If we assume interest rates return to normal, driving cap rates upward over the next 5 – 7 years, then cap rates could rise from their low of 5.5% last year to almost 9% by 2025. This would lower multiples of free cash flow from 18x to only 11x, reversing completely the 40% increase and providing a headwind of 7% per annum.

The other issue facing real estate investors is the actual increase in supply across many classes of real estate. Apartments serve as the classic example of what a changing Supply-Demand Balance can mean over the next few years. The Apartment Market benefitted from a number of fundamental tailwinds this cycle. First, from 2004 – 2007, millions of households bought houses that would not have qualified under traditional home financing standards. As they defaulted on their mortgages, starting in 2008 and accelerating into 2009, banks began to foreclose on these homes in large numbers starting in 2011. (The delay was due to the judicial process coupled with government attempts to keep people in their homes.) As this snowballed, these homeowners became renters once more providing a strong underpinning to rental demand through 2014. Second, apartment rents went from being at a statistically low ratio of income all the way to the high end of the historical ratio. This helped same apartment rental growth to grow at a rapid clip, which helped NOI growth. Third, the Millennials entered their prime rental years, creating significant growth in the number of people age 18 – 35. This led to rising demand for rental properties. These three factors combined with limited new supply of apartments produced a best of all worlds. And at the same time, due to tightness in mortgage standards, these same Millennials were delayed in purchasing homes compared to prior generations. However, all this has changed over the past two years. Apartment supply has accelerated, loosening the supply-demand balance. In cities as diverse as Los Angeles, Philadelphia, and Miami, net new apartment deliveries to the marketplace will exceed job growth. In addition, the forces of demographics continue apace with the Millennials moving into their prime home buying years. This can be seen in the latest data on Household Formation for Q3 2017 in which there were more than 700,000 more households owning homes but almost 350,000 less households renting. In other words, at the same time as the Apartment industry is bringing significant supply to the marketplace, demand is falling on a national basis. And, with this loosening of the supply-demand balance, rental growth has slowed and incentives to bring new renters in the door have increased. In certain segments of the market in certain cities, rents have even fallen. At the same time as the revenue equation is under pressure to the downside, the cost equation is seeing an acceleration. Wages are beginning to grow at a more rapid rate. The cost of construction materials is rising as single family home starts continue to recover to normalized levels. And taxes are going up. In addition, for certain cities which offered 10 Year Tax Abatements for renovation or new construction, these abatements are approaching their end and will cause taxes on those properties to rise sharply once the period for the abatement ends.

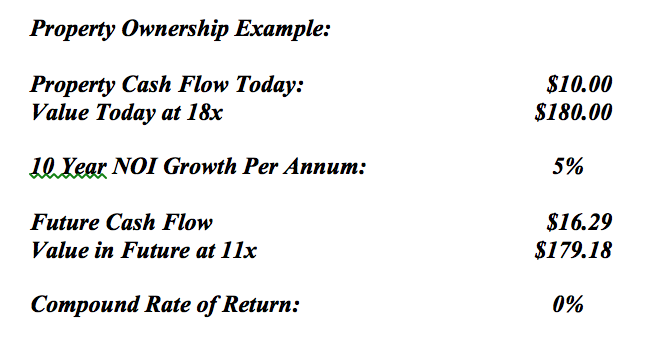

When looking at what this means, overall, for the real estate investor, some unpleasant realities appear. The biggest one is that long term returns on real estate ownership will drop sharply for properties that do not undergo significant upgrading in terms of their position in the marketplace. The following table demonstrates what the math would look like if cap rates truly do increase from 5.5% to 9.0%, driving cash flow multiples down from 18x to 11x and the property does not undergo some form of a major upgrade in terms of its ability to generate cash flow:

As the above example makes clear, the value of the property in 10 years will equal its current value. And should inflation average its normal level of 3.2% over the past 100 years, then the real estate owner would see a significant negative real return of 27% in the value of his or her property, as the overall price level for the economy rose 37% even though cash flow (NOI) would rise in excess of inflation. Faster growth in cash flow would not necessarily lead to a much better result. If NOI Growth Per Annum were to rise to 8%, which would represent very high real growth in rental rates in a nominal wage growth environment of 6% to 7%, given the underlying US demographics, the value of the property would only grow to $237.48, which is only a 2.8% increase per year in the value of the property. And with inflation averaging 3.2%, the real value of the property in 10 years would be only $173.31, less than its value today. And in the case where Cap Rates rise only to 8% in the example above, providing a 12.5x multiple of the cash flow, the value of the property would only grow to $203.63, providing only a 1.24% compound rate of return and a negative real return in the property value of 17.5%.

While there could be some great cataclysm, such as a 9.0 earthquake on the West Coast in California that destroys a significant amount of real estate leading to outsized demand growth off a shrunken base, real estate investors cannot count on such a fortuitous Act of God. Instead they must look at the reality of low cap rates, rising supply, and rising costs. And this landscape provides significant challenges to producing long term returns given the math above. While real estate investors will still have opportunities to profit, especially in growth markets and during economic recessions, they will face a headwind that can significantly lower their returns. Given this reality in Commercial Real Estate, The Past Is Not Prologue To The Present. (Data from Public Companies coupled with Green Drake Advisors analysis.)

The Great Game of Power: Trade Networks & The Rise of Mercantilism, The Re-Emergence of The Cold War, and The Return of the Yellow Peril

“A duty laid upon an article which can not be produced in this country, such as tea or coffee, adds to the cost of the article, and is chiefly or wholly paid by the consumer. But a duty laid upon an article which may be produced here stimulates the skill and industry of our own country to produce the same article, which is brought into the market in competition with the foreign article, and the importer is thus compelled to reduce his price to that at which the domestic article can be sold, thereby throwing a part of the duty upon the producer of the foreign article. The continuance of this process creates the skill and invites the capital which finally enable us to produce the article much cheaper than it could have been procured from abroad, thereby benefiting both the producer and the consumer at home. The consequence of this is that the artisan and the agriculturist are brought together, each affords a ready market for the produce of the other, the whole country becomes prosperous, and the ability to produce every necessary of life renders us independent in war as well as in peace.

A high tariff can never be permanent. It will cause dissatisfaction, and will be changed. It excludes competition, and thereby invites the investment of capital in manufactures to such excess that when changed it brings distress, bankruptcy, and ruin upon all who have been misled by its faithless protection. What the manufacturer wants is uniformity and permanency, that he may feel a confidence that he is not to be ruined by sudden exchanges. But to make a tariff uniform and permanent it is not only necessary that the laws should not be altered, but that the duty should not fluctuate. To effect this all duties should be specific wherever the nature of the article is such as to admit of it. Ad valorem duties fluctuate with the price and offer strong temptations to fraud and perjury. Specific duties, on the contrary, are equal and uniform in all ports and at all times, and offer a strong inducement to the importer to bring the best article, as he pays no more duty upon that then upon one of inferior quality. I therefore strongly recommend a modification of the present tariff, which has prostrated some of our most important and necessary manufactures, and that specific duties be imposed sufficient to raise the requisite revenue, making such discriminations in favor of the industrial pursuits of our own country as to encourage home productions without excluding foreign competition. It is also important that an unfortunate provision in the present tariff, which imposes a much higher duty upon the raw material that enters into our manufactures than upon the manufactured article, should be remedied.”

First Annual Message to Congress

President Millard Fillmore

December 2, 1850

“Specifically, large-scale trade was, from the very beginning, conducted in well-defined political (geopolitical) networks. Internal – to the political network – trade was encouraged, while external trade (foreign trade) was discouraged. The reason was relatively straightforward, namely the classical free-rider problem. As the public good(s) was (were) responsible for the making of markets, it stands to reason that everyone had to bear the cost. Foreigners, not being obliged to pay taxes in the country, would, in the absence of barriers to trade, be classic free-riders. That is, enjoy the fruits of market activity without having contributed.

This, we argue, helps explain why trade, from ancient Sumeria to the present, has been carried out in well-defined geopolitical networks (e.g. city-states, nations, countries, federations), and why extra-network (foreign) trade has, until recently, been either illegal, or been discouraged (barriers to trade). Governments have, from the start, been responsible for the emergence of large-scale specialization and trade making for a situation in which free trade – or the absence of barriers – raises the free-rider problem, which, if left unchecked, can, at least potentially, lead to the demise of government and, in the limiting case, to the demise of markets.”

Interregional and International Trade: A Network Approach

Chapter 1 – Introduction

By Bernard C. Beaudreau, 2008

The Great Game of Power continues onward. China, having used mercantilist economic policy to drive its economy over the past 20 years, now is leveraging its economic gains to foster the ability of its military to project power around the world and, in alliance with Russia, is attempting to set up an alternative economic system with China at the center. However, with direct conflict over Spheres of Influence with the other major nations across the globe now openly occurring and Western nations realizing that China’s intent is not to integrate into the global economy but dominate it, China now faces a rising reaction to the state of affairs that would allow it to become the dominant power globally, both militarily and economically. For the first time in over 25 years, other nations are acting to block its moves. This change in policy is being led by the United States. For the past 20 years, beginning with the entry of China into the World Trade Organization (WTO) and with the granting by the US of Permanent Most Favored Nation Status (MFN), the goal was to integrate China into the global trading system in order to foster the evolution to a democratically elected form of government, much as occurred in Japan, South Korea, Indonesia, … Thus, the economic relationship between the US and China was allowed to produce significant benefits to China without any reciprocal gains for the United States in order to reach this policy goal. However, with China changing its outward face to the world through strongarm tactics, moving to an Orewllian 1984 type government to reinforce the Communist Party’s autocratic control over the country, and flexing its industrial/military muscle in an explicit manner to accelerate its ascension and the decline of other nations, such a state of affairs could not continue.

For those who wish to understand the evolution of the current state of affairs in international trade, a fundamental understanding of the role of trade and trade networks coupled with a return to 19th Century Economics is in order. First, Trade Networks fundamental purpose is to allow trade in such a manner as goods and services can be exchanged with less friction in order to benefit the individual country. Historically, this has involved the exchange of raw materials for finished goods. And it was very closely regulated by the city-state or national government. No goods could be traded without their blessing. And stiff tariffs and regulations were put in place, backed with police and the military, to prevent illegal smuggling of goods. For those who remember their American history, there was something called The Boston Tea Party that involved Britain wanting to collect duties on tea and Americans not wanting to pay them. Second, if one examines the history of the 1700s, 1800s and the 1900s up until World War II, it is one of tariffs and duties globally to both aid internal industry and to fund the central government. In fact, most countries kept tariffs in place to protect their industry from imports and put duties on exports of key raw materials to ensure industry had a ready supply of cheap raw materials and energy throughout the 1800s and 1900s. This idea was central to President Filmore’s first Address to Congress in 1850 cited above. Great Britain was the classic exemplar of this mercantilist strategy. For example, Great Britain imported over 800 million pounds of cotton to use in its vast cotton mills in 1860. And after processing into cloth, Britain exported 65% of all its finished cotton goods, keeping only 35% for domestic consumption. Other countries, such as Germany, developed strong manufacturing bases using their cheap coal and strong technology to develop low cost manufacture of steel. Whichever areas countries chose to leverage, duties and tariffs followed to favor domestic industry. In fact, Adam Smith, in his great tome, The Wealth of Nations published in 1776, understood the need for the nation to protect and encourage its manufacturing lest merchants just set up shop in other countries when he said: “A merchant, it has been said very properly, is not necessarily the citizen of any particular country. It is in a great measure indifferent to him from what place he carries on his trade; and a very trifling disgust will make him remove his capital, and, together with it, all the industry which it supports, from one country to another. No part of it can be said to belong to any particular country, till it has been spread, as it were, over the face of that country, either in buildings, or in the lasting improvement of lands.” (Book III, Chapter IV). One need only look at the current strategies of the US and European multi-national corporations to see this at work.

The idea of free trade did not enter the US lexicon until after World War II. At that time, the US stood victorious with an about to be underutilized industrial stock due to the falloff in war demand. The rest of the world had seen their industry decimated by war as bombing and battles had leveled factories and seen roads and bridges destroyed. The US was spared this destruction. As a result, the US needed a philosophy to justify shipping US goods overseas and pushing other countries to open up their markets to US goods. This stood in contrast to those countries desire to rebuild their industry to supply their own goods. Thus was born the idea of free trade, something that hitherto had not existed in any form. And in order to create a new philosophy, the free trade movement needed a villain. In this case, the tariffs enacted under the Smoot-Hawley legislation were vilified and blamed for the Great Depression. Thus, the philosophical underpinnings of the free trade movement were created to push other countries to open up their markets. (Numerous economic studies over the past two decades show that the Smoot-Hawley tariffs had little to no statistical impact on the depth or duration of the Great Depression. The real culprit was the massive oversupply of goods around the world leading to a collapse in investment, the global overproduction of agricultural goods bankrupting the agricultural economy, the massive speculation and manipulation in the public markets in the US and Europe, and the mismanagement by the government and Central Banks of the ensuing credit and stock market crises.) Armed with this new free trade philosophy, US industry pushed relentlessly to open up overseas markets. Thus was created the GATT in 1947. It was this body that enabled progressive liberalization of markets overseas, specifically Europe, allowing more and more opportunities for US exports. (At the same time, the US put in place the Marshall Plan to rebuild these countries to create markets for the goods.)

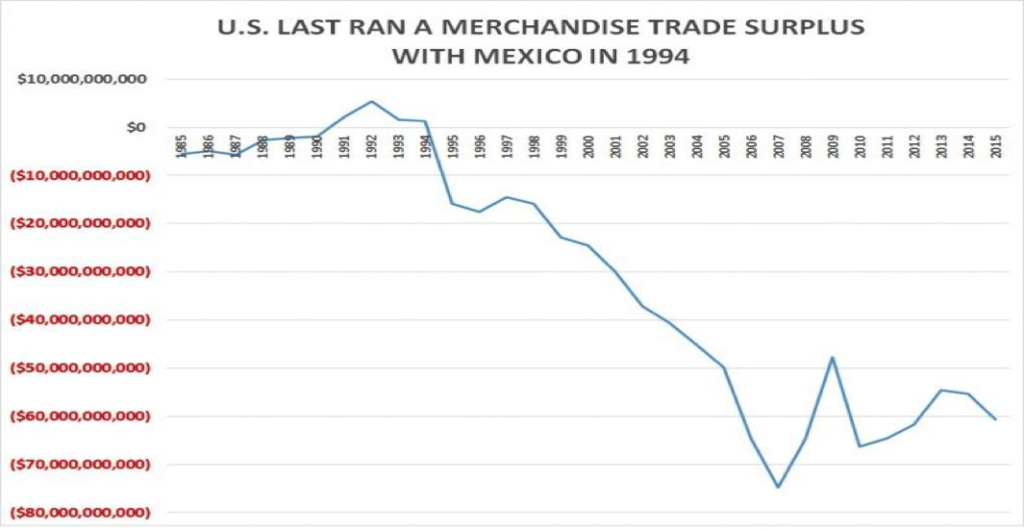

However, the developing world was explicitly excluded from the GATT as there was a fear that opening up the US markets to these countries would provide little to no benefit to the US, as these countries could not afford high value US goods, but such a move would enable them to leverage cheap labor and land coupled with, at best, lax environmental standards to put in place factories and export cheap goods back to the US displacing US manufacturing. Despite this fear, due to US and European multi-nationals desire to open up foreign markets for their goods, the GATT was transformed into the WTO in 1994. This followed right on the heels of the signing of NAFTA in 1993. These agreements were touted as the triumph of free trade opening up markets to the sale of more US goods. The reality was the opposite. Instead of more US goods being sold overseas, other countries sold more goods to the US as is clear from the following chart on trade with Mexico after the signing of NAFTA:

Chart Courtesy of McAlinden Research Partners.

As the above graph makes clear, trade with Mexico became very one sided against the US once a free trade pact was in place. In fact, to think that any other outcome would occur went against the grain of rational thought. In opening up its Trade Network, the US made a cardinal error in ignoring several hundred years of the history of trade and what actually occurred. Historically, governments made sure the results were evenhanded. And when it turned out to not be the result, governments would intervene in the marketplace to ensure that this was rectified, oftentimes imposing tariffs to ensure that trade became more balanced.

This issue with Trade Networks is that the pros and cons of allowing a new entrant into the system must be weighed carefully. The new entrant will destabilize the existing system. Thus, the benefits and costs require analysis that ensure the benefits outweigh the costs. And if a bad actor is allowed into the system, which inevitably will happen if enough players are allowed into the game, then there must be a system to eventually eject the bad actor from the Trade Network in order to restore a proper equilibrium. By bad actor is meant a party to a Trade Network that does not live by the rules that it agreed to follow in order to enter the system. This is what the US did with China in 2000. It allowed a bad actor into the system and “gave up” its right to take direct trade action against China to restore equilibrium. China, despite signing an agreement stating it would open its markets, immediately put in place a series of rules tantamount to classic 19th Century Mercantilism. It built up its own industry, progressively displacing imports in a logical manner, in order to put in place an industrial economy that took in raw materials and exported finished goods. In essence, it put in place the same economic policies that had driven the rise of Great Britain, Germany, and the United States in the 1800s and first half of the 1900s. At the same time, it strategically targeted foreign countries industries with low priced exports in order to drive them out of business. This issue is no different than the one that Millard Fillmore faced in 1850. Except that the US was slow in recognizing the damage to its industrial base from the large trade deficits with China and the inevitable collapse in capital formation that would occur if its industry faced competitors with protected domestic markets and the ability to export goods below cost. If a student of Friedrich List, the famous 19th Century German economist who drove German industrialization, or David Ricardo, who famously wrote about the trade of cloth and wine between England and Portugal and the risk of both being produced in Portugal if the merchant was left to his own designs in his 1817 opus, was involved at the high levels of the US government, he or she would immediately have recognized the policy and recommended immediate action to forestall damage to the country’s industrial base. However, with the philosophy of free trade riding high, it took 8 years of poor economic growth and the collapse of US capital formation for this reality to be publicly recognized. With the new Trump Administration focused on this issue and a new National Security Strategy recently issued that focuses on trade and the US industrial base, the logical course of action is for the US to limit China’s access to the Trade Network including the US in order to restore balance, much as it does with Russia today.

And while China will become the poster child for this change in trade policy, in order to make this policy effective, other countries, such as Mexico, will likely see similar actions. In fact, NAFTA is likely only the first major casualty of this newfound strategy to restore the US industrial base with numerous future actions to follow. Should NAFTA end, then numerous products that now enjoy tariff free entry will face stiff tariffs and much higher domestic content regulations. (This will have a much broader impact than just on Mexico as other countries are using Mexico to transship their goods into the US.) However, that will just solve the issue with Mexico. A whole reshaping of the WTO will be necessary in order to restore something akin to the GATT where the US regains control of its manufacturing base and future economic growth. The reason for this can most easily be seen in what is occurring in the US steel industry. The US steel industry is one of the lowest cost producers of steel in the world due to low energy costs and highly efficient plants requiring little labor. In shutting China out of the market directly then shutting its goods out that were transshipped through third countries, such as Vietnam, Chinese steel imports plummeted. However, other countries rushed to fill the gap and sell their steel to the US in 2017. Thus, US steel imports are up 19% year-over-year with finished steel imports up 29%, despite Chinese exports being shut out of the country. Without addressing these other players, the US steel industry will remain under assault. This is because every other major country possesses a surplus of steel capacity relative to domestic demand which they export, including Germany, Canada, Japan, Brazil, South Korea, India, Slovakia, Turkey, … For example, while Japan’s economy is one third the size of the US economy, it produced 104.8 million tons of steel in 2016 compared to just 78.5 million tons for the US. Other countries such as Iran and Russia are increasing their steel capacity with the goal to export this steel. And with the EU recognizing this and raising tariffs to protect against this coming onslaught, all this steel is finding its way to the US as the only open end market. The only solution for the US will be to impose tariffs on all foreign steel and effectively force this surplus production back into the home markets from whence it came, else watch its steel industry shrivel and die as other countries protect their production from competition and export to drive their economic growth. Such an action would look nothing like regulation under the auspices of the WTO but more like actions traditionally taken under the GATT. In doing so, the US will begin to reshape its Trade Network to look once more as it did prior to World War II with tariffs and duties in place, recognizing the reality that David Ricardo and Friedrich List wrote about in the 19th Century and even Adam Smith recognized in the late 1700s. Thus, the country would effectively transform its Trade Network to its advantage and reinforce The Rise of Mercantilism around the globe.

This growing global economic rivalry between countries can be seen in the actions of Russia to align itself more closely with China to improve its global competitive and strategic position. Russia is now selling significant raw materials to China in the form of timber and oil. In return, China is building its rail line from Beijing to Berlin through Russia as part of its One Belt, One Road economic strategy to avoid the sea in sending its products to Europe and reopen the Silk Road, famously pioneered by Marco Polo. At a minimum, Russia will be able to leverage the new rail lines and improvements to its existing infrastructure to collect shipping fees and to help ship its own goods across its vast expanse and to other countries both West and East. (Whether Europe and Asia will accept all these goods that both Russia and China plan to ship to them to displace their own domestic manufacturing capabilities is a different question.) In support of these goals, Russia continues to build up its energy production and manufacturing base to position itself for completion of the rail line and to underpin its military build-up. These actions will further reinforce the global mercantilist impulse as other countries respond to Russia to ensure that strategic industries are supported with sufficient domestic capacity for both civilian and military needs.

These actions possess other significant consequences as well for the US and Europe outside the realm of international trade. With Russia building up its military, the US and Europe must confront face-to-face the same military and strategic issues they thought left behind in the early 1990s. Russian actions appear to have returned to the global strategic playbook of that earlier period with Vladimir Putin executing the tactics necessary to advance Russia’s global position. The Russian goals seem to fall into the following categories in one way or another: to bring the former Soviet satellites back into orbit, to extend Russia’s Sphere of Influence westward into Europe, to counter the US influence across the globe, to undermine the US political system, to undermine democracy in the Developing Economies, and to reorder the global economic system to one in which Russia possesses primacy over the economies of the West. If one were to return to 1950 or 1850 or 1750, these goals could be found at the highest levels of the Russian government. Simply put: history repeats, but not exactly. Or in the words of George Santayana, “Those who cannot remember the past are condemned to repeat it” which he wrote in 1905. (The Life of Reason: Reason in Common Sense. Scribner’s 1905, 284)

In executing this overwhelming multi-part strategy, Russia appears intent on challenging the West simultaneously on multiple fronts. For example, the economic strategy outlined above addresses the last point while the attempts to interfere in the 2016 US Presidential Election clearly undergird its actions to undermine the US political system. To reach the other three strategic goals, Russia’s increasing use of the military comes to the forefront. This change in Russian strategy was clearly signaled through a number of warning shots to Europe over the past two years: having military aircraft intrude into foreign airspace and buzz foreign aircraft and ships, sending subs to practice infiltration into foreign countries’ waters, and building up military forces along its borders. At the same time, the country pushed ahead with moves to increase its economic leverage over Europe. For example, by increasing the amount of energy exported to Europe, specifically natural gas, Russia plans to put in place an economic chokepoint that would enable increased Russian economic leverage. It already exhibited this leverage by cutting off supplies to Ukraine in 2014 and threatened any European country that tried to bypass its cutoff with a similar fate. Russia also reinjected into foreign policy the role of war to produce results for strategic advantage. As General Carl Von Clauswitz wrote famously in the early 1800s, as head of Prussia’s military and the architect of its military strategy to support its strategic goals at that time:

“We know, certainly, that War is only called forth through the political intercourse of Governments and nations; but in general, it is supposed that such intercourse is broken off by War, and that a totally different state of things ensues, subject to no laws but its own. We maintain, on the contrary, that War is nothing but a continuation of political intercourse, with a mixture of other means. We say mixed with other means in order thereby to maintain at the same time that this political intercourse does not cease by the War itself, is not changed into something quite different, but that, in its essence, it continues to exist, whatever may be the form of the means which it sues, and that the chief lines on which the events of the War progress, and to which they are attached, are only the general features of policy which run all through the War until peace takes place.”

On War

Book VIII: Plan of War

Chapter VI.B. War As An Instrument Of Policy

General Carl Von Clauswitz, 1832

This can be seen in Russia’s invasion of Crimea to ensure the access to its warm water port on the Black Sea at Sevastopol and its military support of Syria to ensure access to its naval base in Tartus, Syria on the Mediterranean Sea. In addition, Russia is supporting militarily the countries in the Middle East that would undermine US strategic interests in the region. Furthermore, just as in its moves to leverage China to improve its economy, it added China to its military strategy in order to leverage its strategic position in both Asia and in Europe. Just this year, Russia completed joint naval exercises with China in the Baltic Sea and the Sea of Japan. In addition, Russia and China completed joint military exercises near the border of North Korea in order to prepare for a potential US led action against North Korea. These combined actions exhibit the rising rivalry that is once more coming to the fore between the US and Europe on one side and Russia on the other side. In essence, a Re-Emergence of the Cold War is afoot, reminiscent of the tense times during the 1950s and 1960s. And while numerous politicians hoped these rivalries faded into the dustbin of history, in order to use the prior military spending to cover new social spending programs by the governments, their reemergence will force a reappraisal of domestic priorities and the need to reorient economies to address these new, unpleasant realities.

At the same time as Europe and the US face a resurgent Russia, China took advantage of the opening provided by the US through the WTO to grow its economy to advantage its global strategic position. And unlike the 1950s and 1960s, when the US military was clearly superior, 20 years of neglect by the US combined with 20 years of planned upgrades to China’s military forces have closed the gap between the two economic rivals. With China’s industrial economy now much larger than that of the US, but smaller than that of the US and Europe combined, China possesses the economic heft to undergird its military upgrades and the technological capabilities to produce comparable equipment for its armed forces. Whether it is missiles, tanks, or stealth aircraft, China can go toe-to-toe with the US and Europe. And with the internal belief, whether true or not, that China is destined to become the number one economy in the world with the capability to project its armed forces across the globe to achieve its strategic goals at the expense of rivals, conflict continues to hurtle ahead with the potential for a real war rising. While the island construction in the South China Sea made headlines over the past two years, the conflict with India in the Himalayas did not. Nor has the construction of dams in China to potentially use the headwaters of the various Asian rivers to cut water flows or to create floods been featured on the nightly news. Nor has the creation of anti-satellite weapons, super EMP, or other advanced military hardware made the front page of the newspaper. In addition to its military advances, China put in place a number of institutions to rival those erected by the US and Europe. These include the Asian Infrastructure Investment Bank and the BRICs Development Bank. The purpose of these multi-lateral institutions is to fund Chinese projects across Asia and the globe and to provide the key financing for its One Belt, One Road initiative. The goal, of course, focuses on advancing China’s strategic position and displacing that of the Western Economic System. For the US and Europe, it truly is The Return of the Yellow Peril of the 1950s.

While the Obama Administration ignored all these warning signs of a rising strategic threat to the US, the Trump Administration has not. In its newly issued National Security Strategy (December, 2017 available at https://www.whitehouse.gov/wp-content/uploads/2017/12/NSS-Final-12-18-2017-0905.pdf ), the US clearly recognizes the true state of the world and the rising challenge the country faces from both China and Russia. In its Introduction, the report states:

“The United States will respond to the growing political, economic, and military competitions we face around the world. China and Russia challenge American power, influence, and interests, attempting to erode American security and prosperity. They are determined to make economies less free and less fair, to grow their militaries, and to control information and data to repress their societies and expand their influence. At the same time, the dictatorships of the Democratic people’s Republic of Korea and the Islamic Republic of Iran are determined to destabilize regions, threaten Americans and our allies, and brutalize their own people. Transnational threat groups, from jihadist terrorists to transnational criminal organizations, are actively trying to harm Americans. While these challenges differ in nature and magnitude, they are fundamentally contests between those who value human dignity and freedom and those who oppress individuals and enforce uniformity.

These competitions require the United States to rethink the policies of the past two decades – policies based on the assumption that engagement with rivals and their inclusion in international institutions and global commerce would turn them into benign actors and trustworthy partners. For the most part, this premise turned out to be false.”

With this statement, the US officially recognized the error of allowing its global rivals into the Western Trade Network over the past two decades and the clear return of Great Power rivalry with Russia and China. It articulated that change will come to address the challenges that the US now faces as a result of assuming that its rivals would turn into partners. The statement indicates, as well, that the US will change policies across a broad spectrum of areas in order to meet the rising challenges that it faces from its global strategic rivals. And, in implementing such change, it will put the country’s interests first. With the Great Game of Power now breaking out into open conflict, the US will move down the path articulated by Franklin D. Roosevelt in his annual State of the Union Message to Congress on January 4, 1939, when he stated:

“All about us rage undeclared wars – military and economic. All about us grow more deadly armaments – military and economic. All about us are threats of new aggression military and economic.

Storms from abroad directly challenge three institutions indispensable to Americans, now as always. The first is religion. It is the source of the other two – democracy and international good faith.

Religion, by teaching man his relationship to God, gives the individual a sense of his own dignity and teaches him to respect himself by respecting his neighbors.

Democracy, the practice of self-government, is a covenant among free men to respect the rights and liberties of their fellows.

International good faith, a sister of democracy, springs from the will of civilized nations of men to respect the rights and liberties of other nations of men.

In a modern civilization, all there – religion, democracy and international good faith – complement and support each other.

Where freedom of religion has been attacked, the attack has come from sources opposed to democracy. Where democracy has been overthrow, the spirit of free worship has disappeared. And where religion and democracy have vanished, good faith and reason in international affairs have given way to strident ambition and brute force.

An ordering of society which relegates religion, democracy and good faith among nations to the background can find no place within it for the ideals of the Prince of Peace. The United States rejects such an ordering, and retains its ancient faith.

There comes a time in the affairs of men when they must prepare to defend, not their homes alone, but the tenets of faith and humanity on which their churches, their governments and their very civilization are founded. The defense of religion, of democracy and of good faith among nations is all the same fight. To save one we must now make up our minds to save all.”

For America, these words ring as true today as they did in 1939. And they likely will light the way towards the uncertain future that once again see the United States take up the mantle of leadership for the free world as The Great Game of Power once more takes precedence. (Data from public sources coupled with Green Drake Advisors analysis.)

That Linear Assembly Line; Depreciating Metal and Plastic; Up On The Farm; and The Space Race

Finally, we close with brief comments on That Linear Assembly Line, Depreciating Metal and Plastic, Up On The Farm, and The Space Race. First, sales of linear motion guides, used in factory automation, are exploding. According to THK of Japan, the global leader with 50% share, sales rose over 70% in Japan and over 100% in China. Given its crucial role in high precision, speed, and long service lines, we see this equipment driving That Linear Assembly Line. Second, one of the impacts of the hurricanes has been to support the price of used cars. With so many owners needing replacements, used car prices are up 7.8% year-over-year, according to the Manheim Index. For now, we see cars bucking the trend of being a Depreciating Piece of Metal and Plastic. Third, farmers appear to be entering a replacement cycle for the vast numbers of tractors bought during the commodity boom. According to the Tractor Manufacturers Association, Total US tractor sales rose 9% year-over-year in November after rising 12% in October. With sales of tractors moving into positive territory, we see things looking Up On The Farm. And Fourth, multiple countries are now putting together missions to space to launch in 2018. While the perennial strongholds of Russia and the US will continue to move ahead with launches, they are being joined by India, Japan, the EU, and China as well as private US companies. With all this activity in space and countries beginning to compete to stake economic positions, we see The Space Race heating up.

In Closing

Should you have any questions on how the above issues or the items discussed in our accompanying cover letter impact your family’s financial position or your business’s future as well as the potential actions you could take in response, please do not hesitate to contact us. We welcome the opportunity to discuss this with you.

Yours Truly,

Paul L. Sloate Steve Rodia

Chief Executive Officer President

Senior Advisor Senior Advisor